Featured

Indemnity Plan Vs Ppo

As a result you have more choice in who you see for dental care. The ASDA also highlights that this is one reason why indemnity plans arent as common as they used to be.

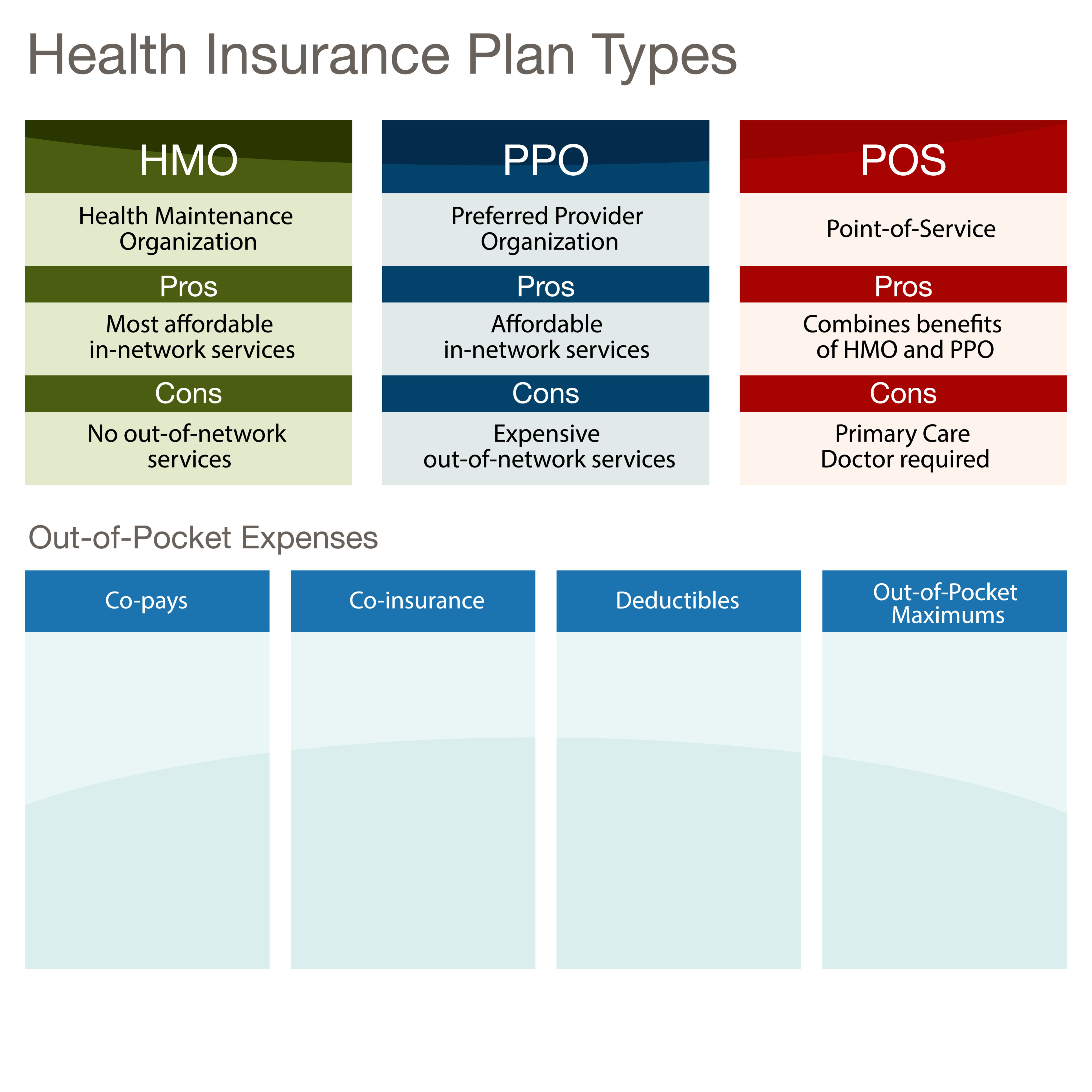

Different Types Of Health Insurance Plans

Different Types Of Health Insurance Plans

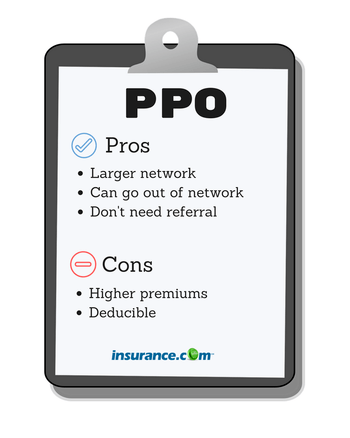

Additionally there is no need to have a specific primary care doctor and no need for a referral to see any specialist.

Indemnity plan vs ppo. DMOs generally offer the lowest monthly premiums and have low out-of-pocket costs for routine services like cleanings. Dental indemnity plans are still fairly common but virtually all commercial major medical plans utilize managed care. When a person purchases health care insurance under the indemnity plan you will receive reimbursement for his or her medical expenses for up to a specified number of days.

Indemnity plans can cost more. The plan you buy will cover either all or a percentage of your bill. In addition to paying benefits when you and your family need medical care this plan is designed to help prevent illness and promote wellness.

Employees with employer-sponsored health insurance had indemnity plans in 2019. You can get a preventative plan for under a dollar a day or can buy a plan that covers major services without having waiting periods. Unlike a PPO plan the consumer generally must complete the paper claim form submit the form to the insurance company and wait to be reimbursed for the services.

Indemnity plans are considered fee-for-service health insurance plans where you have the freedom to choose your health care services and as long as your services are eligible you may. In this type of plan an insurance company pays claims based on the procedures performed usually as a percentage of the charges. An indemnity dental plan is sometimes called traditional insurance.

If choosing or having access to any dentist or specialist is important an indemnity plan may be the best fit. An indemnity plan is often known as a fee-for-service plan. A primary advantage of an indemnity plan relative to a PPO is that benefits typically are consistent across a broader range of providers.

The insurance company is going to charge you more in premium than their PPO plans with similar benefits. However the insurer doesnt maintain the same contractual relationships with providers in many indemnity plans. With a traditional indemnity health insurance plan you will not be limited to choices of health service providers that are within a preferred provider list or network.

Indemnity plans may be more expensive than other plans but with that price. Unlike HMO and PPO health insurance plans most indemnity policies allow you to choose any doctor specialist and hospital that you wish when seeking health care services. With many indemnity plans there are.

However these plans can also be more flexible in your choice of providers. There is a plan to fit you or your familys needs. But their out-of-pocket costs may be higher for services beyond routine checkups and cleanings.

Dental procedures can be a big hit to your wallet but it doesnt have to be when you have dental insurance. The similarity of treatment patterns in HMOs and indemnity insurance suggests that quality differences between the these two types of plans are not large. While the cost of dental insurance varies based on location and level of coverage the National Association of Dental Plans NADP explains that indemnity plans tend to be more expensive than HMO or PPO plans.

Indemnity plans also known as conventional plans have fallen out of favor over the last few decades and are very rare less than1 of US. Indemnity plans unlike HMO and PPO plans allow enrollees the freedom to choose any doctor specialist or hospital without having to worry about if its in-network or not. Indemnity PPO Medical Plan This is a preferred provider organization PPO plan that combines a Health Reimbursement Account with comprehensive medical coverage.

Medical fixed indemnity plans. Generally an indemnity plan allows patients to choose their own dentists but it may also be paired with a PPO. The indemnity plan offers more intense treatment for live births only more Caesarean sections while the HMOs offer more intense treatment for heart attacks and colon cancer.

With BlueCross BlueShield traditional indemnity Preferred Provider Organization PPO and Point-Of-Service POS products our members never have to worry about health care regardless of where they live or travel. It truly pays to buy a dental plan. Your BlueCross BlueShield member identification card - The BlueCard - is your direct link to care anywhere in the country and many.

Therefore your out-of-pocket expenses on services often are higher. These limitations are common with a PPO or HMO plan. Under the PPO plan however persons who have taken this policy will receive reimbursement for all their medical expenses from specified service providers.

Indemnity may also be referred to as Fee-for-Service but PPO and EPO are also fee-for-service ie the provider gets paid a fee for each medical service instead of HMO capitationor a salary so there is nothing unique there.

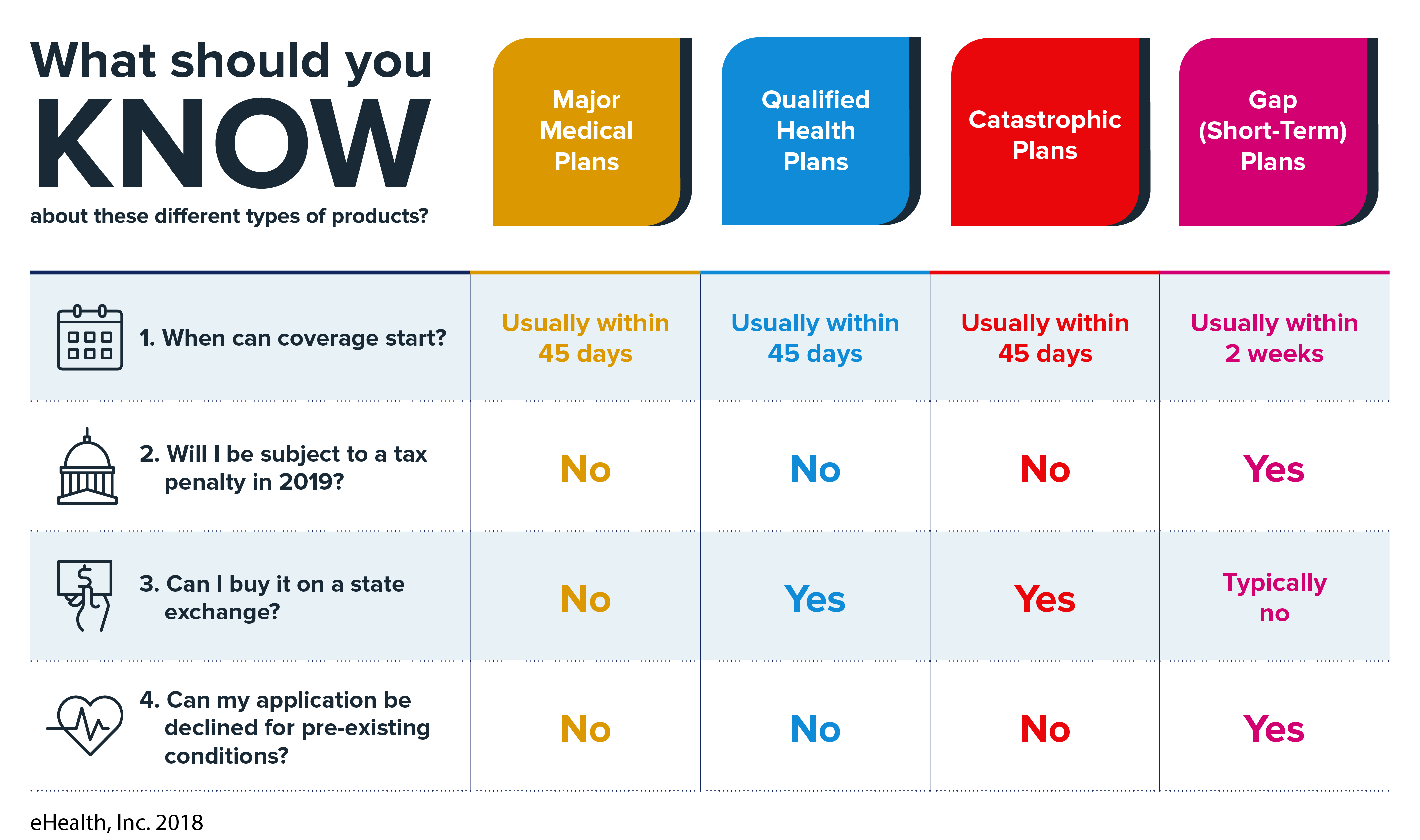

Short Term Health Plan Vs Major Medical Plan

Short Term Health Plan Vs Major Medical Plan

What Is The Difference Between A Ppo Plan Vs An Indemnity Plan Youtube

What Is The Difference Between A Ppo Plan Vs An Indemnity Plan Youtube

Fixed Indemnity Insurance Definitions Video Infographic

Fixed Indemnity Insurance Definitions Video Infographic

The Facts About Ppo Hmo Ffs And Pos Plans Independent Health Agents

The Facts About Ppo Hmo Ffs And Pos Plans Independent Health Agents

Terms Defined Hmos Vs Ppos Empower Health Insurance

Terms Defined Hmos Vs Ppos Empower Health Insurance

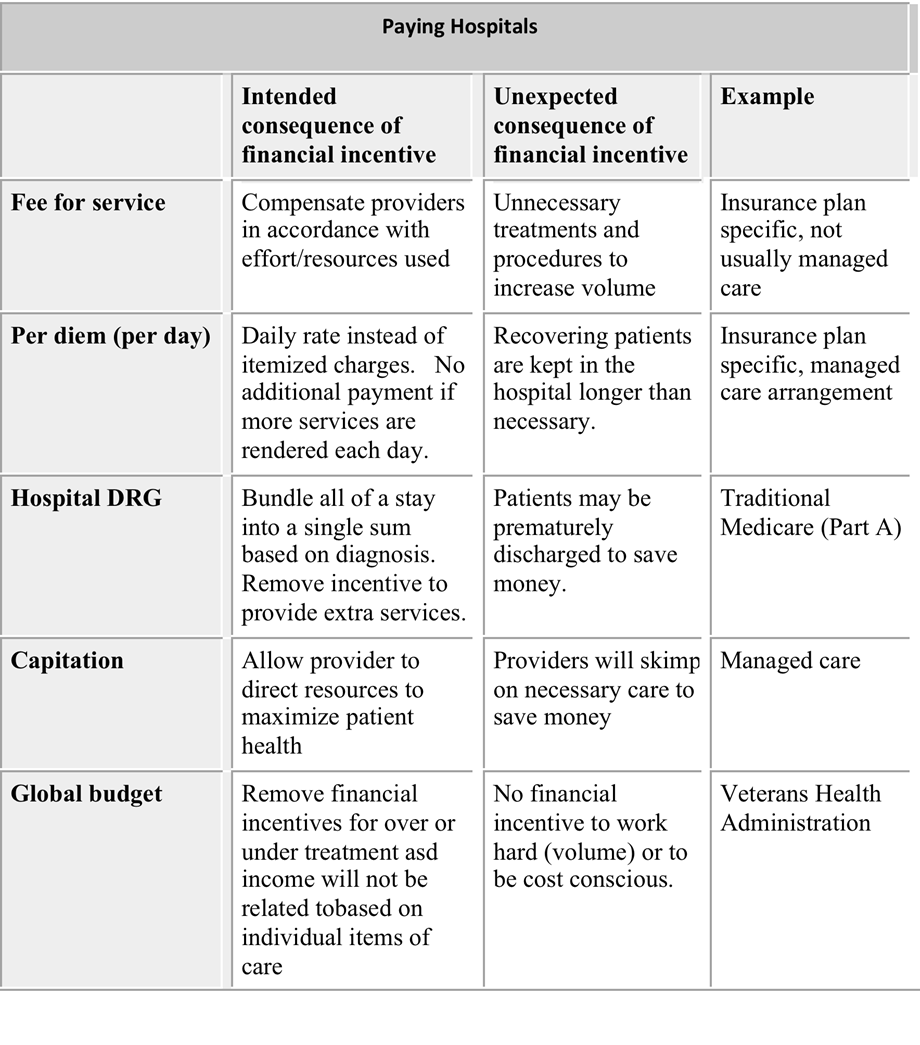

Types Of Health Care Plans By Form Of Government Download Table

Types Of Health Care Plans By Form Of Government Download Table

Paying For Health Care In The Us

Paying For Health Care In The Us

Catastrophic Health Insurance Definitions Plan Costs

Catastrophic Health Insurance Definitions Plan Costs

Group Health Insurance An Overview Indemnity Health Plans Managed Care Plans And Other Health Plans

Group Health Insurance An Overview Indemnity Health Plans Managed Care Plans And Other Health Plans

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment