Featured

- Get link

- X

- Other Apps

Insurance Fraud California

Sections 548 549 550 and 551 Under the California Penal Code it is unlawful to intentionally defraud an insurance company. Fraud is possible with any type of insurance from auto to workers compensation.

California Auto Insurance Fraud Sweep Nets Nearly 200

California Auto Insurance Fraud Sweep Nets Nearly 200

PC 548 damaging or abandoning vehicle Penal Code 548 damaging destroying hiding or abandoning an insured vehicle with intent to defraud the insurance company is a California felony.

Insurance fraud california. The penalties for California auto insurance fraud depend on the form of fraud you are alleged to have committed. Here you will find an overview of three other important insurance fraud regulations in California. The California Insurance Frauds Prevention Act IFPA located under Section 18717 of the California Insurance Code allows members of the public to file private qui tam suits against anyone who commits insurance fraud in the state.

This costs each resident an average of 500 a year. Insurance fraud charges are usually the result of either making a fraudulent insurance claim or from destruction of insured property. California State Law on Insurance Fraud While federal laws might not address insurance fraud directly the same cannot be said for the laws of the State of California.

Even though there are different types of insurance insurance fraud usually involves wrongfully receiving payments andor benefits from an insurance organization. Insurance fraud in California includes any deliberate act done with the intent to defraud an insurance company. Most often investigations conducted by the Fraud.

Effectively fighting fraud is an important step to keep insurance costs down and protect California employers and employees. While the IFPA mirrors the False Claims Act FCA in several important respects the IFPA for example includes qui tam provisions it contains a striking difference. The most common claims are auto insurance fraud claims however.

Staging an accident with fabricated injuries and presenting a car accident personal injury claim for payment 2. Insurance fraud as its name suggests involves insurance and received benefits. The California State Legislature defined workers compensation fraud in 1991 and imposed penalties on those involved in fraudulent activities.

The Fraud Division is charged with enforcing the provisions of Chapter 12 of the California Insurance Code commonly referred to as the Insurance Frauds Prevention Act California Penal Code Sections 549-550 and California Labor Code Section 37005. Some of the effects of insurance fraud in California are Insurance fraud totals over 15 billion each year. A Fraudulent Insurance Claim under California Penal Code 550 occurs when.

Below is a list of common types of fraud offenses in the state of California. There are statutes for a wide range of fraud including medical fraud and unemployment insurance fraud. Common types of insurance fraud.

If you are employed in the insurance industry you must use the eFD-1 system to submit your report. In California insurance fraud can be a misdemeanor or a felony with fines that range to 150000. Consumer Fraud Reporting Portal The California Department of Insurance has developed this form for members of the general public to report cases of suspected insurance fraud.

This results in higher premiums higher taxes and higher prices According to the National Insurance Crime Bureau NICB other than tax evasion insurance fraud is the second most costly crime in the country. Individuals who violate these statutes may face serious criminal charges. California insurance fraud laws seek to prevent and punish false claims intended to generate payments to consumers or other payees of insurance companies.

Recent cases have brought increased attention to the California Department of Insurances CDI unique enforcement statute the Insurance Fraud Prevention Act 18717 IFPA or the Act. The California Penal Code. Current law requires the Fraud Division to investigate various felony provisions of the Penal and Insurance Codes.

Conduct that qualifies as auto insurance fraud includes. The punishment for California insurance fraud can range from probation to five years in prison as well as fines community service and restitution. Purposely damaging concealing or abandoning your car to collect the insurance proceeds 1.

A consumer might commit insurance fraud by submitting a claim based on.

Insurance Fraud Laws Pc 548 550 In California Criminal Defense Attorney In Ontario Ca

Insurance Fraud Laws Pc 548 550 In California Criminal Defense Attorney In Ontario Ca

Prison Jail Sentences For Three In Insurance Fraud Arson Case California Statewide Law Enforcement Association

Prison Jail Sentences For Three In Insurance Fraud Arson Case California Statewide Law Enforcement Association

Fifteen Arrested In Staged Collision Auto Insurance Fraud Scheme California Statewide Law Enforcement Association

Fifteen Arrested In Staged Collision Auto Insurance Fraud Scheme California Statewide Law Enforcement Association

Auto Insurance Fraud Forgery Ring Unravels In California Propertycasualty360

Auto Insurance Fraud Forgery Ring Unravels In California Propertycasualty360

Four California Men Involved Alleged Organized Auto Insurance Fraud Ring

Four California Men Involved Alleged Organized Auto Insurance Fraud Ring

California Auto Insurance Fraud Sweep Nets Nearly 200

California Auto Insurance Fraud Sweep Nets Nearly 200

Cdi Detectives Bust Stolen Car Insurance Fraud Ring California Statewide Law Enforcement Association

Cdi Detectives Bust Stolen Car Insurance Fraud Ring California Statewide Law Enforcement Association

Insurance Fraud Prevention Whistleblower Rewards Constantine Cannon

Insurance Fraud Prevention Whistleblower Rewards Constantine Cannon

Seven Arrested In Family Run Auto Insurance Fraud Ring California Statewide Law Enforcement Association

Seven Arrested In Family Run Auto Insurance Fraud Ring California Statewide Law Enforcement Association

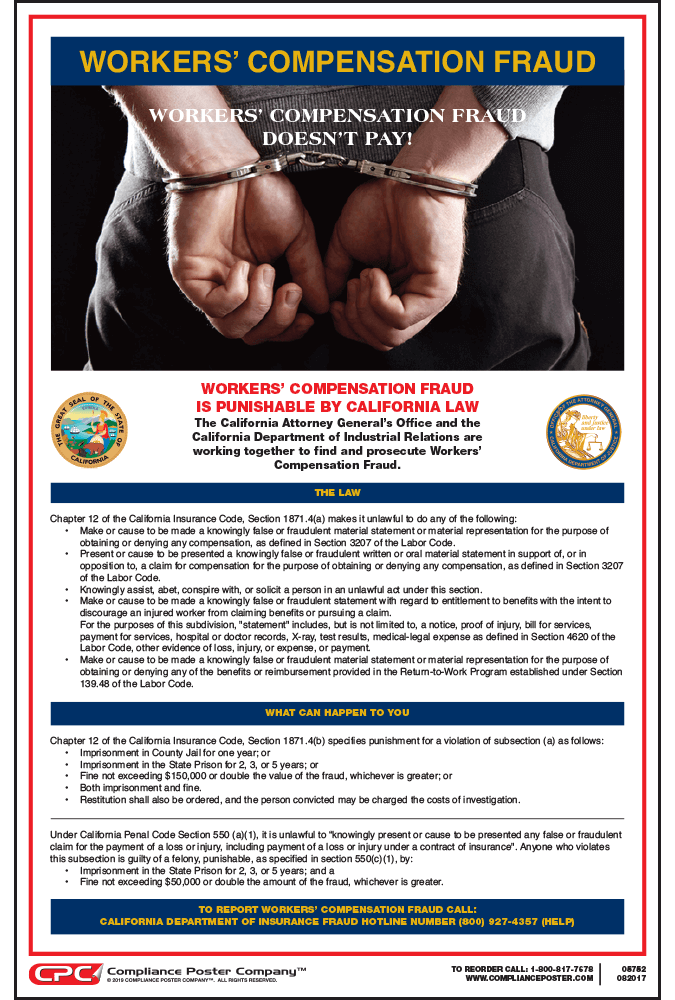

California Workers Compensation Fraud Poster

California Workers Compensation Fraud Poster

Insurance Investigators Arrest Suspects For Insurance Fraud California Statewide Law Enforcement Association

Insurance Investigators Arrest Suspects For Insurance Fraud California Statewide Law Enforcement Association

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment