Featured

Explain Out Of Pocket Maximum

The widely used phrase applies to the costs required to maintain a fixed asset costs incurred by an. At this point any additional covered medical costs you incur throughout the rest of the year will be covered by your insurance 100.

Out Of Pocket Maximum Vs Deductible Xcelhr

Out Of Pocket Maximum Vs Deductible Xcelhr

This fixed-dollar amount is called an out-of-pocket maximumSometimes its called a MOOP for maximum out-of-pocket.

Explain out of pocket maximum. If you meet that limit your health plan will pay 100 of all covered health care costs for the rest of the plan year. There is an explanation for this change. That will change as of January 1 2021.

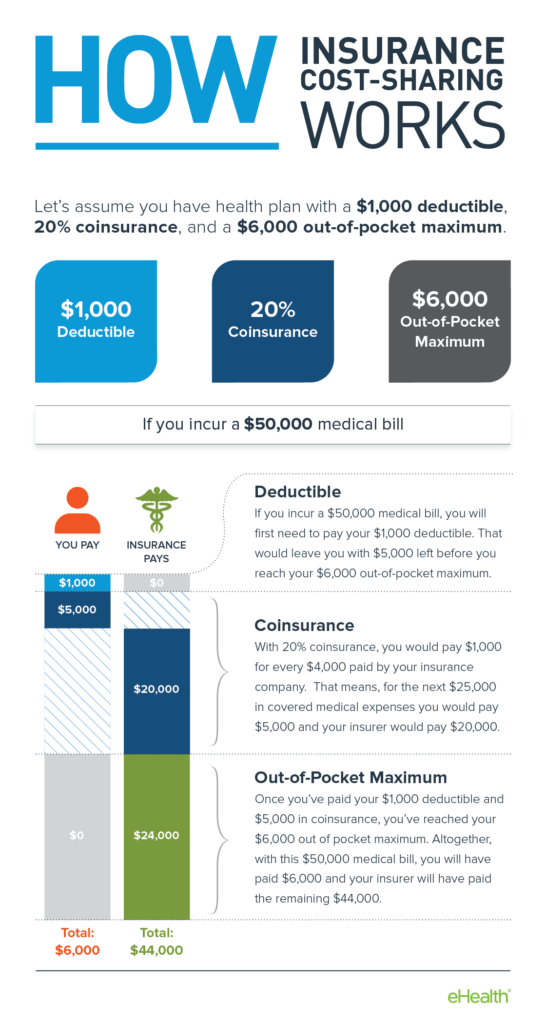

Some health insurance plans call this an out-of-pocket limit. You pay the 1000 deductible to the hospital before your insurance company will pay for any of the covered services you need. Beginning in 2011 Medicare set the maximum out-of-pocket limit for in-network services at 6700 and 10000 for in- and out-of-network combined.

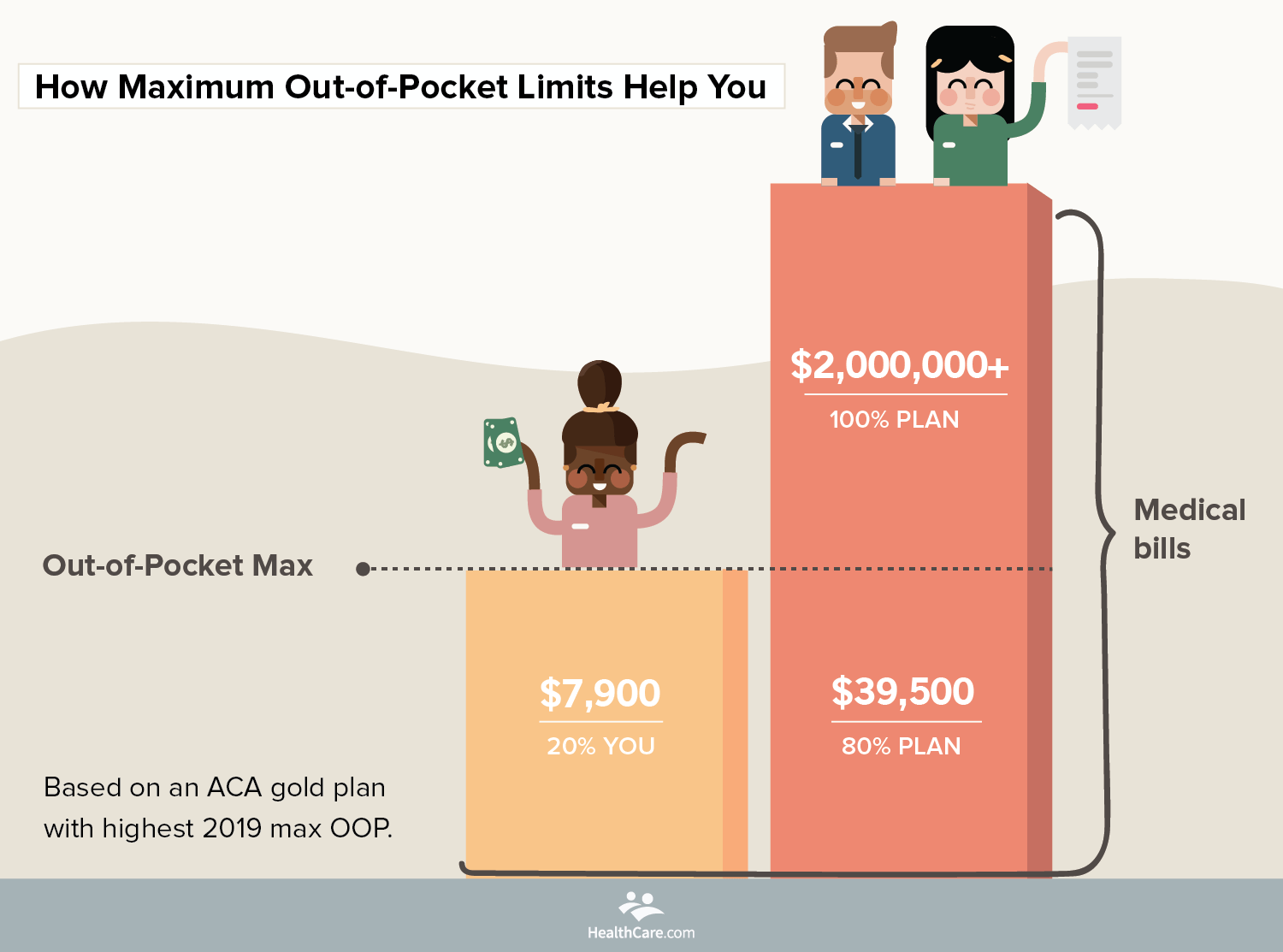

Out-of-pocket expenses refers to costs that individuals pay out of their own cash reserves. The most you have to pay for covered services in a plan year. For example an individual plan may have an out-of-pocket maximum of 5000 for that one person while a plan with two people may have a 5000 out-of-pocket maximum.

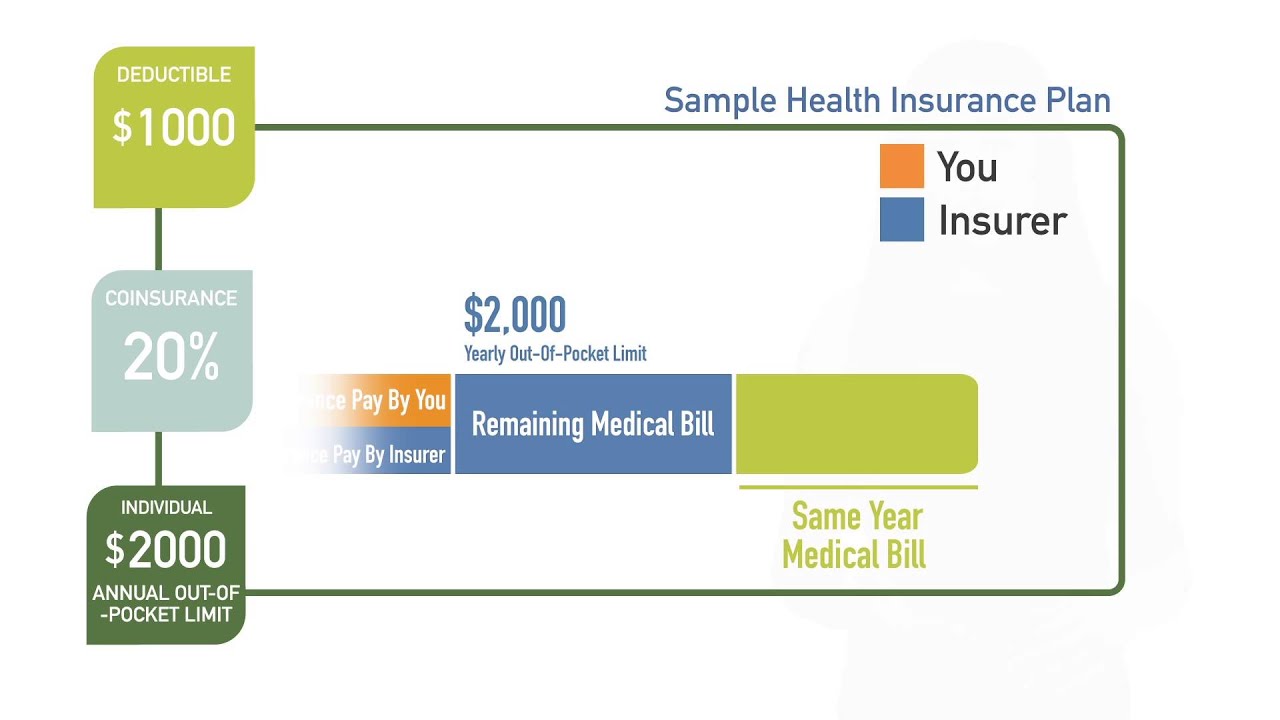

The maximum limits will increase to 7550 for in-network and 11300 for in- and out-of-network combined. An out-of-pocket maximum is the most money that an insurance customer has to pay per year out of their own pocket. If your policy has a plan year limit of 2000 per individual and 5000 per family for example the most you would pay out of your own pocket during the year is 2000 for one covered persons claims or 5000 for your family.

6850 for an individual plan. In most plans there is no copayment for covered medical services after you have met your out of pocket maximum. An out-of-pocket maximum is a cap or limit on the amount of money you have to pay for covered health care services in a plan year.

Its called an out-of-pocket max or maximum. Your insurance policy has a 1000 deductible and an out-of-pocket maximum of 4500. Once your out-of-pocket limit is met your health insurance plan will cover 100 of all your eligible medical expenses.

Therefore you will only owe 2150 in coinsurance because that will get you to your out-of-pocket maximum amount of 7150. All health insurance plans sold in the United States are required to set a maximum limit on the amount of money you have to spend on your own or out-of-pocket in a given year. Your out-of-pocket maximum is the absolute most you will have to pay towards your medical costs for the duration of your health insurance policy.

In 2016 your out-of-pocket maximum can be no more than. The out-of-pocket limit doesnt include. An out-of-pocket maximum is intended to serve as a protection for you as the insured against devastating medical costs.

All plans are different though so make sure to pay attention to plan details when buying a plan. However your out-of-pocket maximum is 7150. Its the most youll have to pay during a policy period usually a year for health care services.

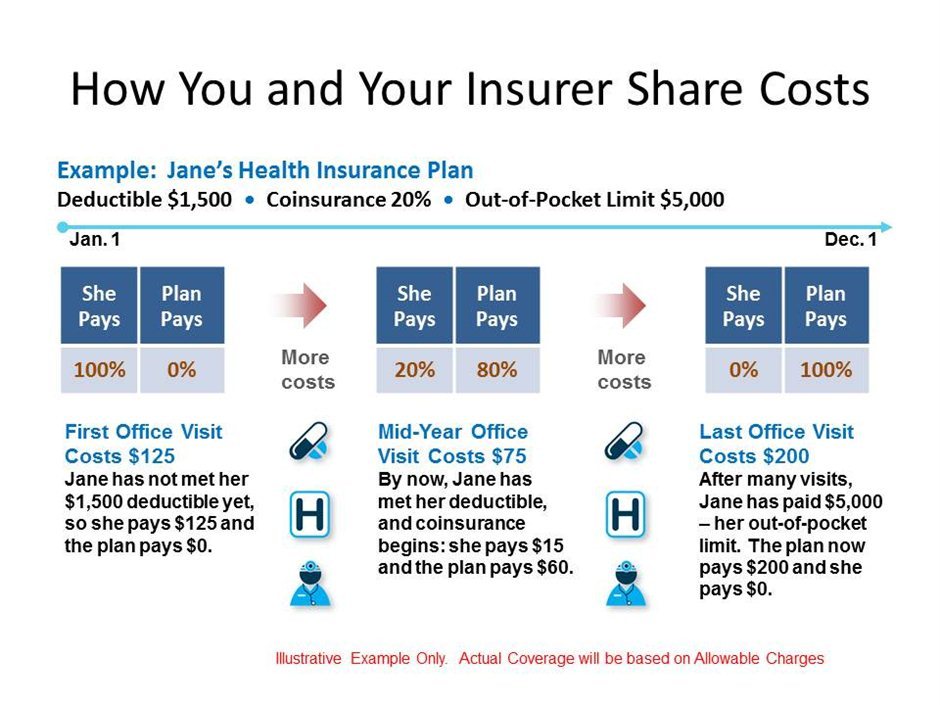

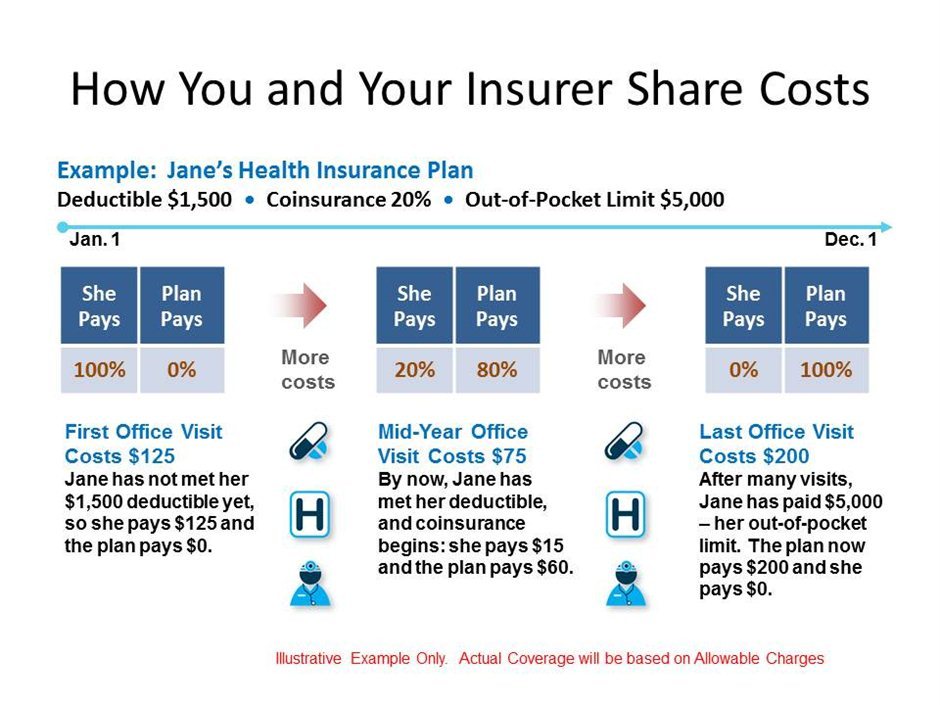

Your out-of-pocket maximum may read differently depending on what type of health insurance plan you have. There are different out-of-pocket maximums for individuals and family plans that have two or more members. You share the cost of your care with your health insurance company when you pay your deductible coinsurance and copays.

After you spend this amount on deductibles copayments and coinsurance for in-network care and services your health plan pays 100 of the costs of covered benefits. An out-of-pocket maximum is a predetermined limited amount of money that an individual must pay before an insurance company or self-insured employer will pay 100 of an individuals covered health care expenses for the remainder of the year. But did you know theres a limit to how much you pay.

An out of pocket maximum is the set amount of money you will have to pay in a year on covered medical costs.

How Does An Out Of Pocket Limit Work On A Health Insurance Policy Youtube

How Does An Out Of Pocket Limit Work On A Health Insurance Policy Youtube

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Oop Out Of Pocket Maximum Deductible Co Pay Participating Providers

Oop Out Of Pocket Maximum Deductible Co Pay Participating Providers

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Out Of Pocket Costs What You Need To Know

Out Of Pocket Costs What You Need To Know

What You Need To Know About Your Out Of Pocket Maximum

What You Need To Know About Your Out Of Pocket Maximum

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Out Of Pocket Costs For Health Insurance

Out Of Pocket Costs For Health Insurance

Deductibles Co Pay And Out Of Pocket Maximums

Deductibles Co Pay And Out Of Pocket Maximums

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

What Are Deductibles And Out Of Pocket Maximums Youtube

What Are Deductibles And Out Of Pocket Maximums Youtube

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment