Featured

- Get link

- X

- Other Apps

Income Requirements For Obamacare 2020

When determining whether a person is eligible for Medicaid or public insurance Obamacare has recommended that all of the states expand their requirements to determine eligibility in the Medicaid program to include all people that make 133 or under the federal poverty line due to the way that the program actually calculates income this rate is actually 138 of the FPL. If you are a single person making more than 400 of that amount 51040 you will likely not qualify for subsidies.

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

To be eligible to enroll in health coverage through the Marketplace you.

Income requirements for obamacare 2020. 23 In March 2021 the federal government enacted the American Rescue Plan Act which expanded the eligibility requirements for subsidies. In addition to the maximum income to receive the premium subsidy theres also a minimum income to get accepted by the ACA marketplace. The discount on your monthly health insurance payment is also known as a premium tax credit.

Obamacare subsidies work on a sliding scale and they make sure your monthly premiums are a fixed percentage of your annual income. You are not currently incarcerated. For example it offers protections for pre-existing conditions and benefits like cost assistance.

Learn about these deductions and how to report them. You can qualify for a premium tax credit if your individual income falls between 12880 and 51520 or 100 and 400 of the FPL. What if my income is hard.

Will I be required to. You are currently living in the United States. And although there is normally an income cap of 400 of the poverty level discussed in more detail below that does not apply in 2021 or 2022.

You may qualify for free or low-cost care for Medicaid based on income and family size if you make 138 of the poverty level or for example 17609 individual or 36156 for a family of four in 2020. They send you to Medicaid instead. Learn about eligible immigration statuses.

The calculator spits out 0 subsidies which is a glitch implying such applicants pay 0 to next to nothing for annual health care premiums. The law requires you and your dependents to have health care coverage. Use your new coverage.

With the new March2021 stimulus bill I understand that the first 10800 of UC benefits will not be taxed as income. Your income is no more than 400 of the federal poverty level. Generally speaking if you qualify for subsidies you will pay somewhere between 2 and 95 of your income toward your health insurance premiums no more.

For income-based subsidy eligibility a household must have an income of at least 100 of the federal poverty level 139 percent of the federal poverty level in states that have expanded Medicaid. Must live in the United States. Count yourself your spouse if youre married plus everyone youll claim as a tax dependent including those who dont need coverage.

If so subtracting 5000 from my MAGI would now put me below the 138 FPL required for subsidies in PA. If your estimated income is too low the ACA marketplace wont accept you. In general you may be eligible for tax credits to lower your premium if you are single and your annual 2020 income is between 12490 to 49960 or if your household income is between 21330 to.

Income under 25100 to be exact for a family of four two adults two children 20780 for a family of three and 12140 for an individual are considered poverty levels in the United States. Including the right people in your household. To qualify for a subsidy your household income must be between 100 and 400 of the FPL.

Anyone with Modified Adjusted Gross Income under 400 of the Federal Poverty Level may qualify for Tax Credits under ObamaCare or other assistance. If you meet these criteria youll be eligible for a subsidy on a sliding scale based on your income. According to the Federal Register the 2020 poverty level for an individual is 12760.

Make sure to check out the 2021 information below if you are buying a plan for 2021 in 2020. To qualify for Obamacare subsidies you must meet the following criteria. The Marketplace allows you to reduce your income with certain deductions.

The Affordable Care Act includes requirements. Learn more about who to include in your household. Specifics may differ by state.

Must be a US. This tool provides a quick view of income levels that qualify for savings. Learn more about Modified Adjusted Gross Income.

Learn more about the Federal Poverty Level. Citizen or national or be lawfully present. In 2021 Obamacare subsidies begin if your health plan cost is greater than 85 of your household income towards the cost of the benchmark plan or a less expensive plan the benchmark plan is the second-lowest silver plan.

But you must also not have access to Medicaid or qualified employer-based health coverage. Can I take any deductions to my income. You are a US citizen or legal resident.

Learn about filing requirements for dependents from the IRS. ObamaCare in 2020 and Getting Ready for 2021 For the most part ObamaCare still offers the same benefits rights and protections it always has. In states that expanded Medicaid the minimum income is 138 FPL.

My 2020 income including approximately 5000 in UC benefits was 139 of FPL. I did have an ACA plan in PA for 2020. That is projected income for the upcoming year after tax deductions.

Learn more about Cost Assistance. Even if they file a tax return when they dont have to like to get a tax refund their income wont be counted. If you purchased coverage from the Health Insurance Marketplace you may be eligible for the premium tax credit.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

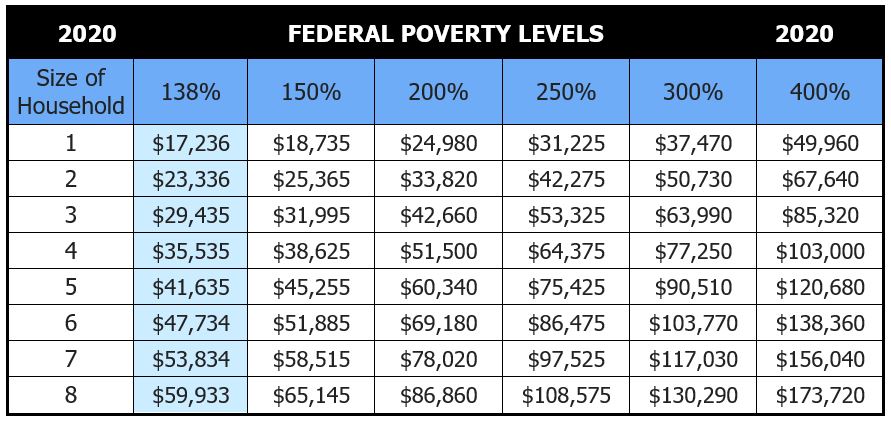

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

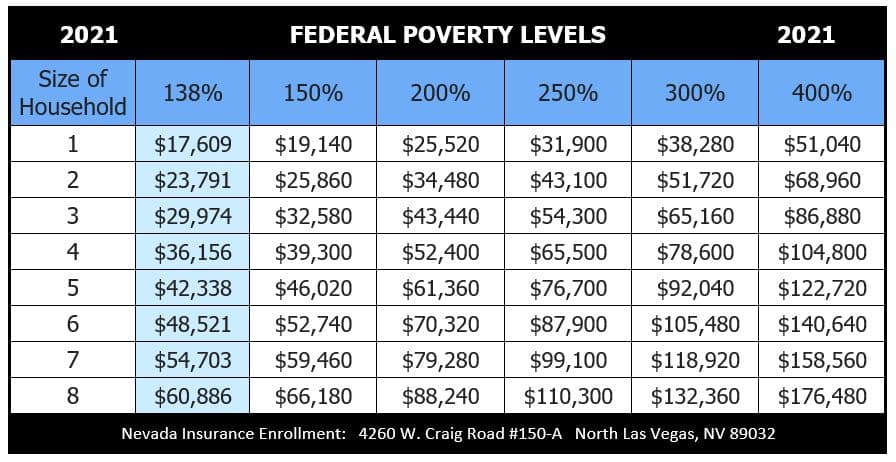

2021 Health Insurance Federal Poverty Level Chart

2021 Health Insurance Federal Poverty Level Chart

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

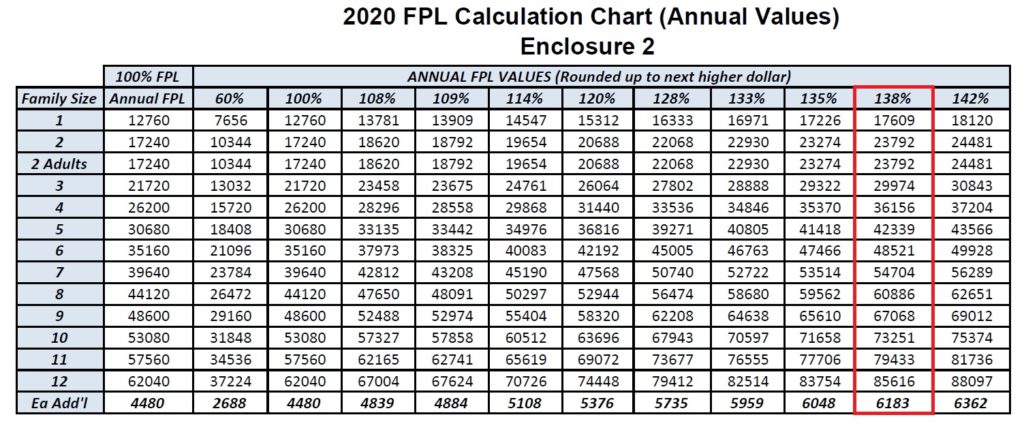

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

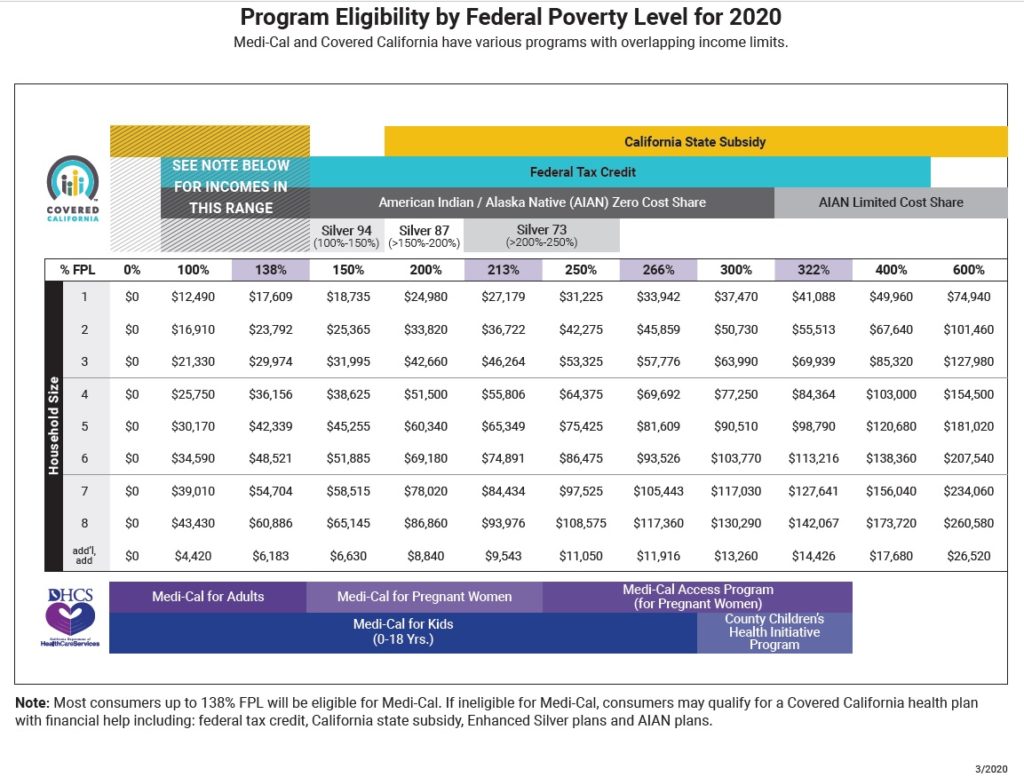

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Health Insurance In Las Vegas Nv Health Insurance Agent

Health Insurance In Las Vegas Nv Health Insurance Agent

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

2015 Aca Obamacare Income Qualification Chart My Money Blog

2015 Aca Obamacare Income Qualification Chart My Money Blog

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment