Featured

Premium Only Plan

Premium only plan refers to the section 125 of the IRS Code a type of cafeteria plan that allows employees to change taxable cash benefits such as salaries into non-taxable benefits. Sie sind auf der linken Seite unten aufgeführt.

Tax Free Premiums Section 125 Premium Only Plan

Tax Free Premiums Section 125 Premium Only Plan

Bitte scrollen Sie nach unten und klicken Sie um jeden von ihnen zu sehen.

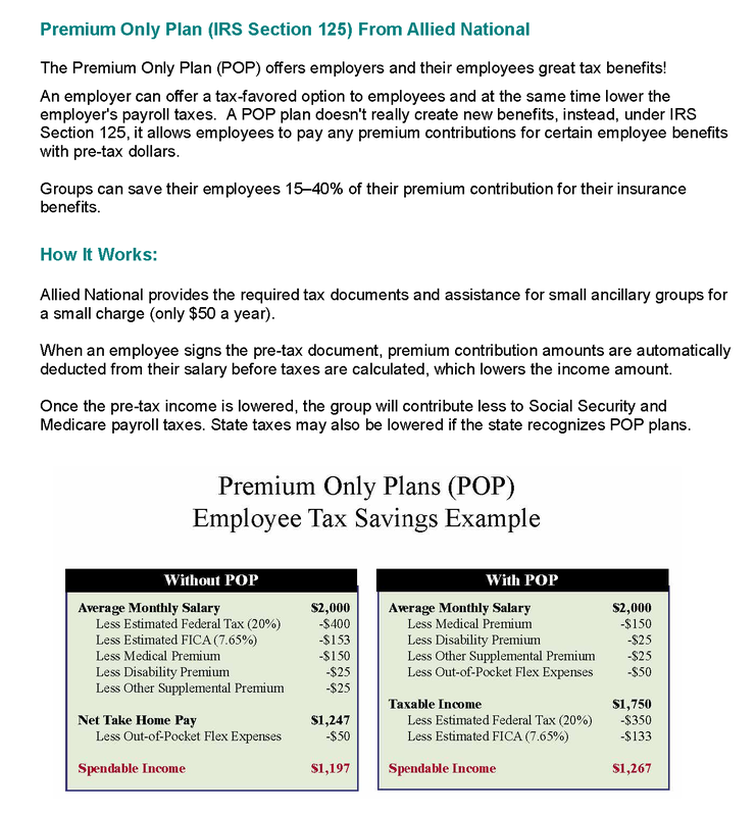

Premium only plan. Health Savings Account HSA contributions. Benefits of a Premium Only Plan Employees are able to pay health care premiums pre-tax saving State Federal and FICA taxes. The premium only plan POP is an initiative that was put into place by the US.

Employees who are enrolled in another group health plan like a plan from a spouse or parent can choose to receive a fixed amount of cash instead. Reduce your payroll tax costs Social Security Medicare and other payroll tax expenses. Premium Only Plans benefit both you and your employees Tax benefits for your business.

Premium Only Plans POP The Premium Only Plan is a fringe benefit plan which is authorized under the IRS. Offsets the rising cost of benefit premiums with your payroll tax savings. Group health insurance plans.

Mozartstr15 90530 Wendelstein 49 912 2939644. Für alle Bedeutungen von POP klicken Sie bitte auf Mehr. This can save employees up to 40 on income taxes and payroll taxes.

Coverage may include the following. To get the most out of your group-sponsored benefit plan employees should have the option to make premium payments on a pre-tax basis. Not only do these plans provide a benefit to employees in the form of a reduced income tax liability but they also provide a savings to both employees and employers in the form of a reduced payroll tax liability as the premiums paid into these plans.

Bitte scrollen Sie nach unten und klicken Sie um jeden von ihnen zu sehen. Congress and added to IRS Code Section 125. Wenn Sie unsere englische Version besuchen und Definitionen von Nur Premium-Plan in anderen Sprachen sehen möchten klicken Sie.

Neben Nur Premium-Plan hat POPULAR andere Bedeutungen. POP plans allow employees to elect to withhold a portion of their pre-tax salary to pay for their premium contribution for most employer-sponsored health insurance plans. The plan offers a simple way to obtain favorable tax treatment for benefits already offered.

It is intended to make premium payments for group benefits more affordable for employees. IRS code Section 125 allows an employer to set up a Premium Only Plan POP where an employees insurance premium contributions can be deducted from his or her payroll on a pre-tax basis. They are ideal for businesses that want to provide some kind of tax benefits for eligible employees without offering a comprehensive Flexible Spending Account Plan.

Instead of providing a pre-tax advantage for benefits sponsored. Pre-tax payment of health care premiums lowers taxable income saving employers payroll taxes. Pre-tax health insurance premium deductions also known as a Premium Only Plan POP.

A premium only plan POP is the most basic and most popular type of Section 125 Cafeteria Plan that allows employer-sponsored premium payments to be paid by the employee on a pre-tax basis instead of after-tax. Sie sind auf der linken Seite unten aufgeführt. Unlike premium payments this dollar amount is taxed.

Coverage may include the following. The employer also saves on these taxes. Overview of POP rules regulations.

Premium Only Plan POP Home Offerings FSA Premium Only Plan POP A POP is a Section 125 cafeteria plan that allows employer-sponsored premium payments to be paid by the employee on a pretax basis. What is a Premium Only Plan. Wenn Sie unsere englische Version besuchen und Definitionen von Nur Premium-Plan in anderen Sprachen sehen möchten.

Premium Only Plans are an excellent solution for saving pre-tax dollars on group insurance premiums for many employers. Premium only plan definition POP. Vision and dental care.

The Premium Only Plan allows employees to pay for their portion of benefit plan costs on a before tax basis. Client issues are just non-existent with isolved Benfit Services. Traditionally POP plans have been used in combination with employer-sponsored group health insurance plans.

A premium-only plan can include a cash-in-lieu of benefits provision for employees who dont want coverage under the group plan. Für alle Bedeutungen von POPULAR klicken Sie bitte auf Mehr. A Section 125 premium-only-plan POP is a cafeteria plan which allows employees to pay their health insurance premiums with tax-free dollars.

Premium Only Plans are governed by Section 125 of the Internal Revenue code which allows payments made by an employee into a cafeteria plan to be excluded from their taxable income. Neben Nur Premium-Plan hat POP andere Bedeutungen. But the IRS requires a Premium Only Plan POP to facilitate the necessary payroll deductions.

However employees can also use POP plans to pay individual health insurance premiums with tax-free. It is a tax reduction plan not an insurance plan.

3 Things To Know About Premium Only Plans Primepay

3 Things To Know About Premium Only Plans Primepay

![]() The Premium Only Plan Cutting Costs Made Easy Basic

The Premium Only Plan Cutting Costs Made Easy Basic

How To Set Up A Section 125 Premium Only Plan For Group Health Plans For 99 Brochure And Forms

How To Set Up A Section 125 Premium Only Plan For Group Health Plans For 99 Brochure And Forms

What Does Adp Charge For A Section 125 Premium Only Plan Or Pop Core Documents

What Does Adp Charge For A Section 125 Premium Only Plan Or Pop Core Documents

Https Www Rsccd Edu Departments Risk Management Benefits Documents Premium 20only 20plan Pdf

Https Www Tasconline Com Uploads Kb Flexsystem Pop Fx 3032 060214 20pop 20manual Pdf

Premium Only Plans Matrix Insurance Marketing Inc

Premium Only Plans Matrix Insurance Marketing Inc

Https Healthequity Com Doclib Bcbsnc General Pop Overview Pdf

What Is A Section 125 Pop Premium Only Plan Gusto

What Is A Section 125 Pop Premium Only Plan Gusto

My Bestflex Premium Only Plan Pop Employee Benefits Corporation Third Party Benefits Administrator

My Bestflex Premium Only Plan Pop Employee Benefits Corporation Third Party Benefits Administrator

Section 125 Premium Only Plan Tax Savings For

Section 125 Premium Only Plan Tax Savings For

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment