Featured

- Get link

- X

- Other Apps

California Law Health Insurance For Employees

1 It extends the federal COBRA coverage to employees of California employers not covered by COBRA employers with 2-19 employees. With just a little paperwork on your part an employee can contribute to the cost of health insurance.

Https Www Cpp Edu Benefits Docs Employer Covered Calif Notice Pdf

Additional information about follow-up requirements is available.

California law health insurance for employees. The law speaks of full time equivalents. California health insurance companies require that an employer contribute at least 50 percent of the employee only monthly cost or premium So for example if the monthly cost for one employee not including dependents is 300 then the employer must pay at least 150. 4 2019 6 AM PT A new California law that reclassifies some independent contractors as employees requiring they be offered a range of benefits.

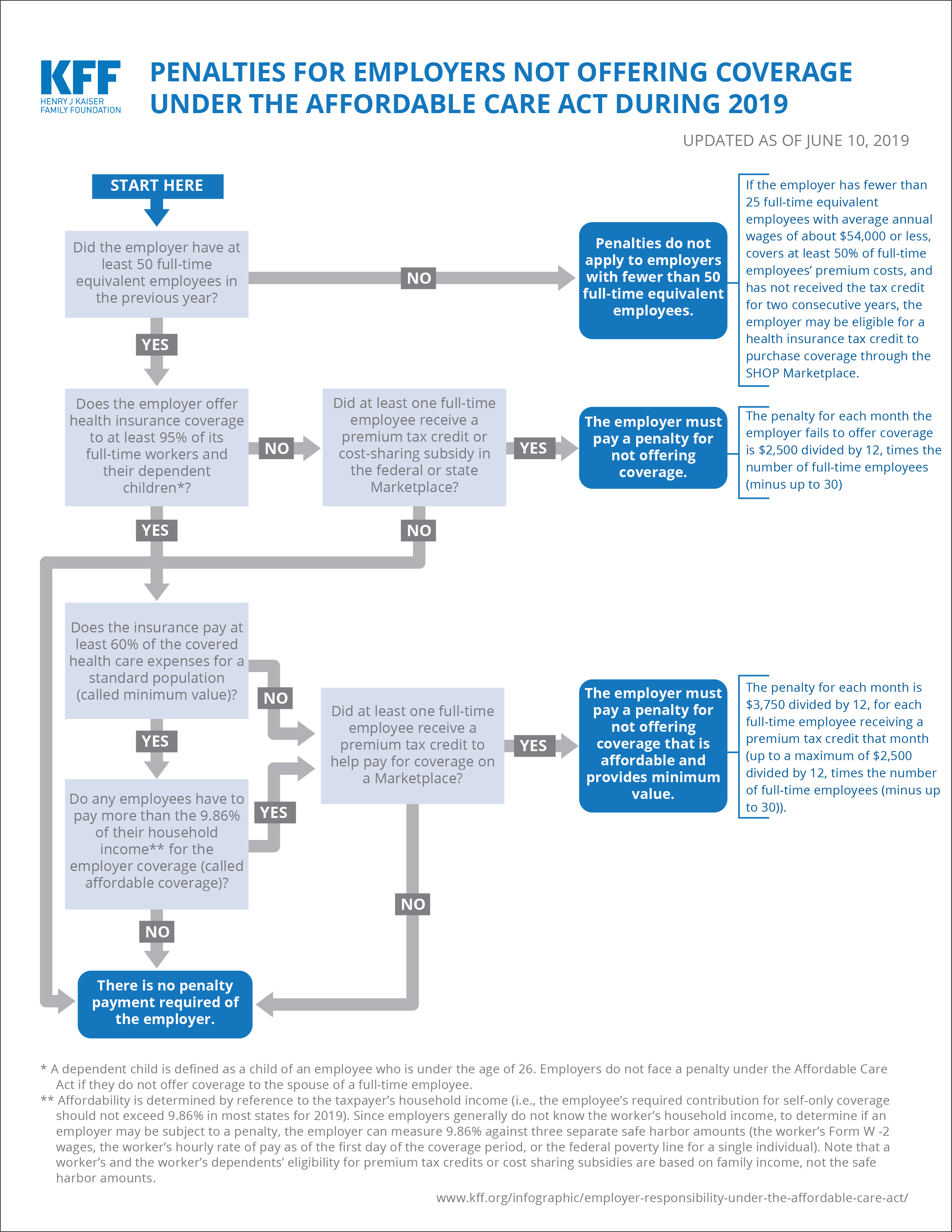

The 2018 health care expenditure rates will increase to. Under the current ACA law theres dividing line based on the size of your company. Coordinate with their insurance carriers and self-insured medical plan vendors to stay informed about updates including announcements giving reporting details.

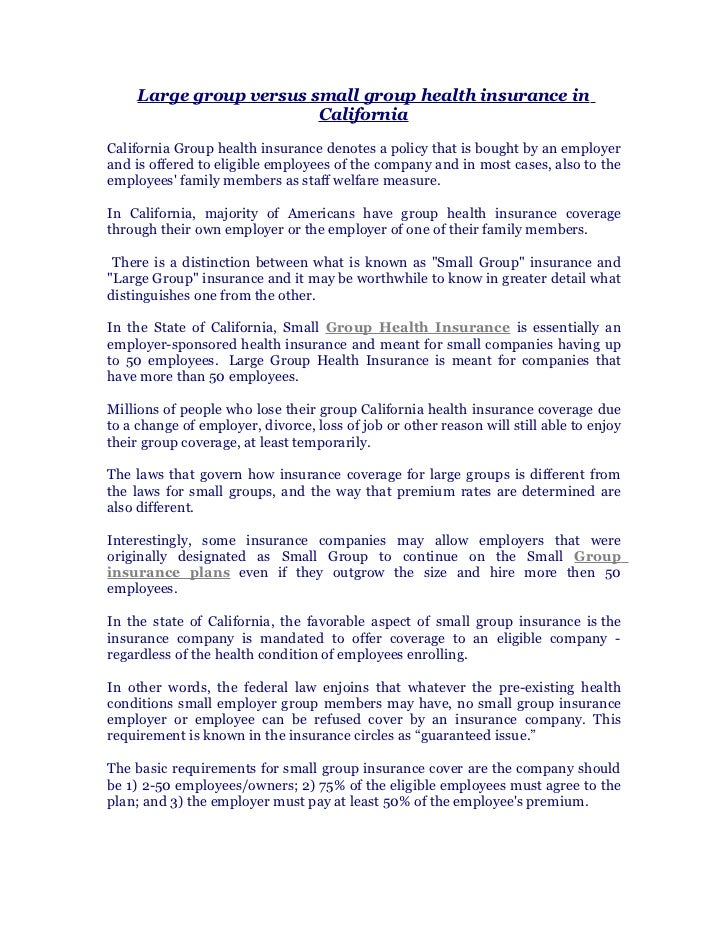

The key take away for 1099 contact workers is that they are NOT covered by California State law AB 1672 which regulates Small Group health insurance. Cal-COBRA - Cal-COBRA is a California-specific program that does two things. All employees eligible for coverage should get a 1095-C regardless of whether they actually participate in the employers health plan.

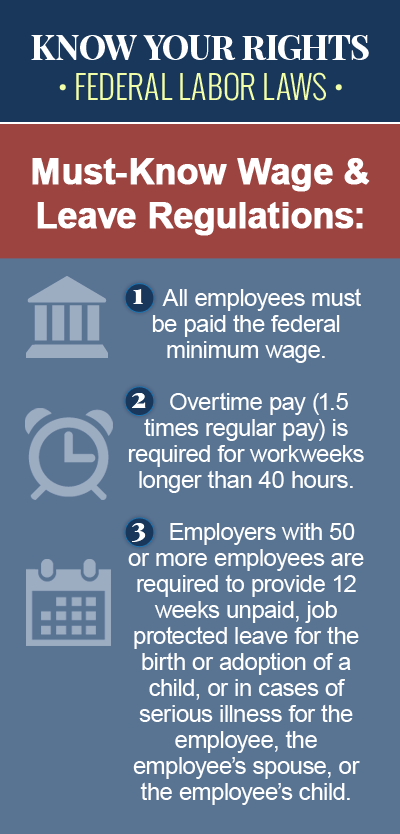

A small business has no obligation to offer health insurance to part-time employees usually defined as employees who work less than 30 hours per week. This means that we add up the of full time employees 30 hours per week PLUS The equivalent of part-time employees. There is currently no state law requiring employers to offer group healthcare insurance to their employees but most employers do provide this benefit.

It is possible to set things up so that your employees save tax money. 2 It extends COBRA coverage for an additional 18 months to a total of 36 months for employees of companies that are covered by federal COBRA employers with 20 or more employees. San Francisco Health Care Security Ordinance HCSO.

Generally speaking any expenses an employer incurs related to health insurance for employees or for dependents are 100 tax-deductible as ordinary business expenses on both California and federal income taxes. In most cases group insurance is better than individual insurance. First a note on how to calculate your size.

283hour for large business with 100 or more employees worldwide 189hour for medium-size business a for-profit with 20-99 employees worldwide and a non-profit with 50-99 employees worldwide EMPLOYMENT LAWS. Employees are eligible for health benefits if they have an appointment of more than six months at least six months plus one day and a time base of half-time or more. California employers in all fields must provide workers compensation insurance regardless of the type of business or the number of employees.

However the employer can require the employee to pay the same portion of health insurance premiums the employer required before taking leave. It gives you more benefits at a lower cost. If an employee is injured at work or becomes sick as a result of working the employer is responsible for a variety of benefits including medical care disability and.

Beyond this general rule taxes get a bit more complicated. The IRS uses the information on form 1095-C to confirm that no employees who. California employer requirements for health insurance.

Additionally employees who are offered affordable minimum essential coverage by their employers are not eligible for premium tax credits if they purchase a plan through Covered California. To prepare for the new laws implementation on Jan. Employers with 100 employees buy large-group policies and those with fewer than 100 buy small-group policies.

If the employees leave does not qualify or the employee is taking time beyond the amounts provided by California or federal law the employee may be required to cover their own health insurance premiums. They must establish their own health insurance plan on an individual or group basis as they are considered self-employed. If your employer provides health insurance California insurance law requires policies that cover certain benefits mandatory benefits and give employees the right to continue group insurance under certain circumstances if the employee leaves the group.

This is also called employee coverage. 1 2020 employers with employees in California should. If an employer provides health insurance Californias insurance laws require policies to cover certain benefits mandated benefits and give employees the right to continue group coverage in certain circumstances if the employee leaves the.

However if an employer offers insurance to at least one part-time employee then the small business must offer group coverage to. Most people in California get group health insurance through a job. Eligible employees have 60 calendar days from the date of appointment or a permitting event to enroll in a health plan or during an Open Enrollment period.

Large Group Versus Small Group Health Insurance In California

Large Group Versus Small Group Health Insurance In California

California S Contract Worker Law Could Add Health Coverage For Some But Put Others At Risk Los Angeles Times

California S Contract Worker Law Could Add Health Coverage For Some But Put Others At Risk Los Angeles Times

Workplace Sonoma State University

Workplace Sonoma State University

Does A Company Have To Offer Health Insurance To Employees In California

Does A Company Have To Offer Health Insurance To Employees In California

Watch Out For California S New Laws Affecting Employer Health Coverage Benefitspro

Watch Out For California S New Laws Affecting Employer Health Coverage Benefitspro

Https Www Calpers Ca Gov Docs Circular Letters 2013 600 051 13 Attach1 Pdf

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

Which Congress Members Cover Health Insurance For Campaign Staff Orange County Register

Which Congress Members Cover Health Insurance For Campaign Staff Orange County Register

New Health Insurance Coverage Options And Your Health Coverage Ppt Download

New Health Insurance Coverage Options And Your Health Coverage Ppt Download

Calameo Affordable Care Act Small Business 949 675 1920 Newport Beach

Calameo Affordable Care Act Small Business 949 675 1920 Newport Beach

Cal Cobra Laws For California Employees Ca Employment Help

Cal Cobra Laws For California Employees Ca Employment Help

Http Www Careergroupcompanies Com Forms Medicalplanbenefitspolicy Ca Pdf

Employer Responsibility Under The Affordable Care Act Kff

Employer Responsibility Under The Affordable Care Act Kff

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment