Featured

Calpers Long Term Care Insurance Reviews

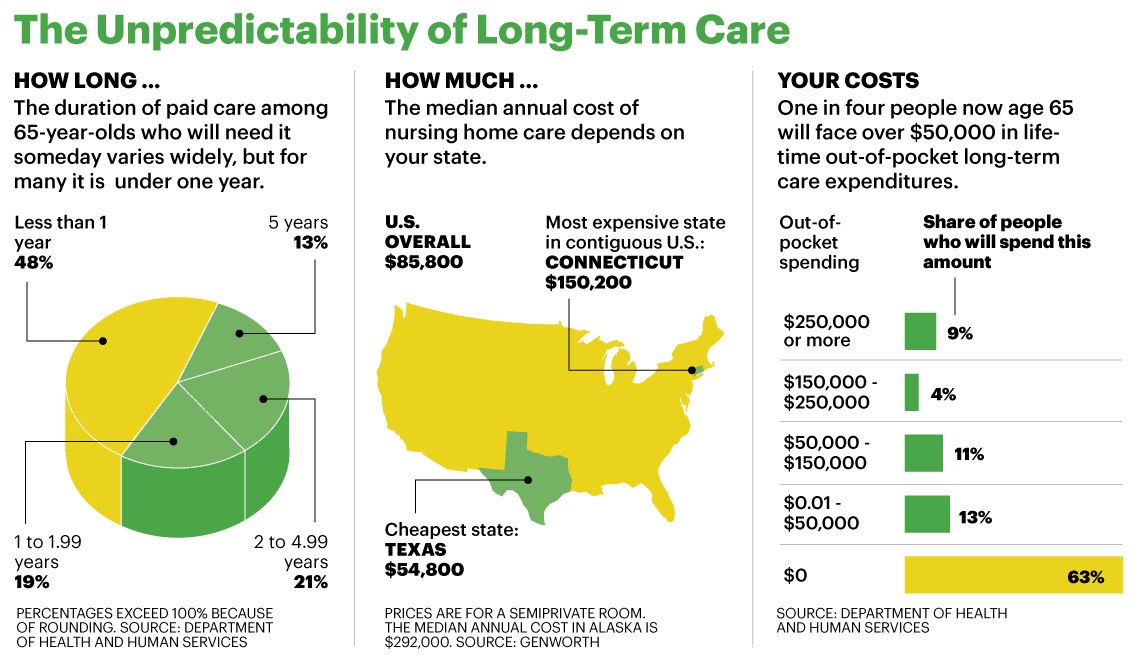

My mother did not even back what she paid in Premiums. Average CalPERS Long-Term Care Program participants spent 34 years in claim and less than 1 percent required long-term care for more than 10 years.

Long Term Care Insurance Ltc Indemnity Vs Reimbursement

Long Term Care Insurance Ltc Indemnity Vs Reimbursement

CalPERS is not an insurance company.

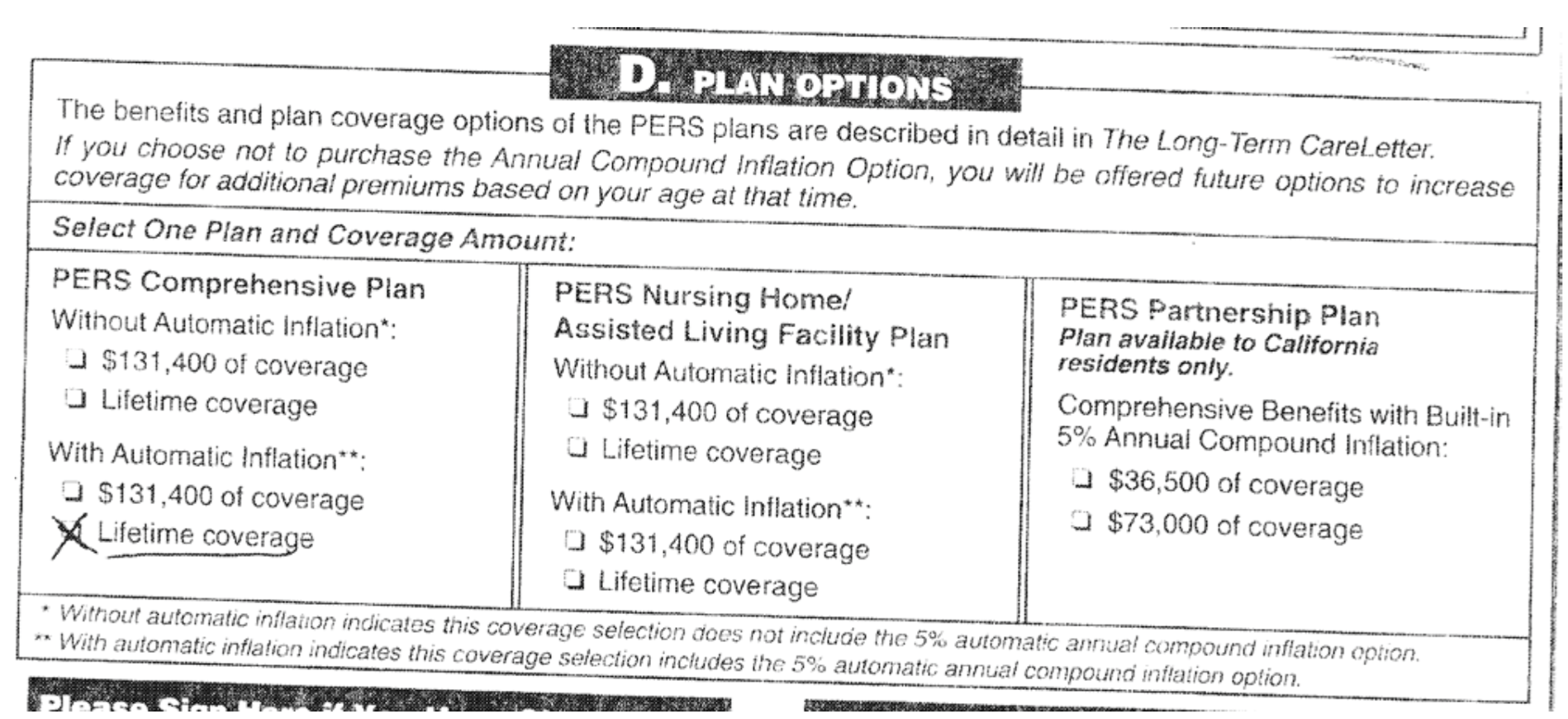

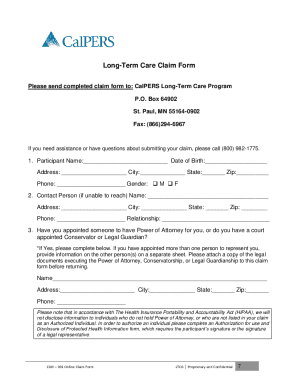

Calpers long term care insurance reviews. According to the American Association for Long-Term Care Insurance the average cost of long-term care insurance premiums for a healthy married couple both aged 55 costs 4826 per. Yes premiums could increase in the future but only after approval by CalPERS. February 7 2014 The reopening of the CalPERS long term care insurance program to new applicants is welcome news for Californians.

And CalPERS made additional big mistakes all on its own. CalPERS started selling long term care insurance in the 1990s. Instead I find myself in old age with a fixed income in a battle with CalPERS which I trusted with an ever-rising premium and an ever-changing long-term care insurance.

Can a monthly premium be increased. And secondly theyll have to change my. Well impartially shop the market of top-rated insurance companies and help you find not only the best rate but the best company.

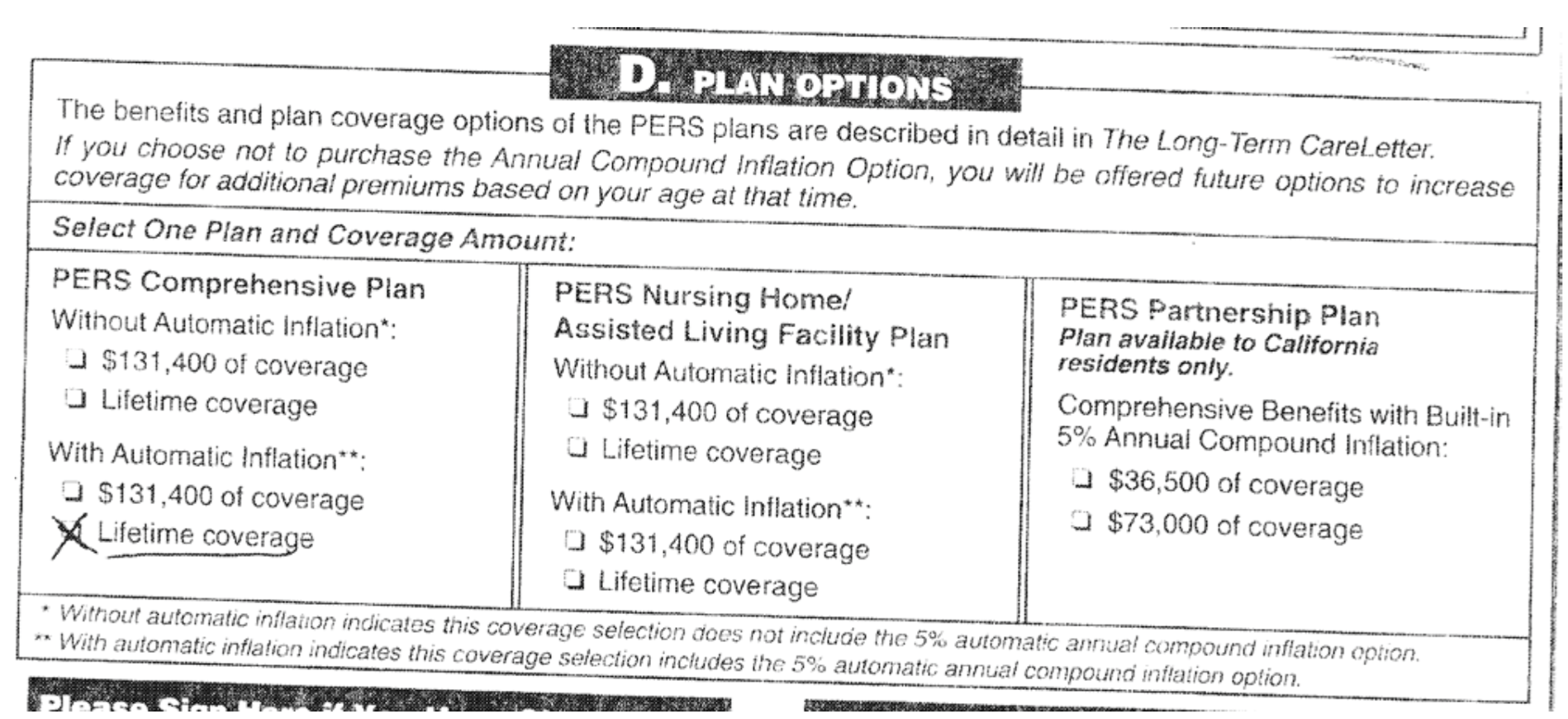

In November 2020 the CalPERS Board of Administration approved a rate increase on all Long-Term Care Program policies to be phased in over two years. My two sisters and I have spent countless hours contacting Bankers Life about our mothers long term care insurance. Long-term care insurance costs can range from 1000 to 5000 or more per year depending on the age when it was purchased the applicants health and the amount of coverage chosen.

This is a huge increase in rate. Below are links to my blog post reviews of a few of the top-selling long term care insurance companies. The long term care insurance will not pay for Memory Care as there is a maximum amount they will pay which comes to only half the cost of Memory Care.

Please call me at 800. Well help you compare the quotes policy costs and plan options side by side. CalPERS is not regulated by Californias Rate Stability Regulation.

Therefore effective June 17 2020 and until further notice the CalPERS Long-Term Care Program will not be accepting new applications for coverage. And its contrary to the basic spirit reason and rationale for purchasing long-term care insurance. They marketed these policies as being 30 cheaper than the competition and said this was possible due to their management of such policies and investment returns.

Your claim will not be approved regardless that you have a 0 day elimination period. Or to force us out of CalPERS long-term care period. Compare Californias leading Long Term Care Insurance providers with the CalPers Long Term Care Program.

If you end up with Alzheimer you may end up homeless wandering the streets talking to yourself. Given this shortfall rate increases are necessary to cover the projected future costs of providing benefits to. Compare With an Independent Agent.

The short version is that the long-term care insurance industry is top to bottom in trouble due to insurers launching the product in the 1990s without the foggiest idea how to price it and got things badly wrong. CalPERS long-term care insurance plan was grossly underfunded. Calpers the biggest example of.

It was a new type of insurance that no one had much experience in and many insurers including CalPERS. The Long-Term Care Fund is facing a shortfall due to lower than expected investment returns and an adjustment in actuarial assumptions. In November 2020 the CalPERS board approved a rate increase on all Long-Term Care Program policies that will be phased in over two years.

If you examine the CalPERS policies they never use the word insurance. So do NOT sign up for Calpers Long Term Care insurance. For example you may get a hip replacement and need care but you will only be expected to need care for 4-6 weeks of rehab.

I dont have an alternative to Long Term Care Insurance other than to tell my kids that Im taking care of them for two reasons - first because I love them. CalPERS sold about 150000 traditional long-term care insurance policies starting in 1995. Many long term care policies include 0 day waiting periods especially for home care but you always have to have a need for care that is expected to be long term in nature.

I chose a long-term care plan to be prepared and ready for the anticipated demands of my health needs in my old age. Ernest Goldsmith made a tough choice when CalPERS told him it was raising the price of his long term care insurance by 85 percent six years ago. 2020 Reviews and Ratings of Long Term Care Insurance Policies.

CalPERS is not regulated by the California Department of Insurance. Should a rate increase occur all impacted CalPERS Long-Term Care Program. That was an exaggeration.

CalPERS Long-Term Care insurance. The first increase will be a 52 increase and will take effect no earlier than November 2021. They use the phrase long term care program NOT long-term care insurance They are a self-funded group they are NOT an actual insurance.

We receive many inquiries from consumers shopping for long term care insurance as to which policy is the best long term care insurance policy to buy. Well supply you with rates ratings and reviews of the carriers that sell these types of policies and compare them to the CalPers. According to a comparison of costs some consumers may be able to save 12 percent yearly by shopping around.

Calpers Long Term Care Insurance Reviews Costs Benefits

Calpers Long Term Care Insurance Reviews Costs Benefits

Calpers Long Term Care Policy Train Wreck Is Bankruptcy The End Game Naked Capitalism

Calpers Long Term Care Policy Train Wreck Is Bankruptcy The End Game Naked Capitalism

Price Hikes Surprise For Calpers Long Term Care Insurance The Sacramento Bee

Price Hikes Surprise For Calpers Long Term Care Insurance The Sacramento Bee

Https Www Calperslongtermcare Com Contentmanagement Viewimage 0817c23b 23eb 4896 9442 0d4638a4b50e Clientguid 630a1846 0727 4268 Bfcd Af0a6f52c9e1

Calpers Long Term Care Insurance Reviews Costs Benefits

Calpers Long Term Care Insurance Reviews Costs Benefits

Calpers Long Term Care Claim Fill Out And Sign Printable Pdf Template Signnow

Calpers Long Term Care Claim Fill Out And Sign Printable Pdf Template Signnow

Calpers Long Term Care Policy Train Wreck Is Bankruptcy The End Game Naked Capitalism

Calpers Long Term Care Policy Train Wreck Is Bankruptcy The End Game Naked Capitalism

Calpers Long Term Care Forms Fill Online Printable Fillable Blank Pdffiller

Calpers Long Term Care Forms Fill Online Printable Fillable Blank Pdffiller

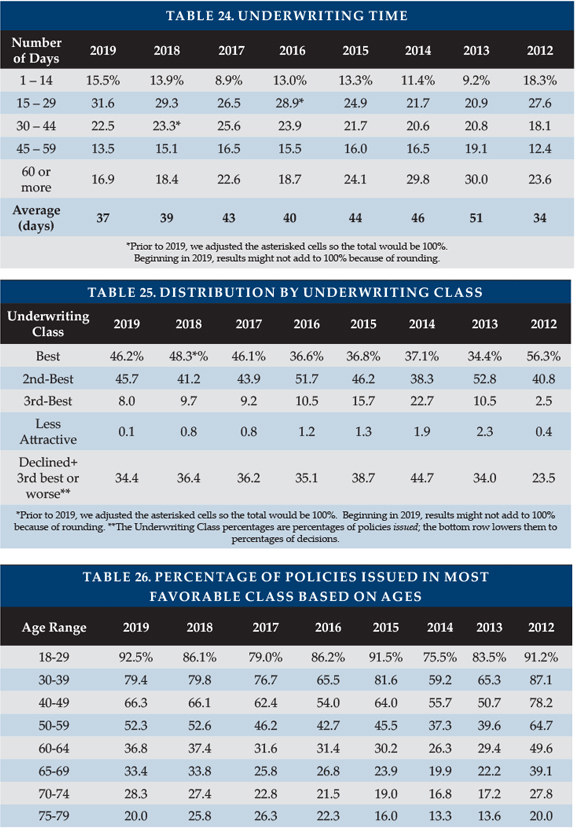

2020 Milliman Long Term Care Insurance Survey Broker World

2020 Milliman Long Term Care Insurance Survey Broker World

Calpers Long Term Care Insurance Reviews Costs Benefits

Calpers Long Term Care Insurance Reviews Costs Benefits

Calpers Long Term Care Insurance Reviews Costs Benefits

Calpers Long Term Care Insurance Reviews Costs Benefits

Https Www Calpers Ca Gov Docs Ltc Newsletter Fall 2019 Pdf

Allianz Long Term Care Insurance Life Insurance Blog

Allianz Long Term Care Insurance Life Insurance Blog

5 Facts You Should Know About Long Term Care Insurance

5 Facts You Should Know About Long Term Care Insurance

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment