Featured

What Is The Deductible For High Deductible Plan G

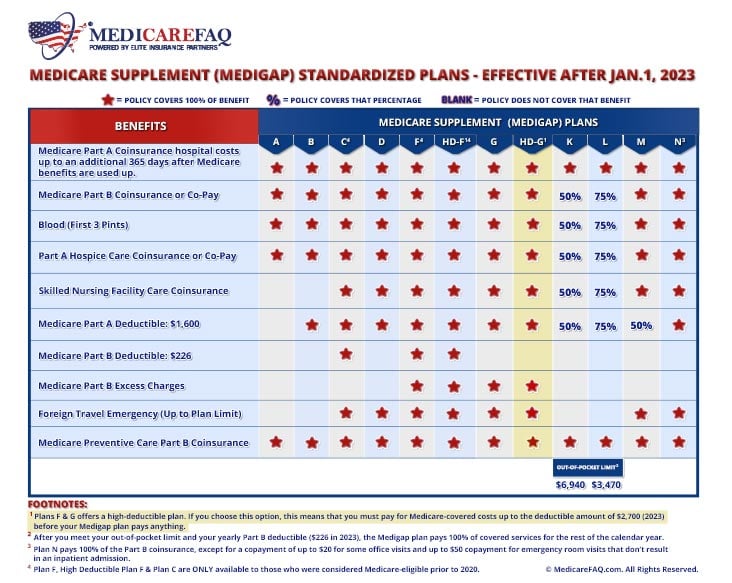

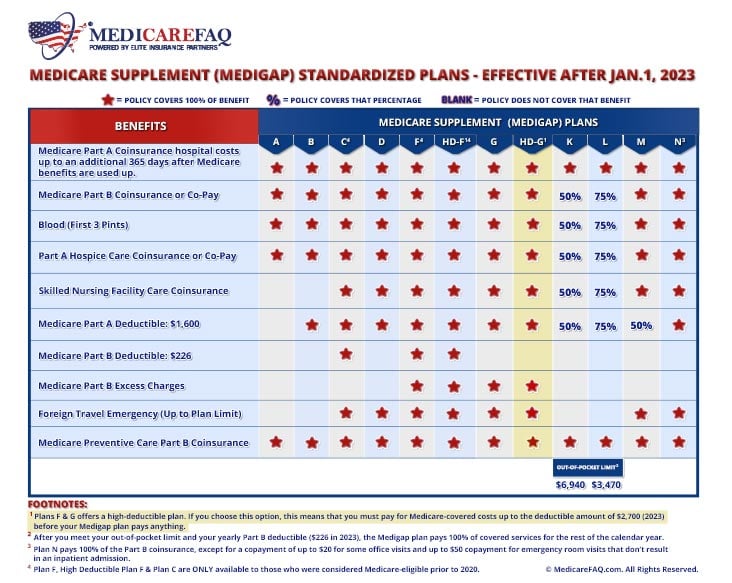

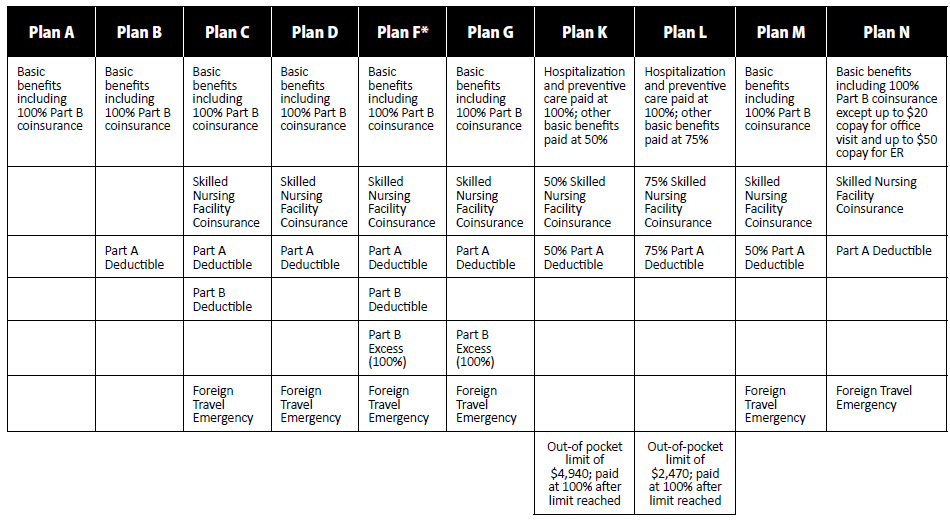

The current definition of a high deductible health plan is one that requires a deductible of at least 1350 for an individual or 2700 for a family. First Plan G covers each of the gaps in Medicare except for the annual Part B deductible.

Medicare Supplement High Deductible Plan G For 2021 Medicarefaq

Medicare Supplement High Deductible Plan G For 2021 Medicarefaq

For 2020 the Medicare supplement Plan G high deductible and the Medicare supplement Plan F high deductible both have a maximum deductible of 2340.

What is the deductible for high deductible plan g. If you shop rates at Boomer Benefits we can often find a Supplement Plan G that saves quite a bit in premiums over Plan F substantially more than 203. Medicare Plan G also called Medigap Plan G is an increasingly popular Supplement for several reasons. While the deductible itself changes every year in.

When you have a High Deductible Plan G policy Medicare pays its 80 share as usual but you pay the remaining 20 of all costs until your out-of-pocket costs reach 2340 2020 deductible. High-deductible Plan G is available but not all insurance companies offer it. High-deductible Plan G has the same benefits as original Plan G after you meet the plans annual deduction of 2370.

The best way to explain how the High Deductible G will work is to compare it to the current Plan F option. Because Medicare still pays its portion first that 2340 is really your Maximum out-of-pocket for 2020. The monthly premiums however can be much cheaper.

Just like High-Deductible Plan F High-Deductible Plan G will not offer you coverage until you have paid the deductible 2340. However youll have to pay a. 4 Zeilen With a High Deductible Plan G the 198 Part B deductible is going to apply towards your.

Therefore the high deductible version of Medigap Plan G is the new option. High-deductible Plan G often has lower monthly premiums. In addition tonormal Plan G with no deductible a high-deductible option is also available.

The deductible amount for the high deductible version of plans G F and J represents the annual out-of-pocket expenses excluding premiums that a beneficiary must pay before these policies begin paying benefits. Once you spend a certain amount in qualified out-of-pocket Medicare expenses you will meet your deductible and your Plan G benefits will kick in. The 2020 deductible amount for high deductible Plan G is 2340.

Effective January 1 2021 the annual deductible amount for these three plans is 2370. Heres what you need to know about the High Deductible Plan G. This deductible is 203 in 2021.

The Plan G deductible is standardized by the federal government and will be consistent no matter where the policy is sold or by whom. High deductible F and G count your payment of the Medicare Part B deductible toward meeting the plan deductible you pay the monthly premium and the only out-of-pocket expense you have is Medicares Part B annual deductible 18300 for 2018 also called Medigap Plan G copayments the Plan G. What is the high deductible.

Foreign travel exchange for as much as 50000 over your lifetime The major difference between High Deductible Plan G 2020 and regular Plan G 2020 is that the high deductible version comes with a higher annual deductible. High Deductible Plan F In 2021 the HDF and HDG has a 2370 Deductible. It functions in much the same way as the high deductible Medigap Plan F just without the Part B deductible coverage.

Original Medicare will still pay its 80 portion You will pay the other 20 until you satisfy the 2370 deductible. Once you reach that level of spending in a calendar year the plan kicks in and pays all remaining costs for the rest of. Once the deductible is met then you will receive the same benefits offered by Medicare Supplement Plan G.

As with any new plan there are looming of questions of how a High Deductible Plan G will stack up against the High Deductible Plan F.

High Deductible Medicare Supplement Crowe Associates

High Deductible Medicare Supplement Crowe Associates

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G High Deductible High Risk Coverage

High Deductible Medigap Plan Makes Sense For Some

High Deductible Medigap Plan Makes Sense For Some

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

High Deductible Plan G Empower Medicare Supplements

High Deductible Plan G Empower Medicare Supplements

The New High Deductible Plan G Health Exchange Agency

The New High Deductible Plan G Health Exchange Agency

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

High Deductible Plan G What Are The Facts Gomedigap

High Deductible Plan G What Are The Facts Gomedigap

High Deductible Plan G Medicare Review Reviews Ratings

High Deductible Plan G Medicare Review Reviews Ratings

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

High Deductible Plan G Boomer Benefits

High Deductible Plan G Medigap Insurance Carriers Your Medicare Enrollment Experts

High Deductible Plan G Medigap Insurance Carriers Your Medicare Enrollment Experts

Medicare Supplement Plan G High Deductible New For 2021 Youtube

Medicare Supplement Plan G High Deductible New For 2021 Youtube

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment