Featured

Hsa Qualified Expenses

Just open the MyHealth mobile app select Eligible Expense Scanner from the menu then simply scan the item barcode to find out if it can be paid for using your health account. We cant leave out the grey area.

List Eligible Medical Expenses Humana

List Eligible Medical Expenses Humana

There are multiple ways you can spend from your HSA.

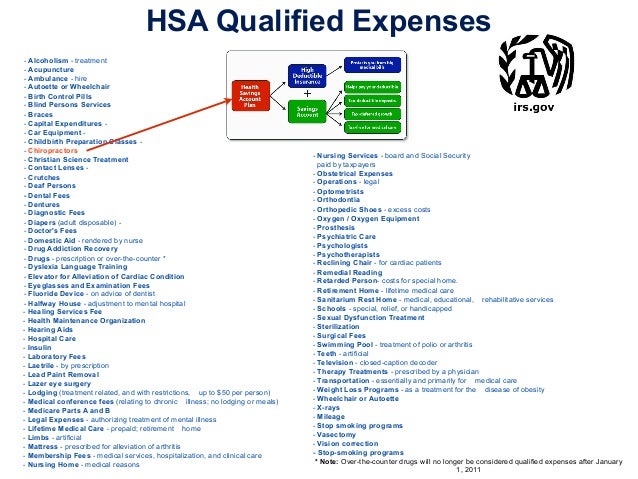

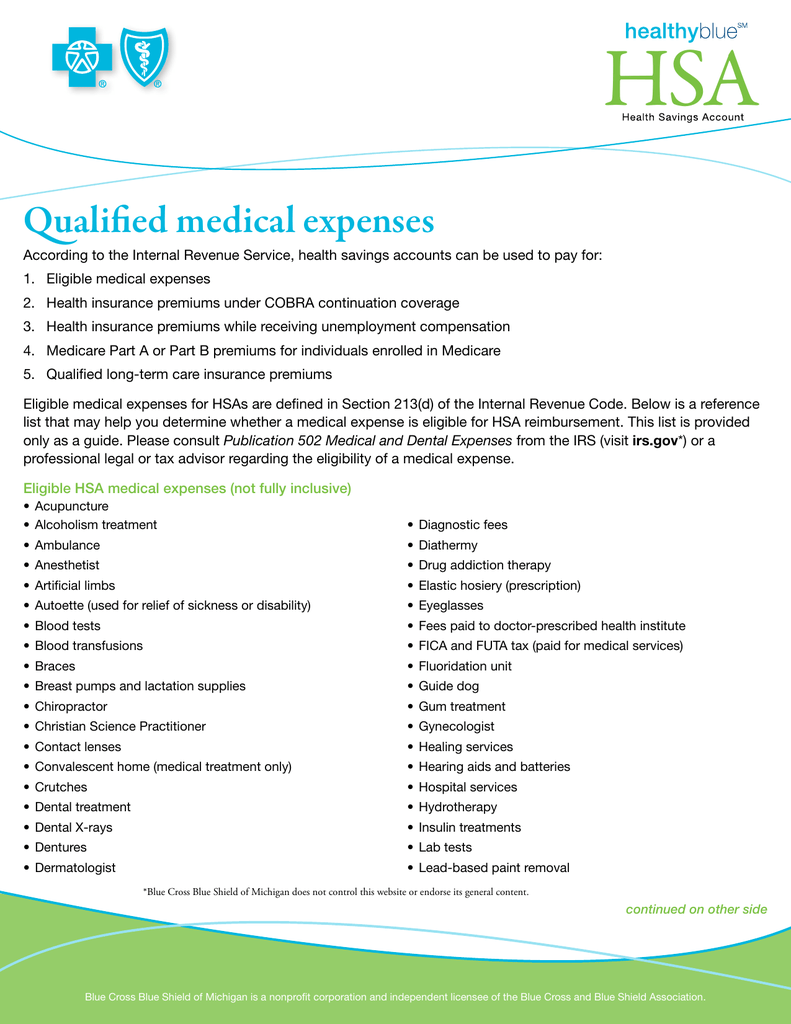

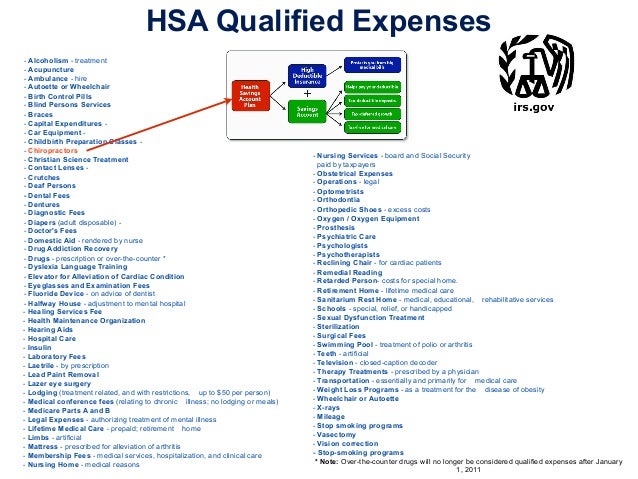

Hsa qualified expenses. Lodging treatment related and with restrictions up to 50 per person Ambulance hire. Funds you withdraw from your HSA are tax-free when used to pay for qualified medical expenses as described in Section 213 d of the Internal Revenue Service Tax Code. 3 rijen If you use a distribution from your HSA for qualified medical expenses you dont pay tax on.

Trusted by than 60000 companies. In most states if you became eligible. Hsa withdrawal tips strategies.

These costs generally include payment to doctors or dentists prescriptions imaging such. The government only allows these tax advantages if you use your HSA money for qualified medical expenses. Trusted by than 60000 companies.

Use your Fidelity HSA. Advertentie Create custom spending limits and rules to control costs. 72 rijen Again please check with your HSA administrator if you have any questions about qualified.

Automate your expenses save time money and mistakes. For a complete list of qualified medical expenses see IRS Publication 502. Automate your expenses save time money and mistakes.

Snap receipts with the app done. Medical expenses are the costs of diagnosis cure mitigation treatment or prevention of disease and the costs for treatments affecting any part or. Any expense you incur before your HSA is established will not be considered qualified.

Learning Center IRS Qualified Medical Expenses HSA HRA Healthcare FSA and Dependent Care Eligibility List The following is a summary of common expenses claimed against Health Savings Accounts HSAs Health Reimbursement Arrangements HRAs Healthcare Flexible Spending Accounts HC-FSAs and Dependent Care FSAs DC-FSAs. The amount you spend will be federal income tax-free. Fertility treatments including IVF.

These funds may also be used for the reimbursement of dental costs such as fillings braces and cleaning. One of the chief benefits of having an HSA is that account holders can use that money to pay for a wide range of eligible medical expenses for themselves their spouses and their tax dependents. Mattress prescribed for alleviation of arthritis.

HSA Qualified Expenses List. Examples of qualified medical expenses The following list includes common examples of HSA qualified medical expenses. Snap receipts with the app done.

Once youve contributed money to your health savings account HSA you can use it to pay for qualified medical expenses for yourself your spouse and your eligible dependents. You can pay for eligible medical expenses for your spouse and tax dependents even if theyre on different insurance and even if they arent eligible to contribute to HSAs. HSA eligible expenses are not limited to medical costs.

The expenses must be primarily to alleviate or prevent a physical or mental defect or illness including dental and vision. COBRA and HMO premiums. HSA Eligible Expenses The IRS determines which expenses are eligible for reimbursement.

An account holders costs are not the only ones that are reimbursable. There are some things that may qualify as an HSA eligible expense as long as you meet other specific requirements. Qualified Medical Expenses.

State law determines when your HSA is officially established. Paying for Eligible Expenses View Now Download Now. A person may even use these funds to cover the price of sports injury prevention equipment such mouth guards.

When you your spouse and your dependents have qualified medical expenses that arent covered by your health care plan you can use your HSA money tax-free 1 to pay for them. Eligible expenses include health plan copayments dental work and orthodontia eyeglasses and contact lenses and prescriptions. These are some of the expenses youll want to doublecheck before you use your HSA.

Youre not required to reimburse yourself from your HSA in the same tax year as the expense. Advertentie Create custom spending limits and rules to control costs.

Hsa Qualified Medical Expenses List Hsa Qmelist 49 00 Banker Store Powered By Bankersonline Com

Hsa Qualified Medical Expenses List Hsa Qmelist 49 00 Banker Store Powered By Bankersonline Com

How Can I Use A Health Savings Account Hsa

How Can I Use A Health Savings Account Hsa

Explained Fsa And Hsa For Concierge Medicine

Explained Fsa And Hsa For Concierge Medicine

Hsa Qualified Medical Expenses

Hsa Qualified Medical Expenses

Common Hsa Eligible Ineligible Expenses Optum Bank

Common Hsa Eligible Ineligible Expenses Optum Bank

How To Set Up Get The Most From A Health Savings Account Austin Benefits Group

How To Set Up Get The Most From A Health Savings Account Austin Benefits Group

Hsa And Fsa Facts For Health Care

Hsa And Fsa Facts For Health Care

Health Savings Accounts Howard Bank

Health Savings Accounts Howard Bank

Retirement Health Savings Account And Medicare

Retirement Health Savings Account And Medicare

Hsa Qualified Medical Expenses List Hsa Qmelist 49 00 Banker Store Powered By Bankersonline Com

Hsa Qualified Medical Expenses List Hsa Qmelist 49 00 Banker Store Powered By Bankersonline Com

What Can You Pay For Using An Hsa

What Can You Pay For Using An Hsa

Https Www Bcbsnm Com Pdf Hsa Eligible Expense Pdf

Https Www Uwhealth Org Files Uwhealth Docs Benefits Hsa Eligible Expenses Pdf

Https Www Conehealth Com App Files Public 9521f899 0bac 4123 Ac8e 724b4b8ef1e2 2021 20employee 20benefits Hsa 20eligible 20expense 20list Pdf

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment