Featured

- Get link

- X

- Other Apps

Copay After Deductible Meaning

Difference between Copay and Deductible. If youve paid your deductible.

Coinsurance And Medical Claims

Coinsurance And Medical Claims

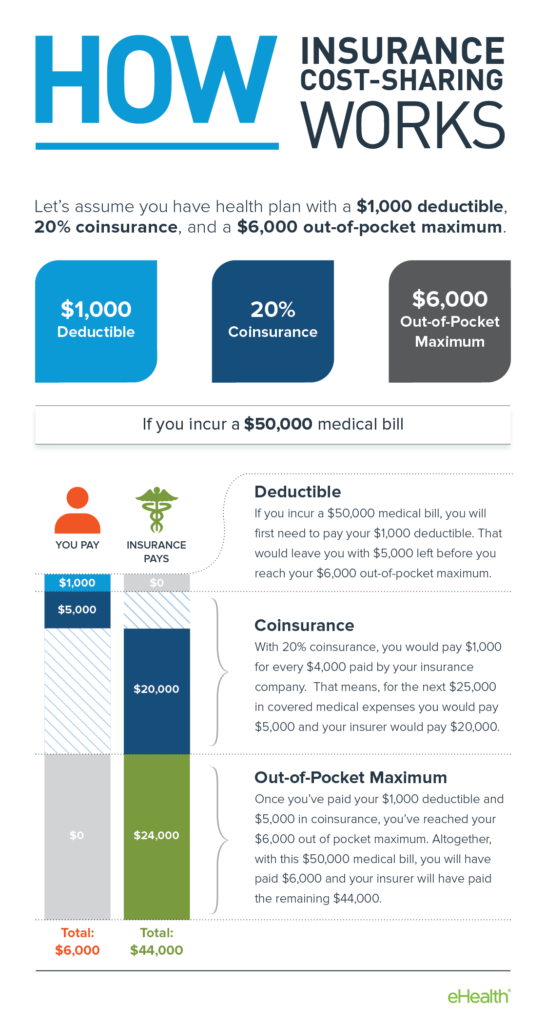

Out-of-Pocket Max the maximum amount you pay each calendar year to receive covered services after you meet your deductible.

Copay after deductible meaning. When you policy has coinsurance it means you may still be liable to pay even after meeting your deductible. The amount can vary by the type of service. The best advice is to shop around and check out all the available options.

Copay with deductible might mean you pay the copay before and after you meet the deductible. The one i am looking at says 60 dollar copay after deductible applies to deductible check mark 2-9-2014 1204am log in or sign up to post a comment Lets say your ins has a 1000 individual deductible. The deductible is the amount that you need to pay as a share towards your medical bill upon which your policy comes into effect.

Coinsurance is a portion of the medical cost you pay after your deductible has been met. Copay is the fixed amount that you have to pay towards your treatment. Coinsurance of 10 percent may seem like a small cost but if you need care for serious medical problems like cancer it could still amount to thousands of dollars.

You may have a copay before youve finished paying toward your deductible. Typically with HDHPs employees must meet their deductible before the carrier will pay for any services other than preventative care. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent.

Your copayment for a doctor visit is 20. To better understand this matter lets take a look at our example insurance policyholder Natalie. The size of deductible and amount of coinsurance affect the cost of a health care plan.

Difference between Copay and Co-insurance. A deductible is an amount that must be paid for covered healthcare services before insurance begins paying. Copays for High Deductible Health Plans HDHPs work a little different from other types of plans.

I get Copay after deductible -- you must pay for the service fully out of pocket until your deductible is met after which you must only pay the copay amount and the insurance pays for the rest. Continuing to pay copay after deductible requirements are met is quite common. I would expect the former to cost more if its copay ONLY less of its in addition to.

A fixed amount 20 for example you pay for a covered health care service after youve paid your deductible. Coinsurance copayment is a percentage of a medical charge that you pay that applies after your deductible has been met. Copay a fixed dollar amount you must pay to a provider at the time services are received.

A copay is a fixed amount you pay for a health care service usually when you receive the service. A copay after deductible is a flat fee you pay for medical service as part of a cost-sharing relationship in which you and your health insurance provider must pay for your medical expenses. It can be a fixed amount per the nature of treatment of a fixed percentage.

For example if your coinsurance is 20 percent you pay 20 percent of the cost of your covered medical bills. In contrast the deductible is a single amount accumulated once a year. Your plan determines what your copay is for different types of services and when you have one.

What your question does not include is the amount of your deductible. So what does Copay with deductible mean. Deductibles coinsurance and copays are all examples of cost sharing.

The deductible is how much you pay before your health insurance starts to cover your bills. Coinsurance the percentage of cost of a covered health care service you pay once you have met your deductible. For instance with 10 percent coinsurance and a 2000 deductible you would owe 2800 on a 10000 operation 2000 for the deductible and then 800 for the coinsurance on the remaining 8000.

Lets say your health insurance plans allowable cost for a doctors office visit is 100. Coinsurance is often 10 30 or 20 percent. The phrase 40 Coinsurance after deductible means that you may be responsible for 40 of the approved part of the bill plus the delta between what they bill and what they cover.

It can kick start your insurance plan once its finalized. You pay 20 usually at the time of the visit. This means that if you have an HDHP with a 3000 deductible and a 20 copay for primary care you may have to meet.

Copays and deductibles are both features of most insurance plans. After deductible might mean you only do the copay after its met.

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

Understanding Cost Sharing Deductibles Coinsurance And Copays Healthtn Com

Understanding Cost Sharing Deductibles Coinsurance And Copays Healthtn Com

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Out Of Pocket Maximums Copayments Coinsurance Bcbs Of Wny

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

Coinsurance And Medical Claims

Coinsurance And Medical Claims

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Copay With Deductible Vs Copay After Deductible Medical Sciences Stack Exchange

Copay With Deductible Vs Copay After Deductible Medical Sciences Stack Exchange

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment