Featured

Obamacare Income Limits 2019 Chart

Lowest eligible income 100 FPL. 978 of your income.

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Before the American Rescue Plan was enacted a single individual in the continental US.

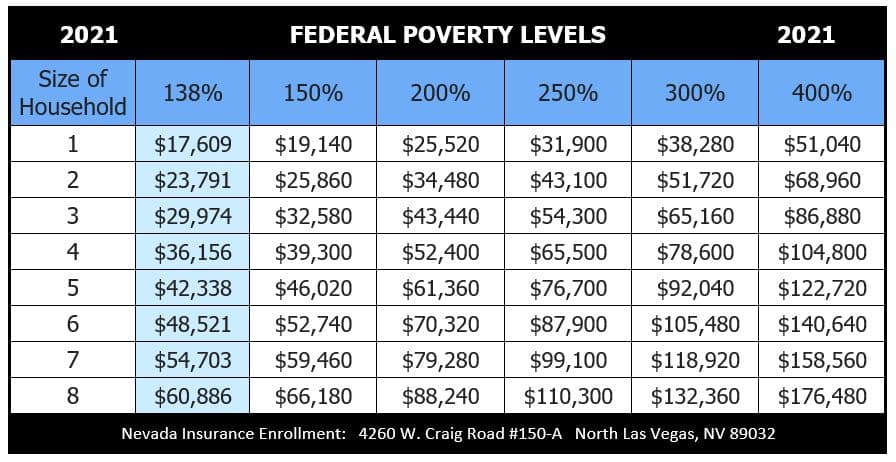

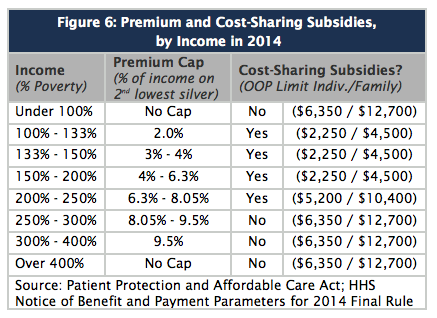

Obamacare income limits 2019 chart. You may qualify for a premium subsidy AND a cost share reduction if your yearly income is between 17237 -30350. 9500 - 4890 4610. The chart states that you are eligible for Obamacare subsidies for 2019 if your household income is at least 100 higher than the percent of the FPL in 2018 or in other terms.

This chart really illustrates the complexity of tax planning taking into account ACA premium subsidies. Cost Share Reduction Tier 1 limit. Please note that in states that expanded Medicaid those making under 138 of the poverty level.

Higher than 12140 and lower than 48560. Select your income range. You may qualify for a 2020 premium subsidy if your yearly income is between.

And 3 New York state where the FPLP threshold is 200. 00978 50000 4890. Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate.

The basic math is 4X the Federal Poverty Level FPL as determined by the government. You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or below. 9 rows You simply wont qualify for monthly premium assistance if you make more than the income limit.

Minimum Income 100 Federal Poverty Level Maximum Income 400 Federal Poverty Level. Dont include qualified distributions from a designated Roth account as income. Fortunately the HealthCaregov exchange figures it all out for you.

See details on retirement income in the instructions for IRS publication 1040. Higher than 16460 and lower than 65580. After earning an income of 100400 or higher for a family of four 83120 for a family of three 65840 for a married couple with no kids and 48560 for single individuals you will no longer receive government health care subsidies.

But the American Rescue Plan changed the rules for 2021 and 2022. So yes in years that you claim your son as a tax dependent youre considered a household of two and youd be eligible for a premium subsidy with an income of up to 400 of the poverty level for a household of two for 2021 coverage that will be 68960. 1 the District of Columbia where the FPLP threshold is 210.

If I have the math correct a family of 2 could have about 25000 in income and pay only approximately 784 in ACA premiums and zero income tax. The income limit for subsidy eligibility is based on the size of your tax household. Estimating your expected household income for 2021.

You can probably start with your households adjusted gross income and update it for expected changes. The premiums are made affordable by a premium subsidy in the form of a tax credit calculated off your income relative to the Federal Poverty Levels FPL also known as the HHS poverty guidelines. You may qualify for a premium subsidy AND a cost share reduction if your yearly income is between 17236 -31225.

2 Minnesota where the FPLP threshold is 200. Was ineligible for subsidies in 2021 if their income exceeded 51040. If your MAGI goes above.

You can check the federal poverty level guidelines each year to figure out what the minimum income level is. Your actual subsidy could be much greater or much smaller depending on your income the number of people in your family your age and whether you smoke or not. Of course 25000 income would be zeroed out by the standard deduction.

Cost Share Reduction Tier 3 limit. Divorces and separations finalized before January 1 2019. For a family of four the income limit was 104800.

The minimum income for ObamaCare is 100 of the federal poverty level. You may qualify for a 2019 premium subsidy if your yearly income is between. Divorces and separations finalized on or after January 1 2019.

Now if your family is really big and there are 8 members the minimum income will be 42380 while. Cost Share Reduction Tier 2 limit. For a family of four it is somewhat difference and the minimum income should be around the 25100 mark while the maximum is 100400.

2019 Federal Poverty Level FPL Guidelines. As the CMMS eligibility chart reports adult households subject to the nations highest FPLP thresholds for Medicaid are those located in. The dollar amount of this changes every year but for 2020 it is 12490 for an individual and 25750 for a family of four.

2015 Aca Obamacare Income Qualification Chart My Money Blog

2015 Aca Obamacare Income Qualification Chart My Money Blog

2016 Federal Poverty Level Chart Gallery Of Chart 2019

2016 Federal Poverty Level Chart Gallery Of Chart 2019

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

How The Affordable Care Act Is About To Become More Expensive Mygovcost Government Cost Calculator

2021 Health Insurance Federal Poverty Level Chart

2021 Health Insurance Federal Poverty Level Chart

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment