Featured

What Does Medigap F Cover

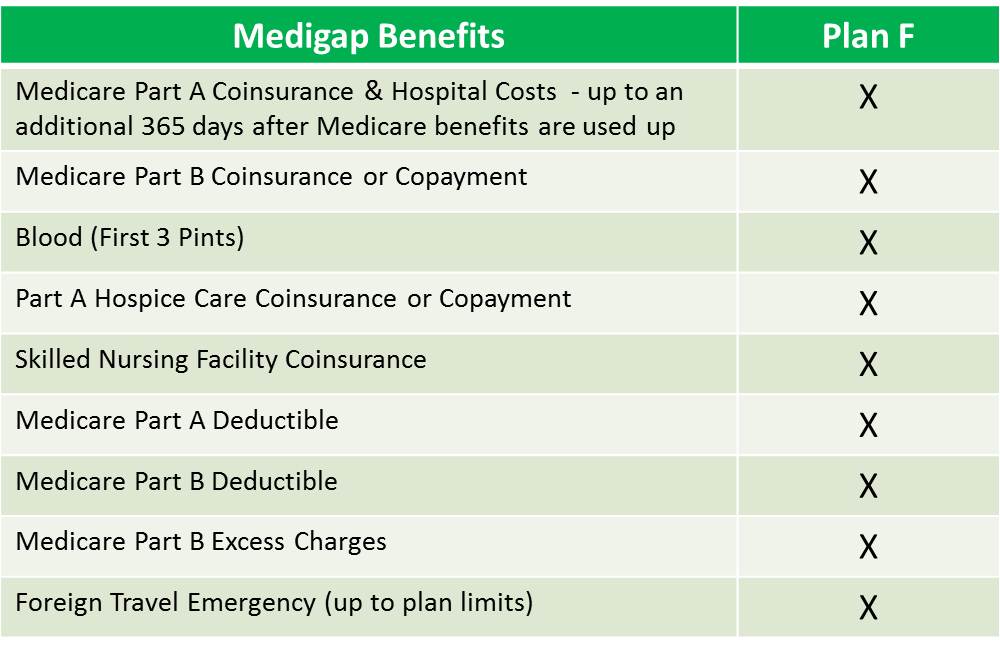

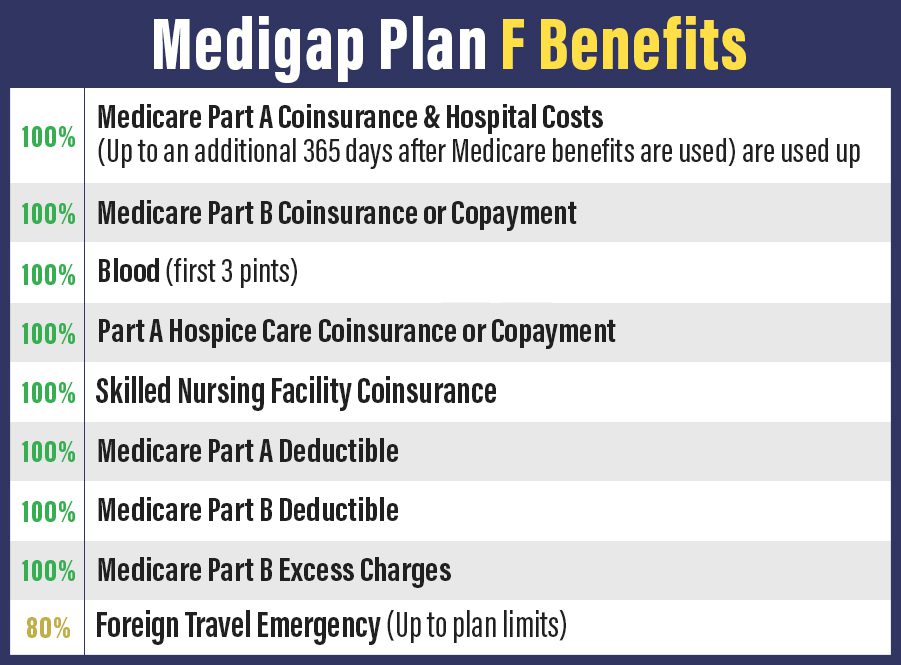

Plan F covers the gap in coverage associated with Parts A and B. Medicare Supplement Plan F has been the top selling Medigap plans for decades.

Additionally it covers foreign travel agency care and skilled nursing facility coinsurance explains BlueCross BlueShield of Illinois.

What does medigap f cover. Certain Medicare Supplement Insurance Medigap plans do offer some coverage for foreign travel emergency health care. 365 additional hospitalization days Nationwide network of doctors and hospitals. Like many other Medigap policies Plan F also covers Part B copayments and the deductible.

Medigap policies are a system of 10 standardized Medigap plans with designations A B C D F G K L M and N. Medicare Plan F is the most comprehensive Medicare supplement plan. Out of all of the Medicare.

Medicare Supplement Plan F covers the most amount of benefits compared to the other Medicare Gap plans. Medigap Plan Anot to be confused with Medicare Part A is the most basic plan available and thus typically the most affordable. They are designed to provide more coverage for Ordinary Medicare in addition to all or part of the expenditure that Medicare does not cover like visual dental pharmaceutical or long-term coverage.

What Does Plan F Cover at the Hospital. The Medigap Plan F is currently the most common and comprehensive Medigap plan. Medigap Plans C D F G M and N each provide foreign travel emergency care coverage which you should keep in mind as you travel overseas.

Medicare Supplement Plan F only covers services that are covered by original Medicare parts A and B. That means you could see a doctor with little to no money out of your own pocket. Article Quick Navigation Links.

Plan G does not cover the Medicare Part B deductible. Numerous individuals pick a Medicare Supplement plan or Medigap plan to help deal with their insurance costs in Original Medicare. The reason Medigap Plan F is likely so popular is because of the comprehensive coverage it provides.

It is designed to fill all gaps in the original health insurance coverage Part A Hospital and Part B PhysicianOutpatient. Also referred to as Medigap Plan F it covers Medicare deductibles and all copays and coinsurance. The aim of the Medigap policies are to refund you for all the expenditure made out of your pocket for Medicare.

Medigap is Medicare supplemental insurance sold by private companies to help cover original Medicare costs such as deductibles copayments and. Medigap Plan F is the most comprehensive Medigap plan covering 100 of your cost-sharing. Medigap Plan F and Plan G both offer coverage for many of the 9 Medicare costs that can be covered by a Medicare Supplement Insurance plan.

If you receive a medical treatment that Medicare does not. In fact Medigap Plan F is the only Medigap policy that provides coverage for all nine basic benefit areas. A Medicare Supplement plan can cover all or just a percentage of your expenses like deductibles copayments and coinsurance sums.

This plan enables someone to be able to visit a doctors office or hospital to receive approved treatment and walk out without paying anything virtually eliminating all out of pocket costs. Also known as Medigap Medicare Supplement plans are designed to help pay some of the health care costs that Original Medicare doesnt cover. Plan F is a plan thats included in Medicare supplement insurance Medigap.

Blue Cross Medicare Supplement Plan F pays the Medicare Part A hospital deductible and coinsurance the Part B deductible and excess charges. It can help pay for expenses that arent covered under original Medicare. There are 10 Medigap plans including Medigap Plan A.

Thus you only pay the monthly premium and have no other out-of-pocket expense. Medigap plans fill in the gaps of Original Medicare however each Medigap plan offers different coverage. Plan F is one of two Medicare Supplement plans that covers Part B excess charges what some doctors charge above what Medicare pays for a service.

Medigap Plan F is the most comprehensive of the Medigap plan offerings as it covers almost all of the costs associated with Medicare parts A and B. Plan C is the other. Medicare Part A coinsurance and hospital.

The main difference is that Plan F covers the Medicare Part B deductible. Plan F is for beneficiaries looking for full coverage for all out-of-pocket costs including deductibles coinsurance and copayments. Here is a list of what Medigap can cover.

Medicare Part A covers inpatient hospital services skilled nursing blood transfusions and home health services that occur in the hospital.

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment