Featured

Medicare Part D Penalty For Not Enrolling

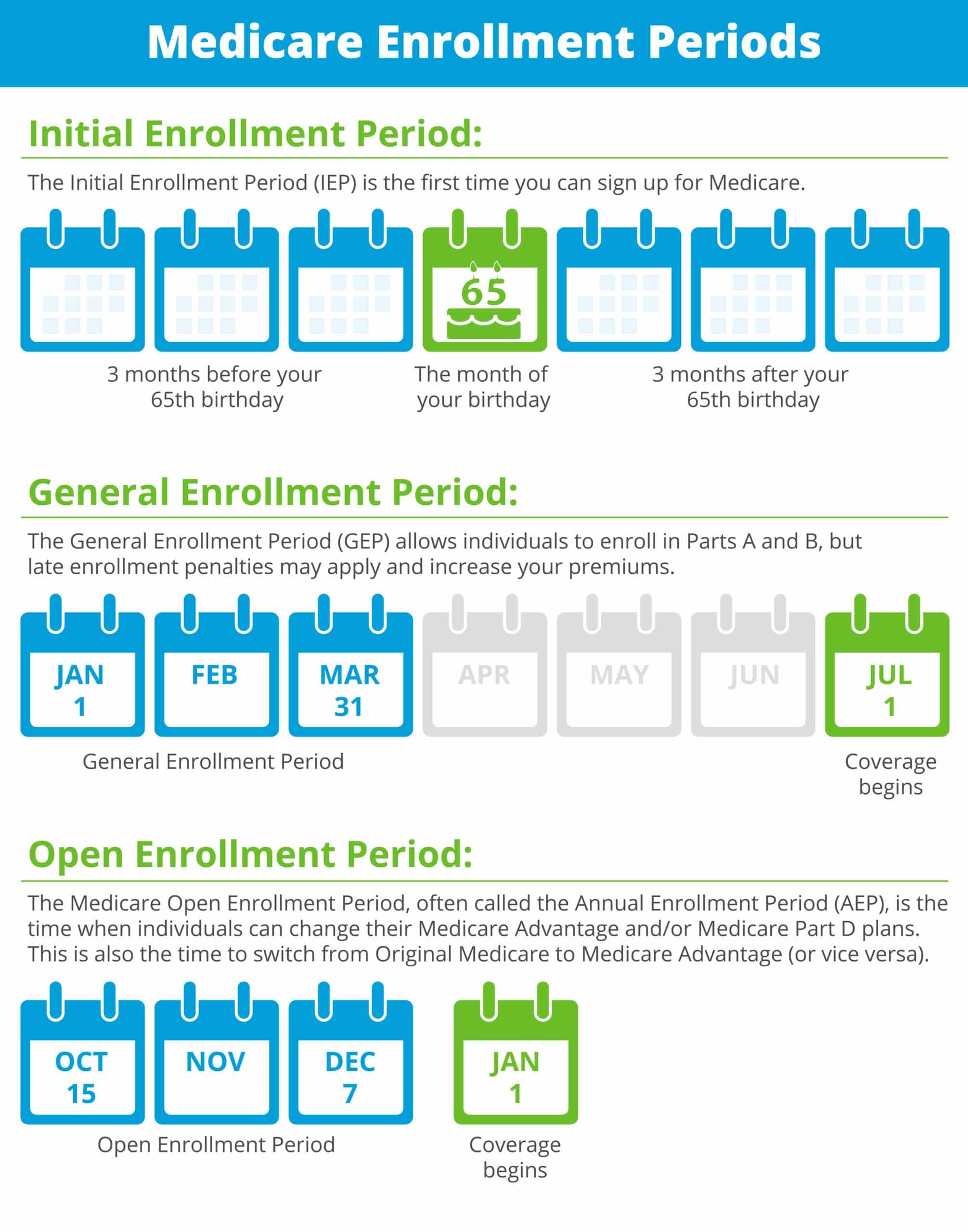

If you wait past this window to enroll a late enrollment penalty for Medicare Part D will be added to your monthly premium. Your coverage starts July 1 2019.

Medicare Part D Open Enrollment When Does It Start

Medicare Part D Open Enrollment When Does It Start

Medicare Part B enrollment is complicated and the wrong decision can leave you without health coverage for months and lead to lifetime premium penalties.

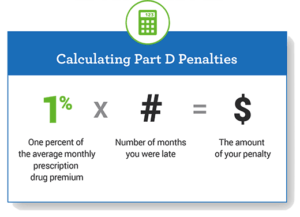

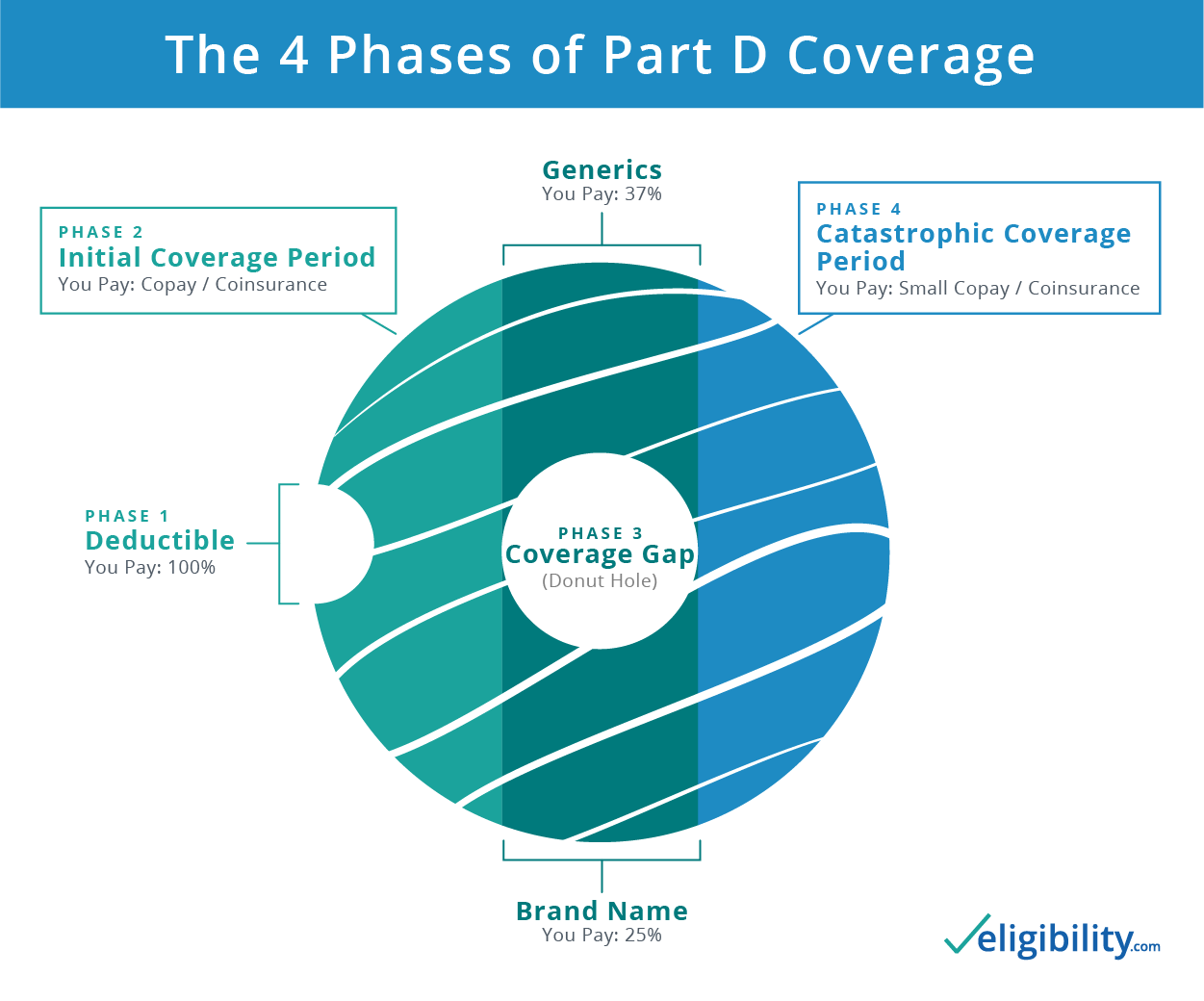

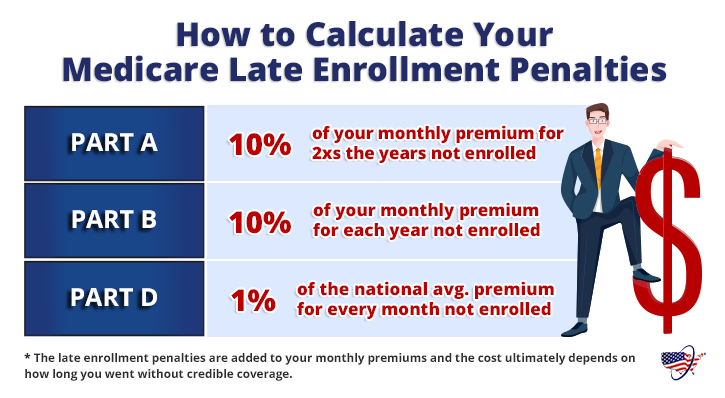

Medicare part d penalty for not enrolling. 1You waited past 63 days without creditable prescription drug coverage when you are leaving company benefits and you are older than 65 years old and 90 daysDont wait past 63 days to get Part D when leaving company health plans. The penalty is calculated by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage. Medicare Part D is not a mandatory program but there are still penalties for signing up late.

Generally the late enrollment penalty is added to the persons monthly. The monthly penalty is always rounded to the nearest 010. Once you are past 65 and leaving creditable employer coverage Medicare gives you 63 days not 70 or 90 days to apply for a Medicare Part D or Medicare Advantage plan.

This means that youd pay an extra 790 per month in addition to your regular Part D monthly premium for the rest of your life. The penalty is again added to your Part D monthly premium and is lifelong. It is calculated by multiplying 1 of the national base premium which is 41 by the number of uncovered months without creditable coverage.

In 2021 the national base beneficiary premium is 3306. Have creditable drug coverage Qualify for the Extra Help program. If you dont meet one of the four requirements above for a period of 63 days or more in a row you will face a penalty that requires some complicated math to figure out.

As with Part B the Part D late enrollment penalty is based on the amount of time you were without coverage. This LEP late enrollment period penalty enrolling penalty rules are. You waited to sign up for Part B until March 2019 during the General Enrollment Period.

The amount of the Part D late enrollment penalty depends on how long you went without prescription drug coverage. The Part D penalty is the number of full months you were eligible for Part D prescription drug coverage but didnt enroll in a Medicare plan providing this coverage and didnt have other creditable coverage multiplied by 1 of the national base beneficiary premium which is 3306 in 2021. Part D premium for as long as he or she has Medicare prescription drug coverage even if the person changes his or her Medicare drug.

Medicare Part D Penalty For Late Enrollment. This fee is 1 percent of. The Medicare Part D penalty is 1 for each month you went without prescription.

This penalty is added to your premium each month you are enrolled and generally lasts for as long as you have Medicare drug coverage. Not Enrolling in Medicare Part D Caused a Penalty. Medicare Part D Late Enrollment Penalty Calculator The Medicare Part D penalty is based on the number of months you went without PDP coverage.

The penalty encourages Medicare beneficiaries to enroll in a Part D plan as soon as they are eligible. 2Your company prescription drug benefits not health benefits are not creditable as. I received a notice from CMS Medicare saying they do not have record of me having prescription drug coverage that met Medicares minimum standards from 812017 to 112020 and I may receive a Part D late enrollment penalty.

For each month you delay enrollment in Medicare Part D you will have to pay a 1 Part D late enrollment penalty LEP unless you. The late enrollment penalty for Medicare Part D is 1 of the average national base monthly premium rounded to the nearest 10 cents for each month you did not enroll. The penalty is based on the national base beneficiary premium which is 3502 in 2018.

The penalty applies for as long as you are enrolled in a Part D plan. Medicare calculates the amount by multiplying the number of months you didnt have prescription drug coverage by 1 of the national base beneficiary premium. If you dont enroll in a Medicare Part D prescription drug plan when you first become eligible you could be subject to a penalty that you will need to pay in addition to your monthly premium.

If you dont sign up for Medicare Part D during your initial enrollment period you will pay a penalty. Your Initial Enrollment Period ended December 2016. People who delay Part B because they were covered through their own or a spouses.

In 2020 that would equal a total of 790. Part B premiums increase 10 percent for every 12-months you were eligible for Part B but not enrolled. Even if you dont take any medications when you enroll in Medicare it may pay off to enroll in an inexpensive plan so you have coverage when you need it.

For each month without coverage you will pay an additional premium of 1 percent of the current national base beneficiary premium For 2021 the average beneficiary premium is 3306. Ron doesnt enroll in Part. In a Medicare drug plan may owe a late enrollment penalty if he or she goes without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more in a row after the end of his or her Initial Enrollment Period for Part D coverage.

Your Part B premium penalty is 20 of the standard premium and youll have to pay this penalty for as long as you have Part B.

Do I Have To Sign Up For A Medicare Part D Plan 65medicare Org

Do I Have To Sign Up For A Medicare Part D Plan 65medicare Org

Medicare Part D Premium And Deductible Costs For 2020 Eligibility

Medicare Part D Premium And Deductible Costs For 2020 Eligibility

Penalties For Not Signing Up For Medicare Boomer Benefits

Penalties For Not Signing Up For Medicare Boomer Benefits

What You Need To Know About Medicare Part D

What You Need To Know About Medicare Part D

2020 Medicare Part D Late Enrollment Penalties Will Decrease For A Third Year In A Row Although Maximum Penalties Can Reach Up To 641 Per Year

2020 Medicare Part D Late Enrollment Penalties Will Decrease For A Third Year In A Row Although Maximum Penalties Can Reach Up To 641 Per Year

Medicare Drug Coverage Penalty How The Part D Penalty For Not Enrolling Works

Medicare Drug Coverage Penalty How The Part D Penalty For Not Enrolling Works

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Unintended Part D Late Penalty Could Get You If Enrolling After Age 65 Aarp Medicare Plans

Unintended Part D Late Penalty Could Get You If Enrolling After Age 65 Aarp Medicare Plans

How To Avoid Medicare Penalties Part B And Part D Penalties Explained

How To Avoid Medicare Penalties Part B And Part D Penalties Explained

How To Avoid The Part D Penalty

How To Avoid The Part D Penalty

Medicare Mistakes How To Avoid 10 Costly Medicare Mistakes Medicare Usa

Medicare Mistakes How To Avoid 10 Costly Medicare Mistakes Medicare Usa

Medicare Don T Wait Until It S Too Late

Medicare Don T Wait Until It S Too Late

Penalties For Not Signing Up For Medicare Part D What Is The Part D Penalty

Penalties For Not Signing Up For Medicare Part D What Is The Part D Penalty

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment