Featured

Does Term Life Insurance Cover Accidental Death

Term plans also provide coverage in case of death of the insured due to an accident. Your spouse goes into the hospital for surgery and winds up dead.

Complete Guide To Accidental Death Dismemberment Insurance

Complete Guide To Accidental Death Dismemberment Insurance

He or she was covered in the event of accidental death under your family life insurance plan.

Does term life insurance cover accidental death. Accidental death insurance also known as accidental death and dismemberment or ADD insurance is an alternative to term life insurance. Under most circumstances however the cause of death would only directly impact the life insurance companys decision to pay the benefit owed 1 if the deceased committed suicide and 2 if the death occurred within the look back period referred to as the contestability period. Term life insurance is basic coverage that pays out if you die within a specific time period regardless of the cause of death.

Major insurers typically issue ADD policies and can also be purchased through credit card offers or credit unions. As the name suggests accidental death insurance is designed to protect your beneficiaries if you were to die accidentally from a car crash for example or a workplace injury. Moreover many term life plans come with an additional accidental death benefit riders under which extra sum assured is paid to the beneficiary of the policy along with the basic sum assured in case of accidental demise of the insured person.

The term accidental death benefit refers to a payment due to the beneficiary of an accidental death insurance policy which is often a clause or rider connected to a life insurance policy. What is Life Insurance Coverage for Accidental Death. Accidental death coverage also can be sold as a rider or add-on to life insurance policies.

If you lie on your application your insurer could refuse to pay out to your beneficiaries when you die. Sometimes ADD coverage is added to a standard life. Yes term insurance pays in case of accidental death.

Accidental Insurance as the name suggests covers only accidental situations offering financial benefit to nominees. Accidental death is defined as a sudden unforeseen and involuntary event caused by an external violent and visible force. Accident related death Accidental deaths are also covered in a term insurance plan.

Are you entitled to. All that aside term life insurance is basically just a form of life insurance that covers you for a set term. Most people can probably guess as to what accidental death insurance is.

The sum assured or cover taken under the term plan will pay the claim if the death has occurred due to any reason be it a natural or accidental death or death due to some form of illness. It doesnt pay out if you die of illness or disease. Life Insurance has variety of plans that covers individual requirement like death cover short and long term financial investment goals retirement solutions etc.

In some cases yes accidental death is covered in a life insurance policy. In simple words its the protection your beneficiary receives in case your death is a result of an accident. You can generally purchase accidental death and dismemberment insurance as a separate policy or as a rider endorsement on a life insurance policy.

Accidental death and dismemberment insurance or ADD is designed to cover accidents. However policies vary by provider so its important to note what your insurance provider considers a covered death before applying as there may be some instances where accidental death is not covered. Some term insurance plans have added riders attached to it offering an additional sum assured on death due to an accident.

However term life insurance is a term that is a bit vaguer. It will pay out whether you die of an illness accident or other. This rule would not apply to an accidental death policy.

In general life insurance policies cover deaths from natural causes and accidents. In this type of policy your beneficiary will only be paid in case you died by accident. Not only does it cover you for a set term but it covers you for a set amount of money.

The coverage can double what your life insurance payout would be if you die as a result of an accident.

Accidental Death And Dismemberment Insurance Memorial Credit Union

Accidental Death And Dismemberment Insurance Memorial Credit Union

Term Life Insurance Vs Accidental Death Dismemberment Nerdwallet

Term Life Insurance Vs Accidental Death Dismemberment Nerdwallet

Is Mortgage Life Insurance The Best Deal Out There

Is Mortgage Life Insurance The Best Deal Out There

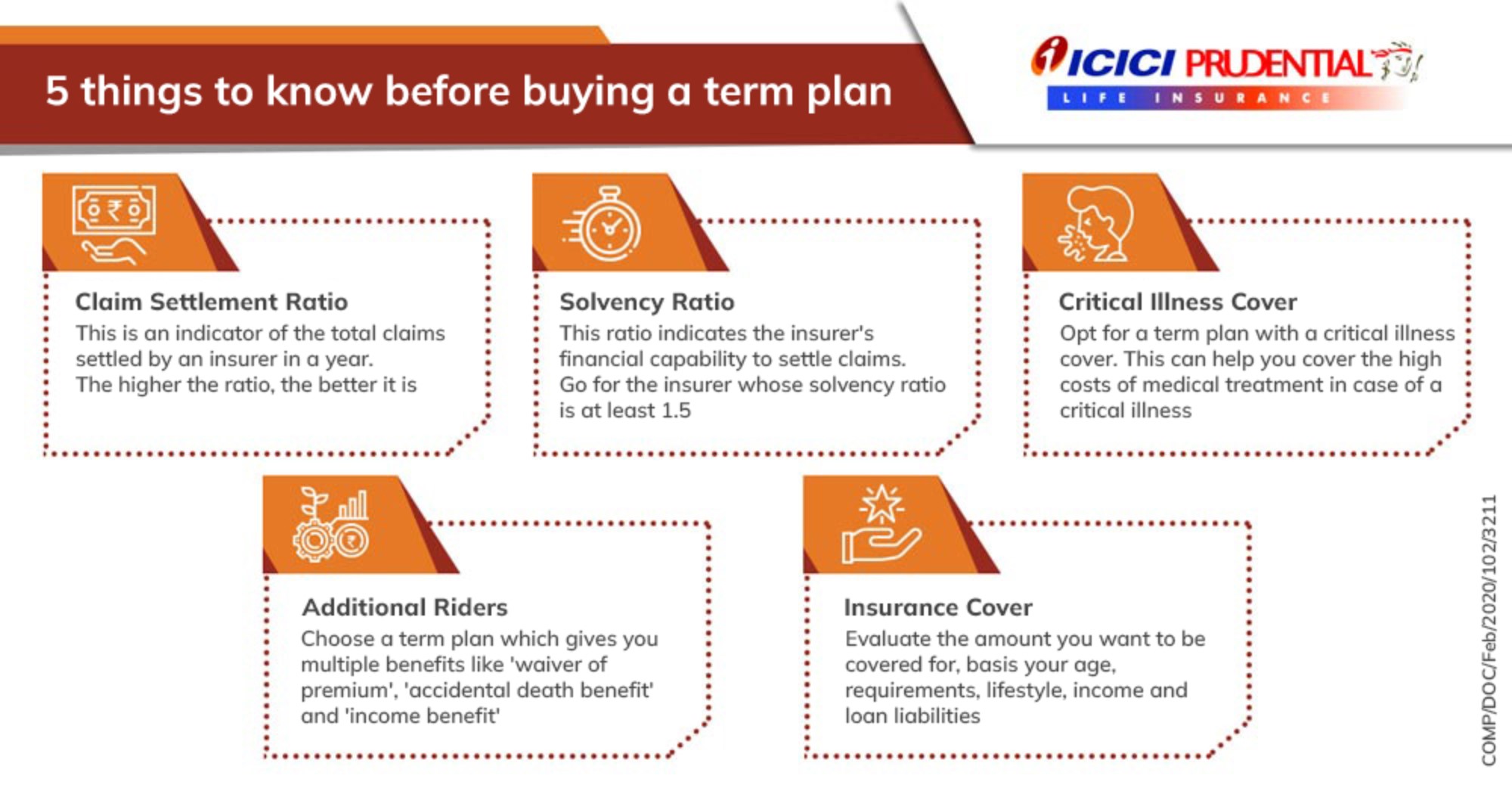

What Is Term Insurance Meaning Of Term Plan Icici Prulife

What Is Term Insurance Meaning Of Term Plan Icici Prulife

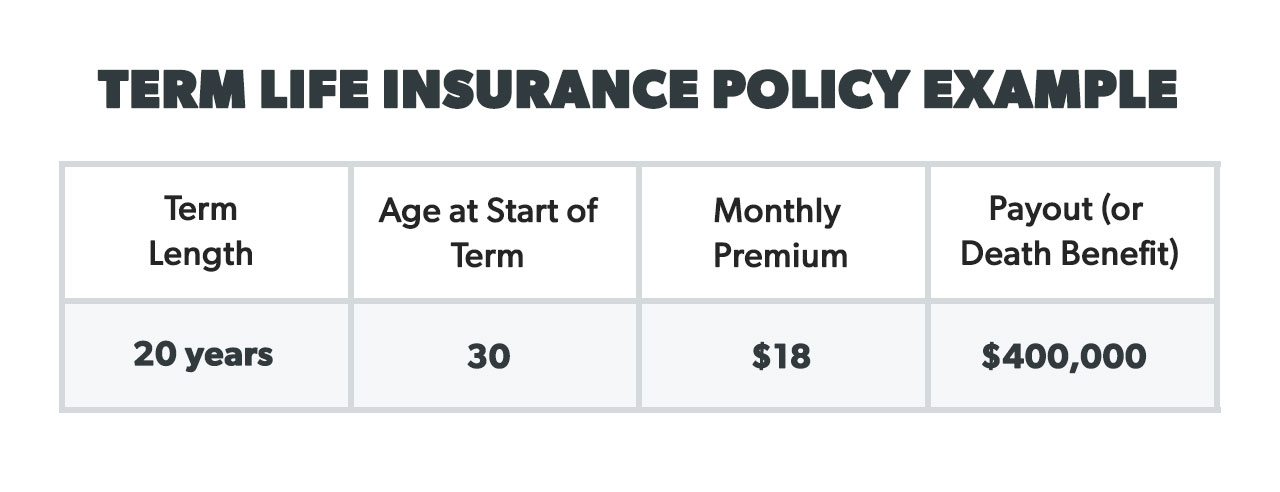

Term Life Insurance 2021 Get Average Premiums

Term Life Insurance 2021 Get Average Premiums

What Is Term Life Insurance Ramseysolutions Com

What Is Term Life Insurance Ramseysolutions Com

What Do Term Insurance Plans Not Cover

What Do Term Insurance Plans Not Cover

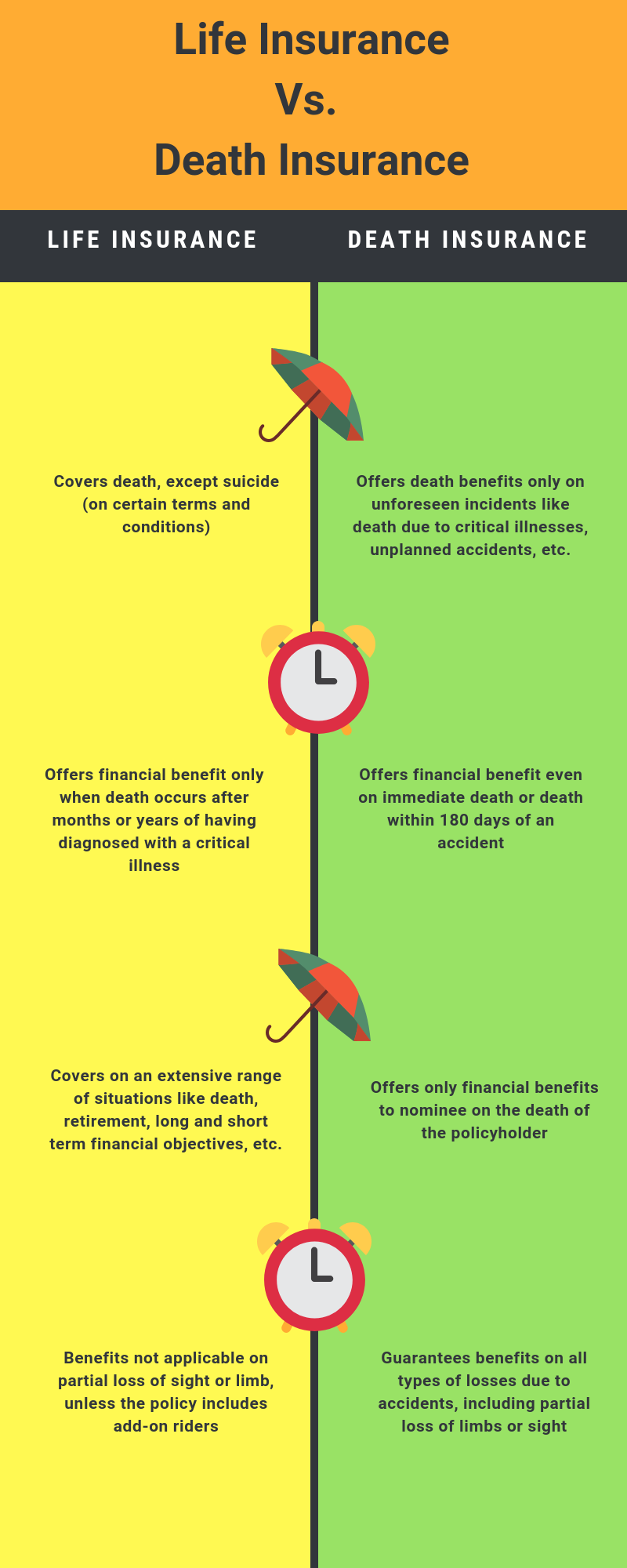

Life Insurance Vs Accidental Death Insurance Explained

Life Insurance Vs Accidental Death Insurance Explained

What Does Accidental Death And Dismemberment Insurance Cover

What Does Accidental Death And Dismemberment Insurance Cover

Accidental Death And Dismemberment Are You Covered Trusted Choice

Accidental Death And Dismemberment Are You Covered Trusted Choice

I Have A Health Insurance Do I Need A Term Plan

I Have A Health Insurance Do I Need A Term Plan

What Is Term Life Insurance Ramseysolutions Com

What Is Term Life Insurance Ramseysolutions Com

Whole Life Insurance How It Works

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment