Featured

- Get link

- X

- Other Apps

California Tax Credit

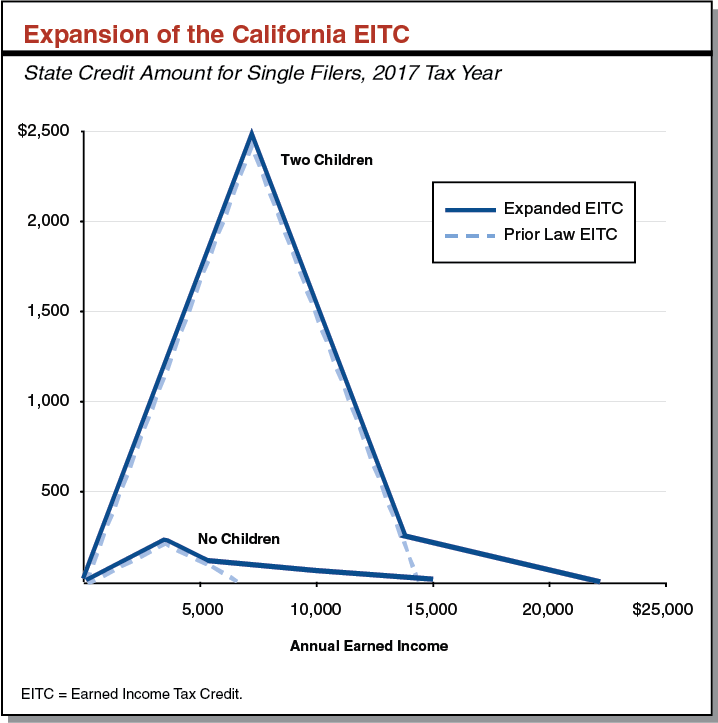

Student loan interest deduction. California also has an earned income tax credit that may get you a refund even if you do not owe tax.

The Caleitc And Young Child Tax Credit California Budget Policy Center

The Caleitc And Young Child Tax Credit California Budget Policy Center

Heres how each could give more money to parents this year The president has proposed an extension of the increased child tax credit through 2025 as.

California tax credit. The Ultimate 2020 Guide To California Solar Tax Credit and Incentives. Tuition and fees deduction. Those that allow you to receive a refund if the amount is more than what you owe refundable tax credits and those that refund only up to what you owe non-refundable tax credits.

Child care tax credit. In 2021 more hard-working individuals and families are eligible than ever including Californians that file their taxes with an Individual Taxpayer Identification Number ITIN. Ensure You Receive the Full 26 Solar Tax Credit and Additional Incentives For Going Solar In 2020.

Unlike the deductions which reduce your taxable income credits reduce your tax liability. These tax credits can be claimed on 2020 individual tax returns. The families of more than 65 million children will start receiving enhanced child tax credit monthly payments of up to 300 on July 15 the Biden administration announced Monday.

Credits range from 243 to just over 3000. The California Tax Credit Allocation Committee CTCAC and the Office of Historic Preservation OHP will administer the tax credit program. TCAC allocates federal and state tax credits to the developers of these projects.

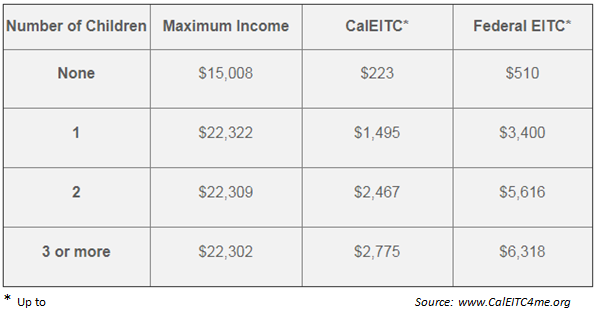

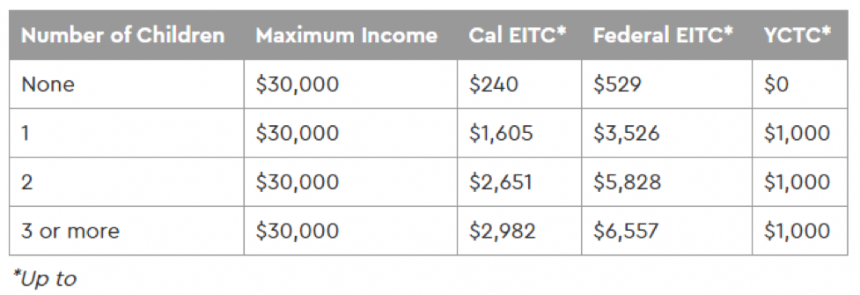

The Young Child Tax Credit was introduced in tax year 2019. Coordinated and complementary regulations will be created by each entity with the OHP responsible for preparing requirements and an application process to guide the program. Corporations provide equity to build the projects in return for the tax credits.

This is a 60 credit for single renters whose annual incomes fall below 42932 as of 2020. While some of the tax credits are refundable meaning that it can add up to your tax refund California renters credit unfortunately isnt refundable. Qualified Research Expenditures QREs generally include wages supplies and contract research costs.

Here electric-car tax credits are usually issued on a federal level so youre likely not going to find a California EV tax credit when you file. Both programs were created to promote private investment in affordable rental housing for low-income Californians. Review the charts for past years below to see how much you could get.

There are two kinds of tax credits. You can also use your 2019 income to claim two federal tax credits the Earned Income Tax Credit and Child Tax Credit on your 2020 taxes. Child tax credit vs.

Californias program linked with Quebecs program on January 1 2014 and Ontarios program on January 1 2018 but unlinked with the latter following Ontarios discontinuation of its program in mid-2018. On your California income tax return you can claim the renters credit to lower your state tax bill. As with the IRC Section 41 federal RD tax credit California provides a permanent tax credit as an incentive for taxpayers to conduct RD activities.

You can now claim the California Earned Income Tax Credit and the states Young Child Tax Credit with an ITIN. California state tax rates are 1 2 4 6 8 93 103 113 and 123. Both programs are available to California residents who have filed a state income tax return.

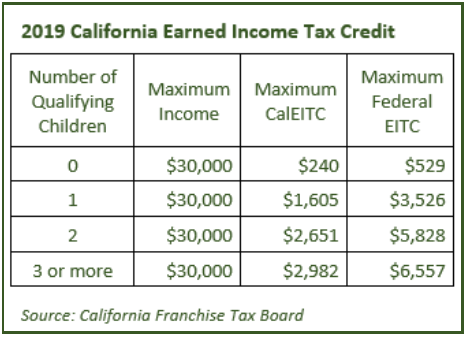

Some of Californias income tax credits include. As with the federal credit the calculation in California. The California Earned Income Tax Credit CalEITC is a refundable cash back tax credit for qualified low-to-moderate income Californians.

Qualified research must occur in California to qualify for the California credit. It increases to 120 for marriedRDP taxpayers who file jointly and whose annual incomes fall below 85864. California Tax Credit Allocation CommitteeCTCAC The California Tax Credit Allocation Committee CTCAC administers the federal and state Low-Income Housing Tax Credit Programs.

During the 2016 legislative session the California House of Representatives considered a bill that would have increased the credit for taxpayers earning less than 70000 per year but the measure failed to reach the floor for a full vote. You may go back up to four years to claim CalEITC by filing or amending a state income tax return. So if your tax liability is 0 the credit.

Tax credits help reduce the amount of tax you may owe. Stimulus checks are automatically sent out to residents who have filed their tax returns but they must apply for the tax credits. The California Earned Income Tax Credit is a yearly tax credit for working people making under 30000.

A 1 mental health services tax applies to income exceeding 1 million. The linked jurisdictions hold joint auctions together. You can mail your return to the at the correct address below and include your payment by check or money order.

If you qualify for CalEITC and have a child under the age of 6 as of the end of the tax year you may qualify for up to 1000 through this credit. This lets you claim these credits even if your. If you pay rent for your housing have a family with children or help provide money for low-income college students you may be eligible for one or more tax credits.

The California RD Credit reduces income or franchise tax. California state tax brackets and income. Offsets and allowances can be traded across jurisdictions.

The California Tax Credit Allocation Committee TCAC facilitates the investment of private capital into the development of affordable rental housing for low-income Californians. You may also electronically file your California tax return through a tax preparer or using online tax software and pay your taxes instantly using direct debit or a credit card an additional credit card fee may apply.

Common Tax Credit Mistakes People Make With Covered Ca

Common Tax Credit Mistakes People Make With Covered Ca

Spending Through California S Tax Code California Budget Policy Center

Spending Through California S Tax Code California Budget Policy Center

California Sees 5 49 Billion In Economic Activity From 700 Million In Production Tax Credits Variety

California Sees 5 49 Billion In Economic Activity From 700 Million In Production Tax Credits Variety

California State Controller S Office 2020 02summary

California State Controller S Office 2020 02summary

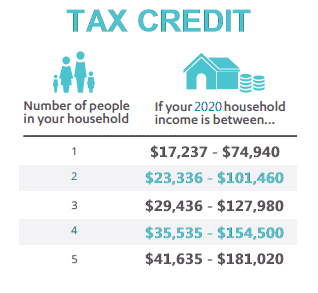

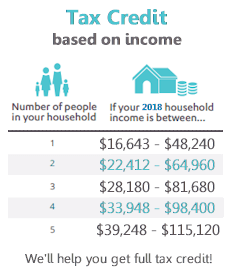

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

How Much Can Californians Benefit From The Caleitc And Young Child Tax Credit California Budget Policy Center

How Much Can Californians Benefit From The Caleitc And Young Child Tax Credit California Budget Policy Center

Claim Your Money Expanded California Earned Income Tax Credit Means More Families Qualify Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

Claim Your Money Expanded California Earned Income Tax Credit Means More Families Qualify Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

The New California Earned Income Tax Credit Institute For Research On Labor And Employment

The New California Earned Income Tax Credit Institute For Research On Labor And Employment

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment