Featured

- Get link

- X

- Other Apps

Covered California Tax Credit Calculator

If you make over that amount but less than 400 of the federal poverty level based on your household income and number of dependents then you may be eligible for an up-front subsidy also referred to as a tax credit 1. This means she has to pay back all of the tax credit she.

The tax credit itself is going up across the board.

Covered california tax credit calculator. California passed a law in 2019 that extends the premium subsidy to 600 Federal Poverty Level FPL for three years starting in 2020. The maximum tax credit available is 50 percent of premium expenses as a for-profit employer. The amount of credit you are eligible to receive works on a sliding scale.

This calculator shows expected spending for families and individuals eligible to purchase coverage through Covered California under the Affordable Care Act. Tax Credit Calculator Tax credits through the IRS are available for both for-profit and tax-exempt organizations to help cover the cost of coverage for employees under Covered California for. Small businesses that purchase coverage through Covered California for Small Business may be eligible to receive a federal tax credit to help offset the cost of providing health insurance.

The calculator also indicates income-eligibility for Medicaid. Calculate how much tax credit including working tax credits and child tax credits you could get every 4 weeks during this tax year 6 April 2020 to 5 April 2021. Small businesses must purchase health insurance through CCSB to be eligible for the tax credits.

2020 Covered California tax credit expansion. When she does her 2017 taxes with TurboTax her income is calculated to be 64021 for 2017. Covered California uses the familys ESTIMATED annual income to determine a monthly subsidy or Advance Premium Tax Credit to lower the health insurance premium.

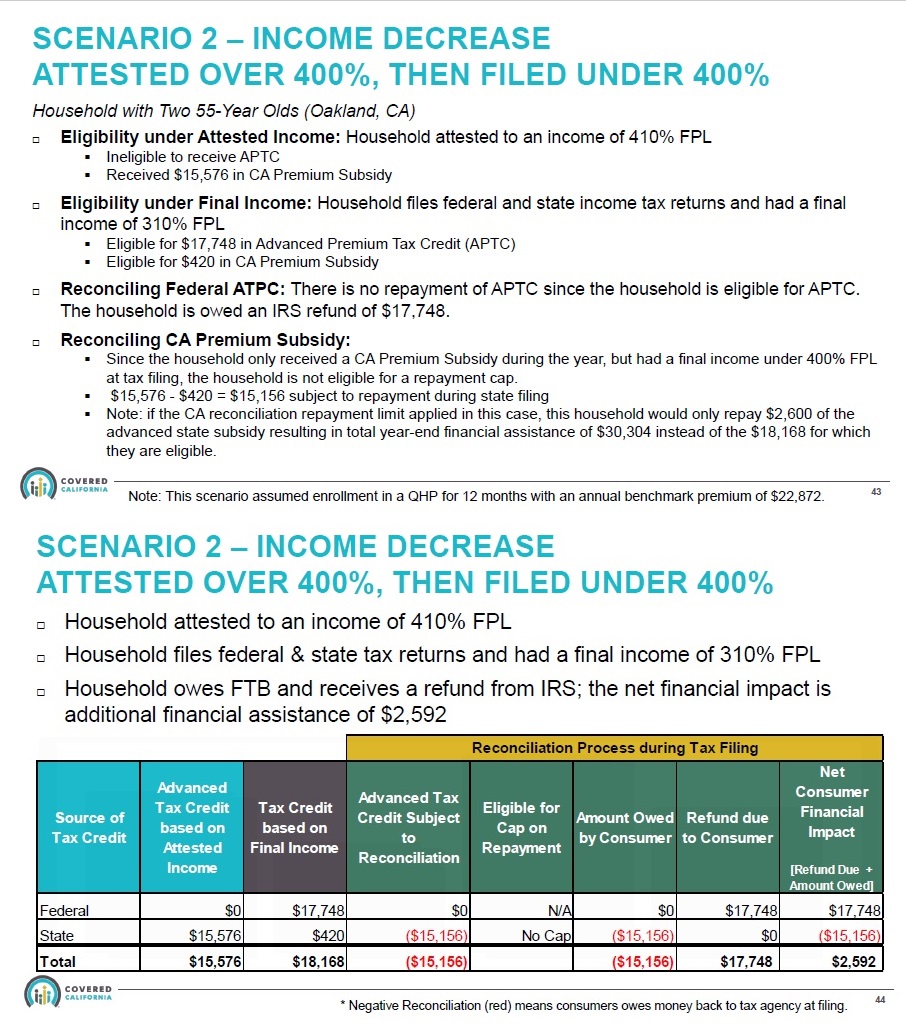

The income threshold for the cap is going up to 600 of the PFL. This credit applies to two consecutive tax years. When the taxpayer went to file their taxes the MAGI was over 400 percent possibly.

Theres a state-sponsored expansion of the tax credit in two ways. If you make less than 138 of the Federal Poverty Level in California you qualify for Medi-Cal otherwise known as Medicaid. Families can reduce their tax liability with a 1000 credit for each qualifying child they claim on their 1040 tax return.

Lets look at each of these two. The maximum credit for tax-exempt employers is 35 percent. Average tax credit of 302.

88 of Californians qualify for a tax credit. 51 of Enrollees qualify for Enhanced Silver Plans. Under the law maximum contributions to premiums will be based on modified adjusted gross income while estimates in this calculator are based on the annual income entered by the user.

This interactive calculator estimates how much eligible individuals and families will spend on premiums for a Covered California health plan under the law. The biggest change for 2020 deals with the tax credit. If you live in California you may be able to breathe a sigh of relief in the next few years.

She qualified for a premium tax credit when she signed up based on what she estimated her 2017 income would be. The smaller your business andor the lower your annual average wage the larger your credit will be. This is big for consumers who received a federal subsidy based on a Covered California MAGI of under 400 percent for 2020.

This is the recommended method if your annual income stays at a constant level from year to year. Premium tax credits cannot be applied to catastrophic health plans. The amount of premium assistance you receive is based on how much money you make your tax household size and where you live.

The calculator will tell you when catastrophic coverage may be an option to you. The American Rescue Plan suspends the repayment of any excess Premium Tax Credit subsidy that may be owed for 2020 by virtue of having a final MAGI higher than originally estimated. Taxpayers in California may also be eligible for a number of tax credits for financial events and expenses including childcare buying a new home the purchase of an electric vehicle and installing solar panels on their house.

Generally the projected annual income on your Covered California application should match your Adjusted Gross Income line 8b of the 1040 from your most recent Federal Tax Return. First the change in income threshold for 2020 tax credits in California. Put simply the Tax Credit means 1000year in savings.

After she enters the details of her 1095-A she finds out that her income is above the threshold to receive the premium tax credit. The standard deduction in California is 4601 for single filers and 9202 for joint filers. If your income is 1 higher than the cutoff you lose all the premium subsidy which can be well over 10000 depending on your age and your household size.

The calculator is designed to estimate eligibility for individuals under age 65. The premiums in this calculator reflect the Covered California. Premium assistance also called Advanced Premium Tax Credits APTC can lower the cost of health care for individuals and families who enroll in a Covered California health plan and meet certain income requirements.

Based on the 1000s of successfully enrolled Covered Ca members a quick snapshot. The Premium Tax Credit is cut off at 400 Federal Poverty Level.

Do You Qualify For The New California Health Insurance Premium Subsidy

Do You Qualify For The New California Health Insurance Premium Subsidy

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

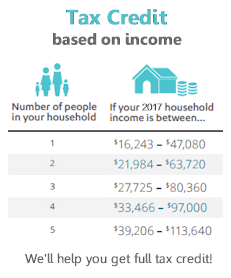

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

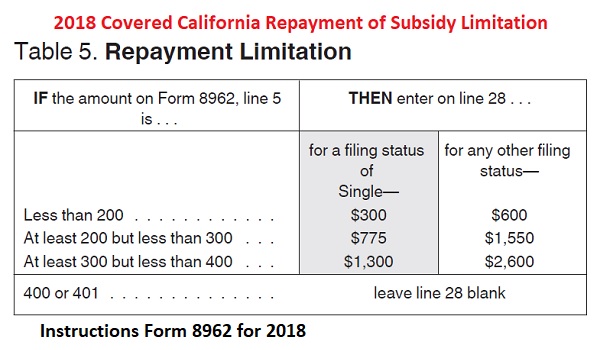

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

Common Tax Credit Mistakes People Make With Covered Ca

Common Tax Credit Mistakes People Make With Covered Ca

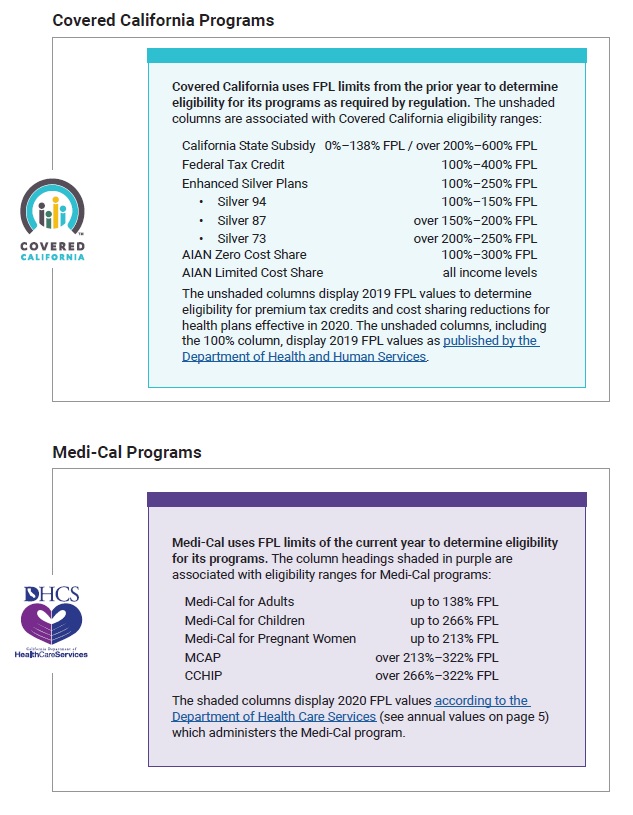

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Step By Step Income Calculation For Obamacare In California

Step By Step Income Calculation For Obamacare In California

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment