Featured

- Get link

- X

- Other Apps

Medicare Advantage Late Enrollment Penalty

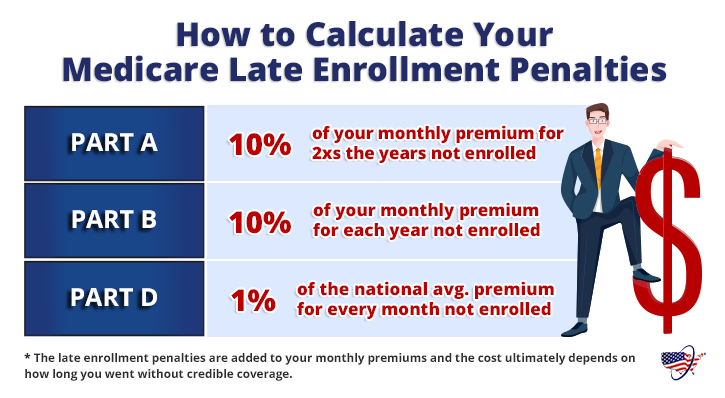

After youve signed up during initial enrollment there are only a few times throughout the year when you can change or drop your Medicare Advantage coverage. The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

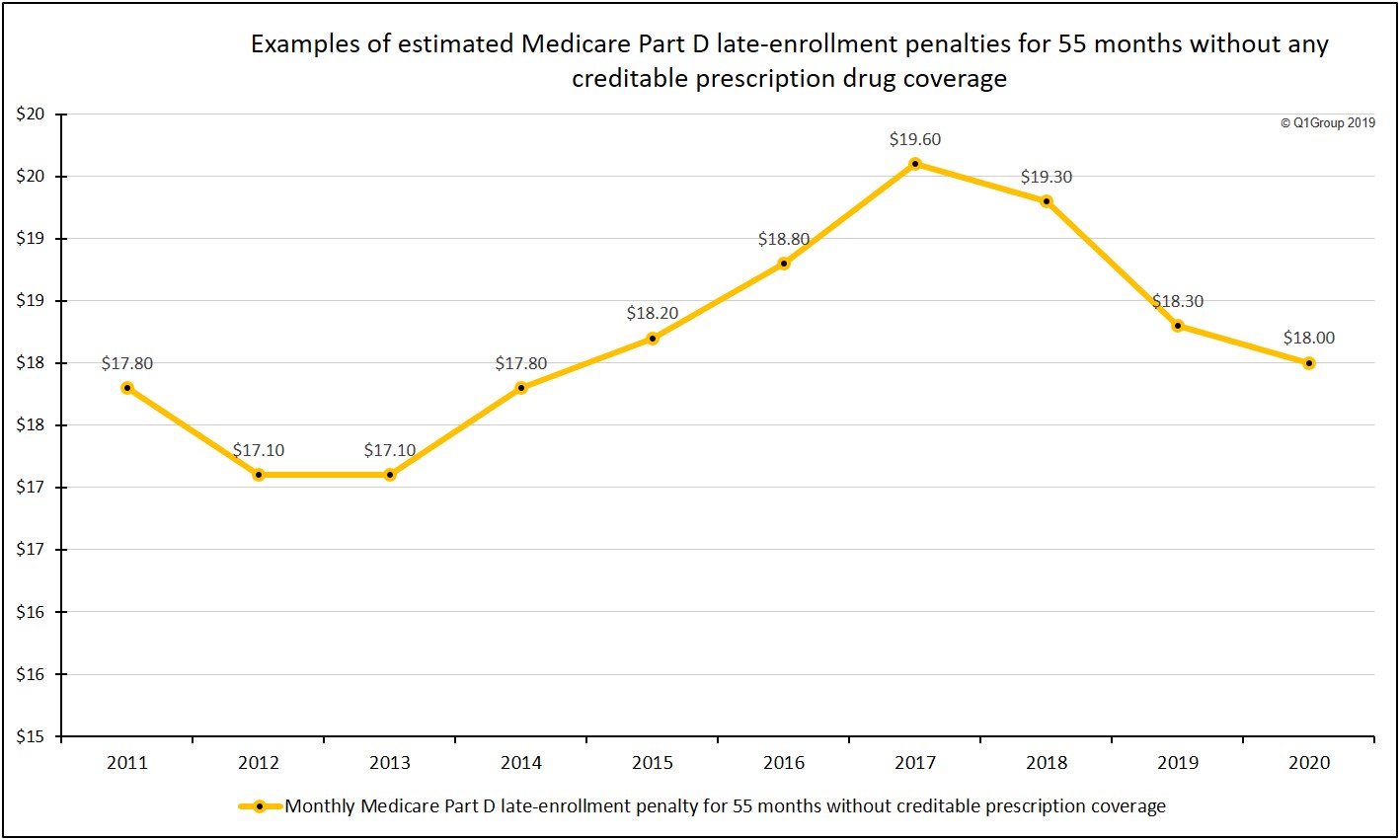

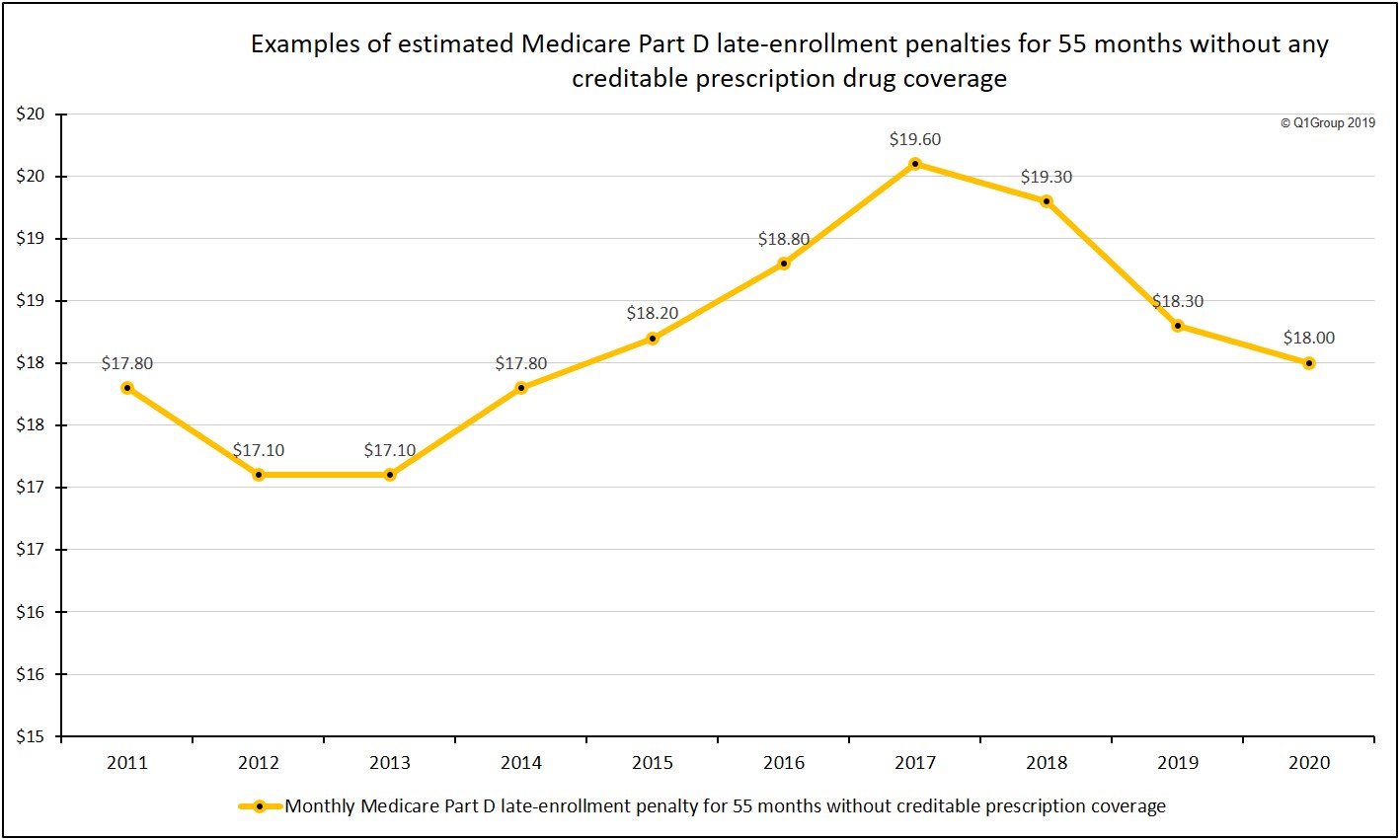

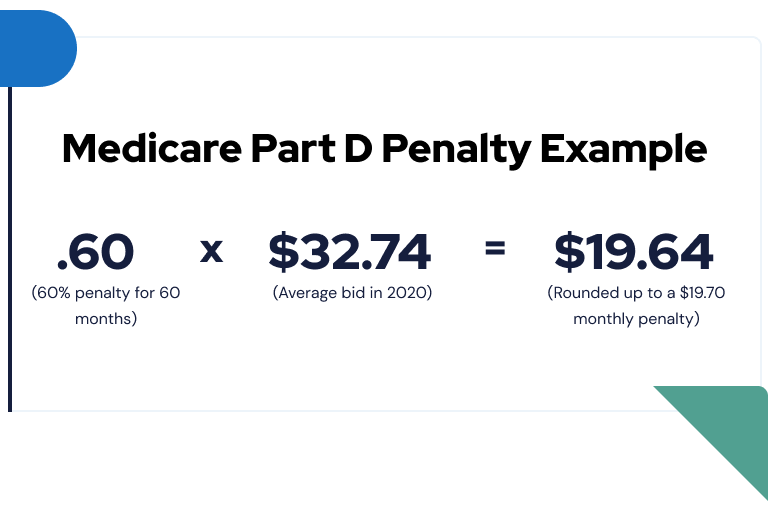

For example if the time period that lapsed without any drug coverage extends 30 full months the penalty would be 30 of 3274 which equals 982 rounded up to 990.

Medicare advantage late enrollment penalty. The late enrollment penalty amount is 10 percent of the cost of the monthly premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over theres a period of 63 or more days in a row when you dont have Medicare drug coverage or other Creditable prescription drug coverage. These are important for every new and existing Medicare enrollee to know as these will be crucial in avoiding late enrollment penalties and g.

Medicare Late Enrollment Penalties If you dont sign up for Medicare when youre first eligible you may have to pay a late enrollment penalty. The Medicare Part B late enrollment penalty is also on a 12-month basis. The penalty applies no matter how long you delay Part A enrollment.

For Medicare Part B the penalty is 10 percent for every 12-month period you delay. Part B late enrollment penalty If you didnt get Part B when youre first eligible your monthly premium may go up 10 for each 12-month period you couldve had Part B but didnt sign up. The penalty applies no matter how long you delay Part A enrollment.

Part D late enrollment penalty. How Much is the Medicare Part B Penalty. In this case 990 would be added to your plans monthly premium which varies by plan and income level for as long as Part D coverage continues.

For the Part A late enrollment penalty Medicare increases the premium by 10 for a period twice the number of years for which a person did not have Medicare Part A while they were eligible. In most cases youll have to pay this penalty each time. If you wait 2 years for example you would pay the additional 10 for 4 years 2 x 2 years.

Medicare Enrollment Periods During specific Medicare enrollment periods you can enroll in a Medicare plan drop a plan or switch between Medicare plans. Part B late enrollment fee If you sign up for Part B after the initial enrollment period and youre not eligible for a Special Enrollment Period you may be subject to a late enrollment penalty. The late enrollment penalty is.

If you have to pay a premium the penalty for late enrollment is 10. The penalty is 10 percent for each 12-month period you should have been enrolled. Generally the late enrollment penalty is added to the persons monthly.

Medicare Part B Late Enrollment Penalty. In a Medicare drug plan may owe a late enrollment penalty if he or she goes without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more in a row after the end of his or her Initial Enrollment Period for Part D coverage. For example if you waited three years after your Initial Enrollment Period to sign up for Medicare Part B your late enrollment penalty.

And you have to pay the penalty fee plus your normal premium for as long as you have Part B. If you dont enroll when youre first eligible for Medicare you can be subject to a late-enrollment penalty which is added to the Medicare Part A premium. Medicare beneficiaries may incur a late enrollment penalty LEP if there is a continuous period of 63 days or more at any time after the end of the individuals Part D initial enrollment period during which the individual was eligible to enroll but was not enrolled in a Medicare Part D plan and was not covered under any creditable prescription drug coverage.

The Part A premium penalty is charged for twice the number of years you delay enrollment. If you dont enroll in Part B when you first qualify for Medicare and you do not have other creditable coverage you may incur a late enrollment penalty that will last during your entire time on Medicare. Medicare Part B is optional but you could face a late enrollment penalty if you do not sign up for it when you are first eligible and dont qualify for special enrollment.

If you wait 2 years for example you would pay the additional 10 for 4 years 2 x 2 years. The penalty for late enrollment. The penalty raises your monthly Medicare Part A premium by 10 percent for a fixed period of time.

If you have to pay a premium the penalty for late enrollment is 10. Youll have to pay this additional cost each month for twice the number of years you were eligible for Medicare. For every 12-month period you delay enrollment you pay an extra 10 percent for your Part B premium.

The late enrollment penalty is an amount thats permanently added to your Medicare drug coverage Part D premium. If youre new to Medicare and dont sign up for Part B when youre first eligible you may end up having to pay the Part B late enrollment penalty. The penalty is 10 of your monthly premium and it applies regardless of the length of the delay.

The Part A premium penalty is charged for twice the number of years you delay enrollment. It differs though in the fact that you have to pay the penalty for the entire time you have Medicare. If your initial enrollment period ended July 31 2015 and you waited until August 2 of 2017 to enroll your premium will go up 20 percent.

Part D Late Enrollment Penalty Maximus Appeals Lep Learn How To Fight It

Medicare Late Enrollment Penalties Healthline Com

Medicare Late Enrollment Penalties Healthline Com

2021 Medicare Part D Late Enrollment Penalties Will Increase Slightly Maximum Penalties Can Reach Up To 695 For The Year

2021 Medicare Part D Late Enrollment Penalties Will Increase Slightly Maximum Penalties Can Reach Up To 695 For The Year

Penalties For Not Signing Up For Medicare Boomer Benefits

Penalties For Not Signing Up For Medicare Boomer Benefits

Medicare Late Enrollment Penalty And How To Avoid It Boomer Benefits

Medicare Late Enrollment Penalty And How To Avoid It Boomer Benefits

2020 Medicare Part D Late Enrollment Penalties Will Decrease For A Third Year In A Row Although Maximum Penalties Can Reach Up To 641 Per Year

2020 Medicare Part D Late Enrollment Penalties Will Decrease For A Third Year In A Row Although Maximum Penalties Can Reach Up To 641 Per Year

Medicare Late Enrollment Penalty Avoid Penalty Fees

Medicare Late Enrollment Penalty Avoid Penalty Fees

Medicare Don T Wait Until It S Too Late

Medicare Don T Wait Until It S Too Late

Medicare Late Enrollment Penalties Stevens Associates Insurance Agency Inc

Medicare Late Enrollment Penalties Stevens Associates Insurance Agency Inc

Petition Remove The Life Long Late Enrollment Penalty From Medicare Part D Change Org

Petition Remove The Life Long Late Enrollment Penalty From Medicare Part D Change Org

Medicare Late Enrollment Penalty Amounts And Conditions

Medicare Late Enrollment Penalty Amounts And Conditions

How To Avoid The Medicare Part B Late Penalty Aarp Medicare Plans

How To Avoid The Medicare Part B Late Penalty Aarp Medicare Plans

2020 Medicare Part D Late Enrollment Penalties Will Decrease For A Third Year In A Row Although Maximum Penalties Can Reach Up To 641 Per Year

2020 Medicare Part D Late Enrollment Penalties Will Decrease For A Third Year In A Row Although Maximum Penalties Can Reach Up To 641 Per Year

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment