Featured

- Get link

- X

- Other Apps

California Individual Mandate

This law requires individuals to have MEC or pay a penalty to the State of California. Most people in California are required to have health coverage.

California Rhode Island Individual Mandates Now Law Tango Health Tango Health

California Rhode Island Individual Mandates Now Law Tango Health Tango Health

Effective January 1 2020 California residents will become subject to an individual mandate.

California individual mandate. Eligibility requirements are similar to those in place during the annual open-enrollment period. FFM states plan selections drop by 5 SBMs increase slightly by 009. Restoration of the California individual health insurance mandate.

The mandate resembles the now defunct ACA individual mandate. Beginning January 1 2020 all California residents must have qualifying health coverage minimum essential coverage qualify for an exemption or pay the state an individual mandate penalty. Starting January 1 2020 California will tax legal citizens if they dont have health insurance.

Californias new individual health insurance mandate 2019 Ch. The legislation also establishes a three-year program to provide additional state subsidies to help certain. This bill would create the Minimum Essential Coverage Individual Mandate to require an individual who is a California resident to ensure that the individual and any spouse or dependent of the individual is enrolled in and maintains minimum essential coverage for each month beginning on and after January 1 2020 except as specified.

California Individual Mandate SB 78 With the passage of California Senate Bill 78 Chapter 38 Statutes of 2019 California created an individual mandate also known as the California Individual Mandate. Visit Covered California or call 800 300-1506 to get more information. A rationale for this is to.

The Affordable Care Acts employer mandate remains in place requiring companies with at least 50 full-time workers to provide health insurance or pay a. Starting in 2020 California residents must either. New Individual Mandate.

Since 2014 the federal Affordable Care Act ACA has required individual taxpayers and their dependents to maintain Minimum Essential Coverage MEC or pay a federal tax penalty. This is called the individual mandate A person meets the individual mandate if they have health coverage that meets the definition of Minimum Essential Coverage Federal and California law define Minimum. Due to the economic impacts from COVID-19 individuals may now enroll in health care coverage during Covered Californias special enrollment period now underway.

This year will mark the first year that California residents will face a new reality of the Individual Mandate. As a result California. The bill would require the Exchange to grant exemptions from the mandate.

Get an exemption from the requirement to have coverage. However Congress removed the federal non-compliance tax penalty beginning in 2019 when it revised the tax code in 2017. As of January 1 2020 every resident of California will be required to be enrolled in minimum essential coverage MEC or pay a penalty.

The tax penalty for noncompliance with the Affordable Care Acts individual mandate is to be eliminated starting in 2019. The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021. California Healthcare Mandate The State of California adopted a new state individual health care mandate that requires individuals to maintain health insurance beginning January 1 2020.

We investigated the potential impact of this change on enrollees decisions to purchase insurance and on individual-market premiums. California loosens its individual mandate for health insurance Ana Oliva and Felix Portillo get health insurance information through Covered California from Valeria Lopez in downtown Los Angeles. 38 SB 78 requires state residents to maintain minimum essential coverage MEC for themselves and their dependents starting on Jan.

California residents will need to include their health coverage information on their 2020 tax return when they file this year. California Releases Individual Mandate Reporting Instructions for Employers. While 2019 was a year of reprieve from the obligation for individuals to obtain healthcare coverage when the federal Individual Mandate was zeroed out in 2019 a new state Individual Mandate in California has sprouted in 2020 to fill the void.

Individual mandate penalty elimination included in Tax Bill HR1 Individual mandate penalty no longer in effect Proposed rule to broaden enrollment in Limited Benefit HPs Consumers indicate confusion about mandate penalty in 2018 2018 FFM AEP 2018 ends. Californias Individual Mandate first went into effect in January 2020 and requires all state residents including dependents to obtain minimum essential health coverage or face a penalty. If you do not have health coverage you may have to pay a tax penalty.

The state needs to come up with 98000000 to pay for free health insurance f. This is similar to the federal individual mandate that was part of the. The mandate generally requires every California resident to enroll in and maintain.

Individuals who do not obtain health insurance for themselves and their dependents will be subject to a penalty unless they qualify for an exemption. 1 2020 or pay a state tax penalty. In a survey of enrollees in the individual market in California in 2017 19 percent reported that they would not have.

How California S Individual Mandate Affects You

How California S Individual Mandate Affects You

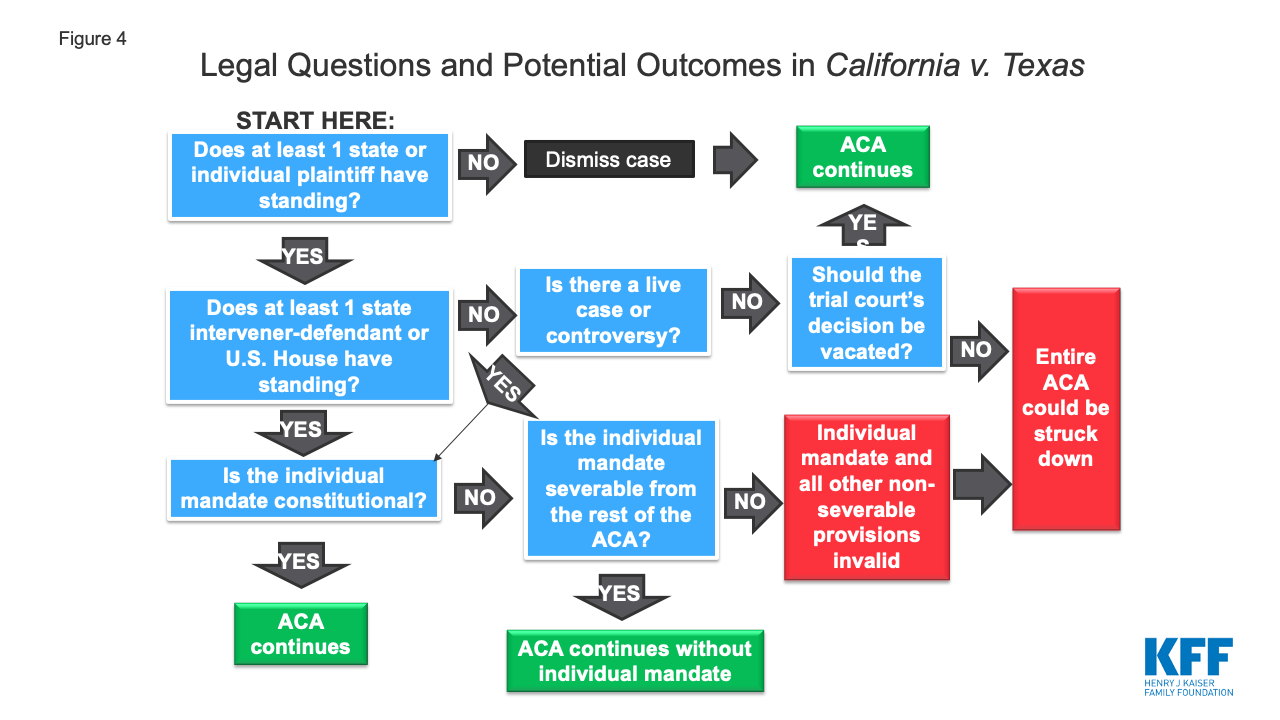

Explaining California V Texas A Guide To The Case Challenging The Aca Kff

Explaining California V Texas A Guide To The Case Challenging The Aca Kff

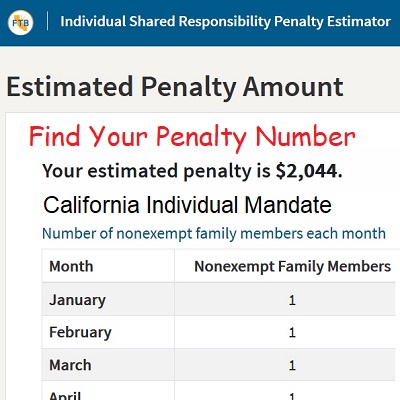

In 2021 Tax Year California Individual Mandate Penalties Will Be Issued

In 2021 Tax Year California Individual Mandate Penalties Will Be Issued

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

California Individual Mandate Penalty Cheap Compared To Cost Of Health Insurance

The 2020 Changes To California Health Insurance Ehealth

The 2020 Changes To California Health Insurance Ehealth

Complete Guide To State Individual Mandates Tango Health Tango Health

Complete Guide To State Individual Mandates Tango Health Tango Health

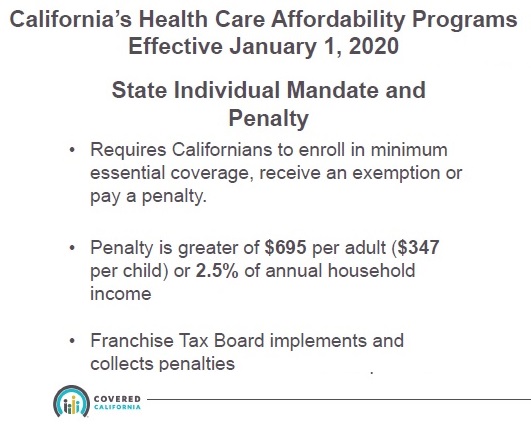

California Enacts Individual Mandate For 2020 Core Benefits Insurance Services

California Enacts Individual Mandate For 2020 Core Benefits Insurance Services

California Penalty For Not Having Health Insurance

California Penalty For Not Having Health Insurance

California Franchise Tax Board Individual Mandate Penalty Flyer

California Franchise Tax Board Individual Mandate Penalty Flyer

California Individual Mandate Penalties Will Be Issued This Yearcalifornia Individual Mandate Penalties Will Be Issued In 2021

California Individual Mandate Penalties Will Be Issued This Yearcalifornia Individual Mandate Penalties Will Be Issued In 2021

California Individual Mandate Special Rules Releasedcalifornia Individual Mandate Final Regulations Have Been Updated

California Individual Mandate Special Rules Releasedcalifornia Individual Mandate Final Regulations Have Been Updated

Mandate Health Insurance Tax Penalty California Mec Qhp 5000 A

Reviving The Health Care Mandate Who Pays Public Policy Institute Of California

Reviving The Health Care Mandate Who Pays Public Policy Institute Of California

Eliminating The Individual Mandate Penalty In California Harmful But Non Fatal Changes In Enrollment And Premiums Health Affairs

Eliminating The Individual Mandate Penalty In California Harmful But Non Fatal Changes In Enrollment And Premiums Health Affairs

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment