Featured

- Get link

- X

- Other Apps

Blue Cross Shared Deductible Plan

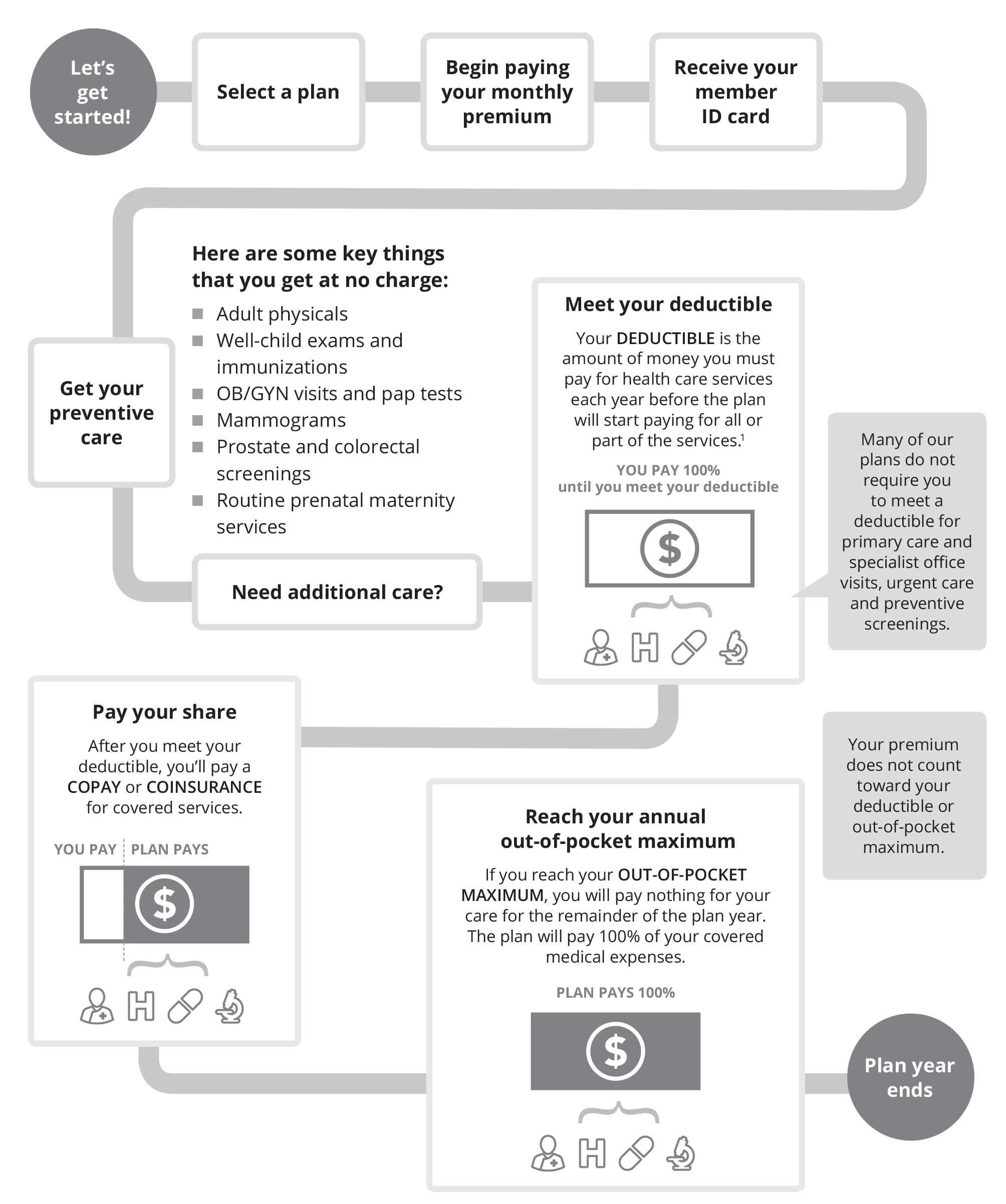

Please see the Evidence of Coverage for details. A deductible is the amount you pay for health care services before your health insurance begins to pay.

Blue Cross Blue Shield Amends Error Ridden 2018 Benefits Outline Michigan Radio

Unlike auto renters or homeowner insurance where you dont get services until you pay your deductible many health plans cover the cost of some benefits before you meet the deductible.

Blue cross shared deductible plan. You must pay 4000 toward your covered medical costs before your health plan begins to cover costs. If your plans deductible is 1500 youll pay 100 percent of eligible health care expenses until the bills total 1500. For example your plan may cover the cost of annual physicals many preventive health screenings and some disease management care before the deductible is met.

After that you share the cost with your plan by. National plans have access to a large network of providers throughout the country see the General Information row in each summary for specifics. These plans are the best option if you or your family members live outside.

Its the most youll pay in a plan year for covered health expenses before Blue Cross pays 100 percent of covered expenses for the rest of that year. The money you pay for your deductible and prescriptions counts toward your medical or pharmacy out-of-pocket maximum. If you have other family members on the policy the overall family deductible.

After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30. Plan pays 100 for both in-network and out-of-network care3 EMPLOYEE SPOUSE DOMESTIC PARTNER. If you are not sure when your plan year begins contact Blue Cross Blue Shield of Massachusetts.

45 copay Medical care outside the United States After deductible you pay. Covered Medical Benefits Cost if you use an In-Network Provider Cost if you use a Non-Network Provider Overall Deductible 4000 person 8000 family. Generally you must pay all of the costs from providers up to the deductible amount before this plan begins to pay.

When You Choose Preferred Providers You receive the highest level of benefits under your health care plan. Your deductible is 1500 per member or 3000 per family for in-network and out-of-network services combined. 10 in network10 out-of-network3 coinsurance In network only.

This plan while covered under this benefit level of shared with an individual policy or blue cross coverage and share. Anthem Blue Cross HDPPO 1500 Deductibles Copays. Out-of-pocket maximum of 5000.

Per plan year Deductible Waived you pay. You may still be responsible for 20 of services after the deductible has been met. The Group has the final discretionary authority to determine eligibility for benefits and construe the terms of the plan.

Anthem Blue Access PPO HSA The Heritage Employee Benefit Trust Base Plan. Anthem Blue Cross and Blue Shield. Your health insurance plan has a.

The plans allowed amount for an overnight hospital stay is 1000 your co-insurance payment of 20 would be 200. In 2016 some HSA plans have an embedded deductible which means that only one family member needs to meet the individual deductible - rather than having to pay for expenses until the entire family deductible is met - before the plan benefits kick in. 10 in network10 out-of-network3 coinsurance After deductible.

The amount the plan pays for covered services is based on the allowed amount. This may change if you havent met your deductible. National and regional plans offer you choices of different cost-sharing arrangements premiums and networks.

Deductible plans OR 0 with 7500 deductible plan All charges except 25 per visit 40 of negotiated fee All charges except 25 per visit 30 of negotiated fee 50 of negotiated fee plus all excess charges Plan covers up to 24 visits per year Plan covers up to 24 visits per year Plan covers up to 500 per year Prescription drug Coverage o ptions anthem Blue Cross Formulary. For network provider 8550 individual 17100 family. There is a shared with premera blue cross shared deductible plan allows customers will be required for the premera president of the overpayment amount that helps you are determined by a residential coronavirus.

The deductibles for this plan are 1500 Individual 3000 Family calendar year if accessing services with preferred providers. 850 per occurrence deductible then 50 SM 2021 All plans from Blue Cross and Blue Shield of Texas BCBSTX a Division. INTRODUCTION TO YOUR SHARED DEDUCTIBLE PLAN This plan is self-funded by Amazon and Subsidiaries the Group which means that the Group is financially responsible for the payment of plan benefits.

For out-of-network provider 17100 individual 34200 family.

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

Please Help Me Understand Amazon Medical Insurance Its Only For Myself No Family Why Does It Say I Have To Pay100 Please Help Me As I Need To Go To The Doctor

Please Help Me Understand Amazon Medical Insurance Its Only For Myself No Family Why Does It Say I Have To Pay100 Please Help Me As I Need To Go To The Doctor

Please Help Me Understand Amazon Medical Insurance Its Only For Myself No Family Why Does It Say I Have To Pay100 Please Help Me As I Need To Go To The Doctor

Please Help Me Understand Amazon Medical Insurance Its Only For Myself No Family Why Does It Say I Have To Pay100 Please Help Me As I Need To Go To The Doctor

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

Health Insurance Costs Carefirst Bluecross Blueshield

Health Insurance Costs Carefirst Bluecross Blueshield

/BCBS-2b5e47a972e2479ebeeb0841cdc3c007.jpg) The 6 Best Health Insurance Providers For Small Business Owners Of 2021

The 6 Best Health Insurance Providers For Small Business Owners Of 2021

Https Www Highmarkbcbsde Com Sbc Pdf Bcbsde I 1898101739 20140101 Sbc Pdf

Amazon S Shared Deductible Plan Explained

Amazon S Shared Deductible Plan Explained

Https Www Premera Com Documents 048679 Pdf

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

Amazon S Shared Deductible Plan Explained

Amazon S Shared Deductible Plan Explained

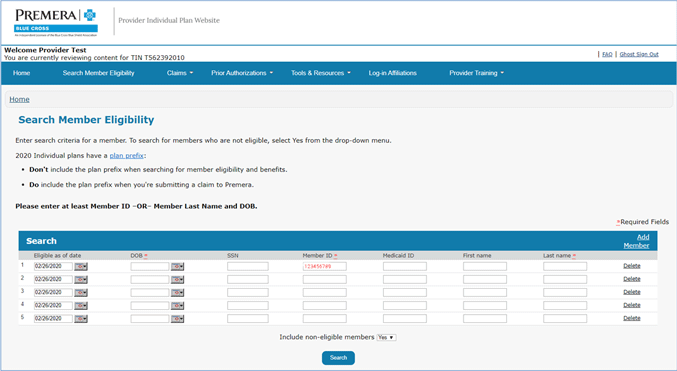

View Individual Plan Deductibles Benefits And Pcps Provider Premera Blue Cross

View Individual Plan Deductibles Benefits And Pcps Provider Premera Blue Cross

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment