Featured

Minimum Income To Qualify For Obamacare 2020

You can probably start with your households adjusted gross income and update it for expected changes. If you already enrolled in an ACA plan and got a subsidy you.

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or below.

Minimum income to qualify for obamacare 2020. But you must also not have access to Medicaid or qualified employer-based health coverage. If your MAGI goes above 400 FPL even by 1 you lose all the subsidy. My 2020 income including approximately 5000 in UC benefits was 139 of FPL.

Learn about eligible immigration statuses. Who Qualifies for a Subsidy Qualification is determined based on household income more about what household income is in a minute. Premiums will drop on average about 50 per person per month or 85 per policy per month.

Please note marketplace cost assistance can be taken in advance based on income projects but is adjusted for actual income at tax time. What is the maximum income for ObamaCare. Modified Adjusted Gross Income for the ACA premium subsidy is basically your adjusted gross income AGI plus tax-exempt muni bond interest plus untaxed Social Security benefits.

Marketplace savings are based on your expected household income for the year you want coverage not last years income. Said Department established in January 2020 that a single person without dependent children who earns an annual salary of 12760 is 100 poor. In states that havent expanded Medicaid the minimum income to qualify for the premium tax credit is 100 FPL.

To qualify for an Obamacare tax credit you have to estimate your household income for the following year in your application. For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. Must be a US.

With the new March2021 stimulus bill I understand that the first 10800 of UC benefits will not be taxed as income. Citizen or national or be lawfully present. You can be worth millions of dollars and still receive Obamacare subsidies if your income is below 45000 per individual or 95000 for a family of four for example.

You must make your best estimate so you qualify for the right amount of savings. But the poverty level is not a line but a range that moves from 100 12760 to 400 51040. Whose income to include in your estimate.

I did have an ACA plan in PA for 2020. Estimating your expected household income for 2021. To qualify for a subsidy your household income must be between 100 and 400 of the FPL.

You qualify for subsidies if pay more than 85 of your household income toward health insurance. And although there is normally an income cap of 400 of the poverty level discussed in more detail below that does not apply in 2021 or 2022. For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify.

You can base this amount on your most recently filed tax return taking into account any changes you expect for the following year. If so subtracting 5000 from my MAGI would now put me below the 138 FPL required for subsidies in PA. If you are a single person with no children your taxable income can be no more than about 47000 per year in 2016 If you are a married couple with one child your taxable income can be no more than about 81000 per year in 2016.

In general you may be eligible for tax credits to lower your premium if you are single and your annual 2020 income is between 12490 to 49960 or if. Which means you can access the subsidized health insurance marketplace known as Obamacare. For 2020 coverage its 12490 for a household of one person 16910 for a household of two persons etc.

Use your new coverage. Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to. Your taxable income is between 100 and 400 of the federal poverty level for your area.

Those with household income between 133. Obamacare Facts Toggle navigation. If you meet these criteria youll be eligible for a subsidy on a sliding scale based on your income.

Minimum Income 100 Federal Poverty Level Maximum Income 400 Federal Poverty Level. The minimum income for ObamaCare is 100 of the federal poverty level. Thus if you make between 12760 51040 as an individual or 26200 104800 for a family in 2021 youll qualify for cost assistance.

This is shown on this web page on healthcaregov. To be eligible to enroll in health coverage through the Marketplace you. For income-based subsidy eligibility a household must have an income of at least 100 of the federal poverty level 139 percent of the federal poverty level in states that have expanded Medicaid.

You will be asked about your current monthly income and then about your yearly income. For 2021 assistance youll use the 2020 poverty levels. Must live in the United States.

The dollar amount of this changes every year but for 2020 it is 12490 for an individual and 25750 for a family of four.

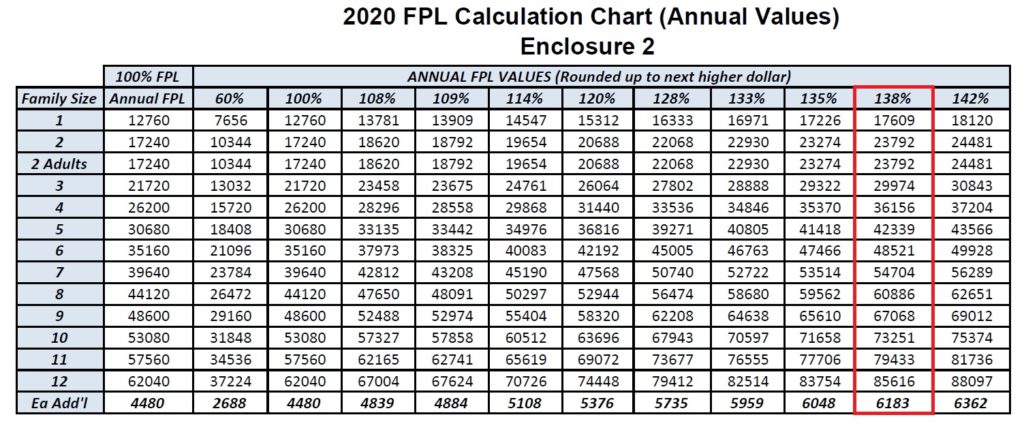

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

What Is The Maximum Income For Obamacare Subsidies In Year 2021

What Is The Maximum Income For Obamacare Subsidies In Year 2021

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Obamacare For Immigrants And People Over 65 Insurancewala

Obamacare For Immigrants And People Over 65 Insurancewala

Obamacare Health Insurance Subsidies Faq Ehealth

Obamacare Health Insurance Subsidies Faq Ehealth

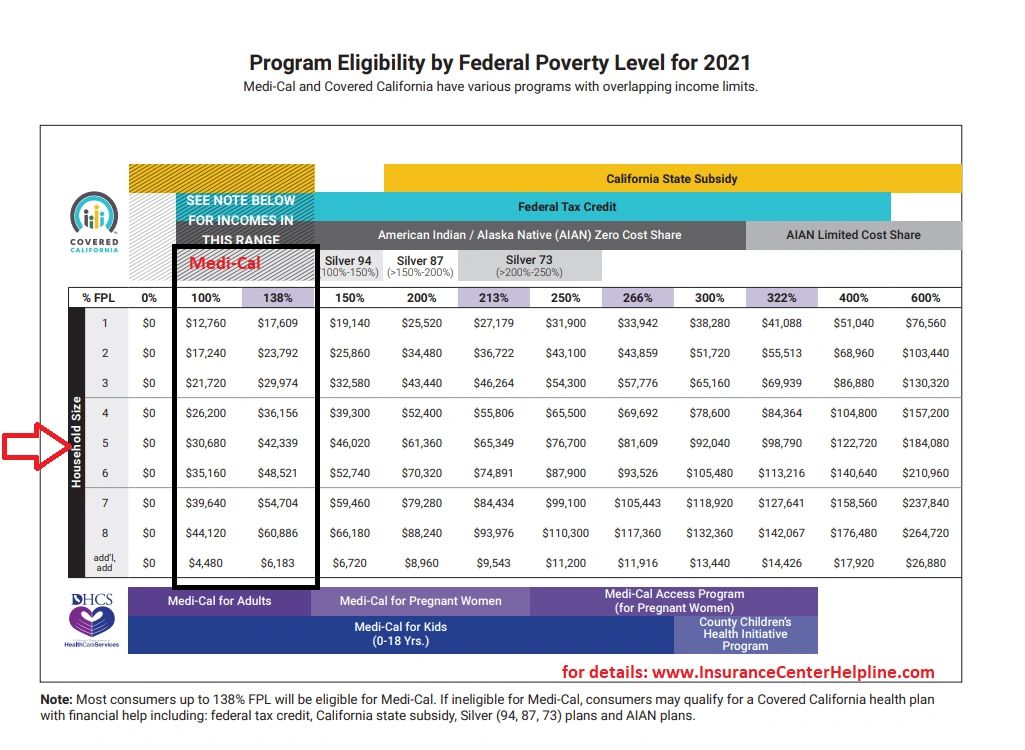

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment