Featured

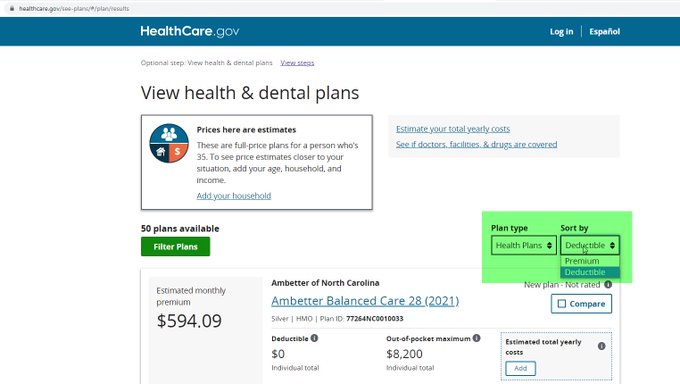

Is A Zero Deductible Good

Copays are typically charged after a deductible has already been met. If you choose to have a zero deductible policy then you should expect to pay more overall for your car insurance.

How To Get No Deductible Zero Deductible Car Insurance

How To Get No Deductible Zero Deductible Car Insurance

Other Costs To Consider.

Is a zero deductible good. If your finances would be seriously rocked by an unexpected 500 or 1000 expense play it safe and opt for a low deductible such as 250. If you have a covered claim for 1500 in repairs your insurer would reimburse you the full 1500. Even having a deductible that is low will have a massive impact on your monthly insurance premium.

Keeping a regular car insurance policy though is more likely to save money. People who suffer from chronic conditions or illness repeat hospitalizations or children who are frequently sick or play sports should consider zero deductible health insurance as it would save them money monthly. A no-deductible health insurance policy does not require the policyholder to pay anything out of pocket before the insurance kicks in.

An insurance plan with no deductible may appeal to consumers who frequently visit doctors or take several. Remember there are also copays and coinsurance. For homeowners insurance having a high deductible can mean annual savings since.

Your insurance company will cover your allowable claims right away. A zero deductible plan means that you dont have to pay for any costs upfront before receiving your benefits. A deductible rate is something that should fit nicely into your budget without breaking.

For example say you opted for collision coverage with no deductible. But these plans offer you coverage that is payable immediately at time of service with a. A low deductible could be a good idea if you live in a congested area where you have a higher chance of experiencing an accident.

A deductible is one way that the car insurance company tries to share the risk with the policyholder so that the insured does not file any unnecessary claims. The Pros and Cons of a Low Car Insurance Deductible Having a low car insurance deductible gives you peace of mind especially if youre on a tight budget. A good deductible is one that meets you and all your familys needs.

That said many people dislike deductibles more than any other factor in a health plan and tend to zero in on zero-deductible policies like a magnet as soon as they hear of them. So now many plans on the Exchange every one I have seen but then I havent seen every single one are built around a deductible in addition to other cost-sharing features. On the other hand if you had collision coverage with a 500 deductible your insurer would.

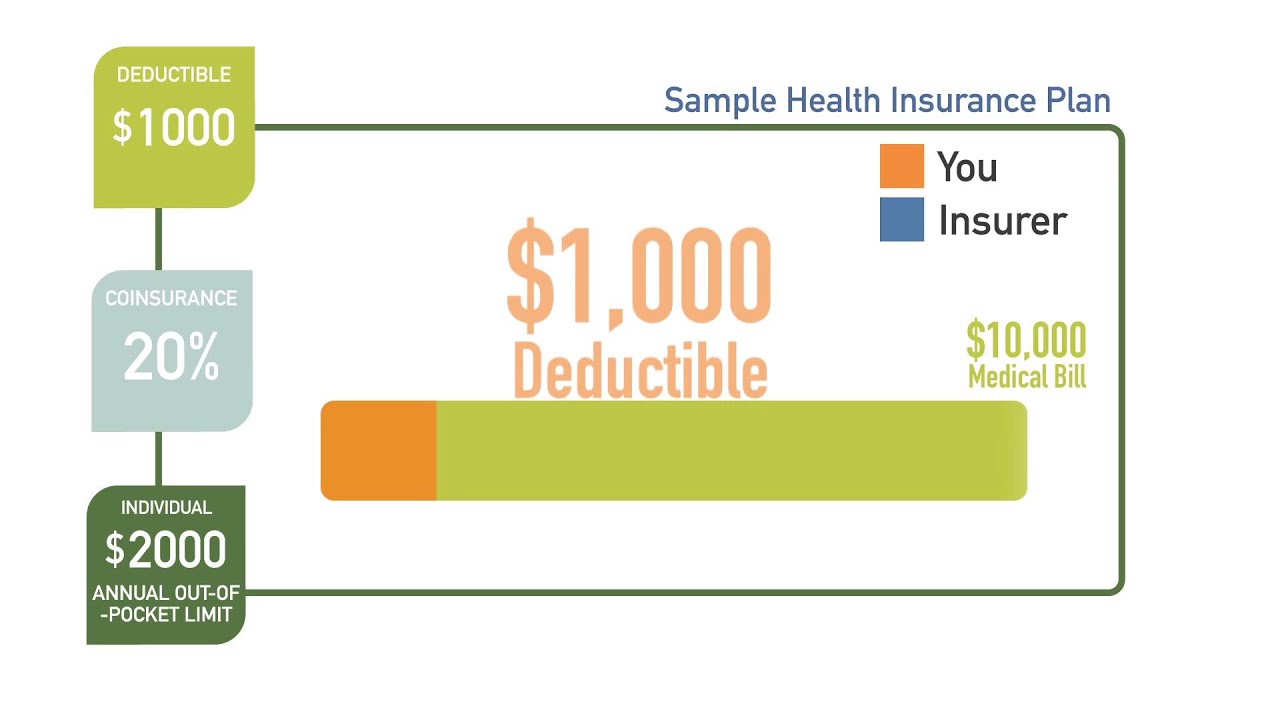

Zero deductible means exactly that - there is zero deductible. A deductible is the amount you have to pay first before the plan benefits kick in there may be some benefits in which the deductible is waived. For example say you opted for collision coverage with no deductible.

Therefore it is smart to look at the maximum you might have to pay which is called the Maximum Out Of Pocket. You can increase your deductible to save money but you can not decrease it if the insurance company has set a minimum deductible. According to this article it seems that a LOW deductible plan is best because you will always pay the full deductible before insurance pays anything.

Having zero-deductible car insurance means you selected coverage options that dont require you to pay any amount up front toward a covered claim. Check the premium difference to see if a portion of zero-deductible coverage might prove beneficial. A zero deductible can mean different things for different types of insurances.

With a zero deductible insurance policy you might not owe anything if you if you get into an accident. With a zero- or low-deductible plan your insurance will start covering a portion of these costs right away whereas a high-deductible plan wont kick in until youve paid the deductible. Some companies offer zero deductibles or disappearing deductibles so be sure and ask how your deductible works and if there is a minimum deductible or if you can have the option to have a zero deductible.

A 1000 deductible is usually the sweet spot for savings. However this only means you pay a higher monthly premium. Low deductible plans tend to cost more than high deductible plans as per monthly premiums paid and so zero deductible plans cost even more.

How Does My Insurance Deductible Change My Insurance Rates. A deductible is an amount that must be paid for covered healthcare services before insurance begins paying. No deductible has been agreed in respect of the DO insurance A deductible would restrict opportunities for acquiring management staff with extensive entrepreneurial experience as these would have to take into account liability risks even in the event of negligent conduct Apart from that the agreement of deductibles in the management area.

Zero deductible means exactly that - there is zero deductible. In some cases. Yes a zero-deductible plan means that you do not have to meet a minimum balance before the health insurance company will contribute to your health care expenses.

Zero-deductible plans typically come with higher premiums whereas high-deductible plans come with lower monthly premiums. If youre in good health rarely need prescription drugs and dont expect to incur significant medical expenses in the coming year you might consider an HDHP. No- deductible health insurance is a kind of health insurance that doesnt include a required up front payment by the enrolled member each year.

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Is There Such A Thing As Zero Deductible Insurance Ruffcorn Insurance

Is There Such A Thing As Zero Deductible Insurance Ruffcorn Insurance

Lower Deductible Zero Deductible Health Insurance Youtube

Lower Deductible Zero Deductible Health Insurance Youtube

When To Choose A High Low Or Zero Deductible Plan

Which Home Warranties Come With Zero Deductible

Which Home Warranties Come With Zero Deductible

No Deductible Health Insurance Is Zero The Right Option For You

No Deductible Health Insurance Is Zero The Right Option For You

What To Know About No Deductible Health Insurance Plans

Health Insurance Zero Deductible Health Tips Music Cars And Recipe

No Deductible Health Insurance Is Zero The Right Option For You

No Deductible Health Insurance Is Zero The Right Option For You

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment