Featured

Term 65 Life Insurance

Joint policies can be converted up until the eldest insured turns 70. Northwestern Mutuals whole life insurance policies provide lifetime coverage with level premiums and can be purchased until you turn age 85.

By age 65 it is likely that you have already purchased a life insurance policy and its possible that you are looking to extend that policy if it is term life insurance.

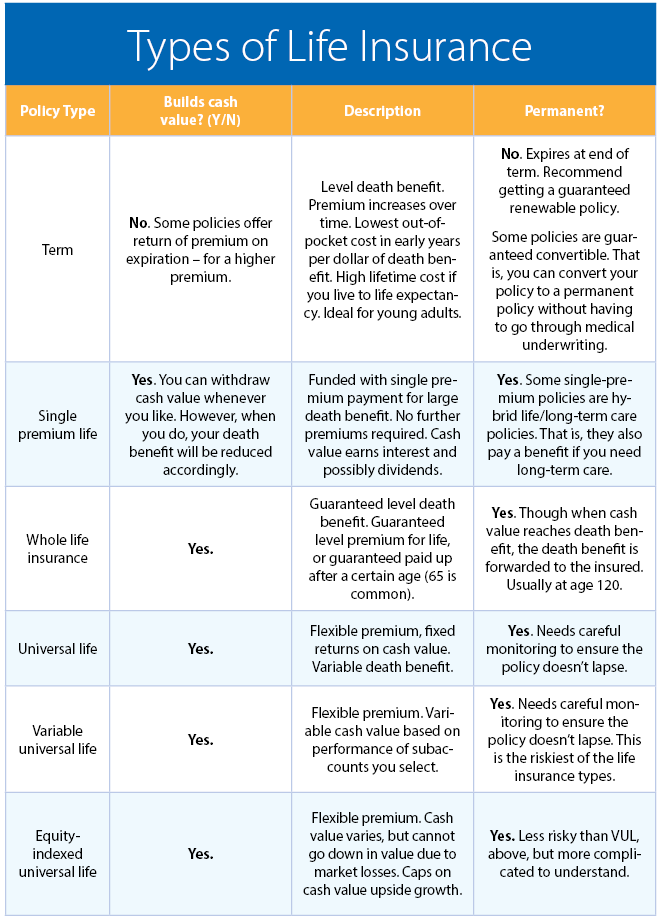

Term 65 life insurance. Term life insurance is life insurance designed to protect your family in the event of your death. Deciding to carry life insurance in retirement can also depend on your specific financial situation. Whole life insurance on the other hand is a type of permanent life insurance.

Im going to let you in on a little secret there is actually a plan that will be the best life insurance policy that you can buy if youre senior over the age of 65. That plan is known as a guaranteed universal life policy AKA no-lapse universal life. Learn more about term life insurance.

65 Life offers security and value during working years and upon retirement at age 65 will be fully paid-up and can provide various options. Depending on your health status and lifestyle you can still get affordable rates on term life insurance. Term life insurance policies are more affordable than other types of life insurance policies and generally have lower premium costs.

At age 65 the business will have the option of surrendering the policy transferring the policy or. The average monthly premium payment for a 20-year 500000 policy for a healthy 35-year-old female is 2439. Rule of thumb.

That is not the case. If you die after the term is over the insurance company doesnt pay. It provides coverage on your life for a period of time based on the term length you select typically 10 20 or 30 years.

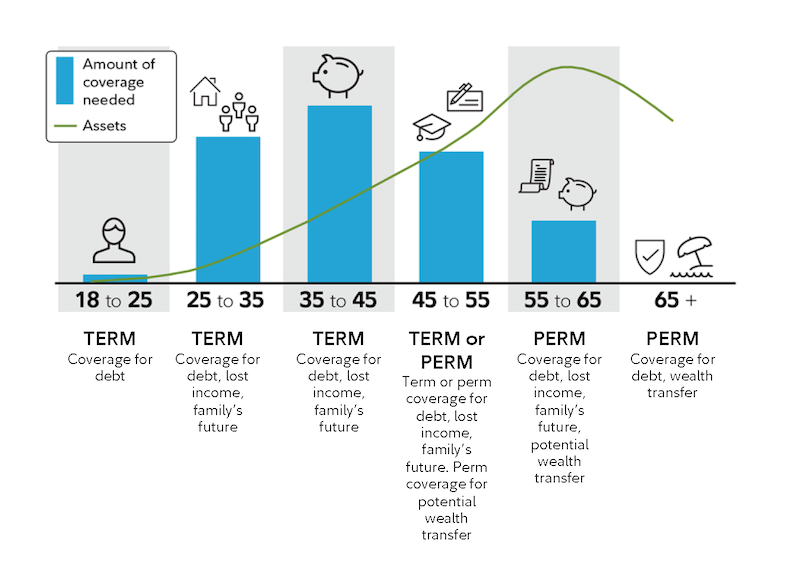

Products available for conversion. Similarly life insurance may be necessary for a surviving spouse to supplement Social Security particularly if you pass away prior to. Term life insurance is a contract between you and an insurance company that lasts for a specific period of time such as 10 years 20 years or until you reach age 65.

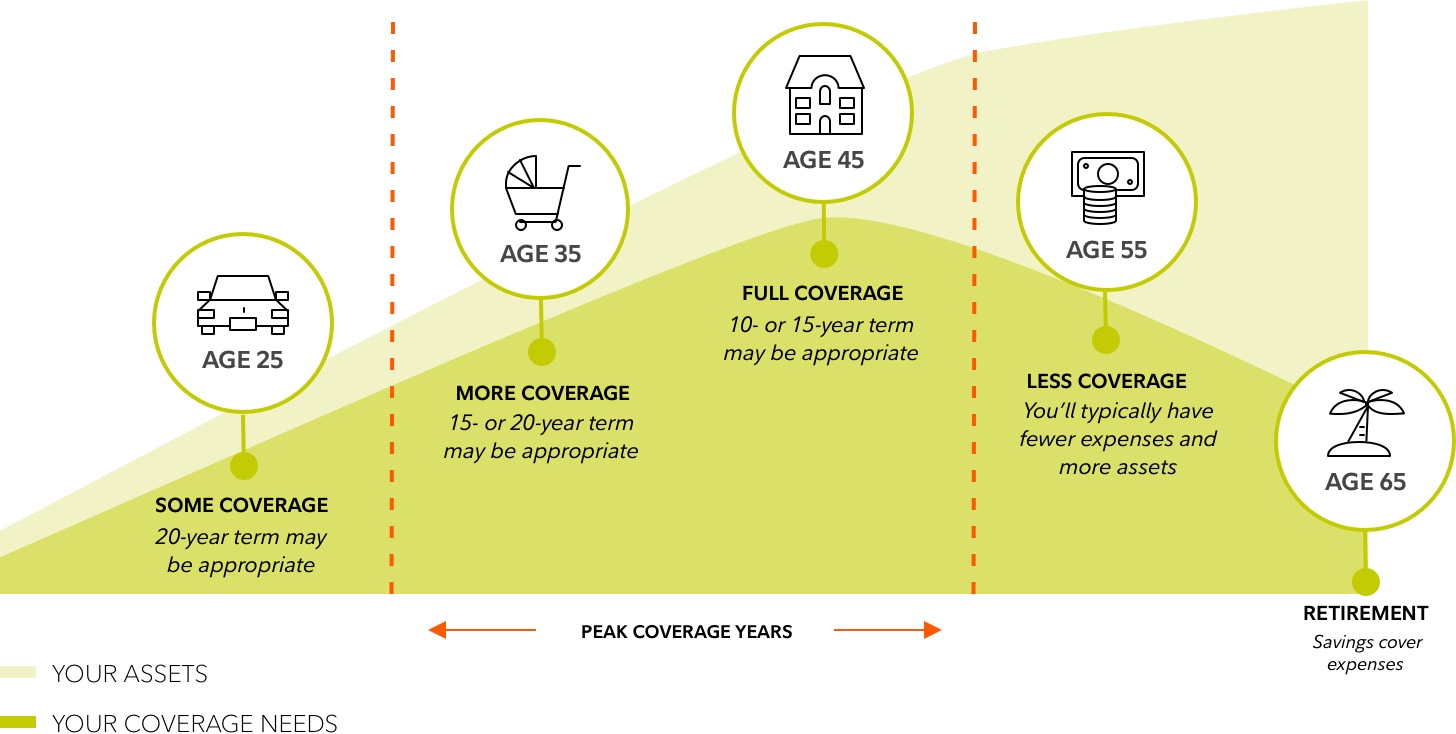

On average we found that a 65-year-old male could expect to pay anywhere from 60 to 85 per month for term life insurance with 100000 in. Your term should last at least until you retire and should also cover your longest financial obligation like a childs college costs. For example the average life insurance quote only increases by 4 between ages 25 and 30 but it jumps much higher between ages 60 and 65 an average increase of 86 or 275.

You need life insurance if you have a family or loved ones who depend on your. Have the opportunity to lower your premiums based on participation in the program for the first 10 or 20 years or until age 65 or 100. Term life insurance provides death protection for a stated time period or term.

If you are one of the many Americans without life insurance coverage at this age theres still a good chance that you need it. Northwestern Mutual Whole Life Insurance. Best Life Insurance for Seniors over age 65.

Term to 65 can be converted into a permanent product up until age 60 without having to provide new evidence of insurability. Family Term with Vitality Help protect your family and earn rewards Earn Vitality Points TM when you complete educational fitness and health-related activities. If you die before the term is over the insurance company will pay the death benefit another way to say payout.

Hybrid life and long-term care insurance policies offer two types of insurance bundled into a single product. Term life insurance just means it lasts for a set number of years or term. Many people age 65 and older think obtaining life insurance coverage is not possible or is too expensive.

Since it can be purchased in large amounts for a relatively small initial premium it is well suited for short-range goals such as coverage to pay off a loan or providing extra protection during the child-raising years. Get a term life insurance quote today and gain peace of mind. The minimum death benefit is 25000 but you should be able to get as much coverage as you need.

CLICK HERE for your life insurance quote. Age Monthly life insurance cost nonsmoker. We recommend buying a term policy that lasts 1520 years.

Term Life Insurance Offers an Affordable Option. Life Insurance Over 65. This is the most affordable simple to understand and a fixed rate policy that provides coverage for a lifetime.

Insuring a few key people 65 Life may fit the bill. Premiums may be fixed for life and not subject to increase as stand-alone policy. For instance if you are entitled to a pension or other retirement income that is solely yours life insurance can maintain that income for your spouse if you die first.

Association option Association option for individual policies.

Http Www Unitedamerican Com Compliance Compliance 20sheets 20v2 Library Liberty 20national Worksite Marketing Brochures R 3757 Group Term Paid Up At 65 Brochure R 3757 Full Page Pdf

4 Life Insurance Questions Fidelity

4 Life Insurance Questions Fidelity

The Ultimate Revelation Of Life Insurance Rate Chart Life Insurance Rate Chart T Term Life Insurance Quotes Life Insurance Quotes Life Insurance For Seniors

The Ultimate Revelation Of Life Insurance Rate Chart Life Insurance Rate Chart T Term Life Insurance Quotes Life Insurance Quotes Life Insurance For Seniors

Understanding Life Insurance What Policy Type Is Best For You

Understanding Life Insurance What Policy Type Is Best For You

Term To Age 65 Life Insurance Life Insurance Canada

Term To Age 65 Life Insurance Life Insurance Canada

Converting Your Term Life Insurance Into A Permanent Policy

Converting Your Term Life Insurance Into A Permanent Policy

Instant Term Life Insurance Quote After Retirement Ages 65 79

Instant Term Life Insurance Quote After Retirement Ages 65 79

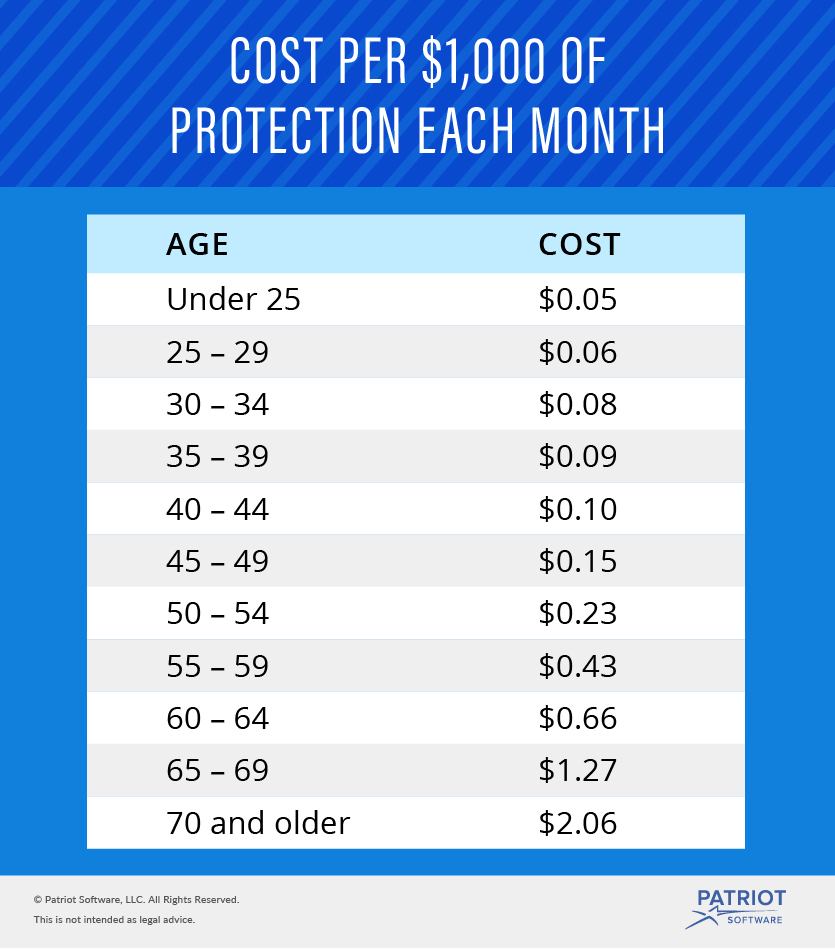

Easy Guide To Group Term Life Insurance Tax Tax Table Example

Easy Guide To Group Term Life Insurance Tax Tax Table Example

Direct Purchase Term Life Insurance Comparison Which One S Best For Me

Direct Purchase Term Life Insurance Comparison Which One S Best For Me

Life Insurance For A 65 Year Old Woman

Term Life Insurance Aim Insurance

Term Life Insurance Aim Insurance

Life Insurance Over 70 How To Find The Right Coverage

Life Insurance Over 70 How To Find The Right Coverage

Term Life Insurance Financial Resources Coverage Options Fidelity

Term Life Insurance Financial Resources Coverage Options Fidelity

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment