Featured

Ca Premium Subsidy

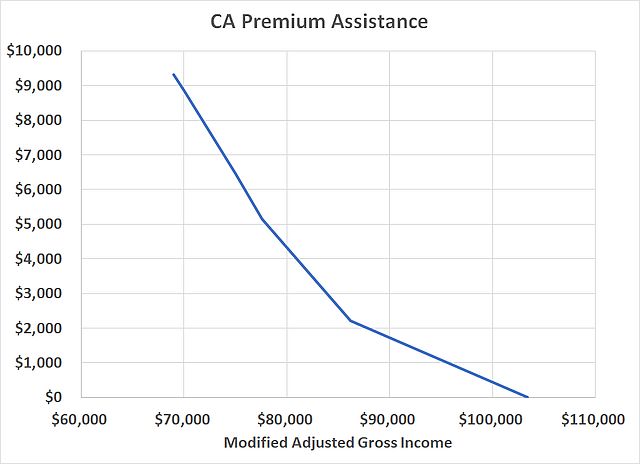

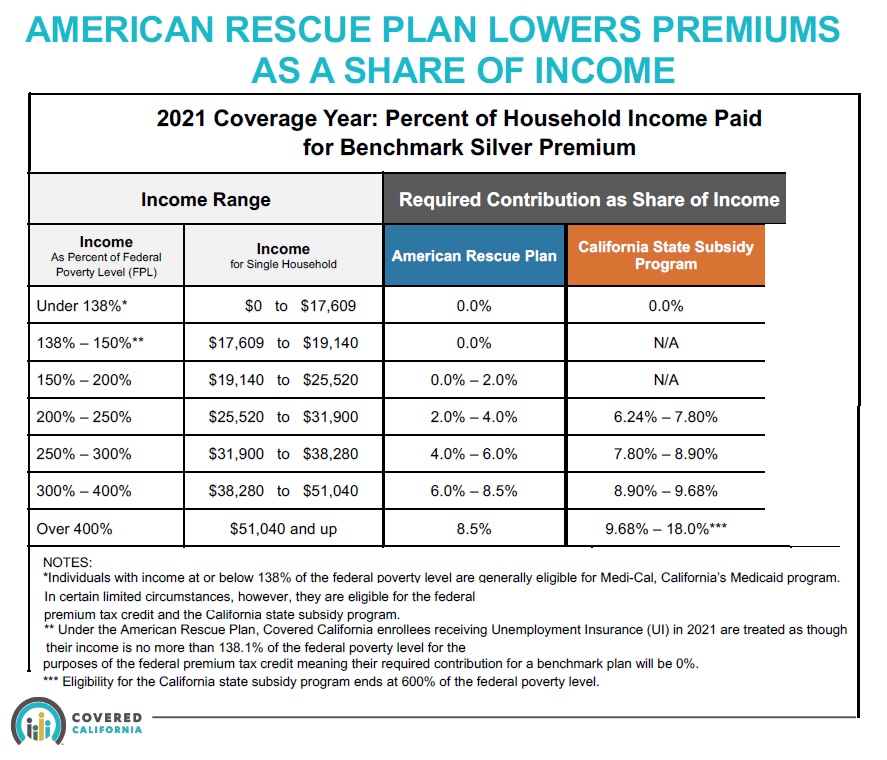

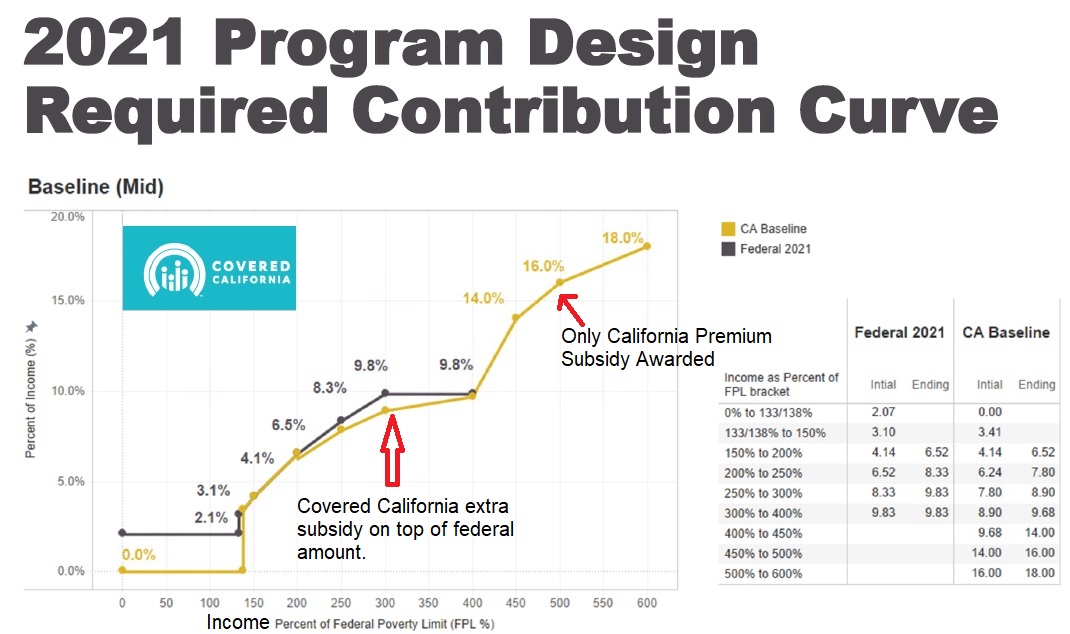

March 26 2021 at 527 am 297173. Some consumers between 200 and 400 of the FPL may also get a small amount of extra subsidy to further reduce their health insurance premiums.

State And Federal Subsidies For California In 2020 Health For California Insurance Center

State And Federal Subsidies For California In 2020 Health For California Insurance Center

Premium assistance subsidy PAS.

Ca premium subsidy. Health Insurance Through Covered California Is More Affordable Than Ever. Similarly how do Covered California subsidies work. The health insurance Premium Tax Credit subsidies will not arbitrarily stop based on income the subsidies will be more generous throughout the income range households who receive unemployment benefits in 2021 will have a special subsidy calculation and repayment of excess Premium.

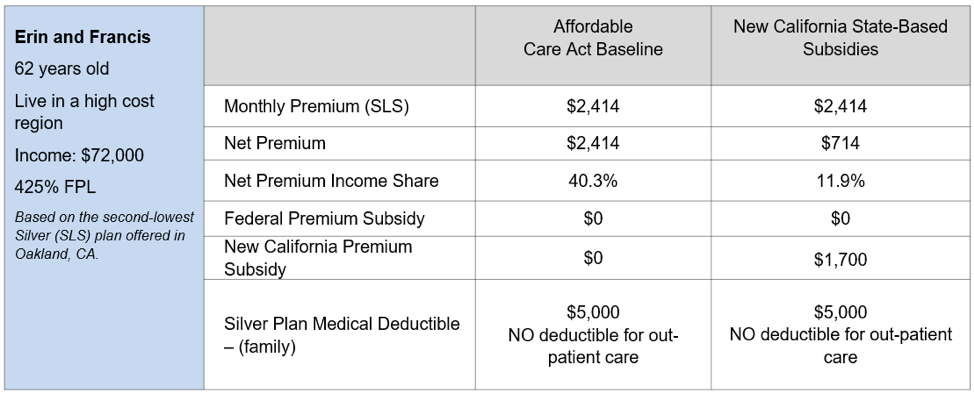

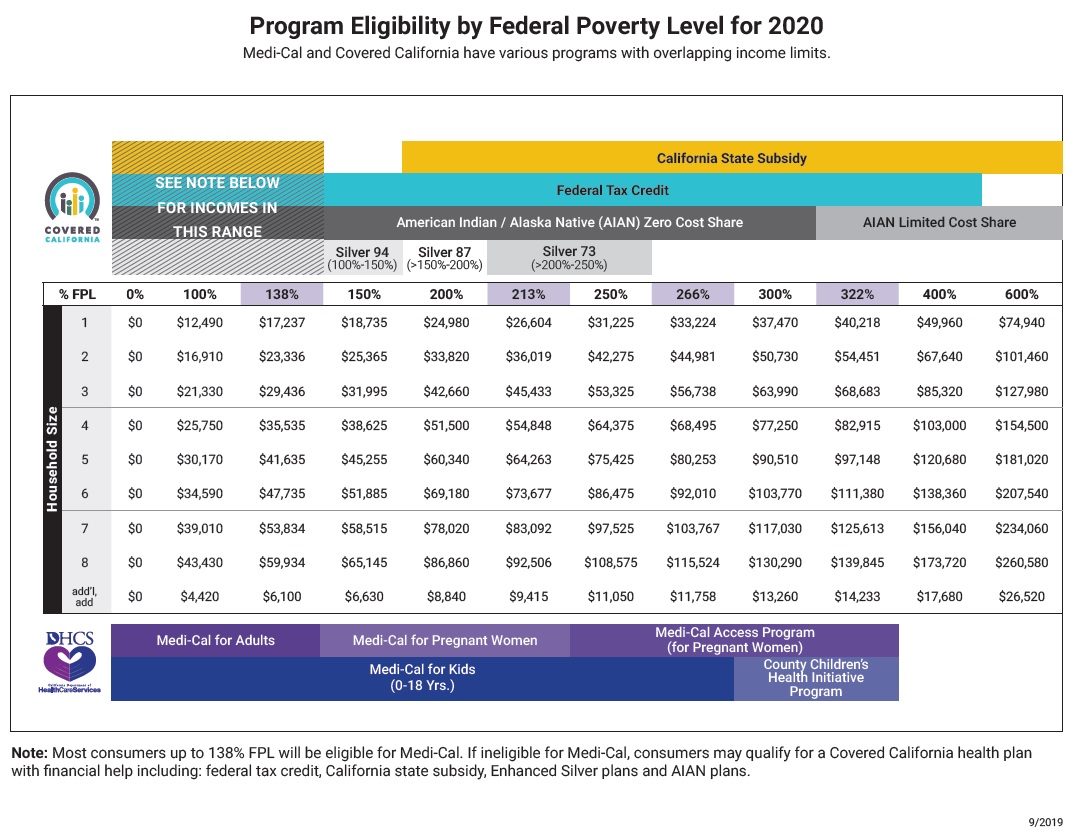

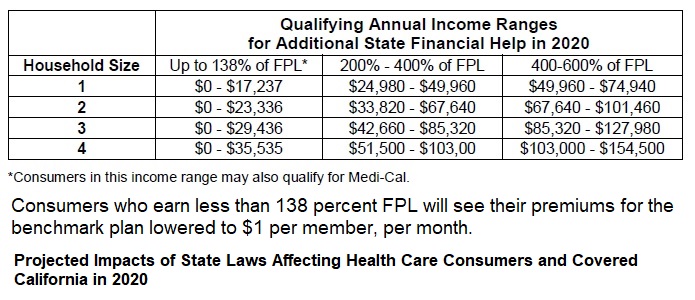

The term Marketplace refers to the California state Marketplace Covered California. California passed a law in 2019 that extends the premium subsidy to 600 Federal Poverty Level FPL for three years starting in 2020. The majority of the states have expanded Medicaid.

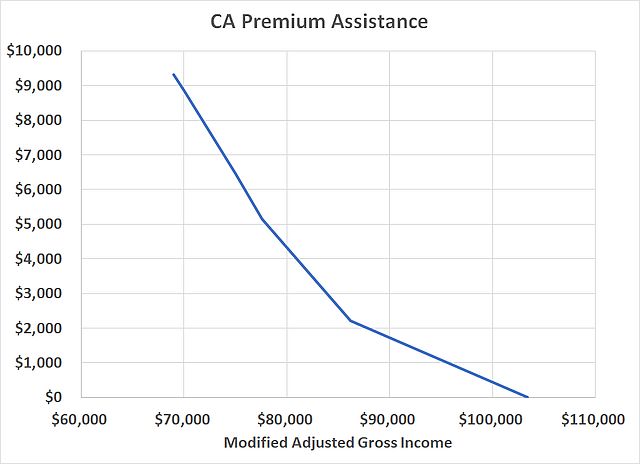

The subsidy provides financial assistance to pay the premiums for a qualified health plan through the California health insurance marketplace Marketplace. I am a Non Resident of California. The California Premium Subsidy will be available to households who earn between 401 and 600 of the FPL.

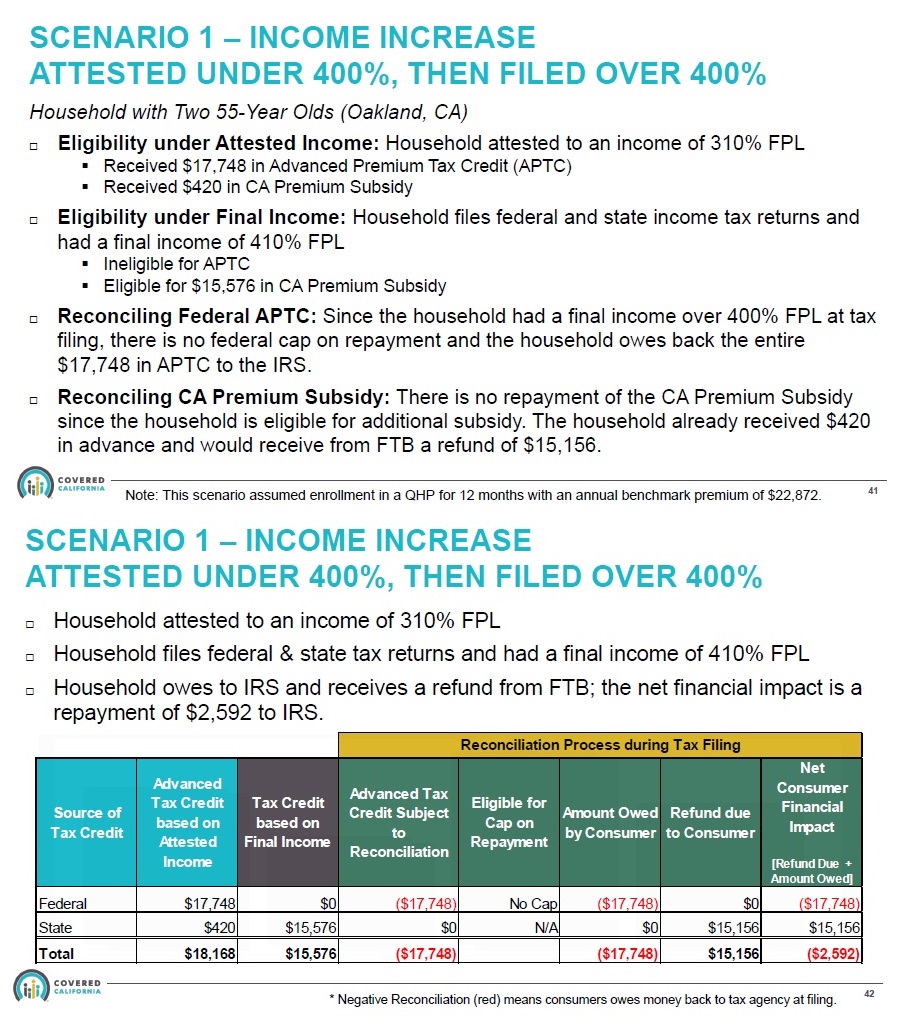

Gavin Newsom has signed his first budget. Im wondering whether or not I should hold a return that the TP has to pay CA 10944 back for excess advance payments. Before the American Rescue Plan California helped people who made too much money qualify for the premium tax credit with a state subsidy.

Federal government websites often end in gov or mil. Federal tax credits reduce the cost of your monthly premium. Why am I getting the healthcare penalty.

No that wont happen. California will also provide a subsidy for people who are ineligible for Medi-Cal and whose income is below 138 FPL. I have a return where the clients income exceeds 400 of poverty level 428 but California Form 3849 is calculating a 7800 Premium Assistance Subsidy.

In testing I found if I play with their AGI to get it below 399 of poverty level it calculates that they owe 30 of subsidy. Its also called the Advanced Premium Tax Credit APTC. California will pick up where the federal government leaves off.

Cost-sharing reductions are subsidies that reduce your out-of-pocket costs such as copays coinsurance and deductibles. California Premium Assistance Subsidy Issue Form 3849 State. 145 452 million CA.

Thanks to the American Rescue Plan Californians will get more help paying for their plan from the federal government and even more Californians qualify for the new savings. Premium assistance subsidy PAS. What is California Form 3849- Premium Assistance Subsidy PAS.

The PAS is. In 2020 California implemented state subsidies and a state penalty which resulted in a 40 increase in new enrollment and contributed to premium increases of less than 1 for 2020 and2021. Before sharing sensitive information make sure youre on a federal government site.

The PAS is available for certain people who enroll or whose family member enrolls in a qualified health plan. California Form 3849 - Premium Assistance Subsidy. Individuals who purchase a qualified health care plan through the California health insurance marketplace may be eligible to receive financial assistance to help pay the insurance premiums known as the Premium Assistance Subsidy PAS.

California Health Care Coverage. The money from the penalty is used to fund the program. Available for certain people who enroll or whose applicable household member enrolls in a qualified health plan.

To be eligible for the California Premium Subsidy you must meet the following criteria. Incorrect CA Form 3849 Premium Assistance Subsidy when the income is above the federal poverty line unable to check not eligible to take the PAS The program generates a huge net PAS to be refunded. News media such as Los Angeles Times reported this in California Gov.

How do I complete the 3849 Form. Are there any proposed changes to eliminate the CA Premium Assistance Repayment. The term Marketplace refers to the California state.

The state subsidy reduces the cost of your monthly premium. COVID Special Enrollment Period in 2020 led to surge in sign-ups 2013 2014 2015 2016 2017 2018 2019 2020 2021 0 CA 172 65 million US. As a reminder the California Premium Subsidy sets a limit on how much one pays for their medical premium based on a percentage of their annual income see table above.

The gov means its official. Establishes a refundable payroll tax credit for employers and plan sponsors to recover eligible subsidy premiums paid For periods of Federal COBRA the person to whom premiums are payable is generally the plan sponsor for most fully insured and self-funded employer plans. Individuals who purchase a qualified health care plan through Covered California the California health insurance marketplace may be eligible to receive financial assistance to help pay the insurance premiums known as the Premium Assistance Subsidy.

Beginning with tax year 2020 the state of California requires residents and their dependents to obtain qualifying health care coverage also referred to as Minimum Essential Coverage MEC. How much can I receive. The American Rescue Plan also known as the 2021 Federal Stimulus Package made numerous changes to the health insurance subsidies dispensed by Covered California.

Prior to 2021 the rule was that households earning between 100 and 400 of the federal poverty level could qualify for the premium tax credit health insurance subsidy the lower threshold is 139 of the poverty level if youre in a state that has expanded Medicaid as Medicaid coverage is available below that level. The subsidy provides financial assistance to. What is my residency status for California.

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Do You Qualify For The New California Health Insurance Premium Subsidy

Do You Qualify For The New California Health Insurance Premium Subsidy

Premium Subsidy California To 600 Fpl Federal Poverty Level And New Mandate Penalty

Premium Subsidy California To 600 Fpl Federal Poverty Level And New Mandate Penalty

Covered California Releases Regional Data Behind Record Low 0 8 Percent Rate Change For The Individual Market In 2020

Covered California Releases Regional Data Behind Record Low 0 8 Percent Rate Change For The Individual Market In 2020

Do You Qualify For The New California Health Insurance Premium Subsidy

Do You Qualify For The New California Health Insurance Premium Subsidy

Covered California Rescued And Reorganized Subsidy Plan For 2021

Covered California Rescued And Reorganized Subsidy Plan For 2021

Covered California 2020 Open Enrollment Official Website Assemblymember Richard Bloom Representing The 50th California Assembly District

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Two Covered California Subsidies Which Do You Qualify For

Two Covered California Subsidies Which Do You Qualify For

Health Care Reform Subsidies Explained In Layman S Terms

Health Care Reform Subsidies Explained In Layman S Terms

2021 California Aca Health Insurance Premium Subsidy

2021 California Aca Health Insurance Premium Subsidy

Faq California Premium Subsidy For Health Insurance

Faq California Premium Subsidy For Health Insurance

Faq California Premium Subsidy For Health Insurance

2021 California Aca Health Insurance Premium Subsidy

2021 California Aca Health Insurance Premium Subsidy

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment