Featured

- Get link

- X

- Other Apps

Plan J Vs Plan G

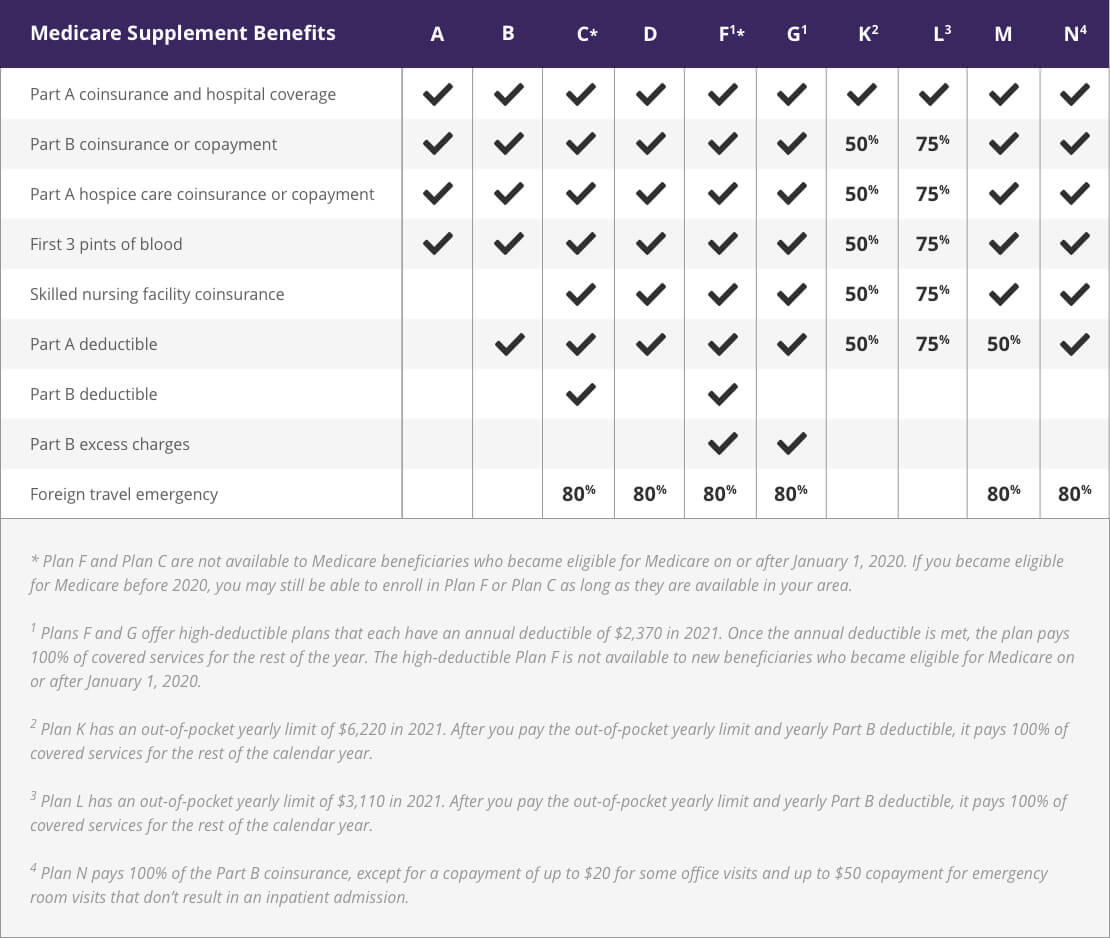

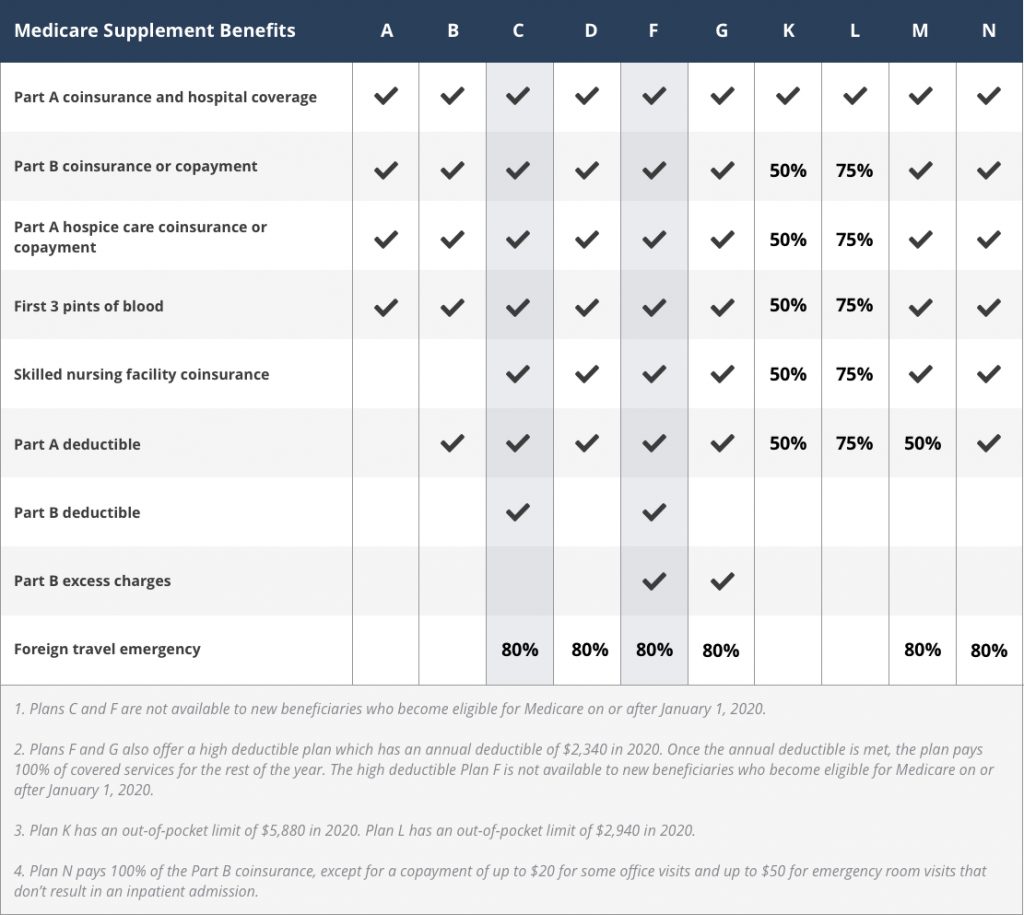

We have already done the shopping for you and have the lowest prices. Plans C F and G are only a few of the options you have available that arent Medigap Plan J.

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

The high deductible version of Plan F is only available to those who are not new to Medicare before 112020.

Plan j vs plan g. Medicare Supplement Plan J Medigap Plan J was discontinued in 2010. High deductible G is available to individuals who are new to Medicare on or after 112020. First of all you do not have to do anything.

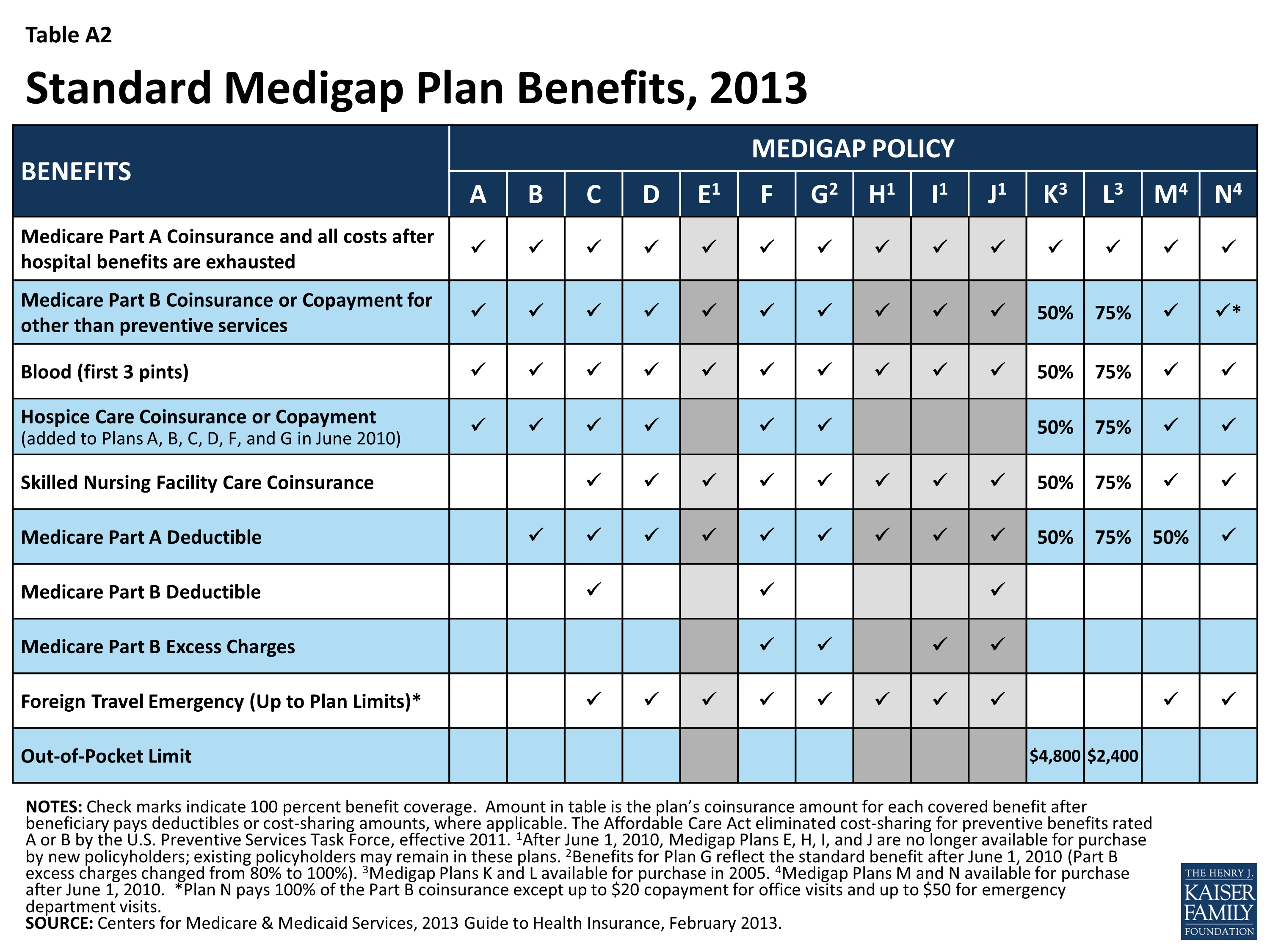

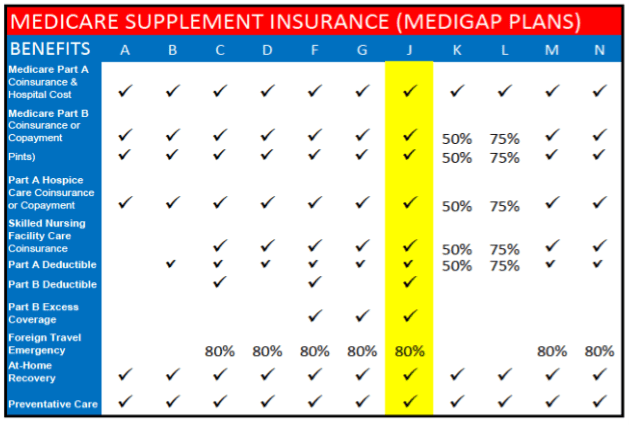

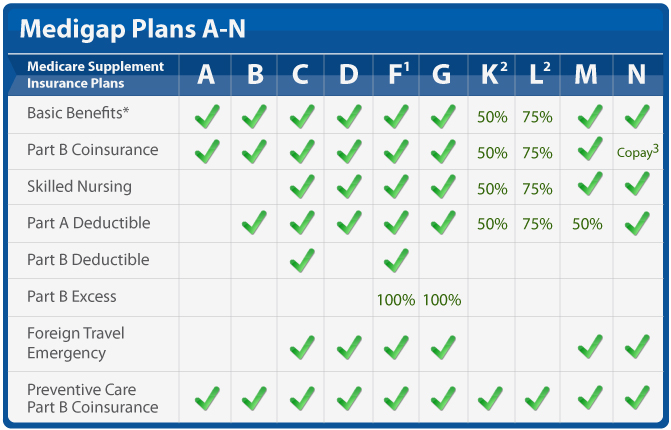

Plan F and Plan J both work secondary to Original Medicare. Plan G Plan G offers all of the same benefits as Plan J except like Plan F it only covers 80 percent of foreign travel emergency care costs. This means the first dollar is covered by Medicare.

Medicare Supplement Insurance Plan J coverage also provides two additional benefits that are not found in Plan F. All enrollees in an expired plan including Plan J are able to keep their plan with no loss of benefits. At-home recovery care up to 1600 a year.

With a Plan G the only cost you have to pay out of pocket is the Part B deductible. All you have to pay is your monthly premium. Plan G will have no out-of-pocket expenses except for its monthly premiums and the Part B deductible which is 147 in 2016.

If you are still on Plan J you are paying an enormously higher premium than you need to so Plan F is the closest in benefits to what you have now. Most people will select Plan F or Plan G. Its Plan F by a landslideabout 55 of all Medigap plans currently in force are Plan F.

With your Plan J you will get the basic coverage categories like Part A coinsurance and hospital costs for an additional 365 days after your original Medicare coverage has expired. For example Plan F and Plan J cover. Plan-G v322 Pay what you like Click on the Donate button Donations provide funding for technical support and continued product development as well as paying the hosting fees.

As long as Medicare pays first Plan F and Plan J will cover the rest of the costs leaving you to pay nothing out-of-pocket. In most states Plan G generally runs about 20-25 more per month than Plan N More about Plan G prices. Depending upon the condition of your health it might be a better idea to sign up for Plan N even though there is a copay and may be 15 in excess charges associated with it.

This deductible is the same for Plan J. That said we always recommend comparison shopping. However while Plan G usually has higher premiums it could save you money in the long run.

Plan J vs. Consider Medicare Supplement Plan G and Plan N. You have no deductible no coinsurance and no copays.

The standard Medicare Supplement Plan G with a low deductible rather than the High Deductible Plan G is usually be the better choice for most people choosing Plan G in my opinion. While Plan F allots for coverage of 80 of costs Plan J provides 100 coverage. If I have a Plan J what should I do.

Plan C is a distant second at about 9 according to the most recent Medigap enrollment data. Plan G also does not cover the annual Medicare Part B deductible. After youve met the deductible Plan G will cover the rest just like Plan F.

Learn more about Medigap Plan J. Both plans provide coverage for foreign travel emergency care but Plan F has 80 cost coverage whereas Plan J has 100 coverage. In fact the law no longer allows you to get some of the coverage.

What Costs Do Medicare Supplement Plan F and Plan J Cover. Their Plan Gs premium is 2552 a difference of 1004 to cover a benefit worth 185. The standard Plan G has a higher monthly premium than the high deductible plan but has a substantially lower yearly deductible and a greater convenience of use.

You might also consider Plan G as that one is only slightly different in benefits and is not scheduled to go away. The decision is really not complicated. Premiums for each plan can vary by the carrier that offers it but Plan G is typically more expensive than Plan N because it offers a higher level of coverage.

Before June 1 2010 Medigap Plan J could also be sold with a high deductible. Plan J and Plan F each provide coverage for foreign travel emergency care as well. Original Medicare refers to Medicare Part A and Medicare Part B and they cover your inpatient and outpatient services.

Most striking is one company in North Carolina that offers a Plan F with an annual premium of 3556. If you do decide to comparison shop and want to maintain the level of coverage you have with Plan J there are other options out there for you. If youre looking for the plan with the highest enrollment growth however Plan N and Plan G are skyrocketing in popularity up 33 and 25 respectively over last years numbers.

Anyone who already had the plan can keep it and receive its benefits. If you have a Plan J still then you have the most coverage that you can buy. Plan G provides all the excellent coverage of Plan F but without the Part B deductible.

And what about Plan G. Plan F is the best plan and Plan G is the 2nd best.

Medicare Plan F Vs Plan J Comparison Costs And Coverage

Medicare Plan F Vs Plan J Comparison Costs And Coverage

Medicare Supplement Insurance Plan J Medigap Plan J Costs Benefits

Medicare Supplement Insurance Plan J Medigap Plan J Costs Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Supplement Plan J Healthline Com

Medicare Supplement Plan J Healthline Com

Plan G Medicare Shunyata Healing Center

Plan F Vs Plan N What Most People Don T Know Clear Medicare Solutions

Medicare Supplement Plan J Vs Plan F What Is The Difference Gomedigap

Medicare Supplement Plan J Vs Plan F What Is The Difference Gomedigap

Medigap Reform Setting The Context For Understanding Recent Proposals Appendices Kff

Medigap Reform Setting The Context For Understanding Recent Proposals Appendices Kff

Medicare Supplement Insurance Plan J Medigap Plan J Costs Benefits

Medicare Supplement Insurance Plan J Medigap Plan J Costs Benefits

Medicare Supplement Plan J Review Pricing Reviews Star Ratings

Medicare Supplement Plan J Review Pricing Reviews Star Ratings

Choosing Between Medigap Plan G And Plan N 65medicare Org

Choosing Between Medigap Plan G And Plan N 65medicare Org

Should I Buy Medicare F Or G Off 55 Rescuelab Com Pk

Should I Buy Medicare F Or G Off 55 Rescuelab Com Pk

What Is A Medsup Plan Medicare Supplement Basics Amba Association Member Benefits Advisors

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment