Featured

- Get link

- X

- Other Apps

What Is Medicare Part D Late Enrollment Penalty

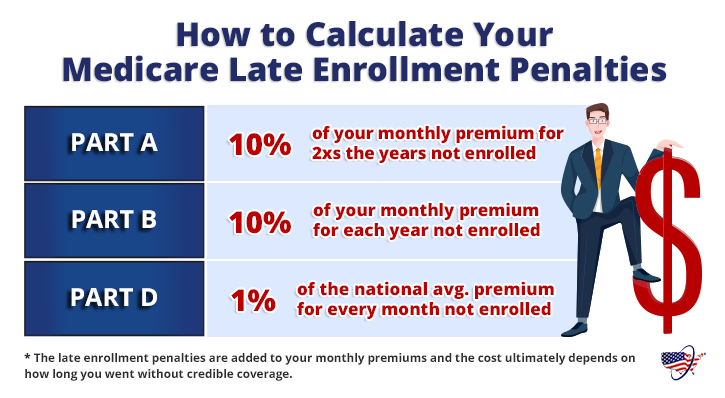

Youll probably owe a late-enrollment penalty for Part B due to the years you were eligible for Medicare but not enrolled in it. The parts of Medicare that charge a late enrollment fee are.

Medicare Don T Wait Until It S Too Late

Medicare Don T Wait Until It S Too Late

More information on Medicare late enrollment penalties.

What is medicare part d late enrollment penalty. For each month you delay enrollment in Medicare Part D you will have to pay a 1 Part D late enrollment penalty LEP unless you. Medicare multiplies this 1 by the number of months you did not have creditable prescription drug coverage. Part A Late Enrollment Penalty Medicaregov Part B Late Enrollment Penalty Medicaregov Part D Late Enrollment Penalty Medicaregov.

Medicare rounds that number to the nearest 010. According to Medicare if you go without one of the following for 63 days or more after your initial enrollment period you may be on the hook for a late enrollment penalty. In general youll have to pay this penalty for as long as you.

When you return to the country you will receive a special enrollment period to choose a Part D plan and wont have to pay a penalty for not being enrolled in that coverage. The late enrollment penalty is an amount thats permanently added to your Medicare drug coverage Part D premium. If you do not enroll in Part D coverage during your initial enrollment period and do not have other creditable drug coverage you will have to pay a late enrollment penalty when you sign up for Part D later.

The amount is 1 for every month you went without coverage when first eligible. As with Part B the Part D late enrollment penalty is based on the amount of time you were without coverage. What is the Medicare Part D Late Enrollment Penalty.

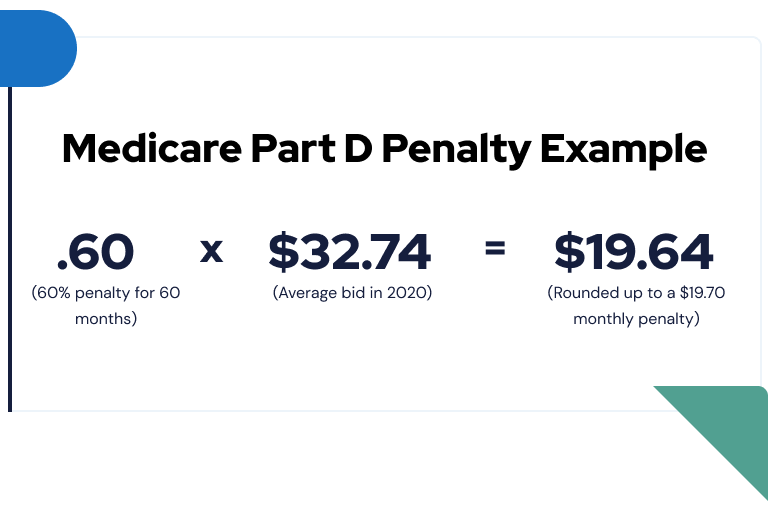

The Part D Late Enrollment Penalty. Creditable drug coverage is required to cover the same costs as Medicare Part D. Medicare multiplies 1 of the national base premium which is 3274 in 2020 by the number of months you delayed your Medicare Part D enrollment or didnt have creditable coverage through another plan such as an employer-based plan this number is rounded to the nearest 10 and added to your Medicare Part D premium.

The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Enroll in Medicare drug coverage if you lose other creditable coverage. A stand-alone Part D prescription drug plan A Medicare Advantage plan that includes Part D prescription drug coverage.

Medicare then determines the late-enrollment penalty by multiplying 1 of the national base beneficiary premium by the number of months you were uncovered. How is the Medicare Part D late enrollment penalty calculated. 3 ways to avoid the Part D late enrollment penalty 1.

That may be added to a persons monthly Part D premium. Medicare decides the Part D late enrollment penalty using 1 of the national base beneficiary premium. Part D prescription drug coverage A Medicare Advantage plan Part C Another Medicare plan that offers prescription drug.

Have creditable drug coverage Qualify for the Extra Help program Prove that you received inadequate information about whether your drug coverage was creditable. If you have creditable prescription drug coverage when you first become eligible for Medicare generally you can keep it without paying the late enrollment penalty if you sign up for Part D later. A person enrolled in a Medicare drug plan may owe a late enrollment penalty if he or she.

In most cases if you dont sign up for Medicare when youre first eligible you may have to pay a higher monthly premium. Creditable prescription drug coverage could. Whats the Part D late enrollment penalty.

The Medicare Part D Prescription Drug Plan then provides that information to the Medicare program. Its calculated like this. The penalty applies for as long as you are enrolled in a Part D plan.

Medicare calculates the Part D late-enrollment penalty by multiplying 1 of the national base beneficiary premium 3274 in 2020 times the number of full uncovered months you didnt have Part D or creditable coverage. If you miss the initial enrollment period and go 63 or more consecutive days without creditable prescription drug coverage you will likely have to pay a late enrollment fee for the duration of your. The Part D late enrollment penalty is a penalty thats addied in addition to the national base benefificary Part D premium.

The late enrollment penalty also called the LEP or penalty is an amount. Part A inpatient hospital insurance Part B outpatient medical insurance Part D prescription drug coverage. Employer group plans or unions usually provide those policies.

You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over theres a period of 63 or more days in a row when you. The late enrollment penalty applies if you go 63 days or more without creditable drug coverage after your Initial Enrollment Period. Enroll in Medicare drug coverage when youre first eligible.

Even if you dont take drugs now you should consider. When you become Medicare eligible the Part D Late Enrollment Penalty is added to your Medicare Part D monthly premium when you fail to obtain creditable prescription drug coverage including. The Medicare Part D penalty is 1 for each month you went without prescription.

Part D Late Enrollment Penalty Maximus Appeals Lep Learn How To Fight It

Medicare Part D Late Enrollment Penalty And How To Avoid It Eligibility

Medicare Part D Late Enrollment Penalty And How To Avoid It Eligibility

What Is Medicare Part D Senior Market Solutions

What Is Medicare Part D Senior Market Solutions

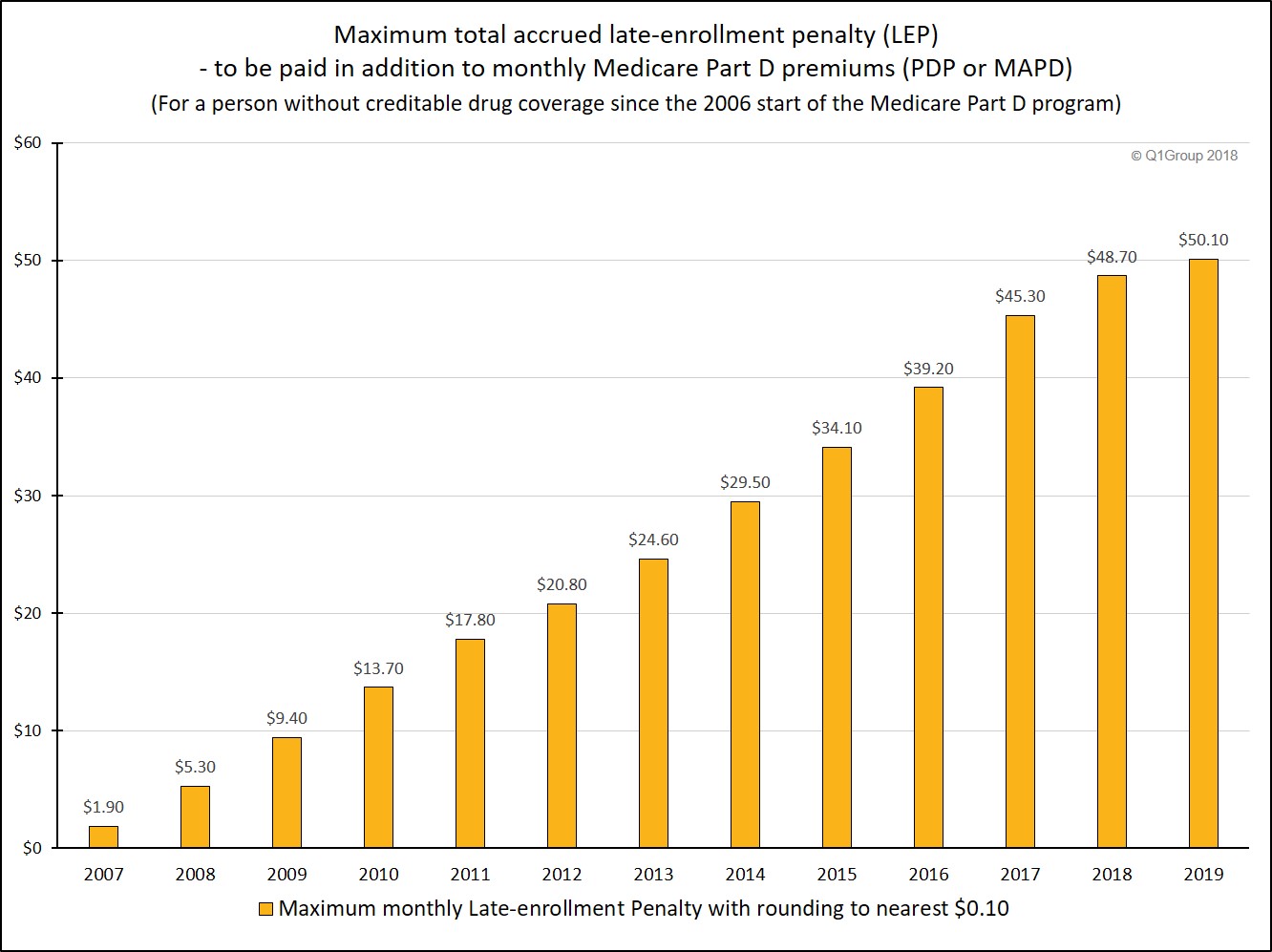

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2021 Medicare Part D Late Enrollment Penalties Will Increase Slightly Maximum Penalties Can Reach Up To 695 For The Year

2021 Medicare Part D Late Enrollment Penalties Will Increase Slightly Maximum Penalties Can Reach Up To 695 For The Year

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

2020 Medicare Part D Late Enrollment Penalties Will Decrease For A Third Year In A Row Although Maximum Penalties Can Reach Up To 641 Per Year

2020 Medicare Part D Late Enrollment Penalties Will Decrease For A Third Year In A Row Although Maximum Penalties Can Reach Up To 641 Per Year

Medicare Part D Late Enrollment Penalty Calculator Reconsideration

Medicare Part D Late Enrollment Penalty Calculator Reconsideration

Understanding The Part D Late Enrollment Penalty

Understanding The Part D Late Enrollment Penalty

Medicare Part D Late Enrollment Penalty Youtube

Medicare Part D Late Enrollment Penalty Youtube

Medicare Late Enrollment Penalty Avoid Penalty Fees

Medicare Late Enrollment Penalty Avoid Penalty Fees

How To Avoid The Medicare Part D Late Penalty Medicare Solutions Blog

How To Avoid The Medicare Part D Late Penalty Medicare Solutions Blog

Penalties For Not Signing Up For Medicare Boomer Benefits

Penalties For Not Signing Up For Medicare Boomer Benefits

Medicare Part D Late Enrollment Penalties Explained Youtube

Medicare Part D Late Enrollment Penalties Explained Youtube

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment