Featured

- Get link

- X

- Other Apps

Hdhp Plans For Individuals

How much are people contributing to HDHP health savings accounts. Studies have shown that switching to an HDHP plan that qualifies for a health savings account HSA could offer health care savings for some consumers especially those with few health care needs whereas low income and less healthy individuals would be most at.

Hdhp Vs Ppo Which Is Right For You Ramseysolutions Com

Hdhp Vs Ppo Which Is Right For You Ramseysolutions Com

The best type of HSA to have is one thats flexible available on demand and includes a debit card you can use to pay for medical expenses.

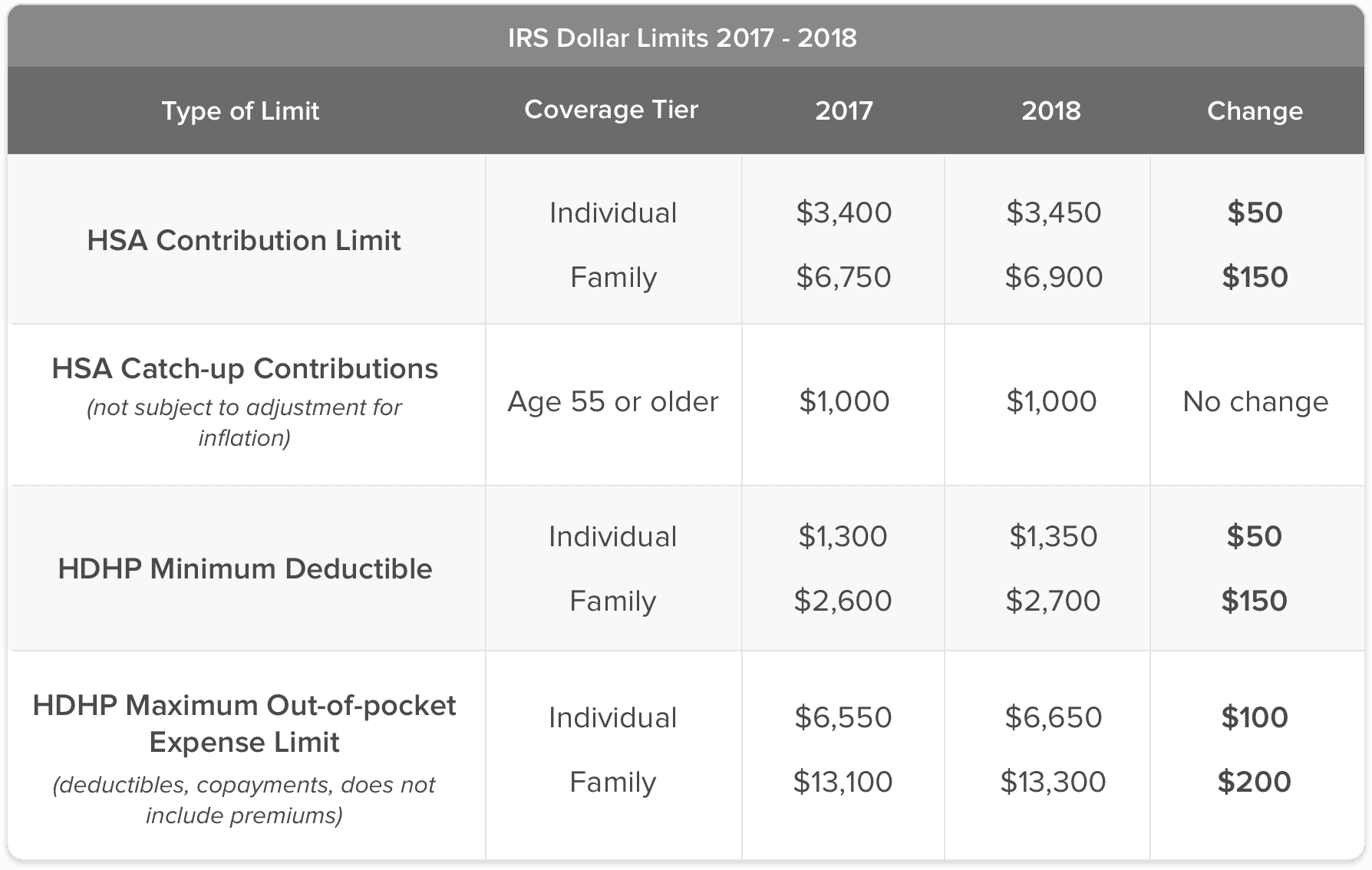

Hdhp plans for individuals. Plans will vary but generally a minimum of 1400 for individuals and 2800 for families 1. High deductible insurance plan examples. If you are age 55 or older at the end of your tax year your contribution limit is increased by 1000.

HSAs are a way to save money for your health care. Annual deductible Will vary by plan and by employer but generally are lower. 7200 for family HDHP coverage.

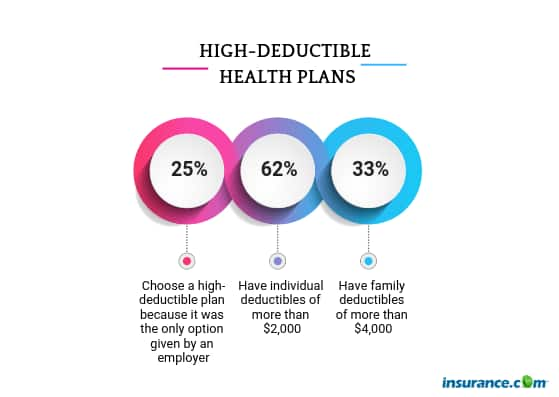

As of 2017 43 of Americans were enrolled in plans with high deductibles which represents a nearly. True to its name the deductible is higher. A health plan cant require any individual to pay a deductible that is higher than the federal limit for the out-of-pocket maximum for individual coverage even if that person is covered under an aggregate.

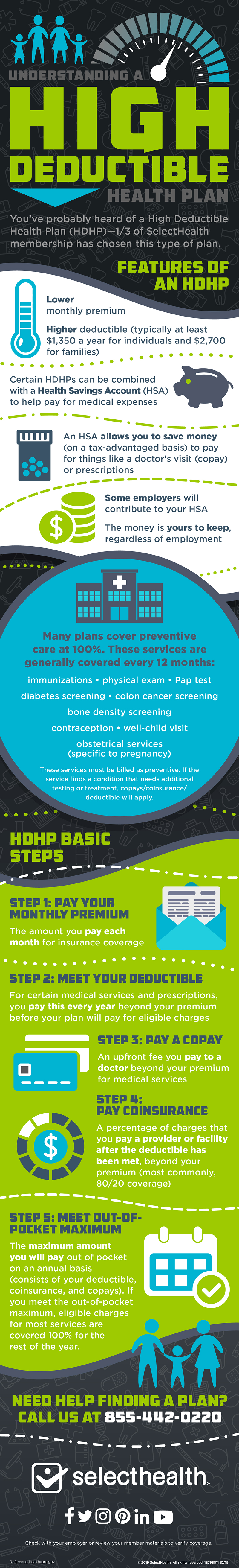

There are yearly limits for deposits into an HSA. To qualify as an HDHP the plan must have a relatively high deductible of at least 2400 for a family plan. A high-deductible health plan HDHP is a health insurance plan with a high minimum deductible for medical expenses.

HDHP-qualifying plans must have a deductible of at least 1400 for individuals and 2800 for families in 2020. If youre considering an HDHP or youre already in one you need to pair it with a health savings account. All ACA marketplace insurance carriers offer at least one HDHP.

We offer a range of High Deductible Health Plan HDHP choices for individuals or families in need of health coverage with an HSA option. That threshold increases a little bit each year. In 2020 that rises to 1400 for individuals and 2800 for a family.

Our HDHPs meet all federal requirements necessary to open a Health Savings Account. With HDHP plans your deductible will be at least 1350 for individuals and 2700 for a family. HDHPs should be designed to help ensure that costs are not a barrier to care.

The added wrinkle is this. An HDHP plan is typically about 10 cheaper than a traditional preferred provider organization PPO plan and is usually associated with a company funded tax-advantaged health savings account HSA that is meant to fund some of your medical expenses. HDHPs have defined minimum deductibles and maximum out-of-pocket limits.

And we found it for you. High Deductible Health Plan Perfect for individuals or families who want to open a Health Savings Account HSA. High Deductible Health Insurance Plans for Individuals.

For calendar year 2021 these amounts for HDHPs are. High deductible plans must also limit annual out-of-pocket expenses to 7000 for individual coverage or 13800 for families. And be sure to educate your HDHP consumers to optimize their Health Savings Account HSA.

The plans annual out-of-pocket maximum the most youll pay in one year cannot be more than 6650 for individuals and 13300 for families. Finding using HSA-eligible HDHPs. These limits for 2021 are.

In order to quality for an HSA you must be enrolled in a qualified HDHP. Since embedded deductibles typically lower out-of-pocket costs for healthcare consumers most plans that contain them do not qualify as an HDHP. Here are some important details that can help you decide if a plan with a high deductible is right for you.

High-deductible health plans paired with a tax-free health savings account HSA-HDHP represent a growing percentage of plans offered on the individual and group market. 3600 for self-only HDHP coverage. But the average deductible for a Silver Plan this year is 3572 for an individual and 7474 for a family according to the health insurance data website HealthPocket.

HDHPs are helping millions of Americans pay for health care. At the time this mostly affected family HDHP health plans since they were the type of plan likely to be using an aggregate versus embedded deductible approach. To qualify the embedded deductible for individuals must be equal to or more than the IRS minimum family deductible.

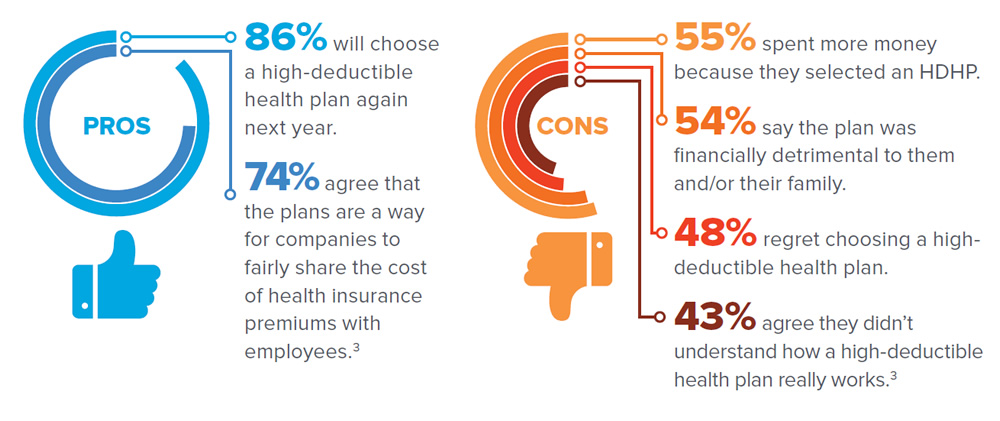

When your employees and their families understand the benefits and risks of high-deductible health plans your organization will reduce risk and promote better health outcomes. A deductible is the portion of. Minimum deductible The amount you pay for health care items and services before your plan starts to pay Maximum out-of-pocket costs The most youd have to pay if you need more health care items and.

Amounts are adjusted yearly for inflation. Out-of-pocket limit Out-of-pocket limits are higher in an HDHP. These plans are usually only available as Bronze-tier options though many Silver-tier plans also include HDHP.

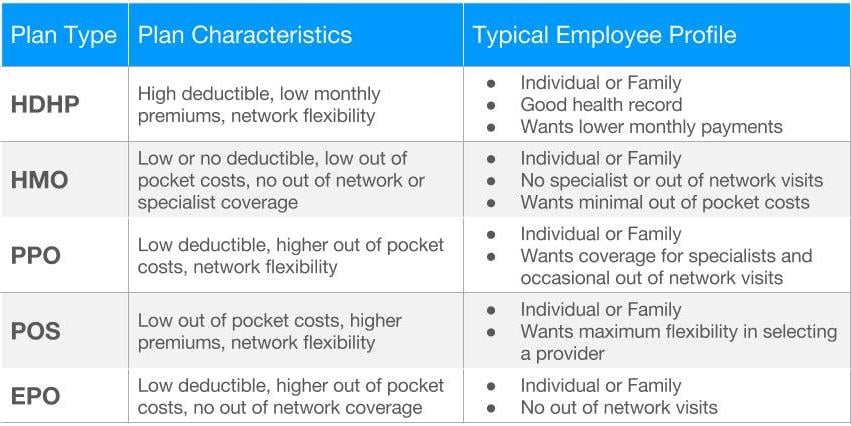

A high-deductible health plan HDHP is any health plan that typically has a lower monthly premium and a higher deductible than traditional plans. The high-deductible health plan HDHP is frequently among the health insurance choices offered by companies these days.

High Deductible Health Insurance And Chronic Disease New Rule Aims To Lower Treatment Costs Ehealth

High Deductible Health Insurance And Chronic Disease New Rule Aims To Lower Treatment Costs Ehealth

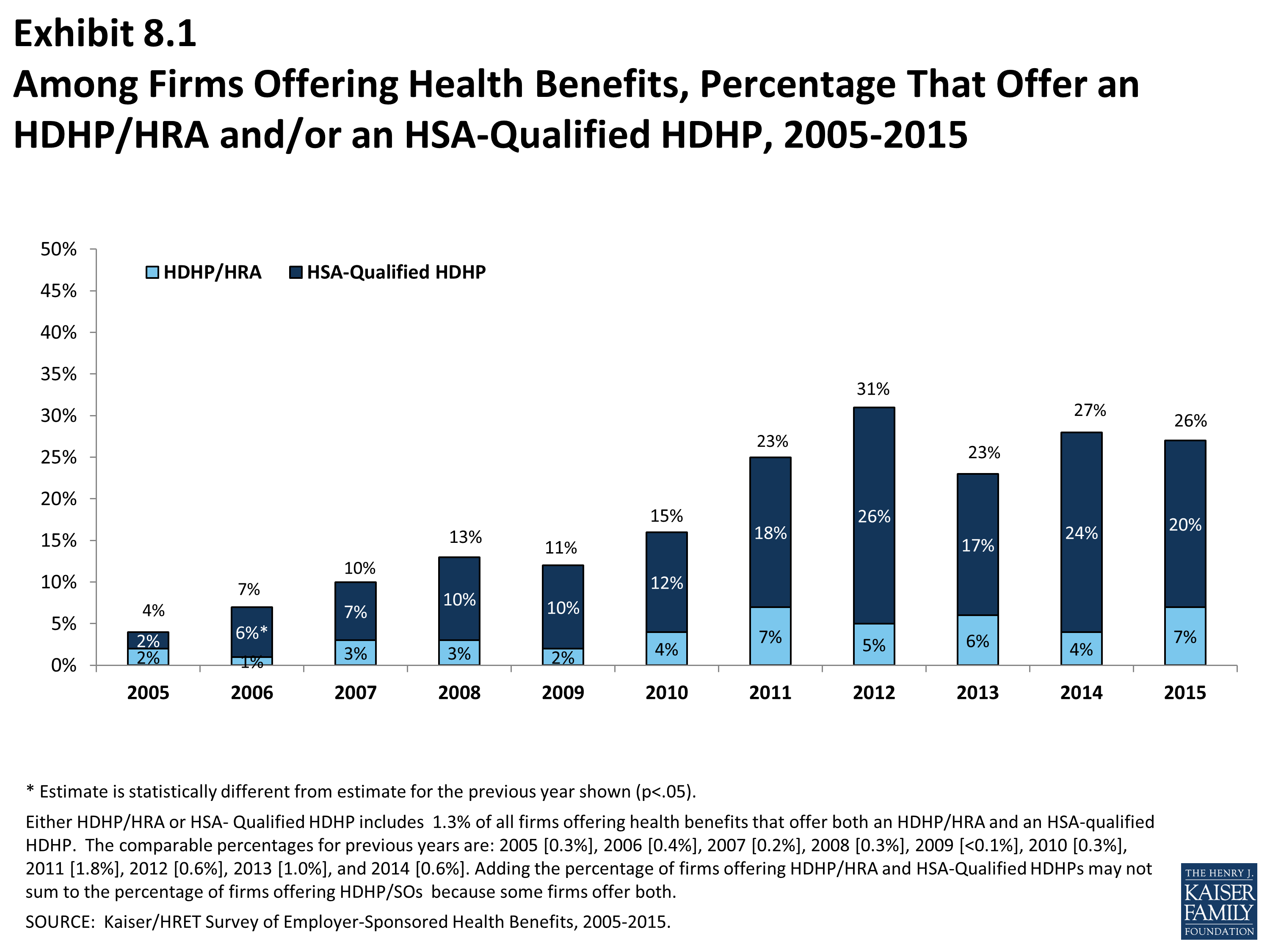

Ehbs 2015 Section Eight High Deductible Health Plans With Savings Option 8775 Kff

Ehbs 2015 Section Eight High Deductible Health Plans With Savings Option 8775 Kff

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

High Deductible Health Plan Hdhp Werhealthcare Com

High Deductible Health Plan Hdhp Werhealthcare Com

The Pros And Cons Of High Deductible Health Plans Hdhps

The Pros And Cons Of High Deductible Health Plans Hdhps

What Is An Hdhp Your Guide To High Deductible Health Plans

What Is An Hdhp Your Guide To High Deductible Health Plans

Products Data Briefs Number 317 August 2018

Products Data Briefs Number 317 August 2018

Health Plan Survey Insurance Com

Health Plan Survey Insurance Com

Despite Mixed Reviews Hdhps Look Like They Re Here To Stay

Despite Mixed Reviews Hdhps Look Like They Re Here To Stay

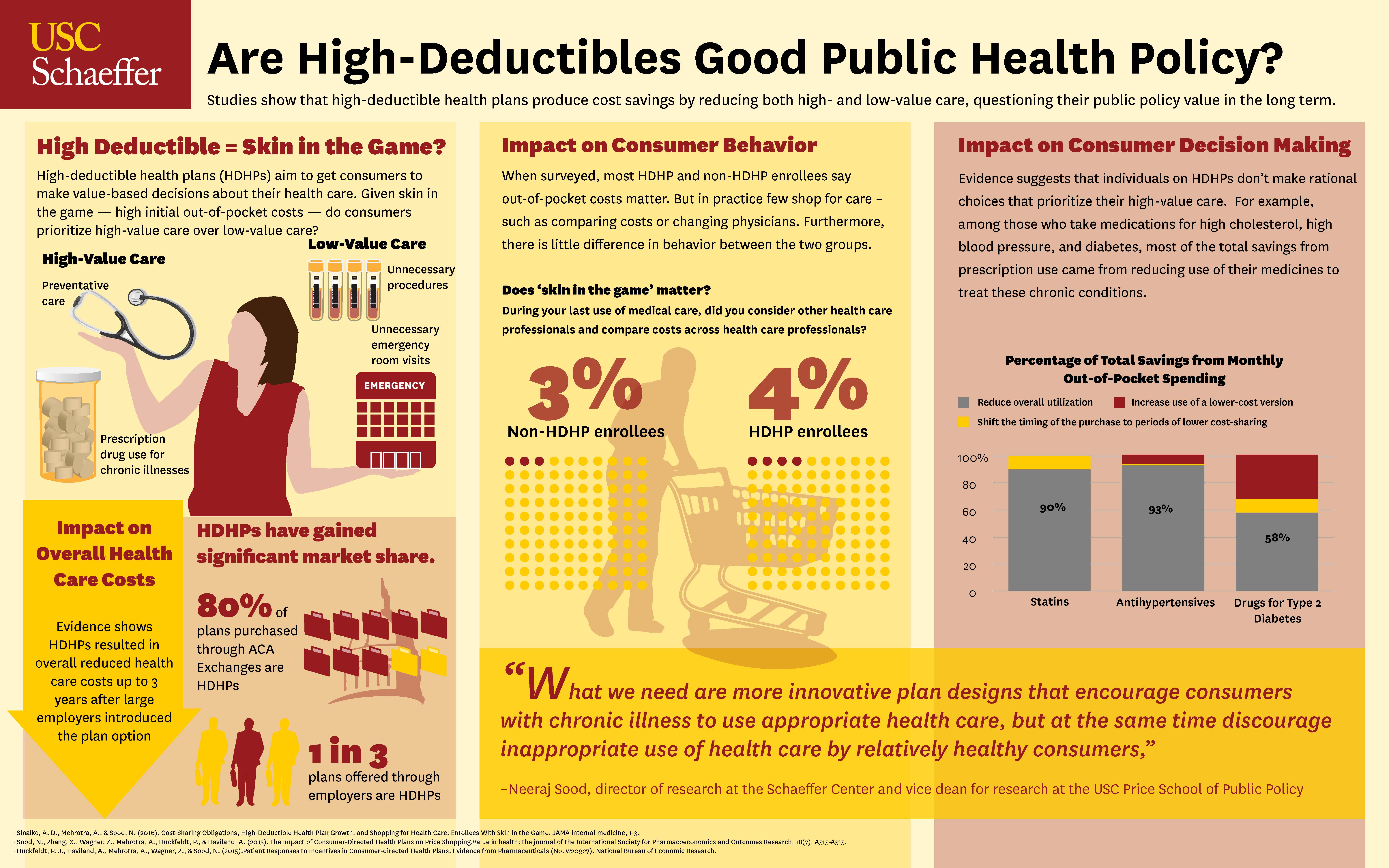

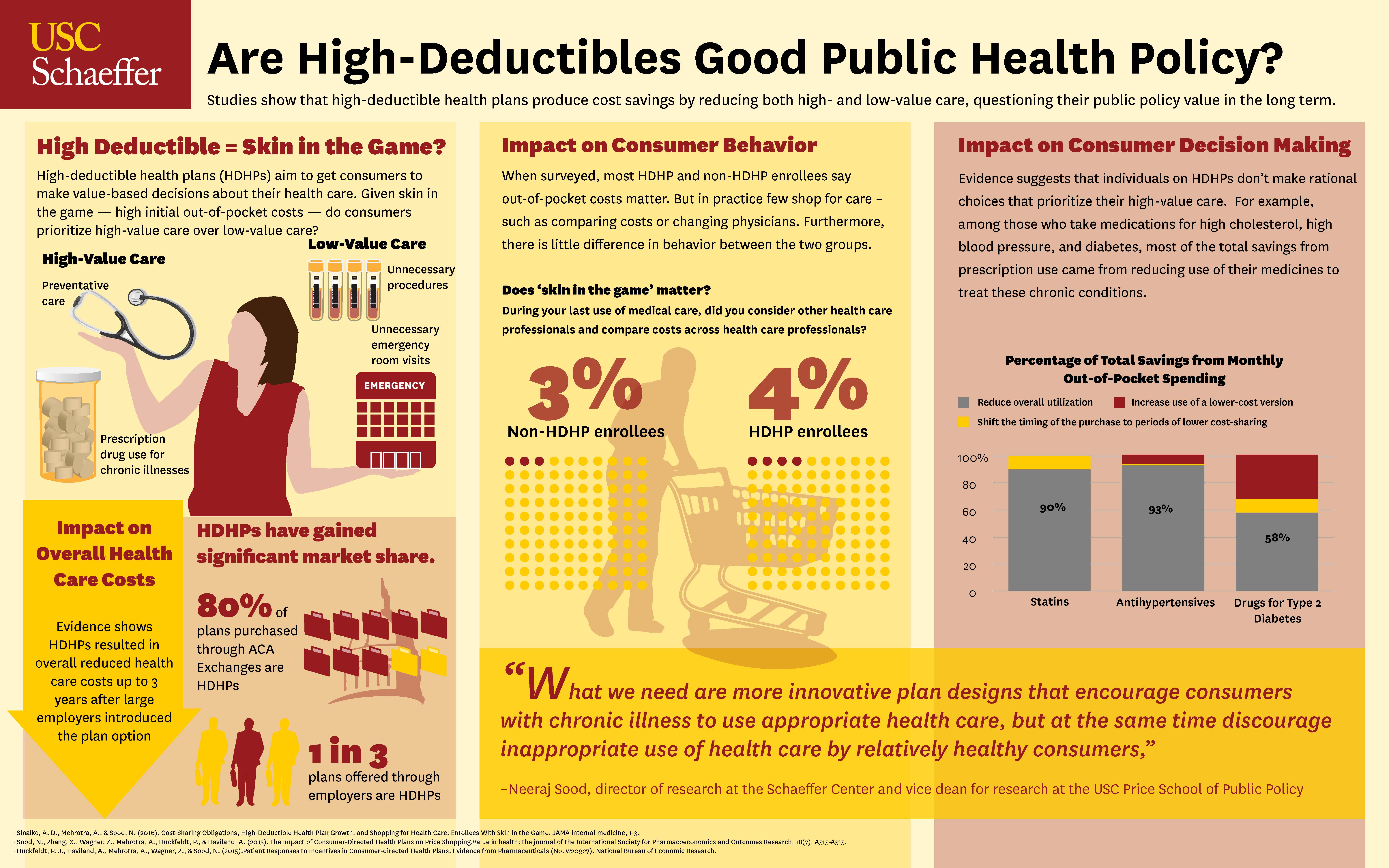

Are High Deductible Plans A Healthy Option For Patients Usc Schaeffer

Are High Deductible Plans A Healthy Option For Patients Usc Schaeffer

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment