Featured

- Get link

- X

- Other Apps

Covered California Qualification Income

Covered California Outreach and Sales Division Updated. Covered California and Medi-Cal use the same application.

Medi-Cal has always covered low-income children pregnant women and families.

Covered california qualification income. Deferred Action for Childhood Arrivals DACA. ACA California requires US citizens US nationals and permanent residents to have health coverage that meets the minimum requirements. Unless you qualify to be exempted you could pay tax penalties if you go for more than two months without any coverage.

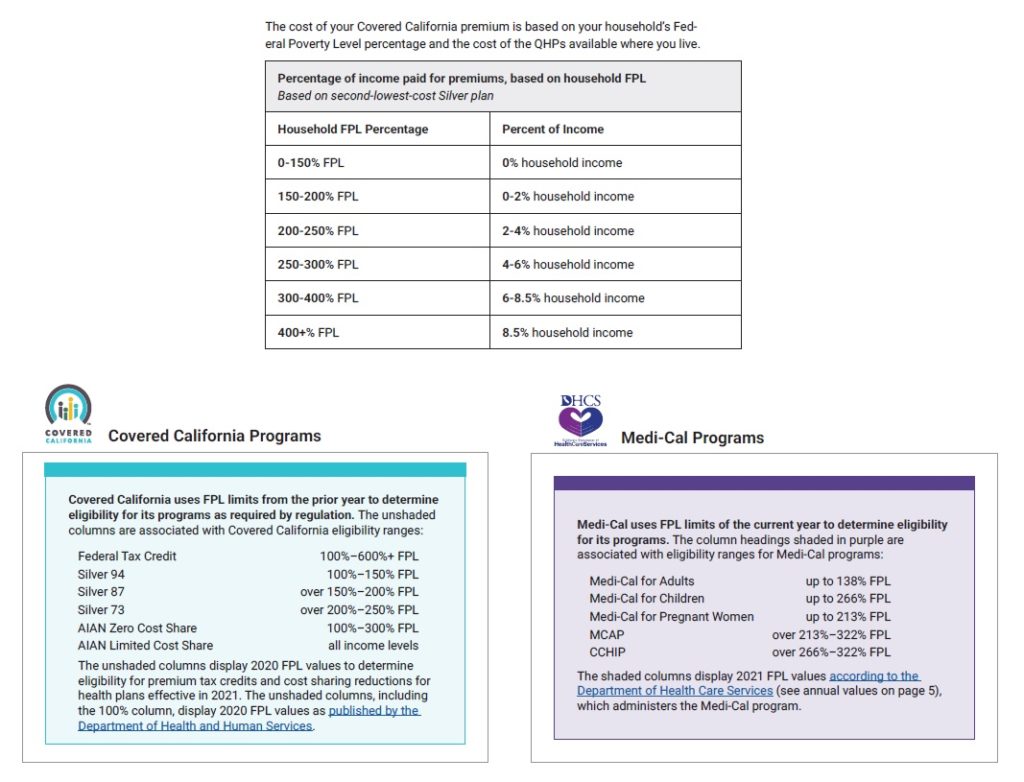

Whether you qualify for financial assistance depends on your household income and. Covered California uses FPL limits from the prior year to determine eligibility for its programs as required by regulation. Its typically different from other Covered California plans because it is regulated by the state and offered based on income qualification via the state.

Income numbers are based on your annual or yearly earnings. When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes. If you make 601 of the FPL you will be ineligible for any subsidies.

Covered California uses FPL limits from the prior year to determine eligibility for its programs as required by regulation. Any Californian can get health insurance through Covered California if he or she is a state resident and cannot get affordable health insurance through a job. Applicants may qualify for a free or low-cost health plan or for financial help that can lower the cost of premiums and co-pays.

When you complete a Covered California application your eligibility for Medi-Cal will automatically be determined. If someones Medi-Cal coverage is cancelled due to increased income or decreased household size does that person qualify for special enrollment into Covered California. To learn more or be notified about the COVID-19 vaccine.

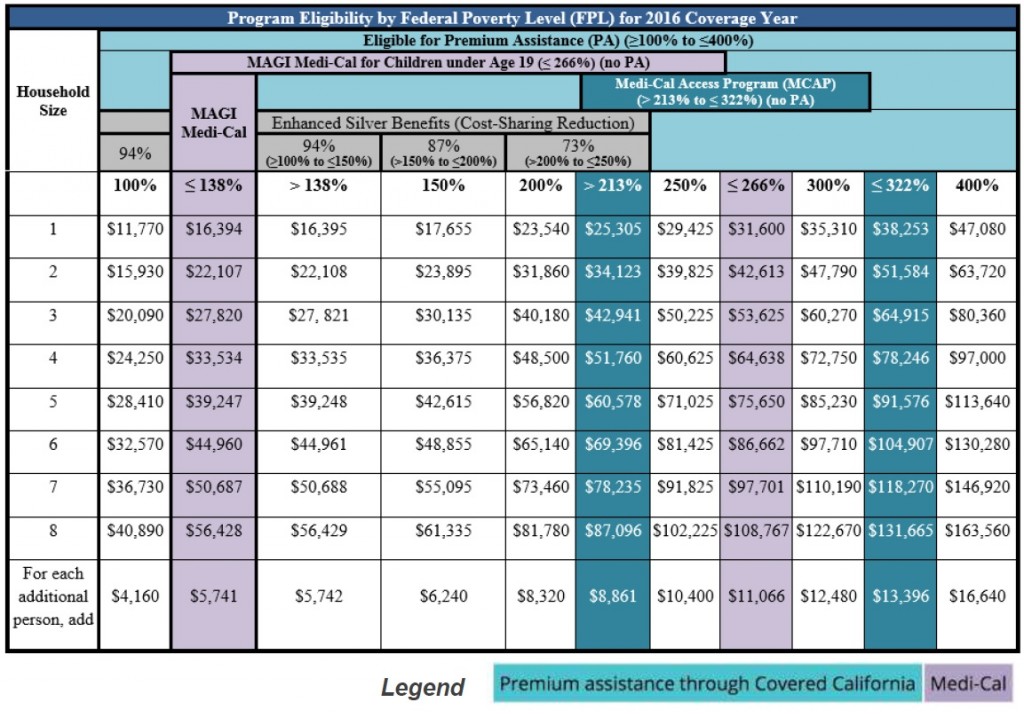

The unshaded columns are associated with Covered California eligibility ranges. To understand better review the Federal Poverty Level Chart. There are 4 basic types of qualifying life events.

Keep in mind that Tax deductions can. How do I know if I qualify. Can anyone get Covered California.

Applicants qualify if their income meets the income. Can I get health insurance through Covered California. For some plans there may be costs like copays coinsurance and deductibles for diagnosis and treatment.

On January 1 2014 California expanded Medi-Cal eligibility to include low-income adults. April 15 2016 OutreachandSalescoveredcagov or Low to help determine if you qualify Income Guidelines use through October 2016 You may be eligible for Medi-Cal -Income Health Plan. The persons first and last name and company name.

This means that you. To qualify for an Enhanced Silver 87 Plan the application must be submitted through Covered California and the individual must meet Covered California income limits. Then add or subtract any income.

For more information click Medi-Cal Eligibility California. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. However when you do your taxes in April you discover your household income was actually 35000 year.

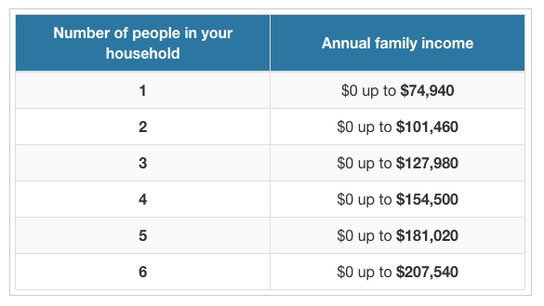

If you live with a spouse or another adult your combined income cannot be more than 22108 a year. The amount of financial help is based on household size and family income. The unshaded columns are associated with Covered California eligibility ranges.

Covered California there is no waiting period or five year bar for eligibility for Covered California and there is no minimum income requirement for eligibility for premium assistance and cost-sharing subsidies if they are not eligible for full-scope Medi-Cal. You can start by using your adjusted gross income AGI from your most recent federal income tax return located on line 8b on the Form 1040. Your household income must not exceed more than 138 percent of the federal poverty level FPL based on your household size.

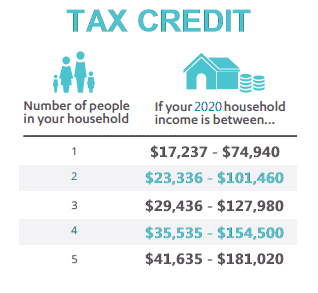

Qualifying Life Event QLE A change in your situation like getting married having a baby or losing health coverage that can make you eligible for a Special Enrollment Period allowing you to enroll in health insurance outside the yearly Open Enrollment Period. In order to be eligible for assistance through Covered California you must meet an income requirement. Federal Tax Credit 100600 FPL Silver 94 100150 FPL Silver 87 over 150200 FPL Silver 73 over 200250 FPL.

For example if you live alone your income cannot be more than 16395 a year. Add any foreign income Social Security benefits and interest that are tax-exempt. You can apply for Medi-Cal benefits regardless of your sex race religion color.

When you applied for Covered California healthcare you estimated that your family income would be 25000 a year. Medi-Cal is free or low-cost health coverage for children and adults with limited income and resources. To see if you qualify based on income look at the chart below.

Self-Employment includes farm income Self-employment Profit and Loss Statement or Ledger documentation the most recent quarterly or year-to-date profit and loss statement or a self-employment ledger. California State Subsidy 0138 FPL over 200600 FPL Federal Tax Credit 100400 FPL Enhanced Silver Plans 100250 FPL. Dates covered and the net income from profitloss.

Https Hbex Coveredca Com Toolkit Renewal Toolkit Downloads 2016 Income Guidelines Pdf

Covered California Income Limits Explained

Covered California Income Limits Explained

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

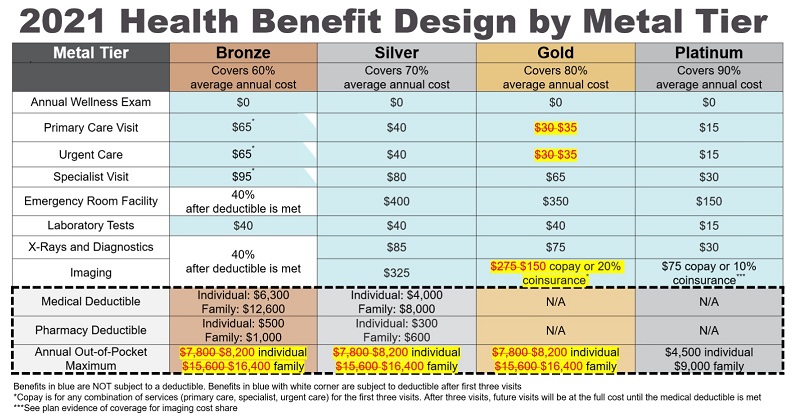

Covered Ca Plan Benefit Changes For 2021 Health For California Insurance Center

Covered Ca Plan Benefit Changes For 2021 Health For California Insurance Center

Covered California Income Tables Imk

Covered California Income Tables Imk

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered California Open Enrollment 2021 A Complete Guide Insure Com

Covered California Open Enrollment 2021 A Complete Guide Insure Com

Covered California Health Insurance Income Guidelines

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Covered California Updates Income Reporting Former Foster Youth

Covered California Updates Income Reporting Former Foster Youth

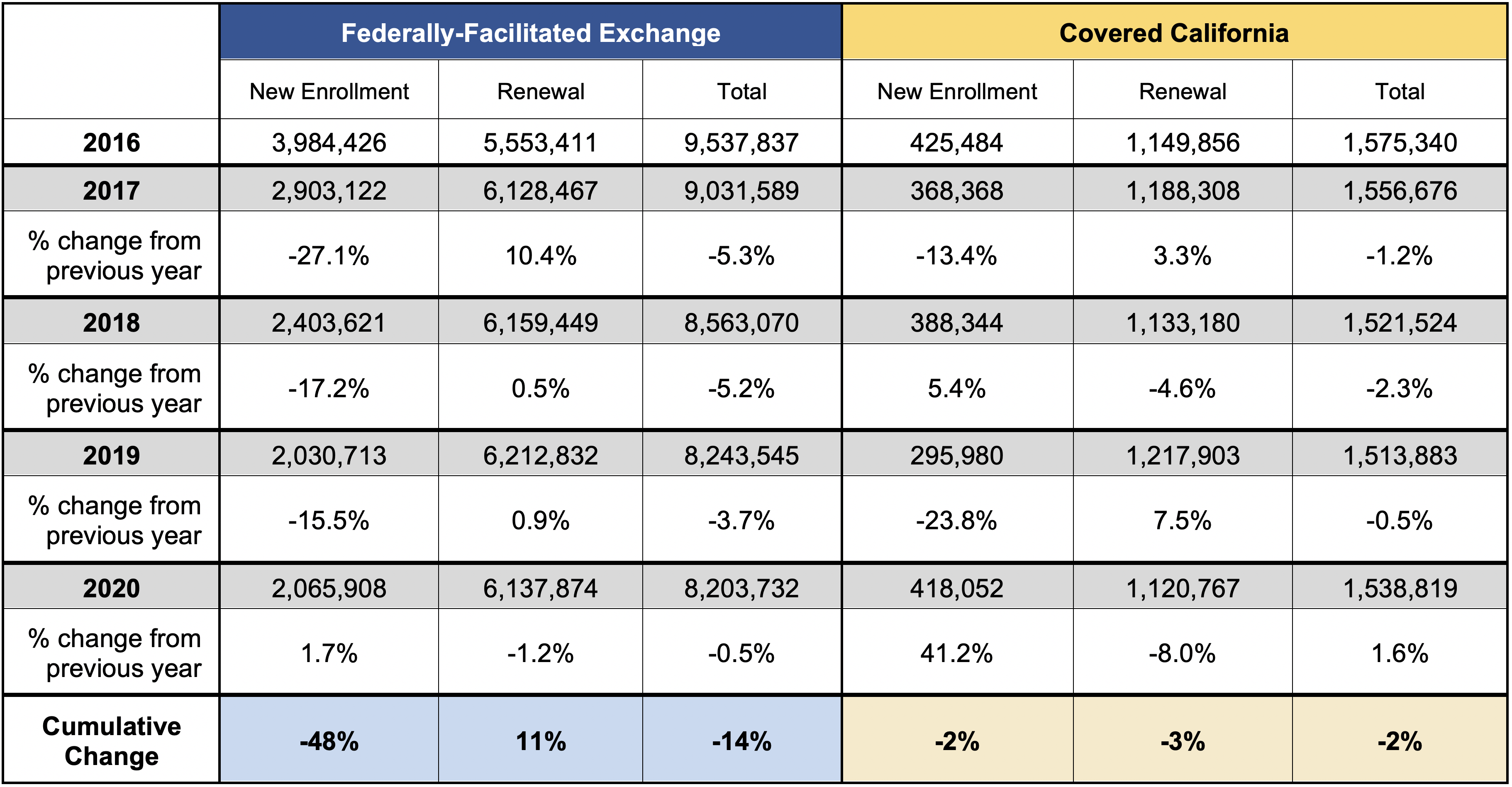

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment