Featured

Will Medicare Pay For Life Alert Systems

Original Medicare doesnt cover Life Alert. 1 By that definition you might expect Medicare to cover medical alert systems.

Life Alert Medical Alert System Cost Pricing In 2021

Life Alert Medical Alert System Cost Pricing In 2021

However there may be restrictions on the alert provider and the type of system theyll pay for.

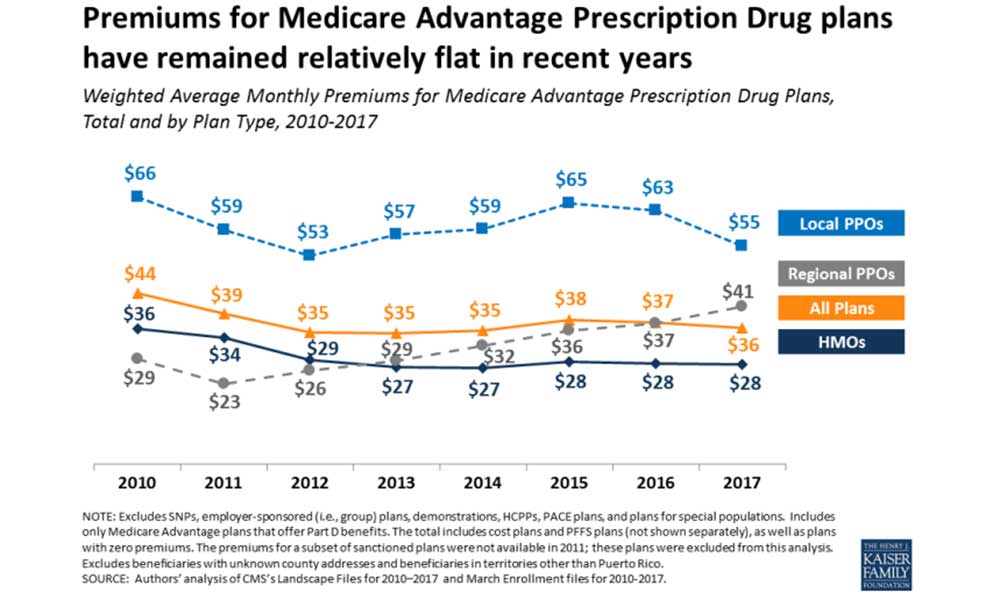

Will medicare pay for life alert systems. But some Medicare health plans such as certain Medicare Advantage plans might cover them. Although Medicare does not cover the cost of a medical alert system other programs do cover these life-saving systems. We share details from our research below to explain how Medicare Advantage plans discounts from medical alert system sellers and manufacturers long-term care insurance and the Medicaid program can help you pay for a medical alert system.

Part B of Original Medicare covers durable medical equipment such as hospital beds canes walkers and blood sugar meters. Since Original Medicare wont cover medical alert systems Medigap doesnt either. Part A covers hospital stays while Part B offers medical insurance.

Medicare insurance makes the argument that these devices are not necessary for health and that care facilities or in-home care can. Although Medicare doesnt consider them medical necessities medical alert. Unfortunately Part A and Part B will not cover the cost of a medical alert system.

Some forms of Medicare may cover a medical alert system depending on the specific plan. If your Medicare plan doesnt cover your medical alert system you may still be eligible for discounts andor tax-advantaged payment methods like health savings accounts or flexible spending accounts. Medicaid State Plan Personal Care Attendant PCA Programs are entitlement programs that pay amounts comparable to the HCBS waivers.

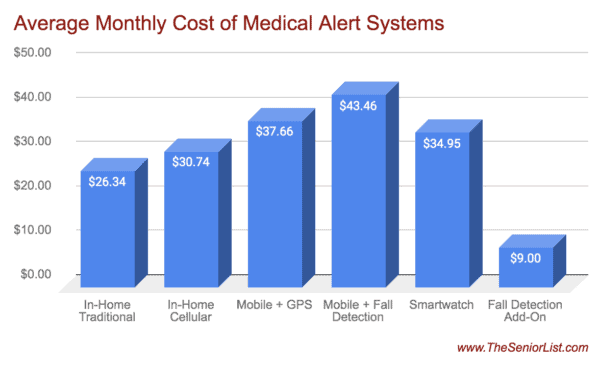

Contacting a device company directly to ask about discounts can. In some cases Medicare Advantage will partially or fully cover the cost of a medical alert bracelet. Medical alert systems generally cost between 25 and 45 per month which can be a significant amount for seniors on a limited budget.

Medicare will not cover the cost of your medical alert. Those interested will need to find out if their insurance or Medicare Part C in their state covers a medical alert device. 3 Your Medigap plan only covers some Original Medicare out-of-pocket costs such as copayments coinsurance or deductibles.

Traditional Medicare doesnt cover medical alert systems but some Medicare Advantage Part C plans and private insurers do. Medicare Part C otherwise known as Medicare Advantage offers supplemental health coverage for older adults insured through Medicare. In short no.

Some private health insurance plans supplemented by Medicare Part C may cover such systems but it varies by company. What Medicare Coverage Options are Available for Life Alert. However if you have a Medicare Advantage plan it may cover the cost of a system.

Medical alert systems can greatly increase seniors quality of life. Private insurance and Medicare Part C may help cover the cost of a medical alert device or assist with defraying the monthly fees for a personal emergency response system. Medigap also called Medicare Supplement Insurance does not cover medical alert devices.

Original Medicare Part A and Part B does not cover medical alert systems. In most cases Original Medicare plans do not provide coverage for medical alert systems. Medicare coverage is often only provided for services or supplies that are deemed to be medically necessary.

Medicare Advantage plans might offer coverage for Life Alert. Medicare wont pay for medical alert systems but Medicare Advantage or Medicaid may help pay for some or all of the costs. Still that shouldnt stop you from getting a system.

Unfortunately Medicare Part B generally doesnt cover medical alert systems. Medicare Advantage plans vary by provider and by state so contact your plan directly to see if it will cover the cost of a medical alert system. However whether or not one of these devices is covered will vary by insurance provider.

Does Medicare Cover Medical Alert Systems. Medical alert devices also known as personal emergency response systems PERS are wearable buttons that allow seniors to contact emergency services or friends and family with the press of a button if they fall or experience an accidental injury. Will Medicare Pay for Life Alert Systems.

There are other ways to pay for a medical alert system. Unfortunately they are not considered a medical necessity by Medicare. Unfortunately though Medicare does not cover medical alert systems.

If seniors need more coverage to improve the quality of their life the ability to lead an independent life and flexibility they can sign up for a suitable Medicare Advantage Plan offered by a. There is a Part A Part B and Part C to Medicare. Medicare Advantage plans may provide medical alert emergency response systems for.

Does Medigap Pay for Medical Alert Systems. Unfortunately Medicare does not provide coverage for the cost of a medical alert system. The cost to you will depend on your Advantage plan and the Life Alert.

Or look at unmonitored medical alert systems to lower your costs. Does Medicare Pay for Medical Alert Systems. This is something we disagree with as.

The first question many people ask when looking for the perfect medical alert device is whether or not Medicare or Medicaid will cover the cost. Many seniors are on Medicare which covers medical expenses and some medical supplies. Since Medicare part A and B do not pay for Life Alert response systems or other emergency response services elderly patients may need to check other options available for the coverage.

Typically medical alert systems or PERS are not covered under Medicare Parts A and B. Both Part A and Part B are known as original Medicare and are available to those who are 65 or older with some special exceptions. To cover medical costs you can can ask your insurance company for coverage.

Life Alert Coverage Costs And Eligibility

Life Alert Coverage Costs And Eligibility

Does Medicare Cover Life Alert In 2021 Find Out Here

Does Medicare Cover Life Alert In 2021 Find Out Here

Does Medicare Cover The Cost Of Medical Alert Systems 2021

Does Medicare Cover The Cost Of Medical Alert Systems 2021

Free Medical Alert System Veterans Medical Alert System Medical Care Alert

Free Medical Alert System Veterans Medical Alert System Medical Care Alert

Does Medicare Pay For Medical Alert Systems The Senior List

Does Medicare Pay For Medical Alert Systems The Senior List

Does Medicare Pay For Medical Alert Systems The Senior List

Does Medicare Pay For Medical Alert Systems The Senior List

Life Alert Medical Alert System Cost Pricing In 2021

Life Alert Medical Alert System Cost Pricing In 2021

Does Medicare Cover Life Alert Medicare Plan Finder

Does Medicare Cover Life Alert Medicare Plan Finder

Does Medicare Cover The Cost Of Medical Alert Systems 2021

Does Medicare Cover The Cost Of Medical Alert Systems 2021

Will Medicare Medicaid Pay For A Medical Alert Device

Will Medicare Medicaid Pay For A Medical Alert Device

Medical Alert Systems Covered By Medicare Does Medicare Pay

Medical Alert Systems Covered By Medicare Does Medicare Pay

Best Medical Alert Systems Updated For 2021 Aginginplace Org

Best Medical Alert Systems Updated For 2021 Aginginplace Org

Help For Caregivers Choosing Medical Alert Systems

Help For Caregivers Choosing Medical Alert Systems

Medical Alert Systems Covered By Medicare Does Medicare Pay

Medical Alert Systems Covered By Medicare Does Medicare Pay

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment