Featured

What Does 70 50 Mean In Health Insurance

Many health plans have limits well below these federally mandated ones. To see all available data on Qualified Health Plan options in your state go to the Health Insurance Marketplace website at HealthCaregov.

Https Marketplace Cms Gov Technical Assistance Resources Summary Of Benefits Fast Facts Pdf

Sometimes employee contributions may be made for additional coverage.

What does 70 50 mean in health insurance. How much you pay for coinsurance depends on your health insurance policy. For example if your health plan advertises 70 coinsurance then your share of coinsurance is 30. You usually need to pay some portion of your medical costs.

This keeps the monthly premium costs of insurance lower and stops people from overusing medical care. If your plans deductible is 1500 youll pay 100 percent of eligible health care expenses until the bills total 1500. The portion of the 110 allowed amount that you have to pay will depend on the terms of your health plan.

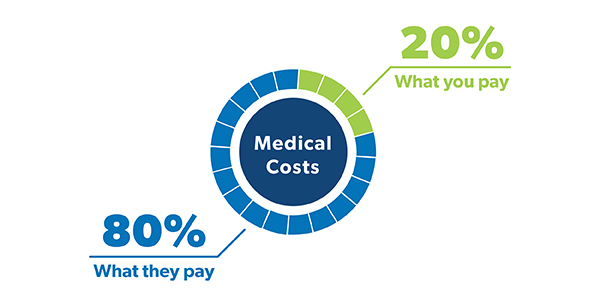

There are also varying degrees of coinsurance levels. 8020 coinsurance 20 coinsurance - You pay 20 of the claim. If you have 20 coinsurance you have to pay 20 of the cost of medical care and your insurance will cover the other 80.

5050 means that you and the other party are equally responsible for the accident and therefore each side will receive 50 of their losses from the other though obviously it is the insurance companies that pay Comprehensive insurance simply means your vehicles damage gets repaired total lossed irrespective of blame. But if you have a high-deductible health plan that counts everything towards the deductible and you havent yet met the deductible. The 7050 PPO plan has a 500 individual calendar year deductible and a 1000 family deductibleThe 7050 PPO plan is only.

Is licensed as an insurance agency in all 50 states and DC. If you pay for a percentage of a covered medical bill then your payment is called coinsurance. Coinsurance can also mean the payment or the percentage of a bill thats paid by your plan.

While individual health insurance plans typically have 8020 or 7030 coinsurance some short-term medical insurance plans have 5050 coinsurance putting more responsibility for medical costs on the consumer. As of 2019 the out-of-pocket maximum is 7900 for individuals and 15800 for family health plans. A deductible is the amount you pay for health care services before your health insurance begins to pay.

So if your medical bill is 1500 and you have a 500 deductible the portion of the bill to which coinsurance will apply is 1000. An 8020 insurance policy is a form of coinsurance in which you satisfy your deductible first and then you pay 20 percent of additional medical costs and your insurer pays the 80. Above are two examples that you can consider to help understand 8020 7030 6040 or 5050 First number is the insurance company portion and the second number is your portion 80 paid by insurance company and 20 paid by the insured until the Out of.

Common divisions are 7030 or 8020 wherein your insurance company would pay either 70 or 80 and you would pay the remaining 20 or 30 respectively out of pocket after the deductible is met. 6040 coinsurance 40 coinsurance - You pay 40 of the claim. Not all agents are licensed to sell all products.

Most health insurance plans do not provide a blank check for medical services. HealthMarkets Insurance Agency Inc. A PPO is a Preferred Provider Organization which pays a higher benefit percentage for services from an in-network provider and a somewhat lesser benefit percentage for services from an out-of-network provider.

Medical Insurance 7050 PPO. You will usually see your coinsurance represented as a number like 20. Some places also list this as 8020 with the amount your insurer pays listed.

Medical Insurance 9070 PPO Employee Benefits A PPO is a Preferred Provider Organization which pays a higher benefit percentage for services from an in-network provider and a somewhat lesser benefit percentage for services from an out-of-network provider. 5050 coinsurance 50 coinsurance - You pay 50 of the claim. 9010 coinsurance 10 coinsurance - You pay 10 of the claim.

After that you share the cost with your plan by paying coinsurance. If you submit a 100 bill to that health plan your plan would pay 70 and youd pay 30. Service and product availability varies by state.

If you have a 30 copay for office visits for example youll pay 30 and your insurance plan will pay 80. One way insurance companies divide costs is through co-insurance plans such as an 8020 medical plan. Your coinsurance responsibility is usually a percentage of the total cost for each instance of care.

Although a common core of benefits may be required the employee can determine how his or her remaining benefit dollars are to be allocated for each type of benefit from the total amount promised by the employer. For example your insurance may be set at 8020 which means that the insurance company pays 80 of the total bill and you pay the remaining 20. Health insurance vacations retirement plans and child care.

This means the health insurance company cant force you to spend more than 7900 if youre an individual or 15800 if youre part of a family plan. Coinsurance may be as much as 50 for some insurance plans. 7030 coinsurance 30 coinsurance - You pay 30 of the claim.

Life Insurance Over 70 How To Find The Right Coverage

Life Insurance Over 70 How To Find The Right Coverage

Health Insurance Basics How To Understand Coverage

Health Insurance Basics How To Understand Coverage

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

Explaining Health Care Reform Questions About Health Insurance Subsidies Kff

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

How Much Does Health Insurance Cost Ramseysolutions Com

How Much Does Health Insurance Cost Ramseysolutions Com

The Aca S Cost Sharing Subsidies Healthinsurance Org

The Aca S Cost Sharing Subsidies Healthinsurance Org

Small Business Group Plans California

Small Business Group Plans California

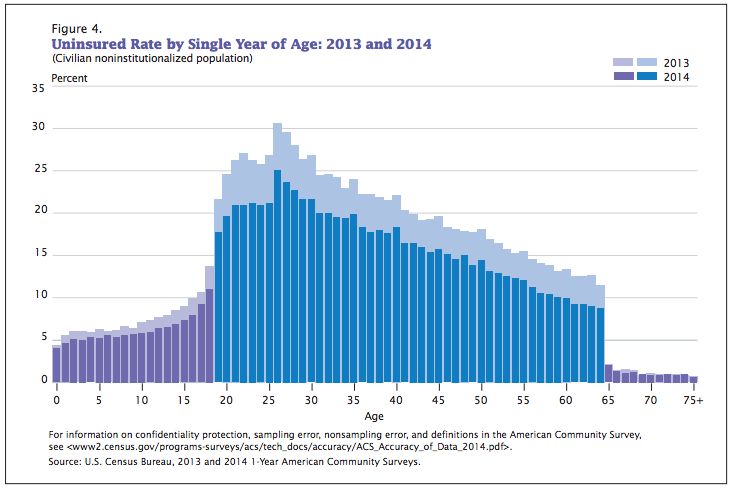

8 8 Million More Americans Have Health Insurance In 2014 But Can They Afford To Use It Pnhp

8 8 Million More Americans Have Health Insurance In 2014 But Can They Afford To Use It Pnhp

How Age Affects Health Insurance Costs Valuepenguin

Medical Insurance 90 70 Ppo Kent State University

Medical Insurance 90 70 Ppo Kent State University

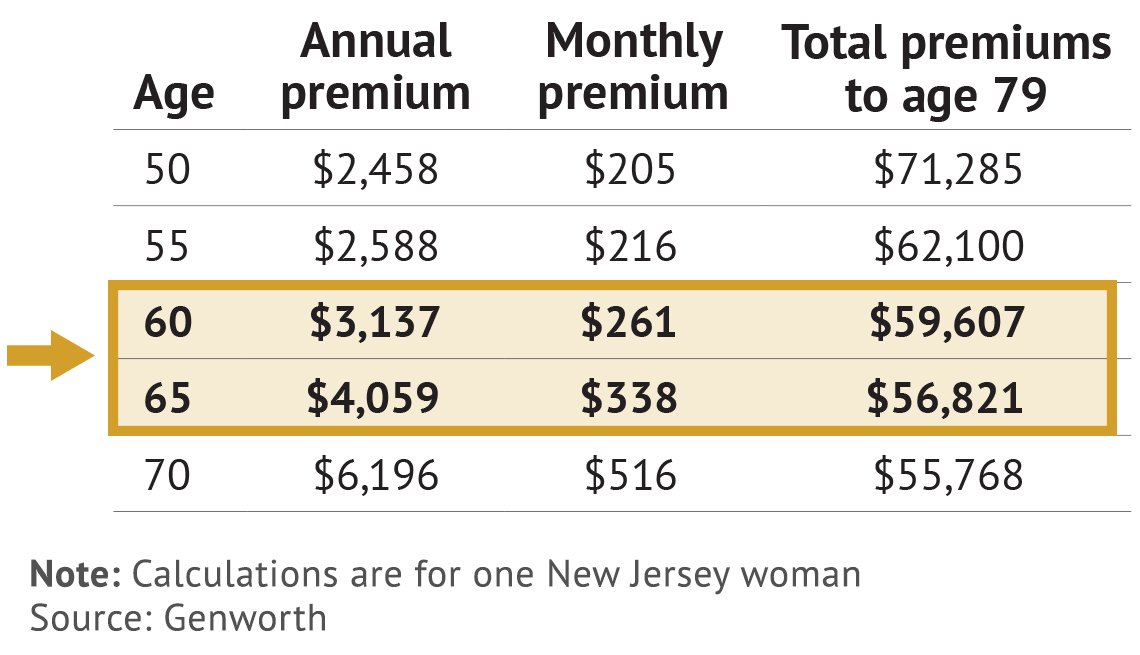

When To Buy Long Term Care Insurance For The Best Value

When To Buy Long Term Care Insurance For The Best Value

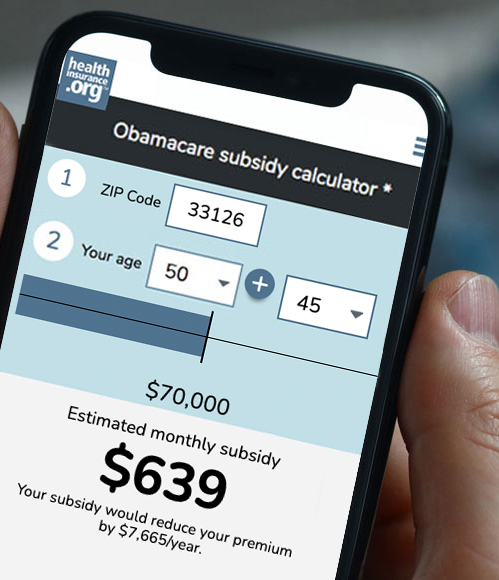

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

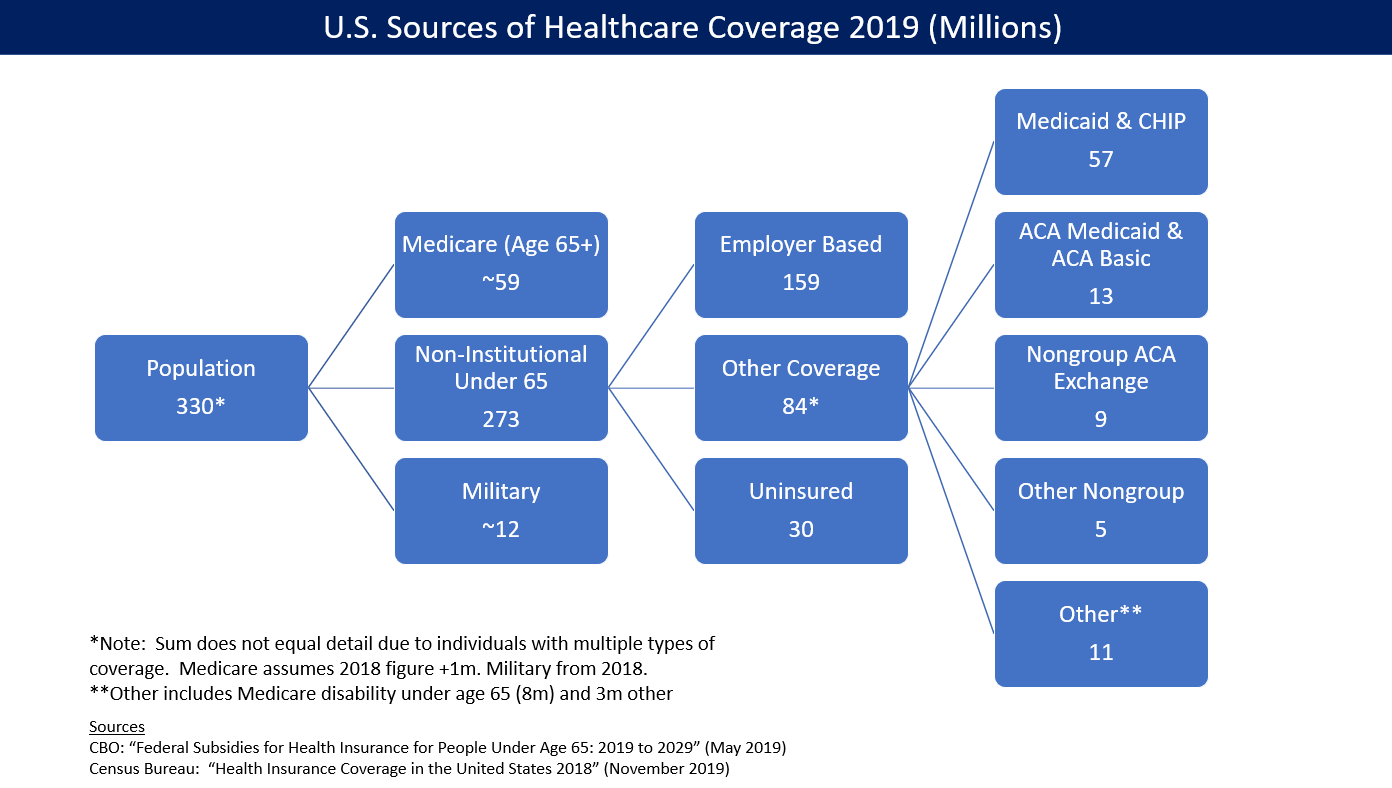

Health Insurance Coverage In The United States Wikipedia

Health Insurance Coverage In The United States Wikipedia

Health Insurance Basics How To Understand Coverage

Health Insurance Basics How To Understand Coverage

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment