Featured

- Get link

- X

- Other Apps

Covered California Subsidy Limits

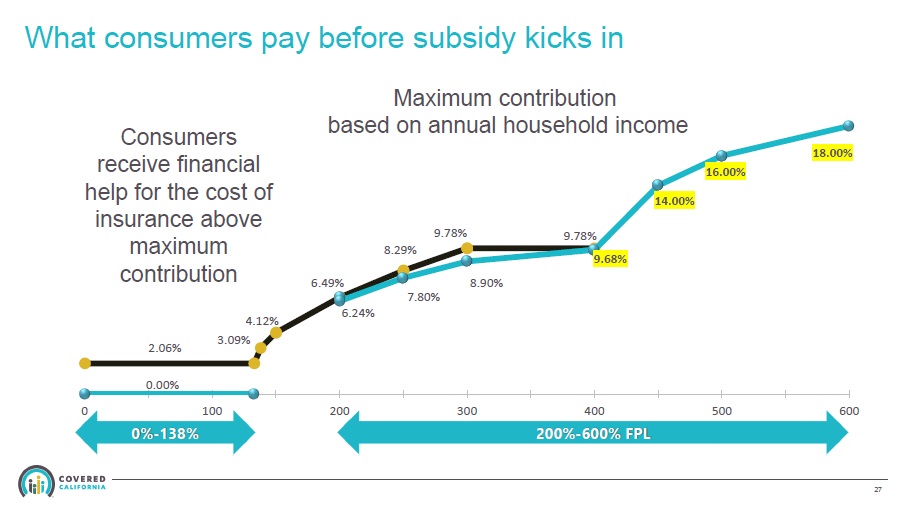

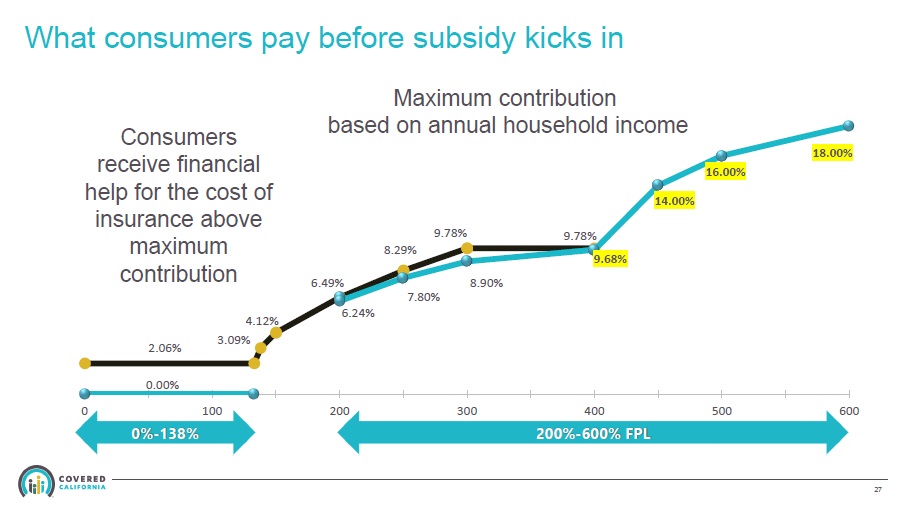

These are the repayment limits for the state subsidy received in. Maximum contribution is the amount that the consumers household is expected to contribute toward the.

Covered California Income Limits Explained

Covered California Income Limits Explained

News media such as Los Angeles Times reported this in.

Covered california subsidy limits. Covered California uses FPL limits from the prior year to determine eligibility for its programs as required by regulation. However when you do your taxes in April you discover your household income was actually 35000 year. The California Premium Subsidy will be available to households who earn between 401 and 600 of the FPL.

However starting in 2020 in California those between 400 and 600 of FPL may qualify for state subsidies. In order to be eligible for assistance through Covered California you must meet an income requirement. The unshaded columns are associated with Covered California eligibility ranges.

To view the monthly Medi-Cal eligibility income amounts please visit my Medi-Cal Page. Covered California administrative data of. Click the link below to.

Determine if you might qualify for a subsidy. Current Covered California consumers who will receive subsidies will pay an estimated 119 less per month per household on average which translates to 1428 per year. Even an individual earning close to 75000 may qualify for financial help.

For example for a household at 500 of FPL the subsidy. 65 who are not eligible for coverage through. Covered California income table revised to reflect new subsidy eligibility under the American Rescue Plan Act.

If you make 601 of the FPL you will be ineligible for any subsidies. For more information about the new state subsidies please review the design documents which have more details about the program. The expectation is that if the household income is under 400 the federal ACA subsidies kick-in.

Apply for tax credit subsidies available through. Some consumers between 200 and 400 of the FPL may also get a small amount of extra subsidy to further reduce their health insurance premiums. California will pick up where the federal government leaves off.

Maximum contribution and benchmark premium. Federal Tax Credit 100600 FPL Silver 94 100150 FPL Silver 87 over 150200 FPL Silver 73 over 200250 FPL. Their employer Medicaid or Medicare can.

Estimated 922000 Californians to be newly eligible for Covered Californias health insurance state subsidy Expanded California State Subsidy program begins in 2020 Households newly eligible include 400 up to 600 of Federal Poverty Individuals with income up to 74940. Modeling assumes uninsured population characteristics match Covered California membership including plan choice. Covered California Cost Sharing Reductions Eligible Income Level 133 to 250 FPL Eligible Californians who buy health care coverage through an Covered California will have a cap on their total out-of-pocket spending including deductibles co-pays and co-insurance.

400 of the federal poverty level. From 0 to 138 of FPL legal residents and US Citizens in California will either get federal subsidies through Medi-Cal the Medicaid program for California or they may qualify for state subsidies through Covered California if they are ineligible for Medi-Cal. If you make over that amount but less than 400 of the federal poverty level based on your household income and number of dependents then you may be eligible for an up-front subsidy also referred to as a tax credit 1.

There is no repayment limitation of the California Premium Subsidy IF the estimated income is over 400 FPL but then the final income on the California state income tax return is UNDER 400 FPL. Those over 400 of FPL do not qualify for federal subsidies. California Premium Subsidy repayment limitations.

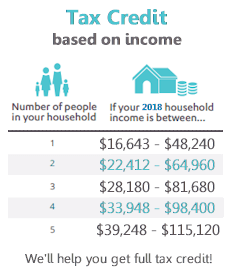

According to Covered California getting a state subsidy depends on the difference between two numbers. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. Some families get a thousand dollars a month in savings even those making up to 154500 a year.

If you make less than 138 of the Federal Poverty Level in California you qualify for Medi-Cal otherwise known as Medicaid. The income table shows the minimum amount of annual income to qualify for either Medi-Cal or tax credits for a private plan through Covered California. When you applied for Covered California healthcare you estimated that your family income would be 25000 a year.

This means that you received 250 a month more than you should have. Repayment is suspended for any extra premiums you received in tax year 2020 because of the American Rescue Plan which passed in March 2021. California passed a law in 2019 that extends the premium subsidy to 600 Federal Poverty Level FPL for three years starting in 2020.

The unshaded columns are associated with Covered California eligibility ranges. California State Subsidy 0138 FPL over 200600 FPL Federal Tax Credit 100400 FPL Enhanced Silver Plans 100250 FPL. Covered California uses FPL limits from the prior year to determine eligibility for its programs as required by regulation.

October 2014 middle-income people under age.

Covered California Q A Covered California Archives

Covered California Q A Covered California Archives

Health Care Reform Subsidies Explained In Layman S Terms

Health Care Reform Subsidies Explained In Layman S Terms

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered Ca Plan Benefit Changes For 2021 Health For California Insurance Center

Covered Ca Plan Benefit Changes For 2021 Health For California Insurance Center

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Https Board Coveredca Com Meetings 2019 05 16 20meeting Ppt Policy 20and 20action May 202019 5 16 Pdf

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Covered California Health Insurance Income Guidelines

Do You Qualify For The New California Health Insurance Premium Subsidy

Do You Qualify For The New California Health Insurance Premium Subsidy

Covered California 2020 Open Enrollment Official Website Assemblymember Richard Bloom Representing The 50th California Assembly District

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment