Featured

Dental 125 Plan

However the plan itself isnt insurance. An employer must have a signed effective Section 125 plan document to legally take pre-tax deductions.

The rules in Section 125 of the Internal Revenue Code Code make this possible.

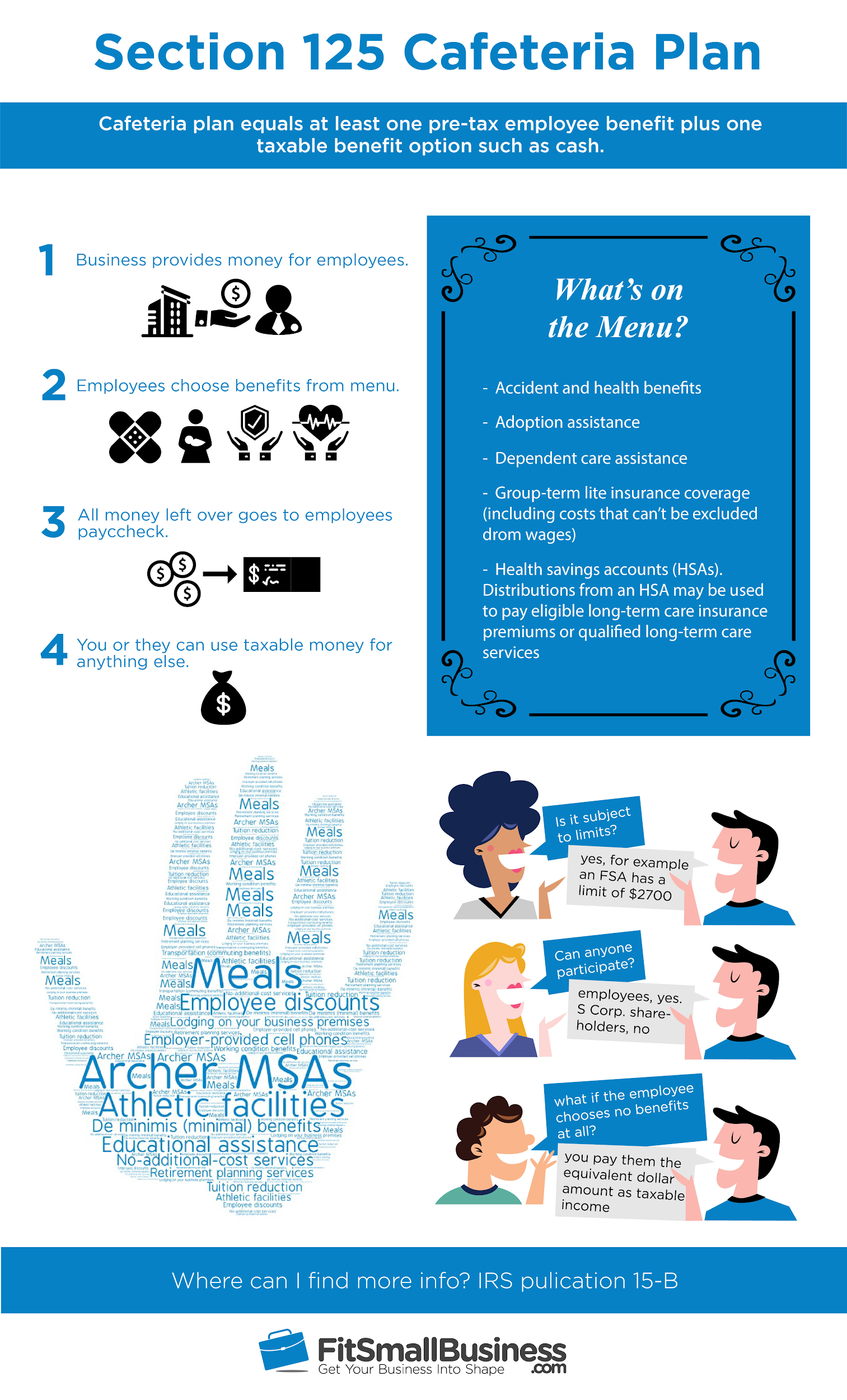

Dental 125 plan. Section 125 Cafeteria Plan Requirements To qualify as a Cafeteria Plan the plan must include. At least one taxable benefit option considered part of the employees salary and At least one qualified pre-tax benefit. What is a section 125 plan.

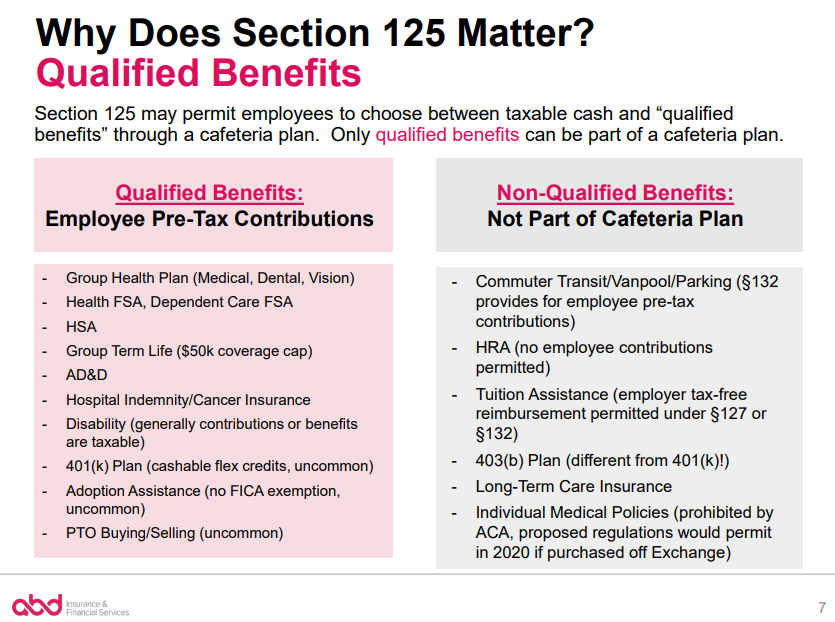

Accident and health benefits but not Archer medical savings accounts or long-term care insurance Adoption assistance. 125 plan must have a written plan document and can only offer certain qualified benefits on a tax-favored basis. You still have to offer group health insurance separately.

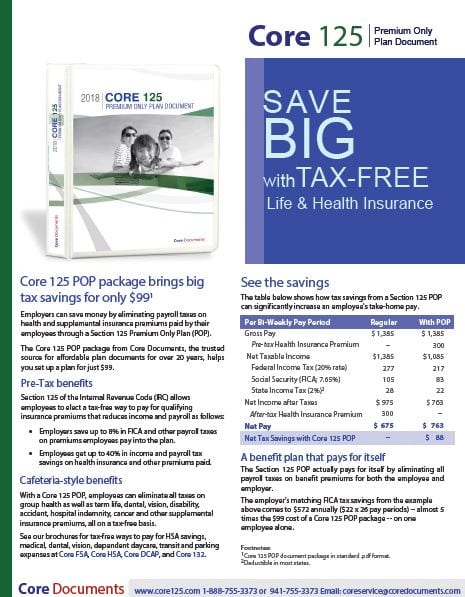

SECTION 125 BASICS What is a Section 125 plan. A Section 125 plan is part of the IRS code that enables and allows employees to take taxable benefits such as a cash salary and convert them into nontaxable benefits. A Premium Only Plan POP is the simplest type of Section 125 Plan.

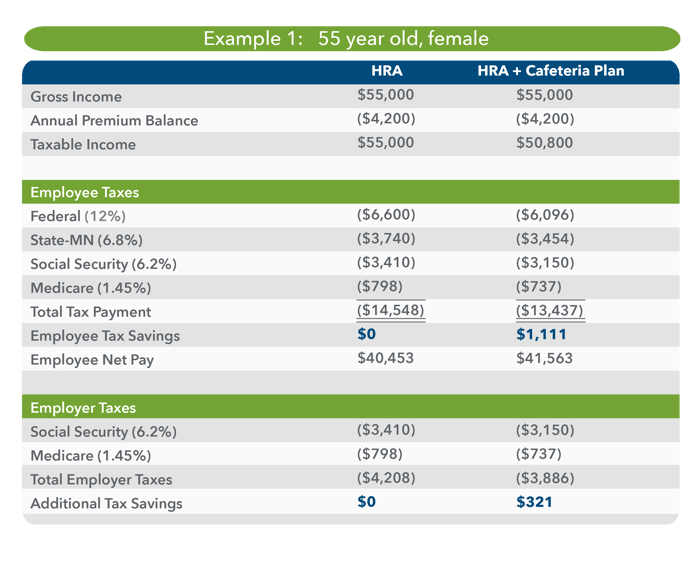

Section 125 plans also called Premium Only Plans POP reduces taxable income for employers and employees by allowing them to pay their portion of medical insurance premiums and HSA contributions using pre-tax or tax-free dollars. What benefits can be included in a Section 125 plan. A Section 125 plan allows employees to purchase qualified benefits such as health insurance with pretax dollars.

Some plans arent capped on coverage. A Section 125 plan is also commonly referred to as a cafeteria plan. A Section 125 cafeteria plan is so-called because you get to choose your benefits from a menu like choosing food at a cafeteria.

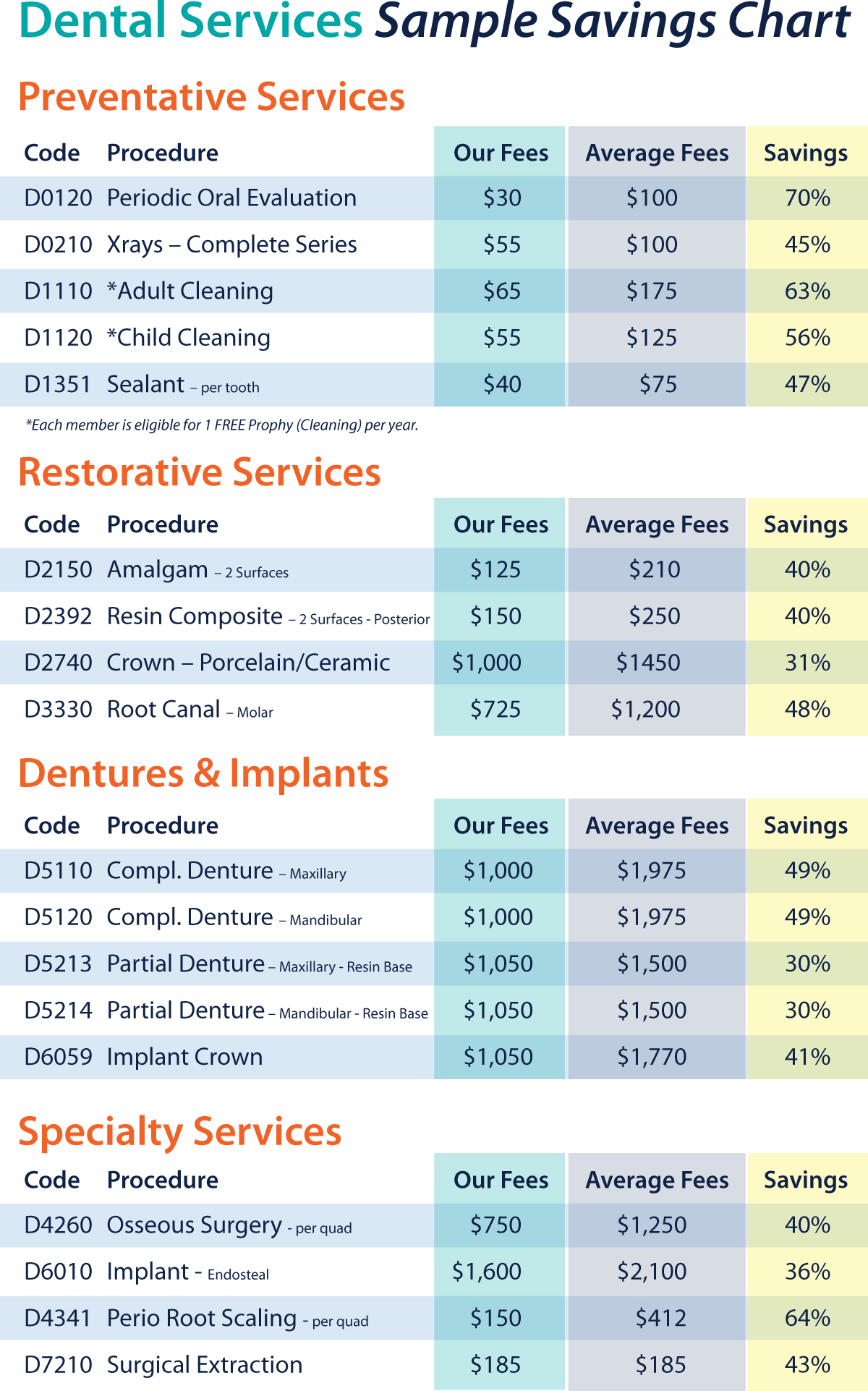

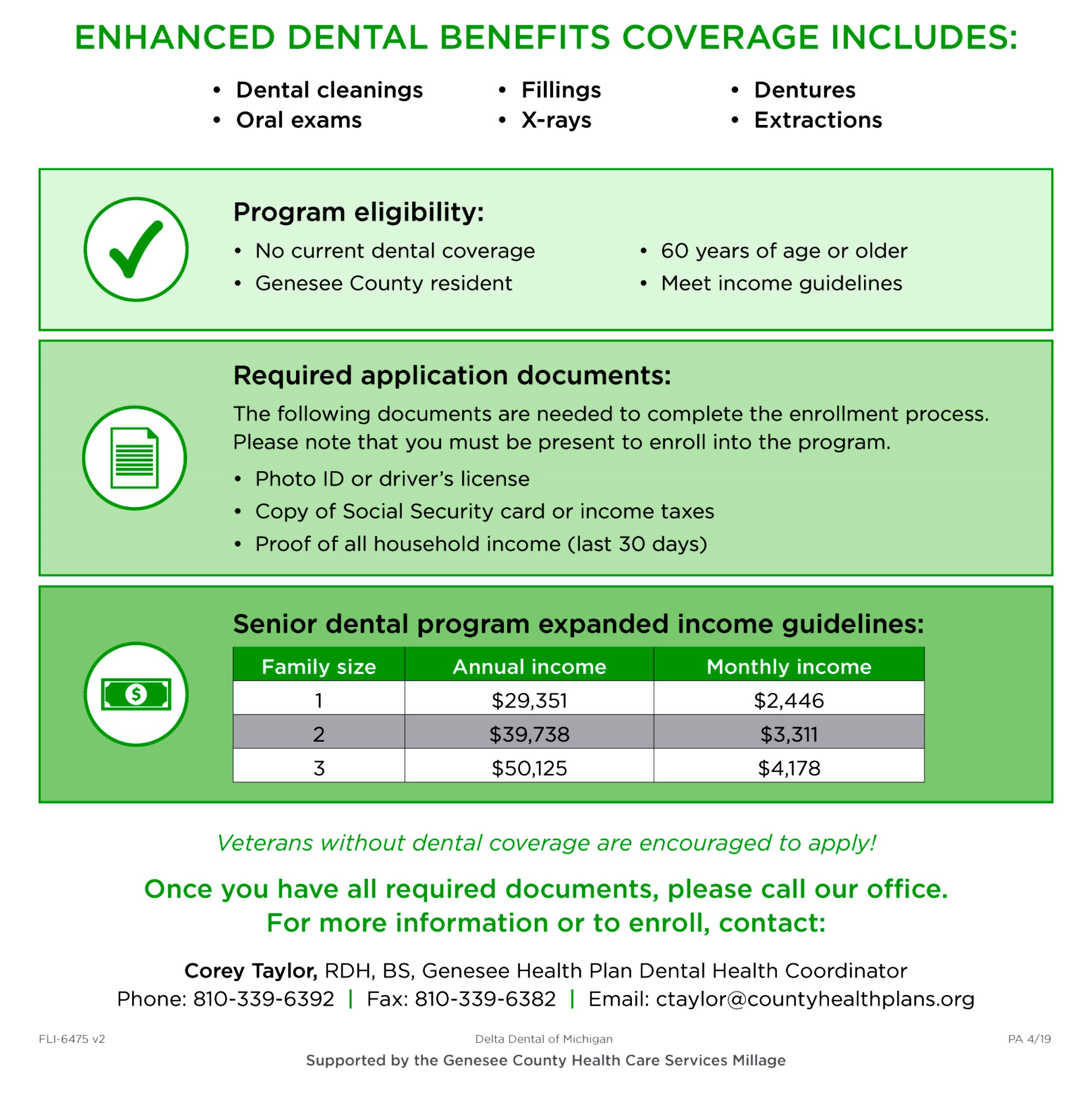

The Benefit Trust Fund dental plans cover reasonable and necessary diagnostic preventive basic and major dental services. The four basic forms of Section 125. Our phones are open Monday through Friday 830 am.

According to the federal tax code Section 125 plans can include. A POP plan is used when health insurance dental insurance andor vision insurance are the only benefits that the employees will be paying for on a pre-tax basis. It is the easiest type of Section 125 Plan to maintain and it involves little or no annual discrimination testing.

A Section 125 POP lets your employees pay their insurance premiums with pretax dollars. These benefits may be. You can contact the IAM Benefit Trust Fund Office directly to get more information about the plan.

Employers do not need a Section 125 plan document in place in order for employees to pay for qualified benefits for example health dental vision premiums pretax. Benefits within a Section 125 plan may include health disability accident and life insurance dependent care reimbursement and. The best part is that there is no deductible and no maximum amount for this plan.

A premium-only plan can include a cash-in-lieu of benefits provision for employees who dont want coverage under the group plan. Vision and dental plans. A written plan document is mandatory and should be amended or restated from time to.

A Section 125 plan is defined as a written plan that documents the structure rules and sponsor information of the plan. In other words failure to have a plan document means there is not a compliant plan in place and the employers pre-tax treatment of employee premiums violates tax law. Orthodontia services are also covered by many Benefit Trust Fund plans.

A basic care dental insurance plan is only 108 per year plus a 10 enrollment fee. Your benefits can begin immediately but you may have to wait one month to start using insurance. Group-term life insurance coverage.

However while the plan may offer many benefits box 14 of your W-2 shows only the benefits that apply to you. With a section 125 plan or cafeteria plan employees can pay qualified medical dental or dependent care expenses on a pretax basis which reduces their taxable income as well as the employers Social Security FICA liability federal income and unemployment taxes and state unemployment taxes where applicable. While self-employed individuals may maintain a Section 125 plan for their employees only common law employees may participate in the plan.

Section 125 is officially an IRS pretax vehicle nicknamed cafeteria plan because employees can choose pretax benefits like medical or dental insurance or opt to receive the equivalent amount on their paycheck paying taxes on it. Benefit Trust Fund plans use both the Delta Dental PPO and Premier networks giving plan participants a large pool of network dentists from which to choose.

Our Dental Plan Pflugerville Smiles Dentistry

Our Dental Plan Pflugerville Smiles Dentistry

Core Documents Releases Educational Brochures On Section 125 Pop Core Documents

Core Documents Releases Educational Brochures On Section 125 Pop Core Documents

Save 50 With The Dental Direct Individual Dental Plan

Save 50 With The Dental Direct Individual Dental Plan

Membership Club Midtown Dental Care

Membership Club Midtown Dental Care

Http Mba Admin Com Wp Content Uploads 2020 09 Mba 125 Fsa Buckets 021419 Share Pdf

Dental Benefit Plan Designs American Dental Association Center For Professional Success

Dental Benefit Plan Designs American Dental Association Center For Professional Success

Https Pages Theabdteam Com Rs 209 Oqw 293 Images 2021 Abd Section 125 Cafeteria Plan Guide For Employers Pdf

Cafeteria Plan Section 125 Features Costs Providers

Cafeteria Plan Section 125 Features Costs Providers

Bow Lane Nl Spring 10 Bow Lane Dental Group

Bow Lane Nl Spring 10 Bow Lane Dental Group

How Aca Affects Flex Credits Abd Insurance Financial Services

How Aca Affects Flex Credits Abd Insurance Financial Services

Teeth Whitening Lassustandartsen Nl

Teeth Whitening Lassustandartsen Nl

Little Britches Pediatric Dentistry Joe Architect Pediatric Dental Office Designs Dental Office Design Pediatric Dental Office Design Pediatric Dental Office

Little Britches Pediatric Dentistry Joe Architect Pediatric Dental Office Designs Dental Office Design Pediatric Dental Office Design Pediatric Dental Office

Combine Your Ichra With A Cafeteria Plan For Maximum Tax Advantages

Combine Your Ichra With A Cafeteria Plan For Maximum Tax Advantages

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment