Featured

W9 Employer Identification Number

You are required to have a Tax ID number. However if you dont want to give out your personal SSN for business reasons you can get an EIN employer ID number from the IRS for free in about 15 minutes.

:max_bytes(150000):strip_icc()/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg) Form W 9 Request For Taxpayer Identification Number Tin And Certification Definition

Form W 9 Request For Taxpayer Identification Number Tin And Certification Definition

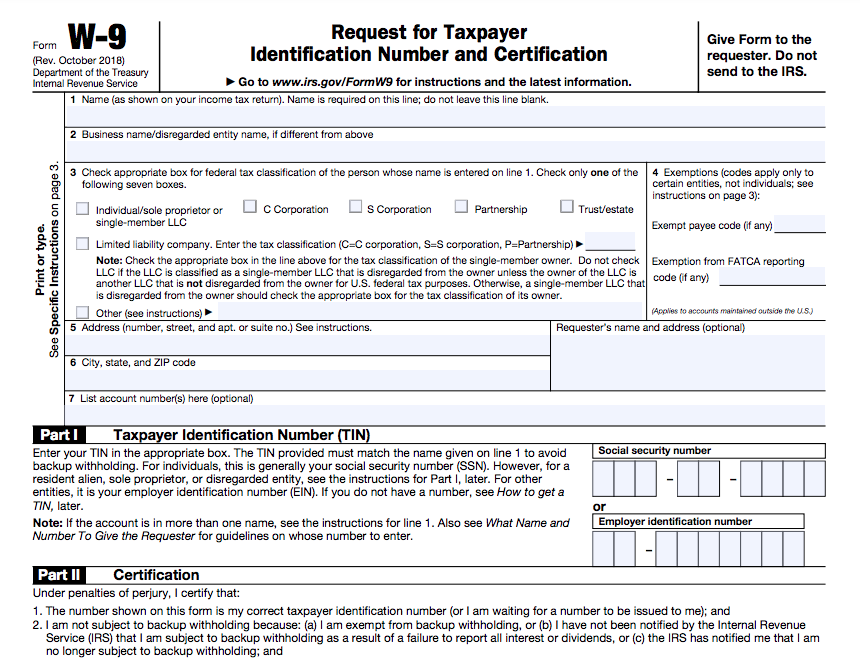

I am not subject to backup withholding because.

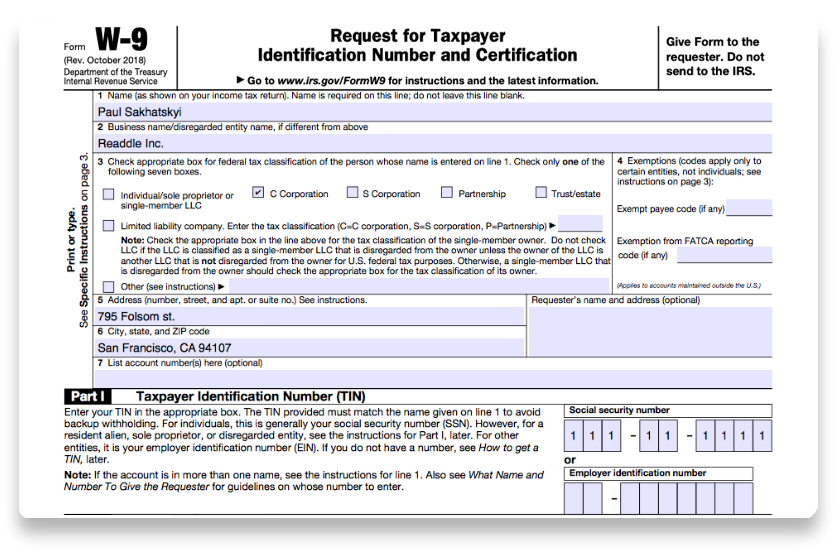

W9 employer identification number. 6 In addition to being used for paying business income taxes an Employer ID is used. Form W-9 is a tax document that must be signed by independent contractors to provide a taxpayer ID number Social Security Number or Employer ID. Do not send to the IRS.

In the case of individuals a TIN is actually the persons social security number SSN. However for a resident alien sole proprietor or disregarded entity see the Part I instructions on page 2. However for a resident alien sole proprietor or disregarded entity see the Part I instructions on page 3.

If you do not. 1 Name as shown on your income tax return. It lets you send your Tax identification number TINwhich is your employer identification number EIN or your social security number SSNto another person bank or other financial institution.

In the case of businesses a TIN is the businesss employer identification number EIN. For instructions and the latest information. The form also provides other personally identifying information like your name and address.

For other entities it is your employer identification number EIN. If you do not have a number. Employer identification number Part II Certification.

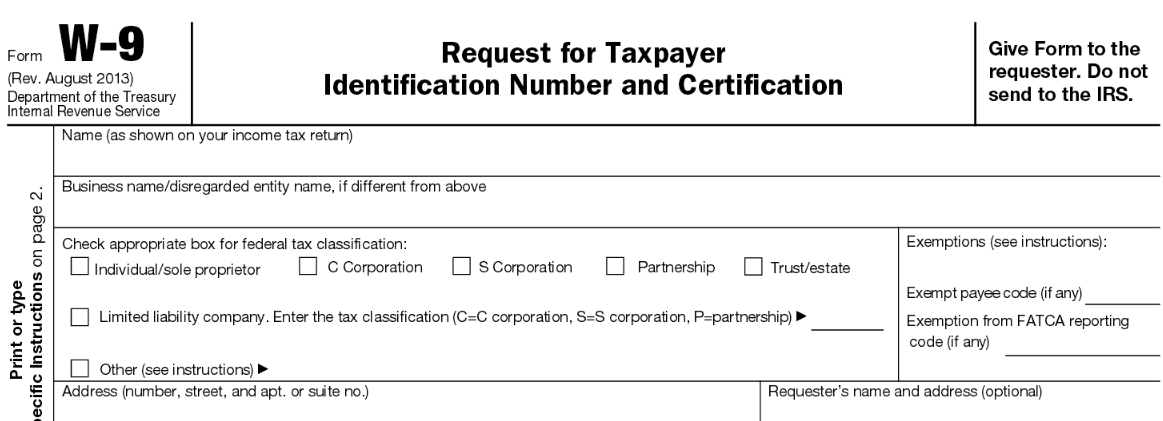

For other entities it is your employer identification number EIN. Form W-9 officially the Request for Taxpayer Identification Number and Certification is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service IRS. Name as shown on your income tax return.

Do not leave this line blank. For individuals this is your social security number SSN. W9 CSS JS.

An Employer ID or EIN is a federal tax identification number for businesses. For individuals this is your social security number SSN. Form W-9 is one of those really simple IRS Forms that has precisely one function.

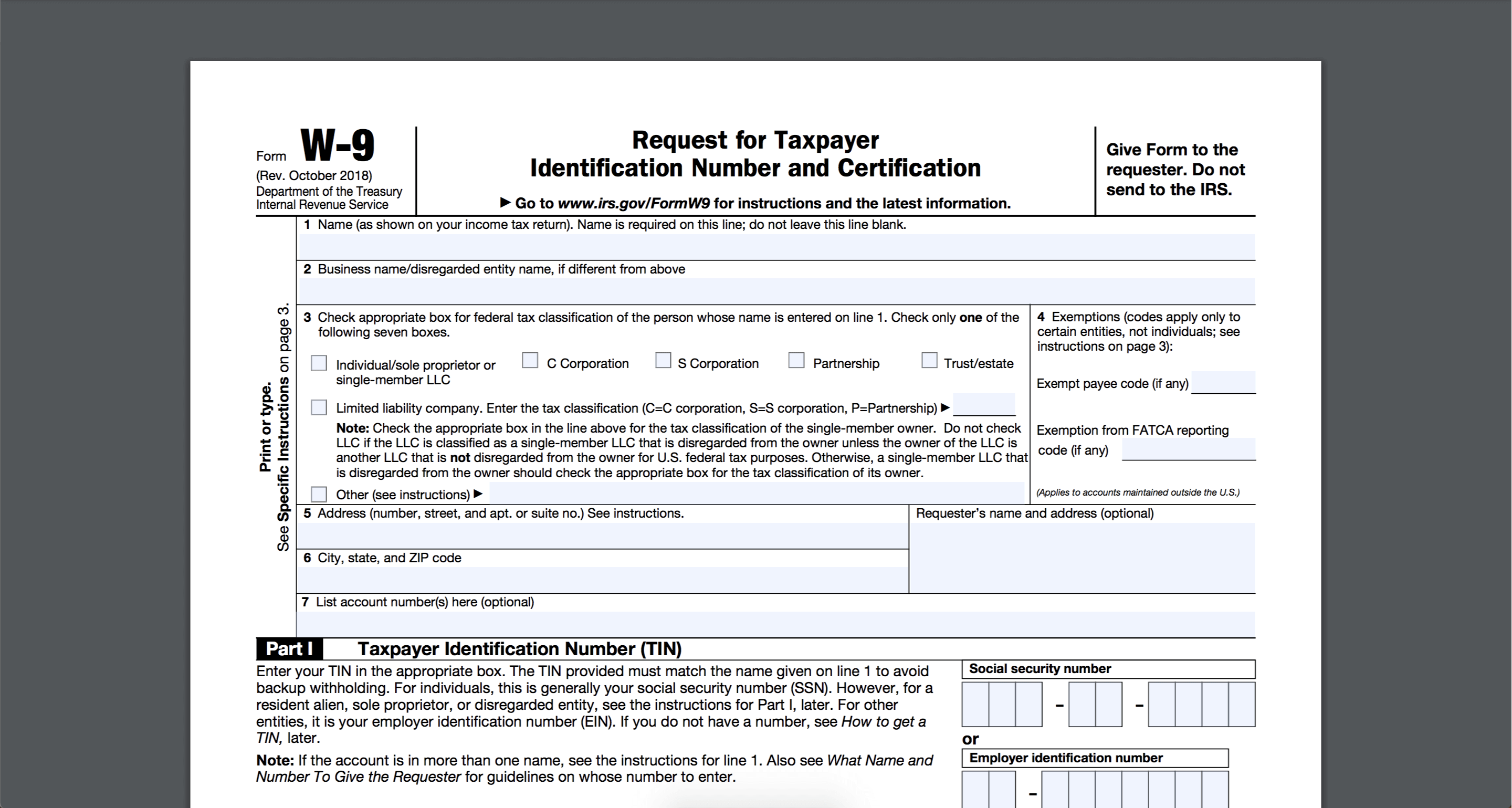

IRS Form W-9 Request for Taxpayer Identification Number and Certification is used to certify the taxpayer identification number TIN or Federal Employer Identification Number FEIN type of taxpayer and tax status. Use Form W-9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS to report for example. Information about Form W-9 Request for Taxpayer Identification Number TIN and Certification including recent updates related forms and instructions on how to file.

ATT W-8 and W-9 Forms Code snippet. See Specific Instructions on page 3. Social security number or.

By default this is your personal SSN. Social Security Number or Employer Identification Number is not certified. Then you use the EIN for business and your SSN for personal and only the IRS knows whose EIN belongs to whose SSN.

If you are hiring employees whether one or many you will need an EIN You need an EIN to open a bank account. To avoid backup withholding. By banks as a requirement for opening a business bank account.

Under penalties of perjury I certify that. Identification Number and Certification Go to wwwirsgovFormW9 for instructions and the latest information. Why are EINs required.

Guidelines on whose number to enter. The number shown on this form is my correct taxpayer identification number or I am waiting for a number to be issued to me. A business relies on the W-9 form as a source for a payees personal information the most important of which is the taxpayer Identification number TIN.

Identification Number and Certification. Our records indicate that your US. Although its labeled as an identifier for employers you dont have to have employees to need an EIN.

Do not send to the IRS. The title of Form W-9 is officially Request for Taxpayer Identification Number and Certification. Access and download ATT domestic and international W-8 and W-9 tax forms for all ATT legal entities with their own specific tax identification number.

Name is required on this line. Your clients will use the information on your W-9 to put your name business name address and taxpayer identification number TIN on the 1099-MISC they. W9EIN lets you look-up and check the details of the Federal Employer Identification Number FEIN of USA companies.

Give Form to the requester. If this Form W-9 is not completed and returned your account may be subject to backup withholding at the applicable tax rate on all dividends and sale proceeds. Employers use this form to get the Taxpayer Identification Number TIN from contractors freelancers and vendors.

A I am exempt from backup. Name is required on this line. Taxpayer Identification Number TIN Enter your TIN in the appropriate box.

If the employer doesnt have a taxpayer ID or if the taxpayer ID is incorrect the independent contractor must have federal income taxes withheld known as backup withholding. UCSD needs to be concerned with W-9s for both payers and payees. Give Form to the requester.

Do not leave this line blank.

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg) Form W 9 Request For Taxpayer Identification Number Tin And Certification Definition

Form W 9 Request For Taxpayer Identification Number Tin And Certification Definition

How To Fill Out And Sign Your W 9 Form Online

How To Fill Out And Sign Your W 9 Form Online

Das Irs Formular W 9 2018 2020 Ausfullen Pdf Expert

Das Irs Formular W 9 2018 2020 Ausfullen Pdf Expert

What Is A W 9 Form Why You Need To Fill It Out Bench Accounting

What Is A W 9 Form Why You Need To Fill It Out Bench Accounting

What Is Irs Form W 9 Turbotax Tax Tips Videos

What Is Irs Form W 9 Turbotax Tax Tips Videos

Form W 9 Request For Taxpayer Identification Number And Certificate

Form W 9 Request For Taxpayer Identification Number And Certificate

Https Www Tuv Com Media Usa Termsandconditions Tuv Rheinland Holding W9 Pdf

How To Fill Out A W9 As A Single Member Llc Should You Use Ein Or Ssn Your Freelancer Friend

How To Fill Out A W9 As A Single Member Llc Should You Use Ein Or Ssn Your Freelancer Friend

Learn How To Fill Out A W 9 Form Correctly And Completely

Learn How To Fill Out A W 9 Form Correctly And Completely

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg) Differences Among A Tax Id Employer Id And Itin

Differences Among A Tax Id Employer Id And Itin

W9 Form Print W9 Form Tax Payer Id Number Compuforms Artcraft

W9 Form Print W9 Form Tax Payer Id Number Compuforms Artcraft

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment