Featured

- Get link

- X

- Other Apps

30 After Deductible

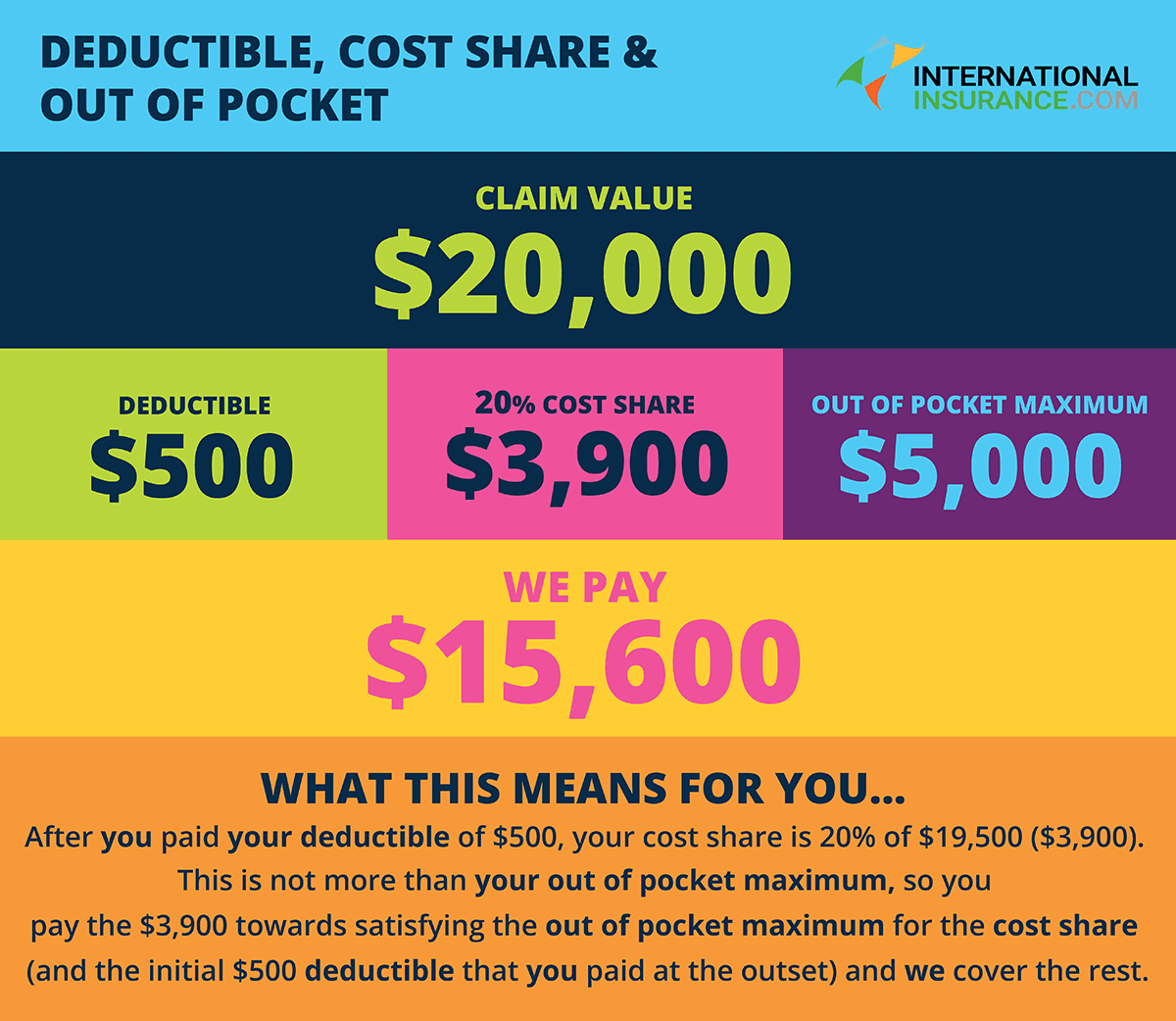

Youll pay 20 of the remaining 9000 or 1800 your coinsurance. When you pay coinsurance you split a certain cost with the insurance company at a ratio determined by the terms of your insurance plan.

Deductibles Co Pay And Out Of Pocket Maximums

Deductibles Co Pay And Out Of Pocket Maximums

Gold customers pay 20 and platinum customers pay 10 of the bill.

30 after deductible. Inpatient services 0 after deductible 30 after deductible. Stick to the assistance here to get a. In March you fall and break your arm.

If you need mental health behavioral health or substance abuse services Outpatient services 0 after deductible 30 after deductible Prior authorization may be required or services will not be covered. This means that if you have an HDHP with a 3000 deductible and a 20 copay for primary care you may have to meet the entire deductible before the copay will apply. Now your health insurance kicks in and helps you pay the rest of the bill.

10 after deductible 30 after deductible Inpatient Hospital Services after deductible 100admission plus 10 30 up to 600day plus 100 Of additional charges Outpatient Hospital Services after deductible 10 30 up to 350day plus 100 Of additional charges Preventive Health Services 0 deductible waived 30 after deductible. The insurance company would pay for all covered. Life Health Insurance 30 After Deductible Concerned About Health Insurance.

20 Coinsurance after Deductible. You pay up to 300 after deductible. Begin Using These Ideas.

Habilitation services 120 copayment 80 after deductible Combined 30 visits for physical occupational therapy and chiropractic services. Typically folks go without proper medical insurance mainly because they dont consider they could pay for it. You would pay 100 along with 30 percent of the remaining 900 up to your out-of-pocket maximum which would be the most you would pay in a year.

An example of paying coinsurance and your deductible would be if you have 1000 in medical expenses and the deductible is 100 with 30 percent coinsurance. The statutory regulations apply with regard to the consequences of a default in payment. This is why HDHPs are often paired with HSAs - the pretax contributions help offset the 3000 deductible amount that youll pay out-of-pocket before your copay can apply.

You pay up to 200 after deductible. In this case that would be an additional 300 20 of 1500the difference between the deductible and the hospital visit. Once he meets the deductible he also pays 20 his coinsurance amount.

So your total out-of-pocket costs would be 4800 your 3000 deductible plus your 1800 coinsurance. You pay up to 100 after deductible. Different service providers supply a wide variety of programs which makes it quite difficult to understand what would work for your needs.

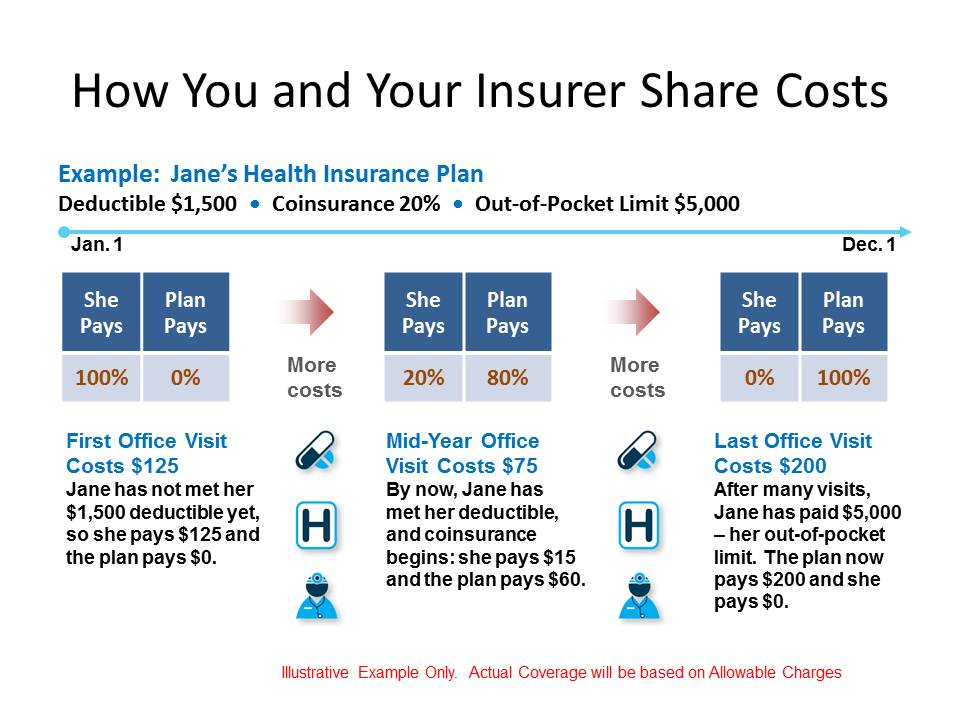

The term no charge after deductible is frequently used in health insurance plans because these plans often require coinsurance which is a shared cost that must be paid even after the deductible is met. When you go to the doctor instead of paying all costs you and your plan share the cost. 60-day supply mail order only.

The bill is 3000 after your insurers negotiated rates are applied. Youll still have to pay some of the rest of the bill thanks to. Physiciansurgeon fees 0 after deductible 30 after deductible None.

TMJ therapy visit 30 after Deductible Nurse treatment room visits to receive injections 10 Administered medications including injections all outpatient settings 20 Coinsurance after Deductible Urgent Care visit 40 Emergency department visit. Silver level customers pay about 30 but this can vary if you qualify for cost-sharing reductions through the affordable care act. Prior authorization may be.

30 visits for speech therapy. The 30 percent you pay is your coinsurance. Youd pay all of the first 3000 your deductible.

For instance with 10 percent coinsurance and a 2000 deductible you would owe 2800 on a 10000 operation 2000. Coinsurance is an additional cost that some health care plans require policy holders to pay after the deductible is met. Skilled nursing care 50 after deductible 80 after deductible Coverage is limited to 60 days.

Different companies will offer different benefits. For instance if you must pay 10 percent coinsurance on a 10000 medical procedure and your deductible is 1000 you must pay the 1000 deductible and 10 percent of the remaining. Coinsurance is often 10 30 or 20 percent.

You start paying coinsurance after youve paid your plans deductible. It is your share of the medical costs which get paid after you have paid the deductible for your plan. Youve paid 1500 in health care expenses and met your deductible.

You pay 1800 of that bill before youve met your yearly deductible of 2000 the 200 from the treatment for the flu plus 1800 of the cost of the broken arm. 20 Coinsurance after Deductible Outpatient surgery visit. If your total out-of-pocket costs reach 6850 youd pay only that amount including your deductible and coinsurance.

For example your plan pays 70 percent. If you opt to find health insurance outside the marketplace then your coinsurance after deductible will be dependent on the plan you choose. Expenses after deductible is met 40 of eligible expenses after deductible and the difference between the allowed amount and the charge 30 of eligible expenses after deductible is met 50 of eligible expenses after deductible and the difference between the allowed amount and the charge Out-of-Pocket Maximum Combined Medical and Pharmacy.

Unless otherwise resulting from the confirmation of order the purchase price is payable net without deduction within 30 days as of the date of invoice. 5 after deductible Not covered6 30 after deductible 10 after deductible 50 after deductible 250 per procedure after deductible EMERGENCY SERVICES Emergency Department visits waived if admitted directly to hospital Ambulance 100 after deductible 75 after deductible PRESCRIPTIONS 37 Generic Brand-name up to a 30-day supply 10 30 HOSPITAL CARE.

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

2015 Obamacare Deductible Out Of Pocket Averages

2015 Obamacare Deductible Out Of Pocket Averages

Bronze 60 100 Coinsurance After The Deductible Confusion

Bronze 60 100 Coinsurance After The Deductible Confusion

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Understanding Your Health Insurance Deductible Co Pay Co Insurance And Out Of Pocket Maximum Money Under 30

Coinsurance After Deductible How To Choose Between 100 And 0

Coinsurance After Deductible How To Choose Between 100 And 0

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

Who Pays After Deductible Coinsurance Not Listed Personal Finance Money Stack Exchange

Who Pays After Deductible Coinsurance Not Listed Personal Finance Money Stack Exchange

Guide To Mental Health Co Payments Co Insurance And Deductibles

Bronze 60 100 Coinsurance After The Deductible Confusion

Bronze 60 100 Coinsurance After The Deductible Confusion

25 Unique What Is A Deductible On Medical Insurance

5 Ways To Use Your Health Insurance After You Ve Met Your Deductible

5 Ways To Use Your Health Insurance After You Ve Met Your Deductible

What Is A Deductible Copay And Coinsurance Policy Advice

What Is A Deductible Copay And Coinsurance Policy Advice

What Happens After I Meet My Deductible Ehealth Insurance

What Happens After I Meet My Deductible Ehealth Insurance

1000 Kleine Dinge In Amerika Krankenversicherung In Den Usa Wichtige Begriffe Erklart

1000 Kleine Dinge In Amerika Krankenversicherung In Den Usa Wichtige Begriffe Erklart

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment