Featured

- Get link

- X

- Other Apps

Cobra Coverage California

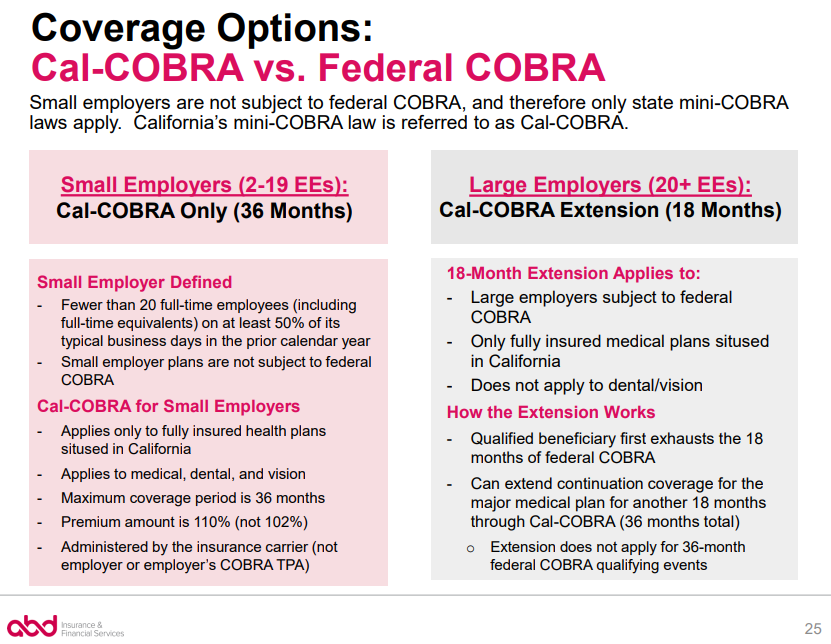

This extension is managed by the health plan carrier and you must inquire with the health plan carrier administering the COBRA coverage. If you take advantage of CalCOBRA you must pay the entire premium that both you and your employer have paid in the past plus an administrative fee.

What Qualifying Events Trigger Cobra California Benefit Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

What Qualifying Events Trigger Cobra California Benefit Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

What the company would have been contributing toward that premium which may be nothing depending on the plan.

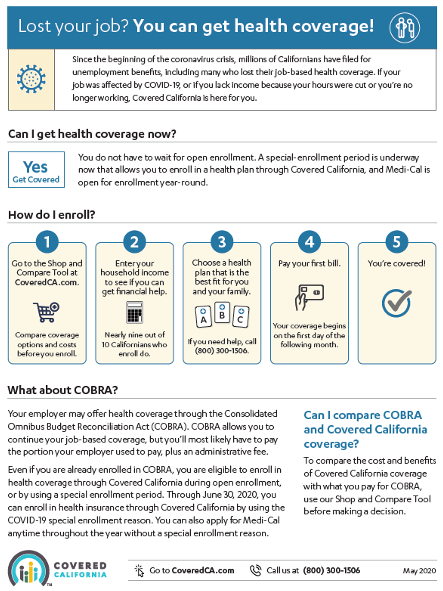

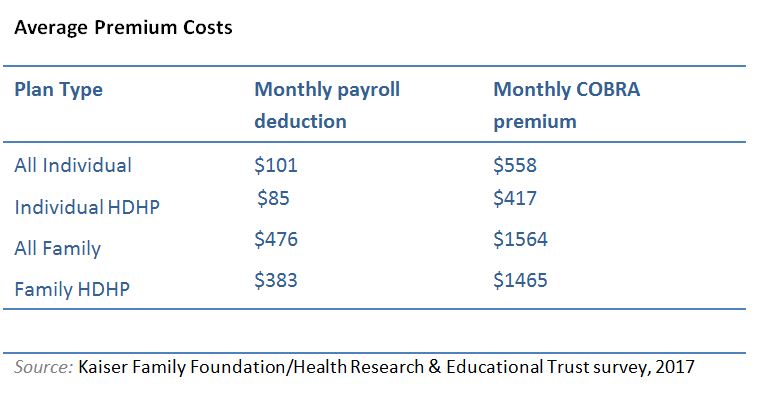

Cobra coverage california. If you use a COBRA plan to cover the one- or two-month gap that can happen when you enroll in Covered California after losing employer coverage you must cancel the COBRA coverage once the Covered California plan becomes effective. To calculate your premium for COBRA coverage with that health plan as a single person they will add. Federal COBRA and California Cal-COBRA basically provide that if you are no longer covered under your Employers group health plan you can keep the group coverage regardless of your health and with no pre-existing condition clause for 18 Federal or 36 months California at 2 to 10 more premium than your employer was being billed from the Insurance Company.

Under certain conditions California law permits an extension of COBRA coverage for an enrollee up to 36 months from the date coverage began. Your premium may be based on the age range of each employee or on a percentage of the total number of the employees covered by the plan. California law also requires the extension of COBRA coverage under certain conditions.

The Consolidated Omnibus Budget Reconciliation Act of 1985 COBRA requires most employers with group health insurance plans to offer their employees the opportunity to continue their health coverage under their employers plan even after they have been terminated or laid off or had another change in their employment status. Cal-COBRA is California law that has similar provisions to federal COBRA. Consolidated Omnibus Budget Reconciliation Act COBRA coverage terminates either at the end of the coverage period required by law or when one of four specific events occur.

With Cal-COBRA the group policy must be in force with 2-19 employees covered on at least 50 percent of its working days during. COBRA can be continued for anywhere from 18 to 36 months. Once you have used up all your COBRA benefits you may be able to get an extension of coverage under Cal-COBRA.

In most circumstances California COBRA participants can continue medical coverage for up to 36 months though it can vary. Forget that most people eligible for Cobra are losing group health coverage or starting their own business. The employees job ends.

Cal-COBRA Coverage Cal-COBRA is a state law in California that applies to employers with group health plans that cover between two and 19 employees allowing employees to keep their benefits for up to 36 months following a qualifying life event such as the following. COBRA can be costly COBRA participants must pay the full cost of the entire health premium s on their own in order to continue the plan. Secondary COBRA Event occurs during the 18-Month Period Dependents.

When all COBRACal-COBRA extensions are exhausted you can get individual health. Cal-COBRA may also be able to extend your coverage if your federal COBRA plan has expired. You must decide to accept or reject COBRA coverage during a certain time period usually 60 days after your employer notifies you.

CalCOBRA provides the same protection as COBRA in California for small employers with 2 to 19 workers. This makes no sense in most cases. To be covered by Cal-COBRA you must have employed two to 19 eligible employees on at least 50 percent of working days.

The COBRA statute requires employers to offer continuation of group coverage eg medical dental and vision to covered employees spouses domestic partners and eligible dependent children who lose group coverage due to a qualifying event. Cal-COBRA applies to employers and group health plans that cover from 2. Cal-COBRA is a California Law that lets you keep your group health plan when your job ends or your hours are cut.

The preceding calendar year or. It may also be available to people who have exhausted their Federal COBRA. Its not unusual to see Cobra coverage running 1500-2K for a family of 4.

Some employers do not contribute towards the cost of coverage for spouses or dependents although most do to at least some degree. There are two ways to beat this option barring the network issue. For individuals covered under federal COBRA Cal-COBRA may be used to extend health coverage for a combined period of up to 36 months.

Cal-COBRA allows individuals to continue their group health coverage for up to 36 months. Small Groups 2-19 up to 36 months of Cal-COBRA coverage Small Groups 20 Large Groups Federal COBRA beyond 18 months with qualifying extension Small Groups 20 Large Groups up to 18 months of Cal-COBRA extension beyond. If you have both COBRA coverage and Covered California at the same time and you receive financial help to help you pay your Covered California premium when.

The California Continuation Benefits Replacement Act of 1997 Cal-COBRA requires insurance carriers and HMOs to provide COBRA-like coverage for employees of smaller employers two to 19 employees not covered by COBRA. You must pay your monthly premiums or you can lose your coverage. In California if your employer has two to 19 employees you may be covered by Cal-COBRA.

Https Www Calpers Ca Gov Docs Initial Cobra Notice Pdf

Cobra Continuation Coverage Rights General Notice California Employees Hrcalifornia

Cobra Small Employer Exception Abd Insurance Financial Services

Cobra Small Employer Exception Abd Insurance Financial Services

Covered California Twitterissa Recently Lost Health Coverage And Being Offered Cobra You May Be Eligible For Financial Help To Lower The Cost For A Plan Through Coveredca Weigh Your Options Https T Co Yiq25mj3lm Https T Co Gzhurjjvsj

Covered California Twitterissa Recently Lost Health Coverage And Being Offered Cobra You May Be Eligible For Financial Help To Lower The Cost For A Plan Through Coveredca Weigh Your Options Https T Co Yiq25mj3lm Https T Co Gzhurjjvsj

Https Www Hemophiliaca Org Lost Your Coverage You Can Get Coverage

Covered California The Cobra Glitch Kqed

Covered California The Cobra Glitch Kqed

Https Www Coveredca Com Pdfs Forsmallbusiness Cc Cobra Rights Pdf

Covered California Sees More Than 123000 Consumers Sign Up For Coverage During The Covid 19 Pandemic

Covered California Sees More Than 123000 Consumers Sign Up For Coverage During The Covid 19 Pandemic

.png) How To Compare Cobra Versus Covered California Health Plans And Rates

How To Compare Cobra Versus Covered California Health Plans And Rates

Cal Cobra California 36 Months Of Medical Coverage When Job Ends

Cal Cobra California 36 Months Of Medical Coverage When Job Ends

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Https Sfhss Org Sites Default Files 2020 01 2020 20cobra Pdf

How To Compare Cobra Versus Covered California Health Plans And Rates

How To Compare Cobra Versus Covered California Health Plans And Rates

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment