Featured

Obama Care Minimum Income Requirements 2019

Obamacare subsidies are available to 117 million Americans but 60 missed out in 2019. And prior to 2021 you could earn up to 400 of the federal poverty level to qualify for subsidies also known as the subsidy cliff.

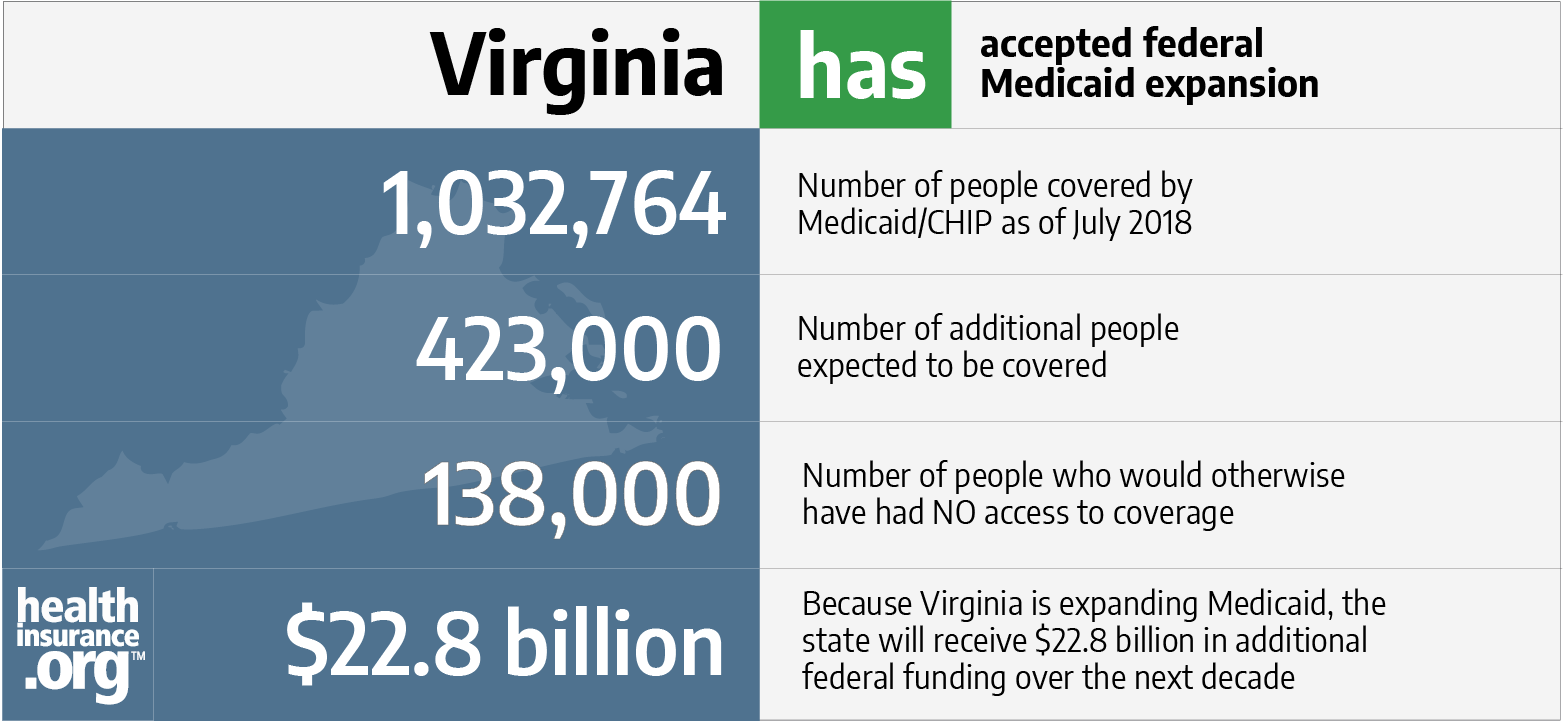

Virginia And The Aca S Medicaid Expansion Healthinsurance Org

Virginia And The Aca S Medicaid Expansion Healthinsurance Org

Among many other benefits the law increases health insurance premium subsidies provides free health insurance if youre unemployed in 2021 and waives excess subsidy payments for the 2020 tax year.

Obama care minimum income requirements 2019. Must be a US. Select your income range. By 2016 the penalty goes up to 25 of income or 695 per adult with a maximum penalty of 2085 per family.

Learn about eligible immigration statuses. Family of Four Annual Income. Citizen or national or be lawfully present.

The basic math is 4X the Federal Poverty Level FPL as determined by the government. In addition to the maximum income to receive the premium subsidy theres also a minimum income to get accepted by the ACA marketplace. Estimating your expected household income for 2021.

Higher than 12140 and lower than 48560. To be eligible to enroll in health coverage through the Marketplace you. It seems prices fluctuate wildly and this is primarily because of the income variations of those applying for policies through the exchange.

In states that expanded Medicaid the minimum income is 138 FPL. That is projected income for the upcoming year after tax deductions. Higher than 16460 and lower than 65580.

Learn more about Modified Adjusted Gross Income. Help to pay your premium if you buy in your states online marketplace Between 12760-51040. If your estimated income is too low the ACA marketplace wont accept you.

Higher than 20780 and lower than 83120. When determining whether a person is eligible for Medicaid or public insurance Obamacare has recommended that all of the states expand their requirements to determine eligibility in the Medicaid program to include all people that make 133 or under the federal poverty line due to the way that the program actually calculates income this rate is actually 138 of the FPL. They send you to Medicaid instead.

Must live in the United States. Anyone with Modified Adjusted Gross Income under 400 of the Federal Poverty Level may qualify for Tax Credits under ObamaCare or other assistance. After earning an income of 100400 or higher for a family of four 83120 for a family of three 65840 for a married couple with no kids and 48560 for single individuals you will no longer receive government health care subsidies.

In states that expanded then anyone making less than 138 FPL qualifies in states that didnt it varies. Obamacare Income Limits 2018 There is a lot of information going around concerning the cost of health care still even after the ACA passed all those years ago. Learn more about the Federal Poverty Level.

For a family of four that number equaled 104800 a year. For example thats a family of four with an income between 26200 and 104800 a year. Which requires those without minimum essential coverage to pay tax penalties.

What is the Minimum Income to Qualify for Covered California. Obamacare subsidies are available to 117 million Americans but 60 missed out in 2019. Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate.

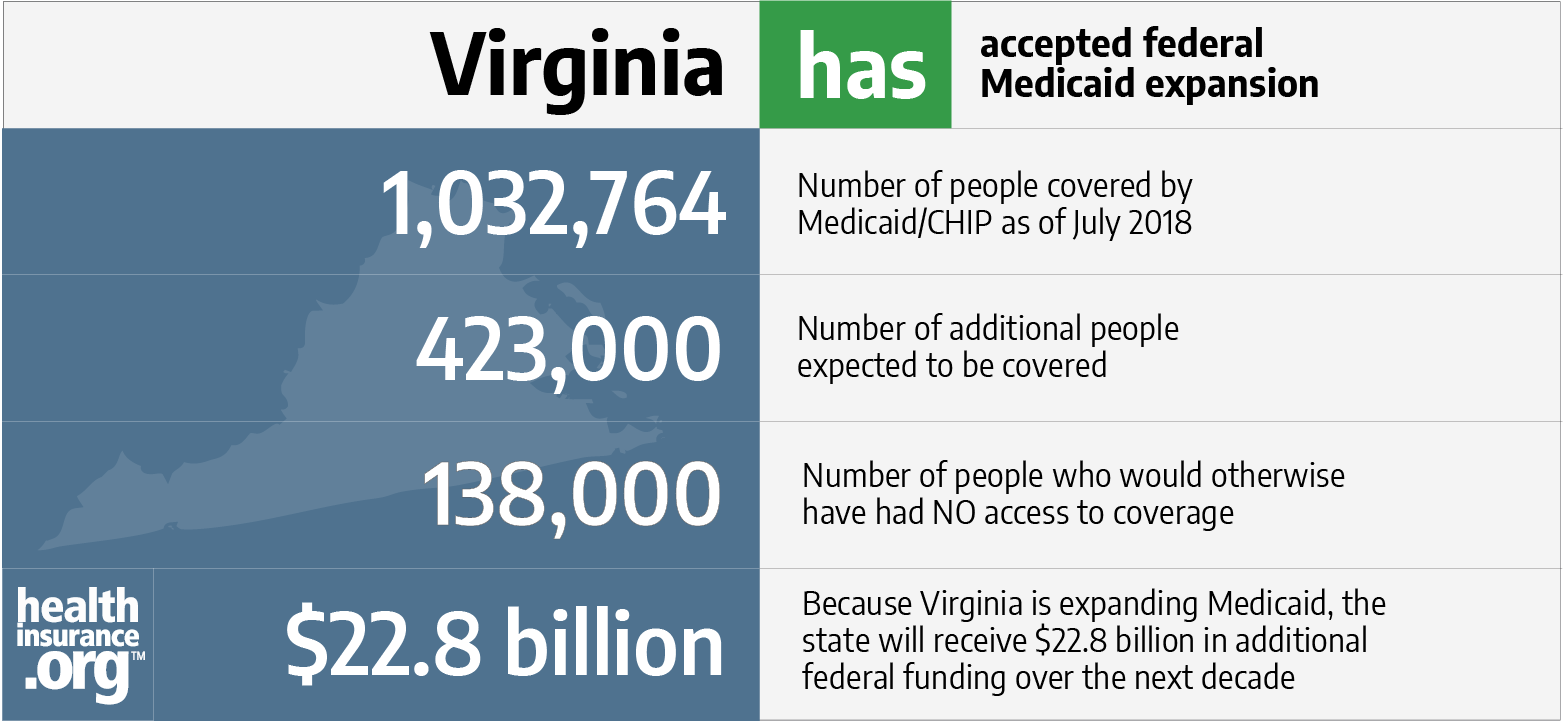

In early January 2019 New York City announced the launch of a 100 million program designed to offer health insurance to 600000 residents. Minimum Income 100 Federal Poverty Level Maximum Income 400 Federal Poverty Level. In short minimum income for cost assistance is 100 of the poverty level.

The chart states that you are eligible for Obamacare subsidies for 2019 if your household income is at least 100 higher than the percent of the FPL in 2018 or in other terms. Medicaid health coverage if your state decides to offer it Up to 17775. Minimum for Medicaid depends on which state you are in.

The penalty for uninsured children in 2014 is 4750 per child with a maximum per-family penalty of 285. Now if your family is really big and there are 8 members the minimum income will be 42380 while the maximum stands at 169520. In 2015 the penalty increases to the higher of 2 of your annual income or 325 per adult.

The Minimum Income. You might be in a state that didnt expand Medicaid as assets shouldnt be a factor in states that did. You can probably start with your households adjusted gross income and update it for expected changes.

No one pays the same. Prior to 2021 you were expected to chip in anywhere from 2 to 983 of your income. Individual Annual Income.

An individual SEP allows people to change plans enroll in new coverage and apply for subsidies if you meet the income. You wont face a federal tax penalty for going without health insurance in 2021but there are many other downsides to being uninsured. Make sure you find out whether you are eligible.

For a family of four it is somewhat difference and the minimum income should be around the 25100 mark while the maximum is 100400. What is the minimum income to qualify for covered CaliforniaThis is actually a relative question as it is based on several identifying personal factors including income source residency dependents and other variables.

Obamacare Health Insurance Income Requirements Il Health Insurance

Obamacare Health Insurance Income Requirements Il Health Insurance

2015 Aca Obamacare Income Qualification Chart My Money Blog

2015 Aca Obamacare Income Qualification Chart My Money Blog

/obamacare-taxes-penalties-and-credits-3306061_FINAL2-acbc62123f0a4d59860dd165ecc6aa8d.png) Will You Have To Pay Obamacare Taxes This Year

Will You Have To Pay Obamacare Taxes This Year

Covered California Income Tables Imk

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Healthcare Jyp Insurance Agency

Healthcare Jyp Insurance Agency

Obamacare Health Insurance Subsidies Faq Ehealth

Obamacare Health Insurance Subsidies Faq Ehealth

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment