Featured

- Get link

- X

- Other Apps

Plan A Supplement

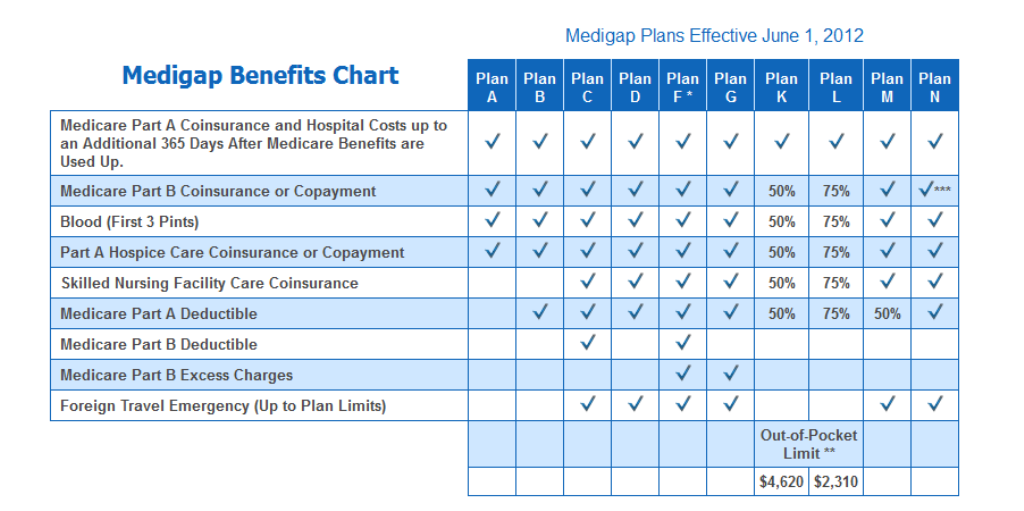

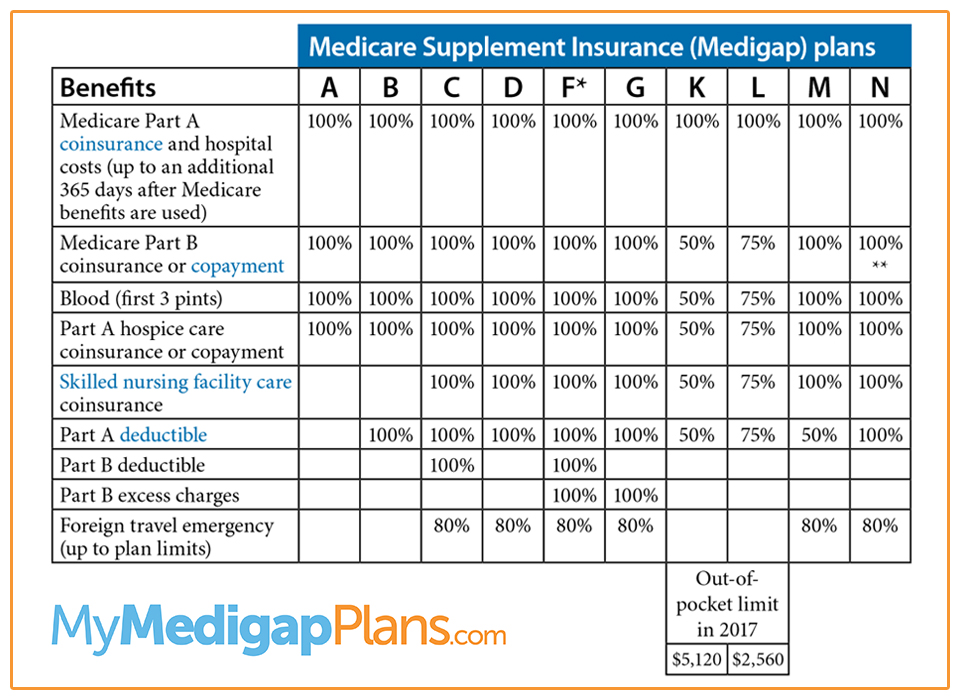

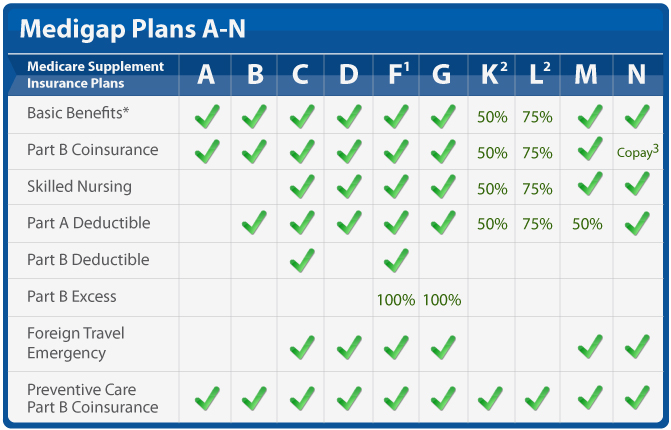

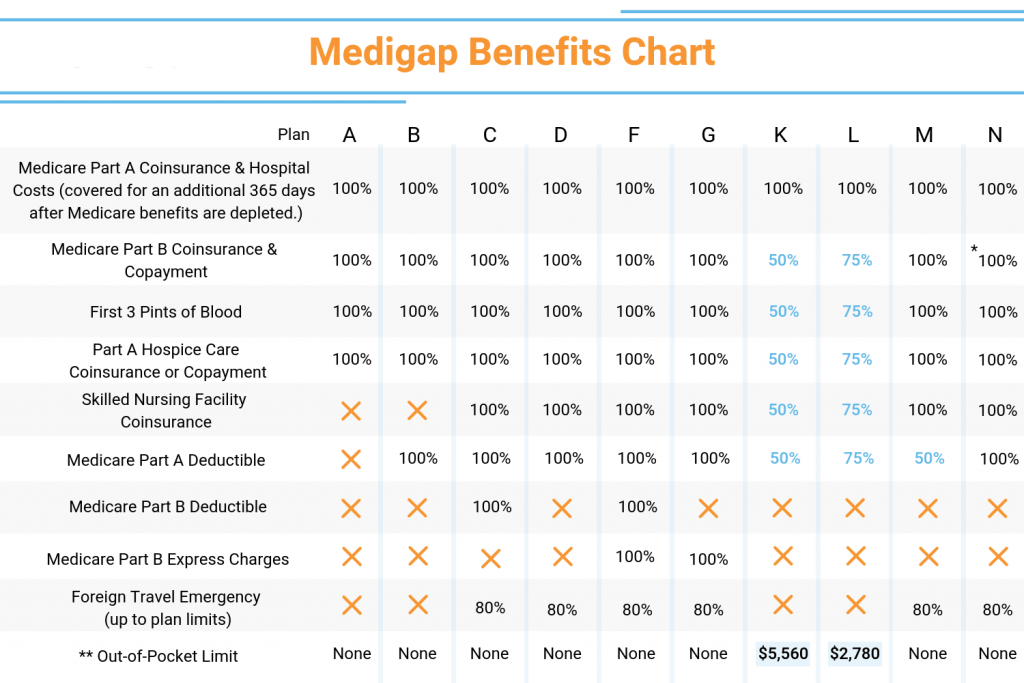

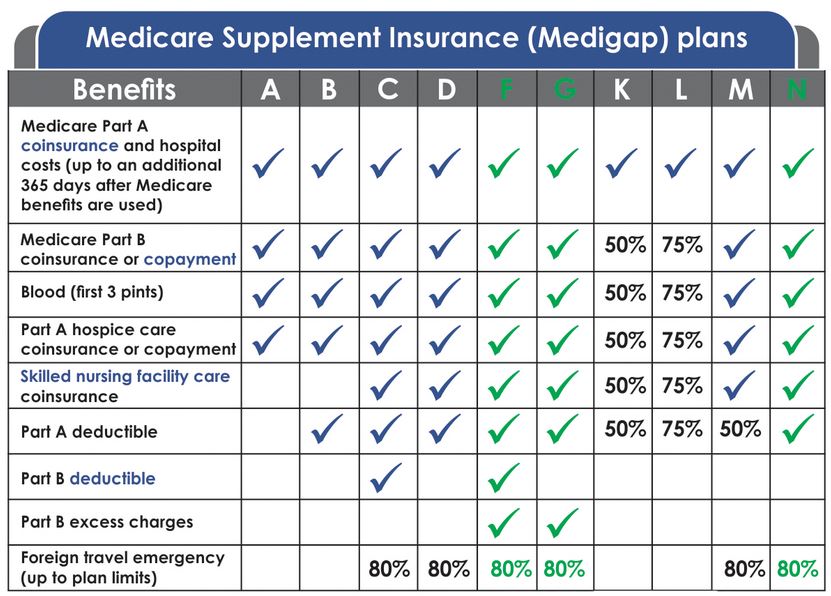

Rather than first coming up with a supplement business owners should instead start out by thoroughly researching the market. Medigap plans pay for things like co-payments deductibles and coinsurance with some plans also paying for health care if you travel outside of the United States.

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Out of all of the available Medicare Supplement plans Plan A offers the least benefits.

Plan a supplement. These private insurance policies help cover out-of-pocket costs of Medicare like deductibles copays and coinsurance. Medicare Supplement Insurance Plan A. Medicare Supplement Plan A provides basic coverage for.

If you are under 65 check with your state insurance department for guidelines. They should research the competition and the target market. Medigap plans are available to most folks under 65 as long as they have Medicare AB.

Among the Medicare out-of-pocket costs not covered is the Part A deductible for inpatient hospital stays. In 2020 the Medicare Part A deductible is 1408. However one of the benefits it does cover is one that could cost you the most out of pocket.

Coverage for Part B coinsurance or copayment blood transfusions and hospice care coinsurance or copayment. Medicare Supplement plans generally cover Medicare-approved inpatient hospital care for an additional year 365 days after your Medicare Part A coverage runs out. Pays Part B coinsurance generally 20 of Medicare-approved expenses or co-payments for hospital outpatient services.

Medicare Supplement Plan A has the fewest individual benefits of the ten standardized Medicare Supplement insurance plans available in most states. A Medicare Supplement plan can consider that disability or health condition and the cost to insure you and reject your application. The benefit and what makes Medicare supplements easier than Medicare Advantage is that Plan A from Aetna is exactly the same as Plan A from Humana or any other carrier.

Medigap For Folks Under 65. The supplement plan pays AFTER Medicare approves and processes the claim. Some states have an open enrollment period for eligible individuals under the age of 65.

Medicare Supplement Plans Coverage Explained Plan A. Medicare Part B copayment or coinsurance expenses The first 3 pints of blood used in a medical procedure Part A. Pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end.

Most Medicare Supplement plans cover 100 of this. Currently there are 10 standardized plans on the market identified by the letters A through N. Medicare Supplement insurance Plan A covers 100 of four things.

To be eligible you must have both Medicare Part A and Part B. For a little more than 15 a month you can add dental vision and hearing coverage to your Medicare Supplement plan. In certain states insurance companies are not required to offer Medigap plans to people under.

Includes the same coverages as plan A along with Part A deductible coverage. Same coverages as plan B along with Part B. A Medicare Supplement Insurance Plan also called Medigap is health insurance you can buy from a private insurance company to pay for gaps in coverage from Original Medicare Parts A and B.

Plan A is optional health insurance that covers a few of the gaps in your Medicare coverage including your Part A coverage. Coverage can begin as early as April 1 2021. Medicare Supplement Plan A helps cover a few of the out-of-pocket costs that Original Medicare doesnt pay for.

Medicare Supplement plans also usually cover at least 50 of your Part B coinsurance or copayments for doctor visits and other Part B services. Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days after Medicare benefits. Medigap Plan A is one of the standardized Medicare Supplement Insurance plan types options available in most states.

Medicare Supplement Plan N is a type of Medigap plan. Many new business owners plan on creating a supplement and then marketing it but this order is actually backward. This additional coverage gives you.

Dental exams and cleanings at no additional cost. Pays for the first three pints of. This means that the basic benefits for a Plan A for example is the same across every insurance company that sells Plan A regardless of location.

Starting Feb 1 2021 Blue Cross will offer this package to all Medicare Supplement members. The lettered plan system makes shopping super simple. Its easy to mistake Medicare Supplement Plan A with Medicare Part A which covers most of your inpatient hospital care.

Learn more about how Medigap Plan A could help with your out-of-pocket health care costs and find out if Plan A is the best plan for your needs. This makes it easy to compare Medicare Supplement insurance plans because the main difference between plans of the same letter category will be the premium cost. Of all Medigap plans Medigap Plan A covers the least amount of benefits.

Here S A Brief Look At Medicare Supplement Medigap Plans

Here S A Brief Look At Medicare Supplement Medigap Plans

What Is A Medicare Supplement Medigap Plan Gomedigap

What Is A Medicare Supplement Medigap Plan Gomedigap

Ultimate Guide To Selling Medicare Supplements Senior Market Advisors

Ultimate Guide To Selling Medicare Supplements Senior Market Advisors

Best Medicare Supplement Plans Online Plan F G Changes

Best Medicare Supplement Plans Online Plan F G Changes

Medigap Coverage Chart 65medicare Org

Medigap Coverage Chart 65medicare Org

Comparison Chart Of All 10 Medicare Supplement Plans Policies

Comparison Chart Of All 10 Medicare Supplement Plans Policies

Illinois Medicare Supplement Plans

Illinois Medicare Supplement Plans

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plans Comparison Chart 2021

Medicare Supplement Plans What You Need To Know Ensurem

Medicare Supplement Plans What You Need To Know Ensurem

Medicare Plan A Medigap Plan A Medicare Supplement Plan A

Medicare Plan A Medigap Plan A Medicare Supplement Plan A

Blog Medicare Supplement Plans Medigap Chart 2018

Medicare Plan A Medigap Plan A Medicare Supplement Plan A

Medicare Plan A Medigap Plan A Medicare Supplement Plan A

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment