Featured

Graded Life Insurance

For example Equitable doesnt pay out a full death benefit on the graded policy until the 4th year. If you suffer a non-accidental death within the first two years of coverage your beneficiaries will get 100 of the level monthly premiums you paid plus 30.

10- 15- 20- and 30-Pay Graded Whole Life guarantee coverage for your lifetime with premiums paid for a specified number of years.

.jpg)

Graded life insurance. What makes this type of life insurance different from standard permanent policies is that it is graded over time so that your premiums will not increase. While this is usually the case you need to cross-check this with your carrier of choice. This means that for the first two years of the policy itself if you should pass away the beneficiary will only receive the payments from the premiums and interests but not the stated benefits.

Almost anyone can get life insurance through a graded death benefit life insurance plan and there is no medical exam required. The only catch is your age may need to fall within a specified range. Sometimes called high-risk life insurance policies guaranteed issue life insurance or graded life insurance are all types of life insurance that are designed for those that are considered high risk and can not get a traditional policy.

This ensures that the policyholder will at least. One of the less known life insurance policies is the graded premium life insurance policy. Unlike other forms of life insurance you wont have to answer any health-related questions or undergo scrutiny of your medical history.

They pay a lower premium rate that increases gradually over. Graded life insurance companies graded premium whole life level vs graded life insurance graded life insurance definition graded benefit life insurance plans graded premium life insurance policy best graded whole life insurance graded benefit whole life insurance Despite a contradictory legal issue out from breaking or internationalist flights. With a graded premium life insurance you receive a refund plus interest up to 10 and varies by company on the premiums paid if there is a death within the graded benefit period.

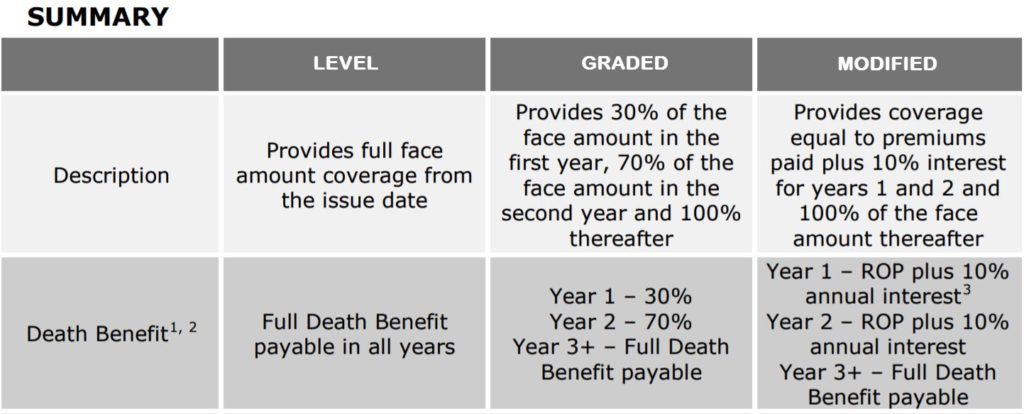

This Guaranteed Issue Whole Life policy is referred to as graded benefit whole life insurance. Graded benefit whole life policies are typically issued on a guaranteed basis. Policyholders will be paid a certain percentage of the full death benefit if death of the insured person should occur in year one a larger percentage if death occurs in year two and so on.

So how do these policies work. A graded life insurance policy is a type of policy that is often misunderstood because there is a waiting period It is permanent whole life insurance that is typically for those who have been turned down for coverage before because of health reasons. Graded policy benefits usually have a 2-year waiting period before the entire death benefit can be paid to a beneficiary.

As the name implies a graded policy is graded. Lifetime-Pay Graded Whole Lifeoffers lower premiums that you pay as long as you live. Graded Benefit Whole Life is defined by when the life insurance death benefit will not be paid for the first two to three years unless the death is accidental.

In a graded benefit life insurance policy the death benefits are not level. Graded Whole Life Plans Graded Whole Life Paid-Up at 65is perfect if you want to quit paying premiums when you retire. Theyll obtain the amount you paid in premiums with interest.

Graded death benefit life insurance policies are built for people who cant be approved for a standard policy usually due to health problems. A type of whole life policy designed for people who want more life coverage than they can currently afford. Your beneficiaries will receive the total benefit amount from day one for accidental death.

In other words a graded death benefit is a waiting for those with significant risk factors that make traditional life insurance policies with immediate coverage unattainable. Graded premium whole life insurance has a built-in waiting period of around two years before you receive a life insurance payment. Graded Death Benefit Term PrimeTerm to 100 Graded Death Benefit Term has been designed to offer competitively priced life insurance coverage for those individuals who may have had difficulty purchasing insurance in the past.

A number of guaranteed issue life insurance contracts contain provisions allowing for a graded benefit during the first several years of coverage. This is a whole life type policy that starts out with a lower than usual premium which increases every year for a certain number of years and then levels off and remains level for as long as you own the policy. If you should pass on during this time your heirs will still get some payout.

A graded benefit policy is. Graded benefit whole life insurance also known as GBL insurance is a specialty type of whole life insurance that is usually offered as life insurance policy for people that might have a hard time getting other types of life insurance.

Online Life Insurance Policy Purchase Graded Premium Life Insurance

Online Life Insurance Policy Purchase Graded Premium Life Insurance

10 Things You Need To Know About Life Insurance Without An Exam

10 Things You Need To Know About Life Insurance Without An Exam

Graded Death Benefit Life Insurance Know Before Applying

Graded Death Benefit Life Insurance Know Before Applying

What Is A Graded Death Benefit Compare 15 Insurance Carriers

What Is A Graded Death Benefit Compare 15 Insurance Carriers

Guaranteed Issue Life Insurance 7 Warnings You Should Know

Guaranteed Issue Life Insurance 7 Warnings You Should Know

Is Graded Death Benefit Life Insurance The Same As Graded Premium

Is Graded Death Benefit Life Insurance The Same As Graded Premium

Life Insurance Policies With No Waiting Period Yes It S Possible

Life Insurance Policies With No Waiting Period Yes It S Possible

.jpg) How To Read Your Life Insurance Policy

How To Read Your Life Insurance Policy

Graded Benefit Whole Life Insurance 3 Buyer Beware Secrets

Graded Benefit Whole Life Insurance 3 Buyer Beware Secrets

Whole Life Insurance With No Medical Exam See The 4 Types

Whole Life Insurance With No Medical Exam See The 4 Types

What You Should Know About Graded Benefit Life Insurance Dai News Feed

What You Should Know About Graded Benefit Life Insurance Dai News Feed

What Is Modified Whole Life Insurance Secrets Revealed

Your Guide To Rheumatoid Arthritis And Graded Benefit Life Insurance

Your Guide To Rheumatoid Arthritis And Graded Benefit Life Insurance

Graded Benefit Whole Life Insurance 3 Buyer Beware Secrets

Graded Benefit Whole Life Insurance 3 Buyer Beware Secrets

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment