Featured

Nonprofit Health Insurance Companies

So how do not-for-profit organizations afford to offer it to their employees. Five of the CO-OPs have succumbed this year.

One of the primary benefits of an HRA is the ability for each participant to determine how they want to use their allowance.

Nonprofit health insurance companies. Non Profit Health Insurance Companies. An Insurance Guide for Nonprofit Organizations Steve Thompson Recognizing the importance of nonprofit organizations in the US this insurance information will help nonprofits navigate fundamental insurance issues and help them better understand the insurance risks they confront. Non-profit insurers on the other hand have a consistent consumer base.

In so doing nonprofits can continue to provide client services without needlessly. How some health insurers ended up as nonprofits - Marketplace. The Alliance for Advancing Nonprofit Health Care works towards delivering and helping those in need of health care.

In most cases of self-funded insurance the employer contracts with a commercial insurance company to administer the benefitsso the enrollees might have plan ID cards that say Humana or Anthem for examplebut its the employers money thats being used to pay the claims as opposed to the insurance companys money. To find a better way to search for free online health insurance rates use your zip code on this website and start researching now. Currently more than 3300 nonprofit and governmental organizations employing hundreds of thousands of people rely on.

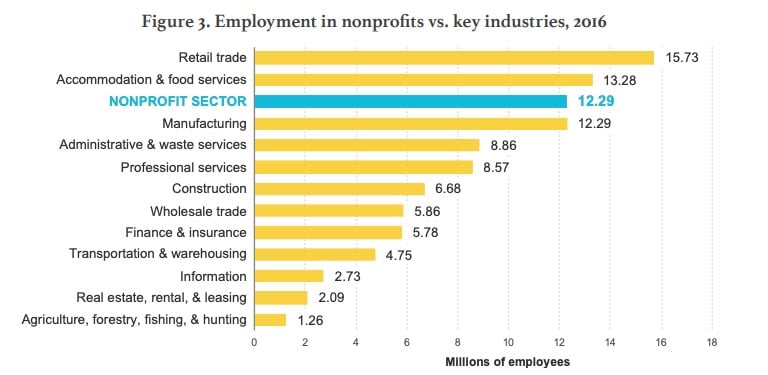

Health insurance costs money. They have a greater need to please consumers in order to be in competition. Health plans with over 100000 enrollees are nonprofit.

Also some of the network health insurance plans may be for profit in some areas and nonprofit in others like. According to Alliance for Advancing Nonprofit Health Cares most recent report about 63 of US. All Blue Cross Blue Shield plans used to be nonprofit.

Blue Shield of California was stripped of its tax-exempt status by the California Franchise Tax Board in 2014. Because the White House and Congress couldnt figure their way to a realistic public option in the Affordable Care Act they turned to completely new nonprofit health care cooperatives but then undermined them through a variety of financial and operational impediments. Today it is the second-largest insurer in the United States.

That way a more senior member of your team can purchase an insurance policy that works best for their needs at the same time. Health insurance is at the top of the benefits wish list for employees. Now the majority have become for-profit plans.

According to the Alliance for Advancing Nonprofit Health Care there are 84 nonprofit health plans with more than 100000 enrollees. Renamed WellPoint it is the biggest of the for-profit companies descended from the original nonprofit Blue Cross Blue Shield Association. Blue Shield was started as a tax-exempt insurer to cover employees of mining and lumber companies in the Pacific Northwest with a group of local doctors providing care through a service bureau.

Many of these providers are limited to a specific region. Those who need insurance but cant seem to get it. Nonprofit Health Insurance Options.

For-profit insurance companies are generally more impacted by market forces. There are numerous nonprofit health insurance companies in the US. The not for profit insurer is an organization set up to provide insurances and services including health insurance yes health insurance is a part of what they do.

There are some very good reasons employers of any kind are likely to get a boost for their business by offering employees health care coverage benefits. Most of its plans still operate under the name Anthem BlueCross BlueShield but in New York the plans operate under the Emblem brand. The idea behind nonprofit health insurance companies and organizations is that they should serve communities and populations.

With insurance exchanges opening in hopes of getting exactly those people to buy insurance. Since nonprofit organizations hire people of all ages offering a competitive health benefit that works for everyone is crucial. The individual and small group marketplace in Maine was dominated by for-profit Anthem Blue Cross a subsidiary of WellPoint until the state selected nonprofit Harvard Pilgrim Health Care to provide coverage options for small businesses individuals and self-employed residents through a public-private partnership called DirigoChoice a precursor to the state.

Now the Los Angeles. AmTrust acquired First Nonprofit Insurance Company in 2013 quickly making us a dominant player in the nonprofit insurance field.

Best Not For Profit Health Providers Funds In Australia Compare Club

Best Not For Profit Health Providers Funds In Australia Compare Club

Why 5 New Nonprofit Health Insurance Cooperatives Failed To Thrive The Federal Undermining Of A Field Of Nonprofits Non Profit News Nonprofit Quarterly

Why 5 New Nonprofit Health Insurance Cooperatives Failed To Thrive The Federal Undermining Of A Field Of Nonprofits Non Profit News Nonprofit Quarterly

Health Insurance For Profit Or Nonprofit Beingwell

Health Benefits For Non Profit Organizations

Health Benefits For Non Profit Organizations

Health Insurance Companies In California Covered California

Health Insurance Companies In California Covered California

Health Plans In Minnesota Made More Money In 2018 Star Tribune

Health Plans In Minnesota Made More Money In 2018 Star Tribune

What Are Non Profit Health Insurance Companies Safe Policies Insurance

What Are Non Profit Health Insurance Companies Safe Policies Insurance

Best Not For Profit Health Providers Funds In Australia Compare Club

Best Not For Profit Health Providers Funds In Australia Compare Club

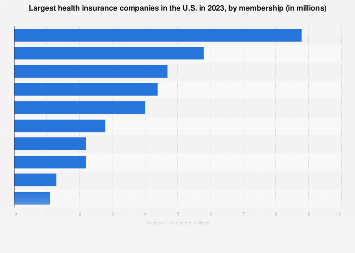

Largest U S Health Insurers By Membership Statista

Largest U S Health Insurers By Membership Statista

What Are Non Profit Health Insurance Companies Safe Policies Insurance

What Are Non Profit Health Insurance Companies Safe Policies Insurance

Insurance Non Profit Vs For Profit Policy Interns

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment