Featured

- Get link

- X

- Other Apps

How Does Cobra Insurance Work In California

COBRA coverage begins the date your health insurance policy ends because of a qualifying event. COBRA health insurance will allow you to pay for all of your health insurance including your employers portion in order to continue the plan for a period of time.

Cobra Small Employer Exception Abd Insurance Financial Services

Cobra Small Employer Exception Abd Insurance Financial Services

The Consolidated Omnibus Budget Reconciliation Act COBRA Passed in 1985 COBRA is a federal law that allows employees of certain companies to continue their health insurance with the same benefits even after they stop working for their employer.

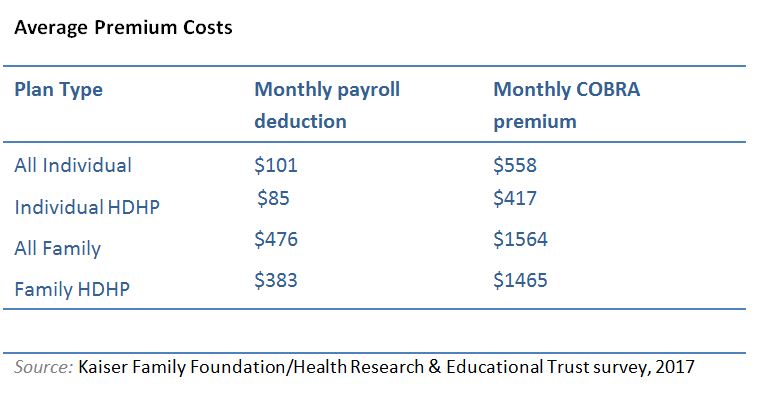

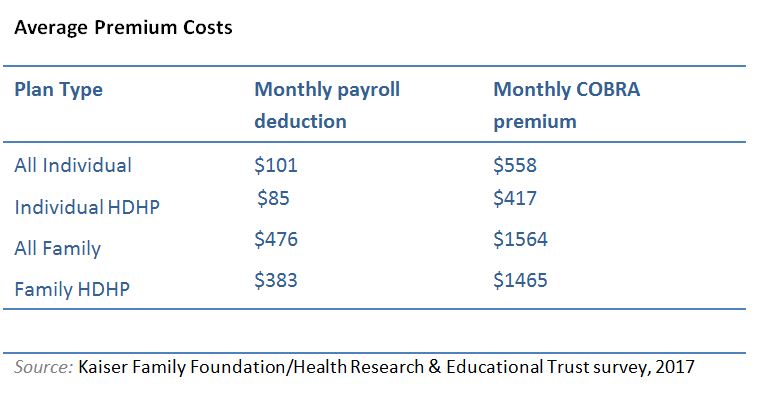

How does cobra insurance work in california. It enables you to keep your benefits for 18 months and sometimes up to 36 months depending on the circumstances. The COBRA insurance definition comes down to one important thing making sure you are able to keep your current insurance plan while you are between jobs. If you take advantage of CalCOBRA you must pay the entire premium that both you and your employer have paid in the past plus an administrative fee.

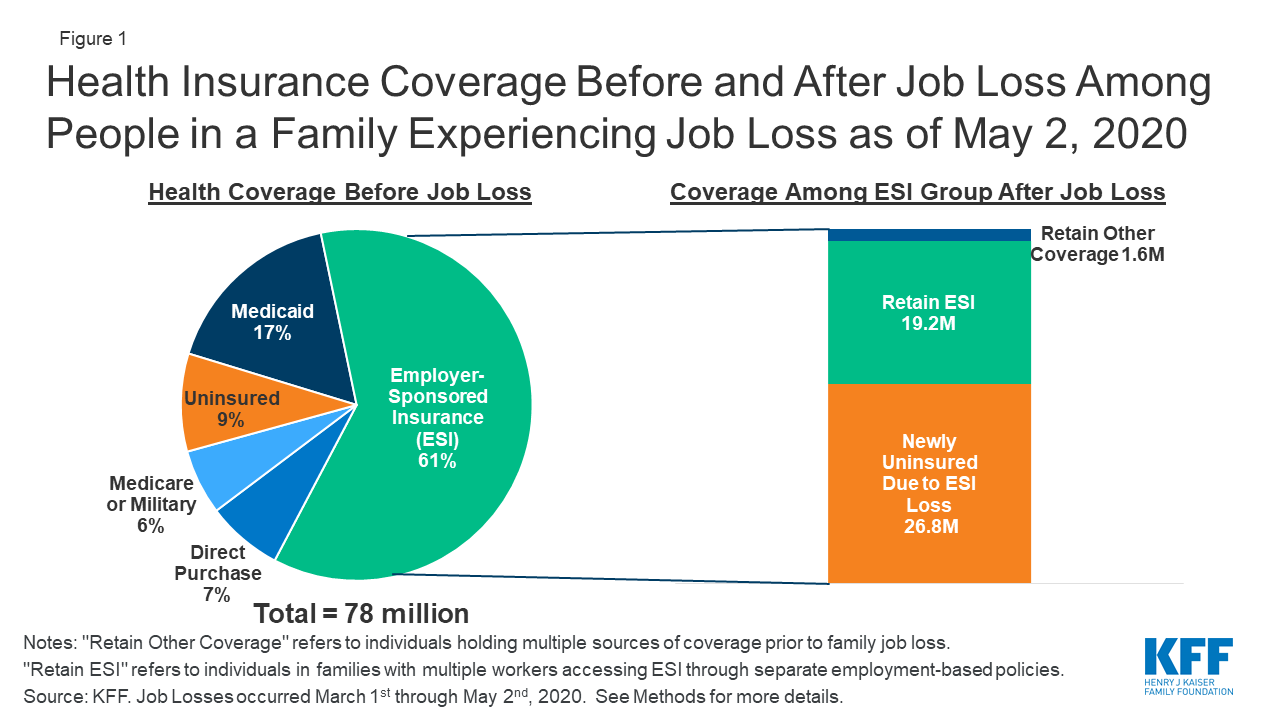

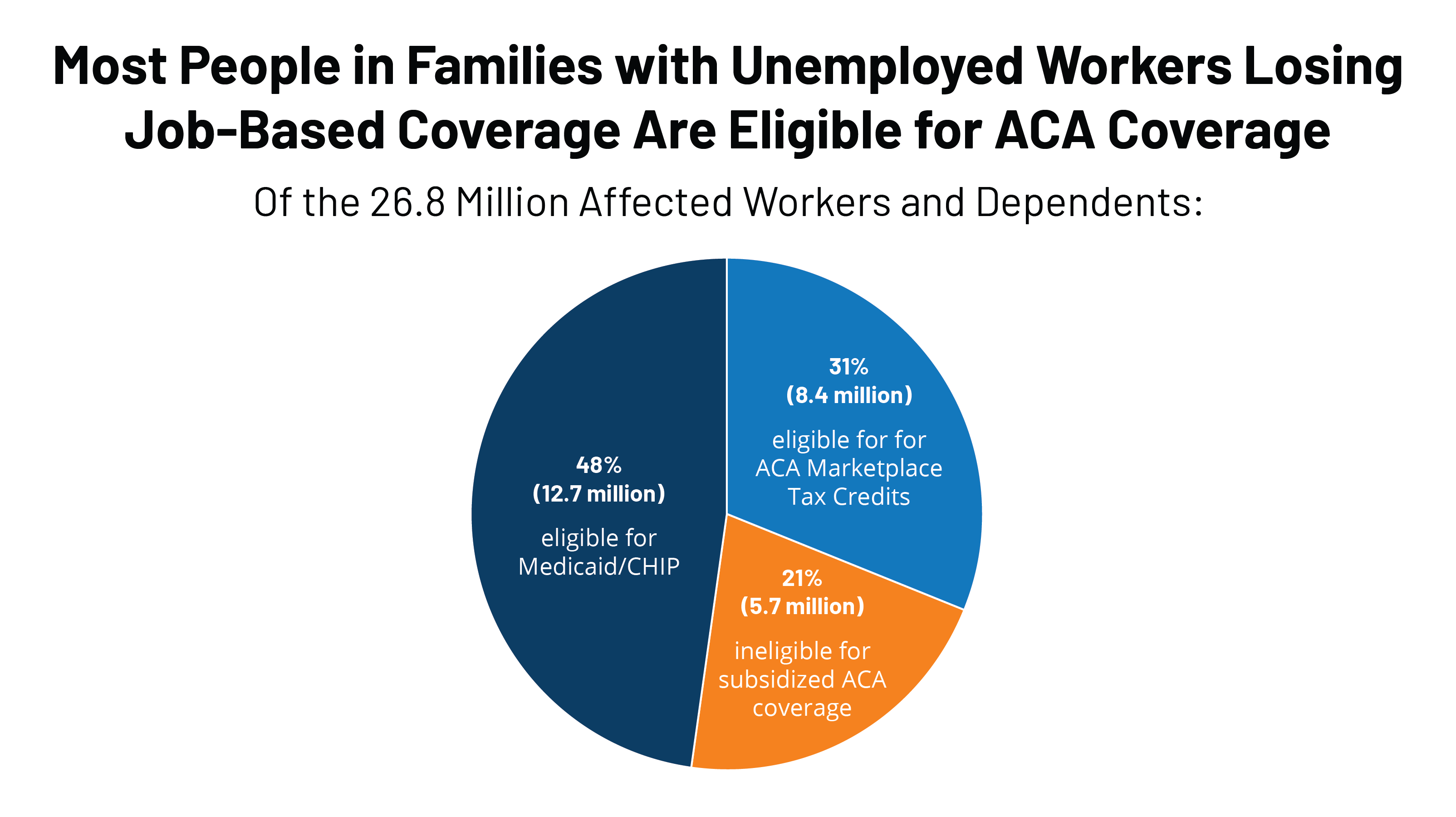

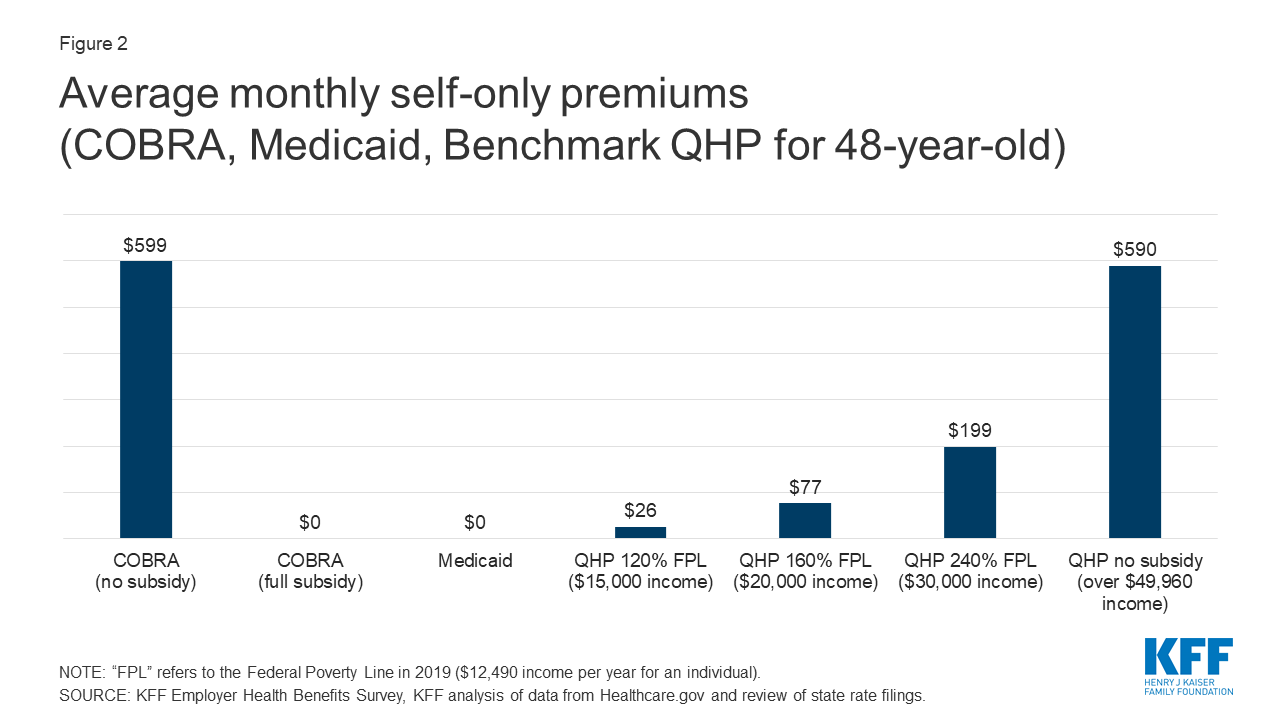

It may also be available to people who have exhausted their Federal COBRA. More than 2 million people could benefit according to the Congressional Budget Office. For an employee covered under a qualifying event COBRA coverage can last for 18 months from the date you elect coverage.

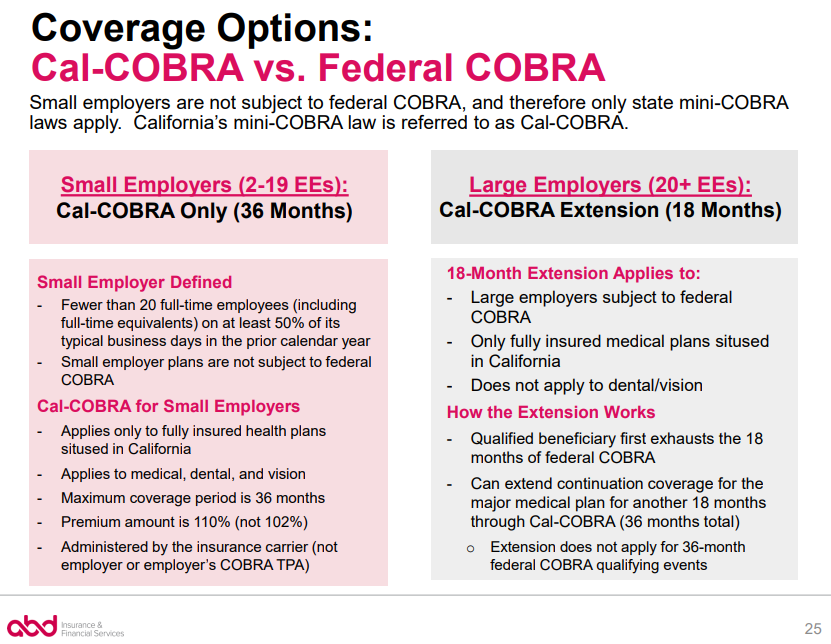

Cal-COBRA applies to employers and group health plans that cover from 2 to 19 employees. The State of California has the Cal-COBRA Act that extends benefits beyond the federal COBRA law. This extension is managed by the health plan carrier and you must inquire with the health plan carrier administering the COBRA coverage.

COBRA stands for Consolidated Omnibus Budget Reconciliation Act. How does the COBRA insurance work. COBRA mandates that former employees retirees spouses former spouses and dependent children be offered continuing health coverage after a qualifying event that would have previously made them ineligible.

The employees job ends. In the end COBRA insurance is a way for you to extend your health care coverage for a certain period. Under certain conditions California law permits an extension of COBRA coverage for an enrollee up to 36 months from the date coverage began.

Moral of the Story. COBRA stands for the Consolidated Omnibus Budget Reconciliation Act. The COBRA statute requires employers to offer continuation of group coverage eg medical dental and vision to covered employees spouses domestic partners and eligible dependent children who lose group coverage due to a qualifying event.

Its available if youre already enrolled in an employer-sponsored medical dental or vision plan and your company has 20 or more employees. What does COBRA do. In simple terms this law gives eligible individuals the right to continue to purchase the same.

The federal COBRA Act allows workers to stay on the their employer sponsored insurance when their jobs end or hours are reduced. If you get COBRA you must pay for the entire premium including any portion that your employer may have paid in the past. COBRA allows former employees retirees and their dependents to temporarily keep their health coverage.

The health insurance company will then notify you with information about how to sign up for COBRA. Read on to learn how COBRA insurance works. The terms and timeframes are set by the Department of.

However dependents can receive up to 36 months of coverage if you switch to Medicare get divorced or die. Your premium may be based on the age range of each employee or on a percentage of the total number of the employees. Your spousepartner and dependents can also be included on your COBRA coverage.

Secondary COBRA Event occurs during the 18-Month Period Dependents. If you work at a company with. If you become eligible for a COBRA plan such as losing your job the employer will contact the health insurer about the situation within 30 days of your last day.

The way it works is through the federally administered program known as COBRA. Its typically considered to be an accessible and affordable more on that later way to obtain health insurance when in normal circumstances you would not have access to this health care coverage. Cal-COBRA is a state law in California that applies to employers with group health plans that cover between two and 19 employees allowing employees to keep their benefits for up to 36 months following a qualifying life event such as the following.

CalCOBRA provides the same protection as COBRA in California for small employers with 2 to 19 workers. How does it work. These individuals are known as qualified beneficiaries.

COBRA is a federal law passed three decades ago to give families an insurance safety net between jobs. Cal-COBRA is a California Law that lets you keep your group health plan when your job ends or your hours are cut. The coverage is required to be offered to the covered employee their spouse and dependent children.

Cal-COBRA is California health coverage protection that requires employers of 2 to 19 employees to provide their employees and their dependents the right to continue health insurance benefits when a qualifying event occurs. Its a federal law that was created in 1985 that gives individuals who experience a job loss or other qualifying event the option to continue their current health insurance coverage for a limited amount of time. The federal law known as COBRA sometimes called continuation coverage protects the health care rights of workers who are laid off as well as spouses and dependents of those workers in certain situations.

Mandate Health Insurance Tax Penalty California Mec Qhp 5000 A

Cobra Insurance Everything You Need To Know

Cobra Insurance Everything You Need To Know

How To Sign Up For Cobra Insurance 8 Steps With Pictures

How To Sign Up For Cobra Insurance 8 Steps With Pictures

Eligibility For Aca Health Coverage Following Job Loss Kff

Eligibility For Aca Health Coverage Following Job Loss Kff

Eligibility For Aca Health Coverage Following Job Loss Kff

Eligibility For Aca Health Coverage Following Job Loss Kff

What Is Cobra Coverage And How Does It Work State Farm

What Is Cobra Coverage And How Does It Work State Farm

/coordination-of-benefits-1850523021ff453f8f4f2e19a99324ea.png) Coordination Of Benefits With Multiple Insurance Plans

Coordination Of Benefits With Multiple Insurance Plans

Health Coverage Of California Workers Most At Risk Of Job Loss Due To Covid 19 Uc Berkeley Labor Center

Health Coverage Of California Workers Most At Risk Of Job Loss Due To Covid 19 Uc Berkeley Labor Center

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png) How Does Health Insurance Work

How Does Health Insurance Work

Key Issues Related To Cobra Subsidies Kff

Key Issues Related To Cobra Subsidies Kff

Best Cheap Health Insurance In California 2021 Valuepenguin

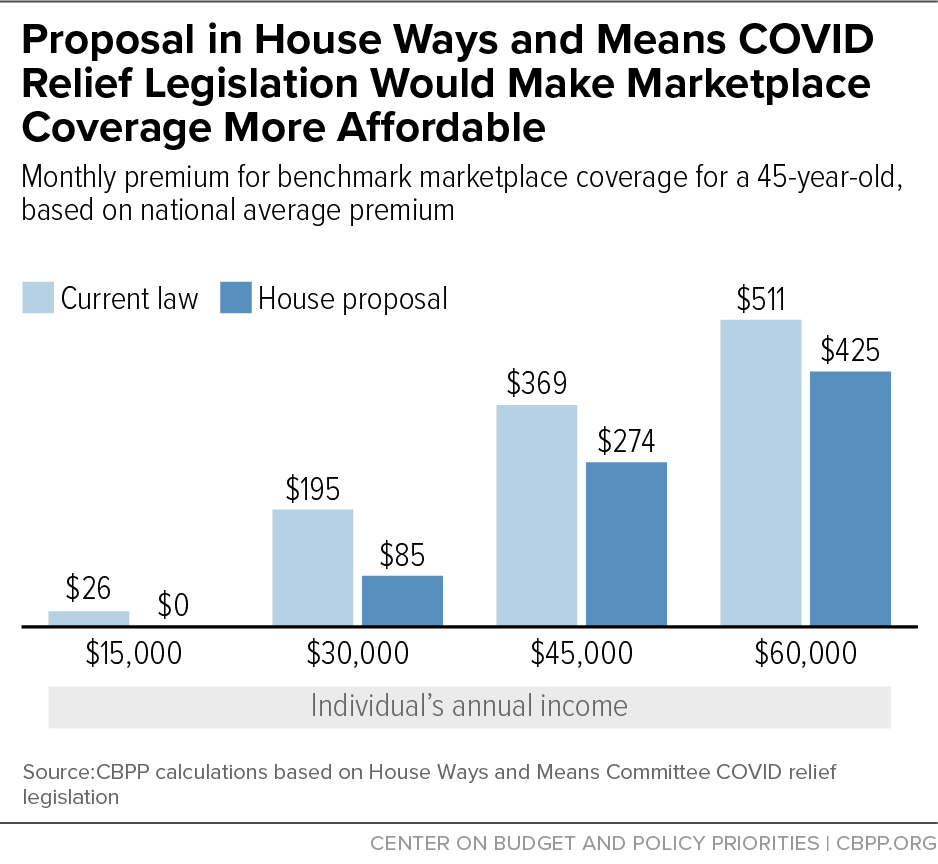

Health Provisions In House Relief Bill Would Improve Access To Health Coverage During Covid Crisis Center On Budget And Policy Priorities

Health Provisions In House Relief Bill Would Improve Access To Health Coverage During Covid Crisis Center On Budget And Policy Priorities

Cobra Is Free For Six Months Under The Covid Relief Bill Los Angeles Times

Cobra Is Free For Six Months Under The Covid Relief Bill Los Angeles Times

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment