Featured

Covered California Income Brackets

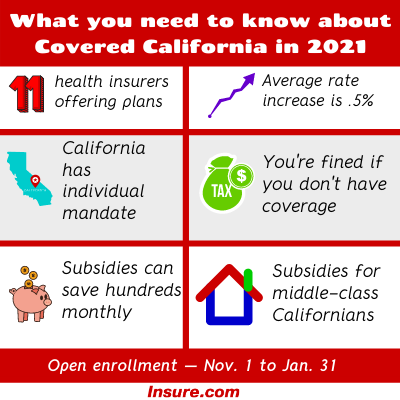

Its the only place to get financial help to pay for your health insurance. Covered California rates are going up 06 on average and the plan benefits are not changing very much.

Covered California Health Insurance Income Guidelines

Form 540 line 19 is If the amount on Enter.

Covered california income brackets. If you make over 138 of the FPL you are unlikely to qualify for Medi-Cal unless youre pregnant or otherwise medically needy. If 100000 or less use the Tax Table. Providing You With Financial Support To Help Ensure You Make A Full Recovery.

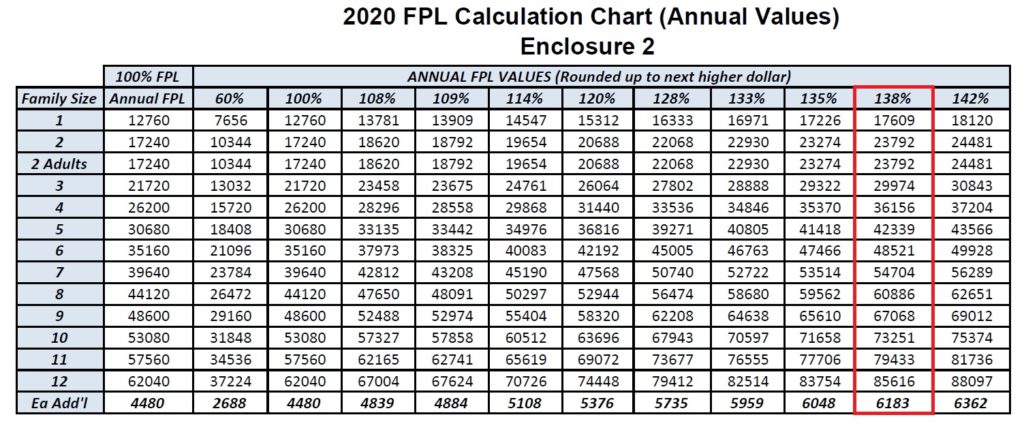

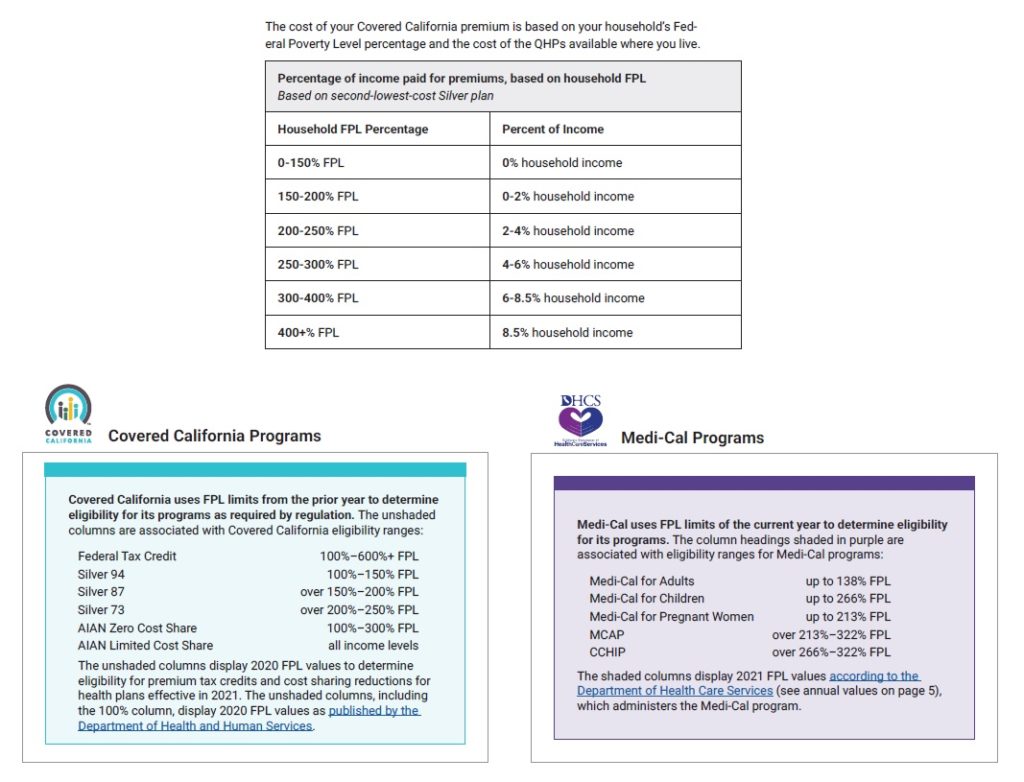

Any financial help you get is based on what you expect your household income will be for the coverage year not last years income. Use the Shop Compare tool to find the best Health Insurance Plan for you. An estimated 23000 Covered California enrollees whose annual household income falls below 138 percent of the federal poverty level FPL which is less than 17237 for an individual and35535 for a.

Family size adjustments HUD applies to the income limits and 4 determining income limit levels applicable to Californias moderate-income households defined by law as household income not exceeding 120 percent of county area median income. Bronze Silver and Gold The out-of-pocket maximum is going up from 7800 to 8200 on the Bronze Silver and Gold Plans. COVERED Household Size For each additional person.

Ad We Do All The Hard Work For You Finding You the Best Cover At The Right Price. Covered California Typically if you make between 0 and 138 of the FPL you will qualify for Medi-Cal. Counts as Income.

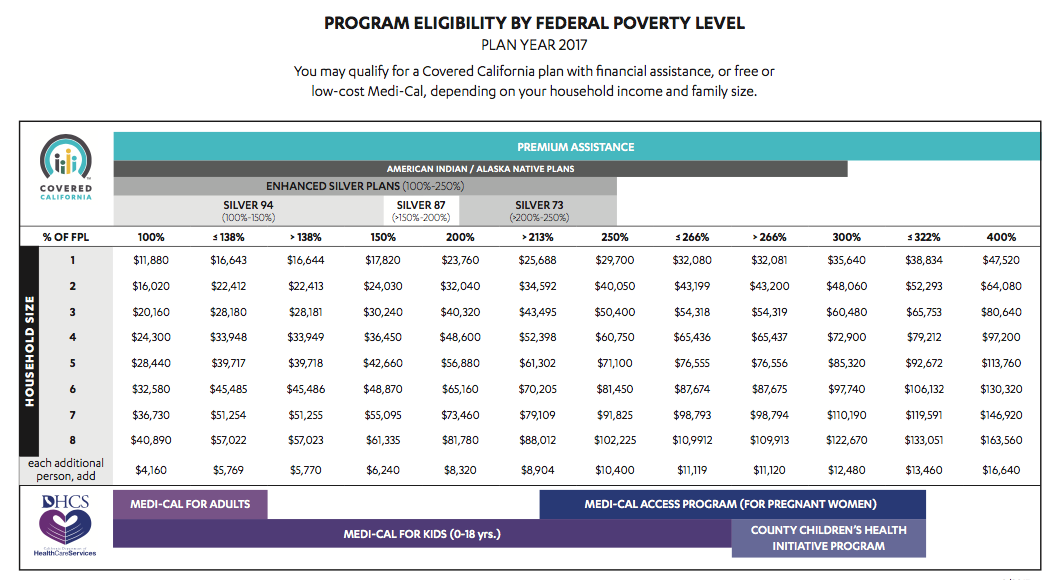

You can start by using your adjusted. Add 100 S15930 S20090 S24250 S32570 96730 S4160 MAGI Medi- Cal 13800 S16394 S22107 S27820 93534 99247 S56428 Program Eligibility by Federal Poverty Level FPL for 2016 Coverage Year Eligible for Premium Tax Credit PTC 2100 to. Medi-Cal has free or low-cost coverage if you qualify.

How to Estimate Your Income. To figure your tax online go to. Even if you do not have enough income.

Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act. In the Inland Empire a middle income for that family would be between 60336 and 211177. All plans cover treatment and vaccines for COVID-19.

Both Covered California and Medi-Cal have plans from well-known companies. Providing You With Financial Support To Help Ensure You Make A Full Recovery. Compare brand-name Health Insurance plans side-by-side and find out if you qualify.

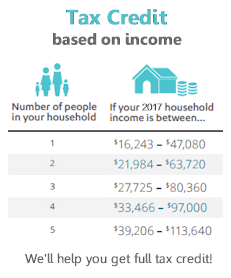

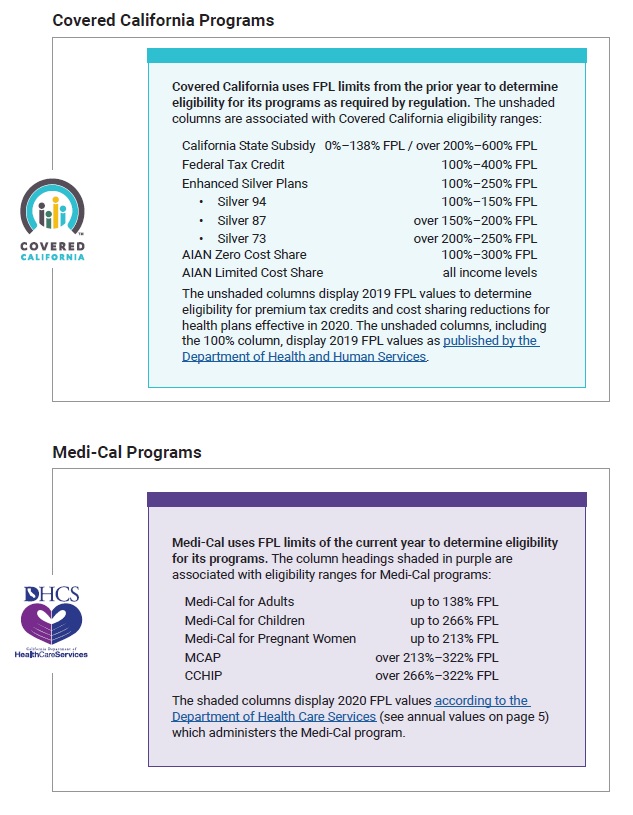

When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes. Personal Income Tax Booklet 2020 Page 93 2020 California Tax Rate Schedules To e-file and eliminate the math go to ftbcagov. Household FPL Percentage Percent of Income 0-150 FPL 0 household income 150-200 FPL 0-2 household income 200-250 FPL 2-4 household income 250-300 FPL 4-6 household income 300-400 FPL 6-85 household income 400 FPL 85 household income The cost of your Covered California premium is based on your households Fed-.

The Covered California exchange will permit individuals to enroll in health plan coverage or Medi-Cal during the initial enrollment period from October 1 2013 to March 31 2014 and thereafter during an open enrollment period that will begin on October 15 and last through December 7 annually. We will keep our members informed if any changes occur in the future. Ad We Do All The Hard Work For You Finding You the Best Cover At The Right Price.

Also if their income falls between 138 and 250 percent of the FPL Covered California may also qualify them to receive extra discounts that reduce their medical costs. Use only if your taxable income on Form 540 line 19 is more than 100000. Covered California rates coverage and financial help will remain intact for 2017.

Pandemic Unemploment Compensation 300week Social Security. For families or individuals with a household income below 400 percent of the FPL Covered California may qualify them to receive subsidies that will lower their premiums. In Orange County those numbers are 71920 to.

Its the only place where you can get financial help when you buy health insurance from well-known companies. Social Security Disability Income SSDI Retirement or pension.

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

How Do I Know If I Qualify For Covered California Or Medi Cal

How Do I Know If I Qualify For Covered California Or Medi Cal

Covered California Open Enrollment 2021 A Complete Guide Insure Com

Covered California Open Enrollment 2021 A Complete Guide Insure Com

Covered California Versus Medi Cal Pfeifer Insurance Brokers

Covered California Versus Medi Cal Pfeifer Insurance Brokers

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Step By Step Income Calculation For Obamacare In California

Step By Step Income Calculation For Obamacare In California

2021 Covered California Renewal And Open Enrollment Changes

2021 Covered California Renewal And Open Enrollment Changes

Covered California Income Tables Imk

Covered California Income Tables Imk

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered California Income Limits Explained

Covered California Income Limits Explained

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment