Featured

What Is An Hra Medical Plan

A Health Reimbursement Arrangement HRA is an employer-funded account that helps employees pay for qualified medical expenses not covered by their health plans. The HRA is an employer-sponsored plan that can be used to reimburse a portion of your and your eligible family members out-of-pocket medical expenses such as deductibles co-insurance and pharmacy expenses.

Hra Vs Fsa See The Benefits Of Each Wex Inc

Hra Vs Fsa See The Benefits Of Each Wex Inc

The QSEHRA qualified small employer HRA and the ICHRA individual coverage HRA are the only health reimbursement arrangements that allow employers to reimburse employees tax-free for health insurance premiums and qualified medical expenses.

What is an hra medical plan. An HRA or health reimbursement arrangement is a kind of health spending account provided and owned by an employer. What is a HRA medical plan. Second you dont necessarily withdraw funds from HRAs to cover medical costs.

There can be tax advantages. What Is an HRA. Sometimes called a health reimbursement arrangement an HRA works a bit differently than an HSA.

First of all employers solely fund this type of account. An HRA is currently defined as a group health plan. So if yours offers one youre in luck.

HRA Plans are accounts that employers pay into for their employees out of pocket healthcare expenses There are tax benefits for both employers and employees using these plans If you have an HRA plan make sure to take this into account when you are comparing health. The health reimbursement arrangement or health reimbursement account HRA is a truly effective way for an employer to offer special healthcare benefits while permitting an employee to still control their own medical careThe question is what exactly are these plans. Lets take a look at how the health reimbursement arrangement works HRA eligible expenses and various types.

Health reimbursement arrangements HRAs are a benefit that some employers offer their employees to help with healthcare expenses. Lets look at the health plans that work together with the two major types of HRAs. Health Reimbursement Arrangements HRAs On June 20 2019 the Internal Revenue Service the Department of the Treasury the Department of Labor and the Department of Health and Human Services issued final rules regarding health reimbursement arrangements HRAs and other account-based group health plans.

Its an especially good option for small businesses that cant afford to offer group health insurance as the business can choose the amount of the allowance to offer its employees. Most employers set up HRAs for their employees to pay for expenses not typically paid for by health plans medical and pharmacy expenses that may be paid out-of-pocket before meeting a deductible as well as coinsurance after meeting a deductible. You may need long-term care for which a low-deductible health plan may be a better choice.

The only possible draw-back to an HRA is that it is not portable. Health Reimbursement Account HRA Frequently Asked Questions. What does this mean.

An HRA medical plan is a popular alternative to traditional group plans. The QSEHRA qualified small employer HRA and the ICHRA individual coverage HRA are the only health reimbursement arrangements that allow employers to reimburse employees tax-free for health insurance premiums and qualified medical expenses. What is mean is that you do not have to pay taxes on the money you are reimbursed.

What is an Health Reimbursement Account HRA. Other key things to know about HRAs are. An HRA plan is an excellent way to provide health insurance benefits and allow employees to pay for a wide range of medical expenses not covered by insurance.

Since you spent the money on qualified medical expenses HRA funds are not considered income and therefore not subject to taxes. Theyre a way for. Specifically benefits paid out of group health plans cannot have annual limits.

Sounds amazing right. Typically this type of HRA is offered alongside a high-deductible plan and employees may request reimbursement for insurance deductibles co-insurance costs and other qualifying healthcare expenses. What is an HRA health plan.

Think of an HRA or health reimbursement arrangement as a 401 K style benefit that puts the power in the hands of employees thus shifting the risk from the employer and offering. Group Coverage HRA GCHRA GCHRAs also referred to as integrated HRAs can only be offered in conjunction with group health insurance plans. So now you might be wondering.

The Affordable Care Act commonly referred to as Health Care Reform placed certain restrictions on group health plans. The money in it pays for qualified expenses like medical pharmacy dental and vision as determined by the employer. Lets look at the health plans that work together with the two major types of HRAs.

HRAs are also considered tax-advantaged plans.

Understanding Hsa Hra And Fsa Plans New Youtube

Understanding Hsa Hra And Fsa Plans New Youtube

What Is A Health Reimbursement Account A Basic Understanding

What Is A Health Reimbursement Account A Basic Understanding

Hra Health Reimbursement Account Millennium Medical Solutions Inc

Hra Health Reimbursement Account Millennium Medical Solutions Inc

What You Need To Know About Hsas Hras And Fsas

What You Need To Know About Hsas Hras And Fsas

Health Reimbursement Arrangements Pittsburgh Pennsylvania

Health Reimbursement Arrangements Pittsburgh Pennsylvania

Comparing Tax Favored Hsa Hra Fsa Medical Options Don T Mess With Taxes

How Does A Hra Health Plan Work

How Does A Hra Health Plan Work

Health Reimbursement Arrangements Hra Changes For 2020

Health Reimbursement Arrangements Hra Changes For 2020

Https Www Cms Gov Medicare Coordination Of Benefits And Recovery Mandatory Insurer Reporting For Group Health Plans Ghp Training Material Downloads Health Reimbursement Arrangement Hra Pdf

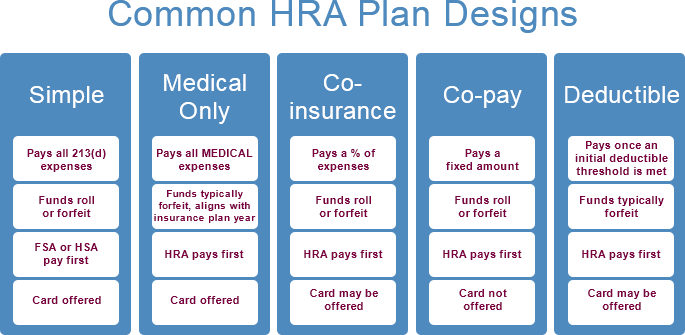

Best Practices To Keep Your Hra Plan Design Simple But Impactful Bri Benefit Resource

Best Practices To Keep Your Hra Plan Design Simple But Impactful Bri Benefit Resource

Fsa Vs Hra Vs Hsa What Are The Similarities And Differences

Fsa Vs Hra Vs Hsa What Are The Similarities And Differences

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

/GettyImages-1144275830-13fc9256a5b846ae809e04aaa54987e1.jpg)

Comments

Post a Comment