Featured

Benefits Of Medicare Supplement Plans

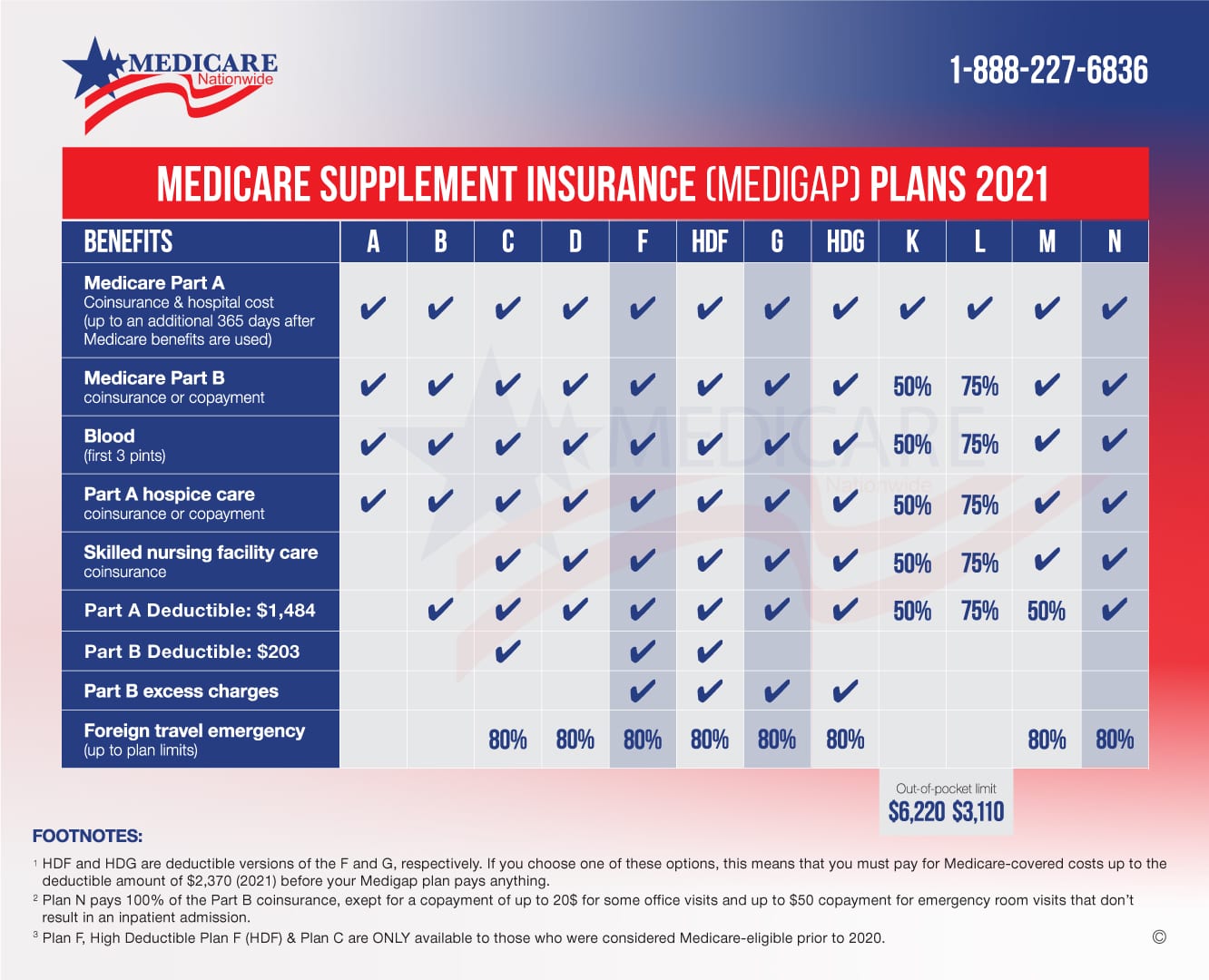

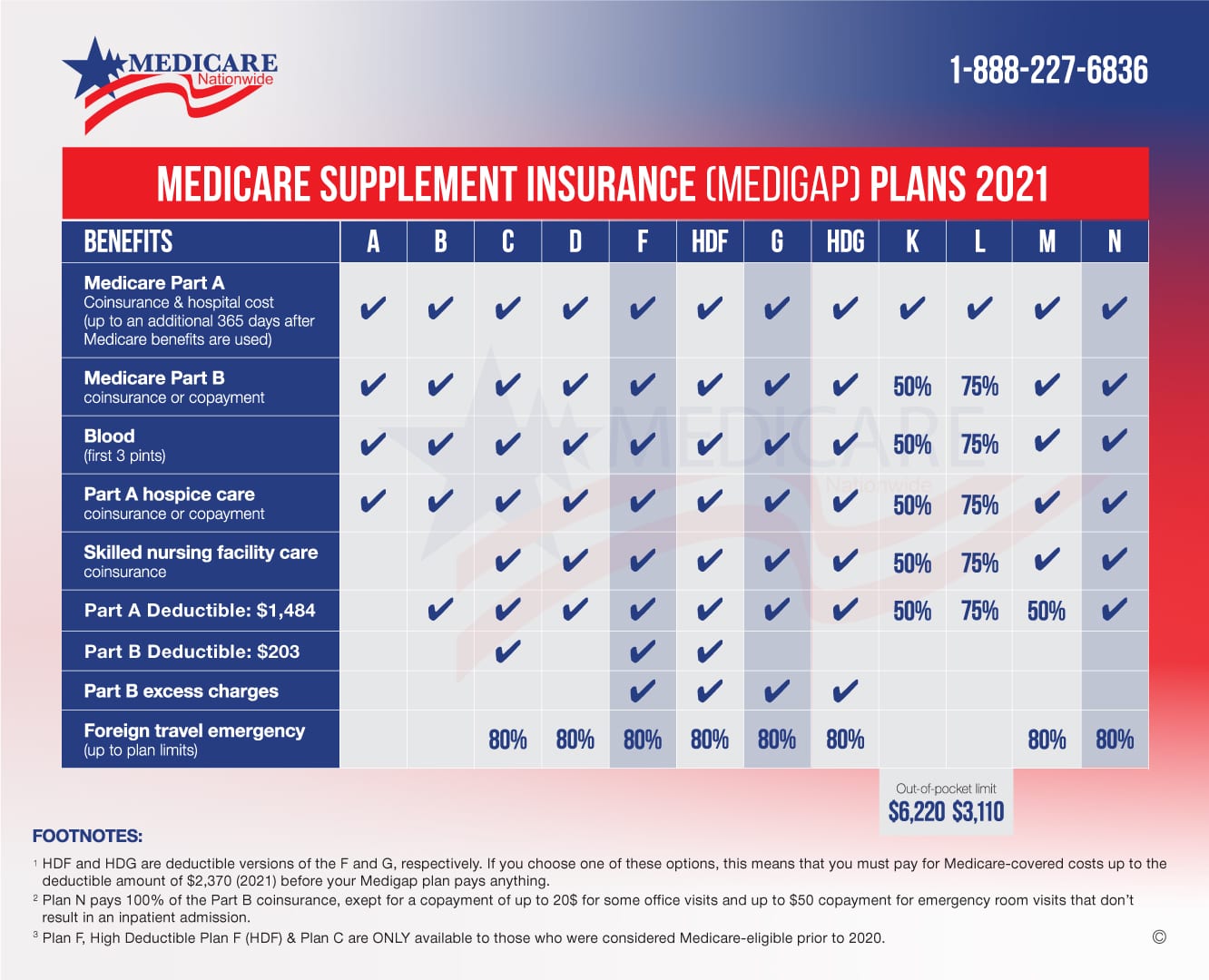

You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. Only applicants first eligible for Medicare before 2020 may purchase Plans C F and high deductible F.

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement plans allow you to see any doctor who accepts original Medicare.

Benefits of medicare supplement plans. Medicare supplement insurance plans are a different option for additional Medicare coverage. Pre-existing health conditions can cause coverage delays. Medicare Supplement Medigap plans are designed to help pay your share of health-care costs under Medicare Part A and Part B.

Although Medicare Advantage plans must provide the same benefits as Original Medicare some of them provide additional benefits such as dental vision and prescription drug coverage. Coverage is available nationwide. Plans are guaranteed renewable.

In other words Medicare Supplement Plan. If you plan to keep your original Medicare insurance and pay your Part B premium consider a Medicare supplement insurance plan instead to cover the gaps in traditional Medicare costs. You can choose a Medigap plan that will help you to pay for your deductibles copays and coinsurance.

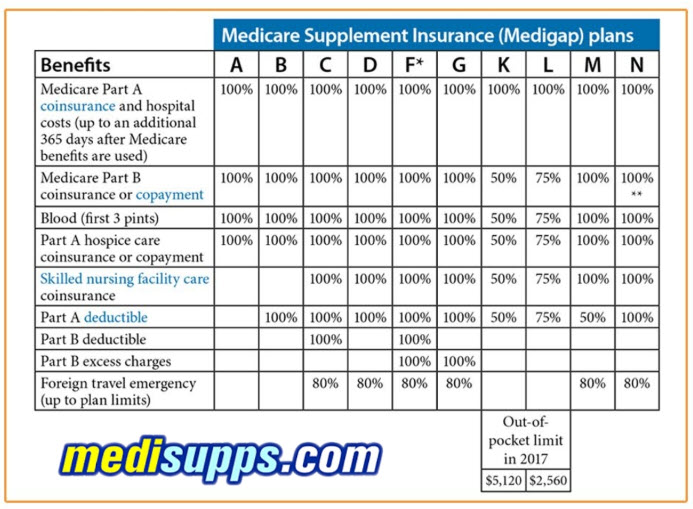

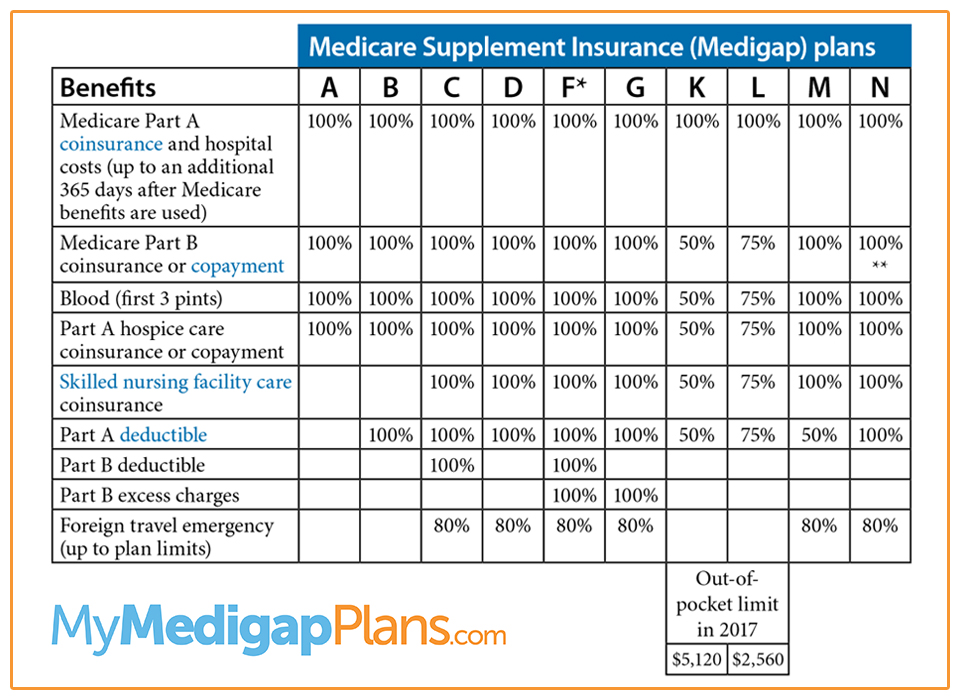

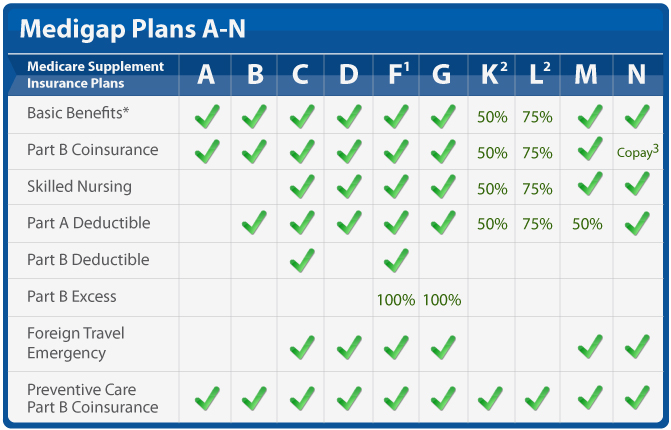

This chart shows the benefits included in each of the standard Medicare supplement plans. Medicare Supplement Plan N Standardized basic benefits with the exception of requiring a 50 copay for inpatient stays and a 20 copay when. For Plans K and L after you meet your out-of-pocket yearly limit and your yearly Part B deductible the Medigap plan pays 100 of covered services for the rest of the calendar year.

Medigap plans are different from Medicare Advantage Plans which serve as a method of receiving Medicare benefits. Benefits of Medicare Supplement Plans. Medicare Supplement plans are sold by private insurance companies but they have standard benefits designed by the government.

Another benefit of Medicare Supplement Plans is that if you enroll during Open Enrollment begins the first day of the month when you turn 65 and are enrolled in Medicare Part B and ends six months later you cannot be denied coverage based on your health either a preexisting condition or a current one. Some plans may not be available. Each supplement insurance plan comes with different benefits.

A Medigap policy only covers one person. Premiums can be expensive every month. What began as voluntary standards governing the behavior of insurers increasingly became requirements.

Again these plans are also called Medicare Supplements same thing just two different terms When you compare Medicare Supplement plans in 2021 youll find that many name brand carriers you are familiar with are offering these plans. Medigap plans on the other hand serve as a way to add coverage to your Original Medicare benefits Parts A and B. 1980s The history of Medicare Supplement Plans Medigap insurance takes us back to 1980.

However one of the benefits it does cover is one that could cost you the most out of pocket. For example they may pay your Medicare Part B coinsurance for Medicare-approved doctor visits and lab tests. For certain seniors Medicare supplement programs may provide substantial cost savings and benefits.

Medicare Supplement also known as Medigap are supplement insurance plans that fill the gaps in Original Medicare and are sold and offered by private health insurance plans. What are Medicare Supplement plans. This is a nationwide doctors list.

Most Medicare supplement plans do not come with a gym membership or over-the-counter benefits. In many cases you may be instantly approved for a Medigap plan. Those plans are ways to get Medicare benefits while a Medigap policy only supplements your Original Medicare benefits.

Medicare Supplement Plan A Core Policy Benefits. Consumer protections were continuously strengthened and there was a trend toward the simplification of Medicare Supplement Plans. This is much more comprehensive than a Medicare Advantage plan.

You pay the private insurance company a monthly Premium for your Medigap policy. In general supplement plans do not cover ancillary benefits such as vision dental and hearing aid coverage and they must be purchased separately. Plan N pays 100 of the Part B coinsurance except for a copayment of up to 20 for some office visits and up to a 50 copayment for emergency room visits that dont result in inpatient admission.

Medicare supplement plans on the other hand allow you to custom pick the coverage you need to keep your expenses at a minimum. History of Medicare Supplement Plans Medigap Insurance. A means 100 of the benefit is paid.

Drawbacks of Medicare Supplement Plans. Benefits of Medicare Part A When people think of health insurance emergencies are one of the first things that come to mind. Skilled nursing facility coinsurance costs Hospice care copays or coinsurance Out-of-country benefits 100 of preventative care costs.

The Benefits of Medicare Supplement Insurance Plans by Christian Worstell Published April 26 2021 Reviewed by John Krahnert Medicare Supplement Insurance also called Medigap can help cover the costs of deductibles copayments coinsurance and other fees associated with Original Medicare Part A and Part B. There are many types of plans to choose from. Having a Medicare.

Of all Medigap plans Medigap Plan A covers the least amount of benefits. Medicare Supplement Plan A helps cover a few of the out-of-pocket costs that Original Medicare doesnt pay for. If you and your spouse both want Medigap coverage youll.

Guaranteed Medicare supplement plans. However each lettered plan guarantees certain standardized benefits regardless of your location or. Benefit Chart of Medicare Supplement Plans Sold on or after January 1 2021.

The only larger doctors list would be through private insurance companies for example a group health plan through a company.

Blog Medicare Supplement Plans Medigap Chart 2018

Medicare Supplement Plans Medigap Senior Healthcare Direct

Medicare Supplement Plans Medigap Senior Healthcare Direct

Ultimate Guide To Selling Medicare Supplements Senior Market Advisors

Ultimate Guide To Selling Medicare Supplements Senior Market Advisors

Medicare Supplement Plans Comparison Chart 2021 What S New

Medicare Supplement Plans Comparison Chart 2021 What S New

Medicare Supplement Plans What You Need To Know Ensurem

Medicare Supplement Plans What You Need To Know Ensurem

Medicare Supplement Plan B Covers The Basics And A Bit More

Comparison Chart Of All 10 Medicare Supplement Plans Policies

Comparison Chart Of All 10 Medicare Supplement Plans Policies

Medicare Supplement Plan Comparison Bobby Brock Insurance

Medicare Supplement Plan Comparison Bobby Brock Insurance

Best Medicare Supplement Plans Online Plan F G Changes

Best Medicare Supplement Plans Online Plan F G Changes

Medigap Coverage Chart 65medicare Org

Medigap Coverage Chart 65medicare Org

Medicare Supplemental Insurance In Pensacola Florida 2021 Best Medicare Supplement Medigap Plans Pensacola Florida

Complete Medicare Supplement Plans Comparsion Chart For 2021

Complete Medicare Supplement Plans Comparsion Chart For 2021

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment