Featured

- Get link

- X

- Other Apps

Irs Ein Reference Number 101

All other reference numbers are routed to an automated message which provides instructions to correct invalid information and resubmit the application. EIN Reference Number 101 name conflictduplicate.

Error 109 When Applying For An Ein Online Error 109 When Applying For An Ein Online

We recommend employers download these publications from IRSgov.

Irs ein reference number 101. EIN Reference Number 101 name conflictduplicate. It is the most common error message that people will face while registering for EIN online. The IRS requires a unique entity name before it will issue an EIN similar to how the secretary of state requires a unique entity name within that state before Articles or Certificates of Formation may be successfully filed.

Reference numbers 101 or 115 are directed to a CSR for assistance. There are a few common reasons for that. If you have received a Reference 101 error while using the IRS online EIN application we can help.

Reference number 101 is the most common error that our agents experience while processing our clients application through our automated e-filing system. IRS EIN Reference Number 101 is the most common error message that people experience while applying for an EIN online. A rejected EIN application indicating Reference Number 101 has a name conflict.

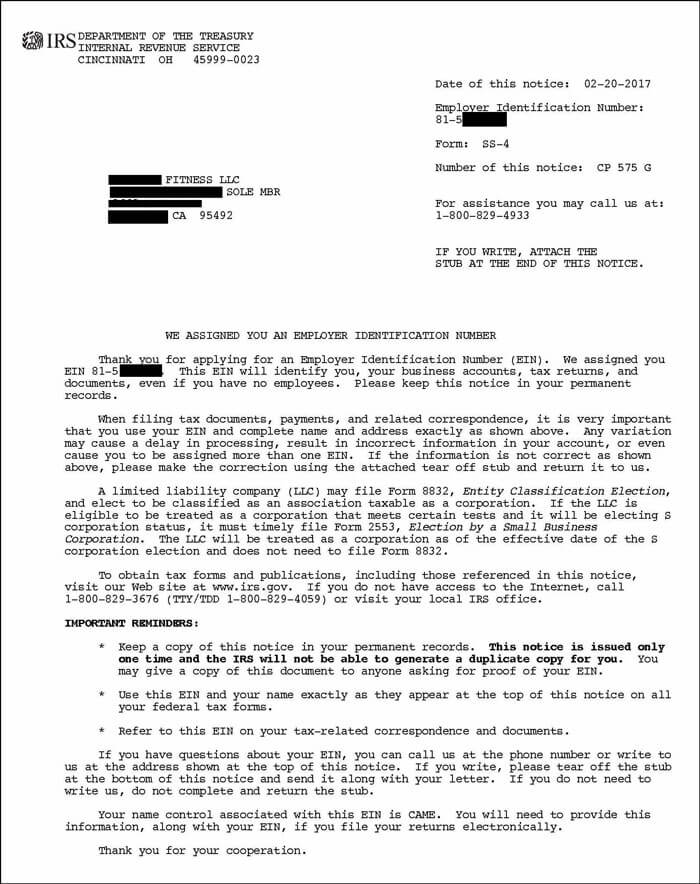

The IRS requires a unique entity name before it will issue an EIN similar to how the secretary of state requires a unique entity name within that state before Articles or Certificates of Formation may be successfully filed. It really doesnt say much about your application at all. What is an EIN and IRS Taxpayer ID Numbers.

A company from another state has the same name. Reference number 101 means the IRS has found a business entity name that is too similar to the name of your LLC. One of the reasons that this could happen is that your companys name closely resembles another entity name.

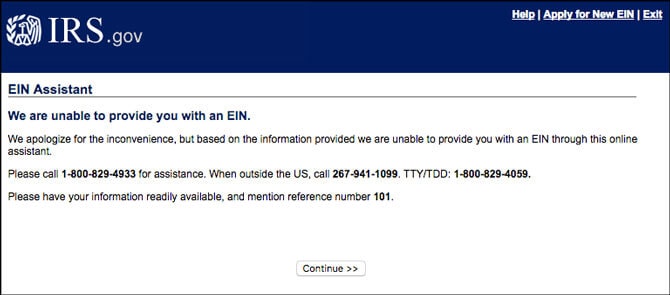

The IRS requires a unique entity name on online EIN applications similar to the requirements for incorporating your business within a state. We apologize for the inconvenience but based on the information provided we are unable to. We recommend reading the following articles before applying for an EIN.

IRS EIN Reference Number 101 is the most common error message that people experience while applying for an EIN online. Reference number 101 means the IRS has found a business entity name that is too similar to the name of your LLC. Before resolving issues for reference numbers in paragraphs 9 and 10 below you must use the table below to.

The process will take longer than the typical online process but with a little patience we can assist you in filing and receiving your EIN number. A Reference 101 error is a general error and typically has to do with a naming conflict. How to apply for EIN for your LLC using Form SS-4.

Do not be alarmed as this does not mean your application has been denied or that you are missing any pertinent information. A rejected EIN application indicating Reference Number 101 has a name conflict. Copies can be requested online search Forms and Publications or by calling 1-800-TAX-FORM.

This is usually the result of an incomplete EIN application or the IRS has found another registered entity name that is too similar to yours. Your business name closely resembles another. This could be resolved when the IRS could manually review the issue.

Also called an error code 101 in your employer identification number application to the Internal Revenue Service the reference 101 code simply means that there is some conflict with your application. Youll see a message that states We are unable to provide you with an EIN. Since the IRS handles transactions from across the nation you could experience an issue if your name is too similar to another.

Reference 101 Error This error code is a general one when applying for EIN number with IRS. Youll see a message that states We are unable to provide you with an EIN. This issue arises because IRS must have found a business with a similar name that of yours.

Click to see full answer. A few important notes. For some reason the agency cannot distinguish your companys identity.

Click to see full answer. Specifically a 101 error code means there is a name conflict of some kind with your application. Last updated March 5 2021.

The IRS reference number 101 fault triggers when there is a naming conflict with your business. Youll see a message that states We are unable to provide you with an EIN. We will see a message that states We are unable to provide you with an EIN.

Important We cannot process your application online if the responsible party is an entity with an EIN previously obtained through the Internet. An EIN 101 Error refers to a name conflict with your EIN Employer Identification Number. IRS EIN Reference Number 101 is the most common error message that people experience while applying for an EIN online.

How To Resolve The 101 Error From The Irs Ein Application Tool

How To Resolve The 101 Error From The Irs Ein Application Tool

5 Reasons Why You Might Get Denied An Ein Mind My Business

5 Reasons Why You Might Get Denied An Ein Mind My Business

Ein Reference Number 101 109 110 115 What Do They Mean Llc University

Ein Reference Number 101 109 110 115 What Do They Mean Llc University

/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg) Differences Among A Tax Id Employer Id And Itin

Differences Among A Tax Id Employer Id And Itin

Ein Reference Number Errors And What They Mean Itincaa

Ein Reference Number Errors And What They Mean Itincaa

Applying For Ein Reference Number 101 What Does Irs Reference Number 101 Mean

Applying For Ein Reference Number 101 What Does Irs Reference Number 101 Mean

How To Resolve The 101 Error From The Irs Ein Application Tool

How To Resolve The 101 Error From The Irs Ein Application Tool

How To Resolve The 101 Error From The Irs Ein Application Tool

How To Resolve The 101 Error From The Irs Ein Application Tool

Get An Irs Ein Number The Definitive Step By Step Guide

Get An Irs Ein Number The Definitive Step By Step Guide

How To Apply For An Ein For Your Llc Online Step By Step Llc University

How To Apply For An Ein For Your Llc Online Step By Step Llc University

Federal Tax Identification Number How To Get An Ein Online

Federal Tax Identification Number How To Get An Ein Online

What Does Error 101 Mean Online Filing Simplify Tax Id Filing

What Does Error 101 Mean Online Filing Simplify Tax Id Filing

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment