Featured

- Get link

- X

- Other Apps

Marketplace Tax Form

The process remains unchanged for taxpayers claiming a net PTC for 2020. 42-5043 A 2 that in relation to the sales made on behalf of the Seller on the Facilitators marketplace the Facilitator has remitted or will remit the applicable tax to the department pursuant to ARS.

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

Taxpayers claiming a net PTC should respond to an IRS notice asking for more information to finish processing their tax return.

Marketplace tax form. Marketplaces must collect tax on behalf of third parties marketplace sellers selling on the marketplace when the marketplaces total Massachusetts sales including those facilitated on behalf of marketplace sellers and those made directly by the marketplace on. Other publishers outside the United States must fill out an IRS W-8 form. Publishers who satisfy certain United States residency requirements must fill out an IRS W-9 form.

Such reporting must be requested manually using the Departments form BT-1. Form 8962 Premium Tax Credit PDF 110 KB Form 8962 instructions PDF 348 KB Form 1095-A Health Insurance Marketplace Statement. Where asked if you had one of the less common plans shown click on NO since you have a Form 1095-C.

Failure to Reconcile Open Enrollment Warning Notices September 2018 English Spanish. Among other things Form. Get a quick overview of health care tax Form 1095-A when youll get it what to do if you dont how.

They must file Form 8962 when they file their 2020 tax return. Regardless of your countryregion of residence or citizenship you must fill out United States tax forms to sell any offer or add-ons through the commercial marketplace. You must have your 1095-A before you file.

If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A. This means you dont have to report the excess APTC on your 2020 tax return or file Form 8962 Premium Tax Credit PDF 110 KB. Start the Health Insurance section over.

Marketplace Facilitator legislation is a set of laws that shifts the sales tax collection and remittance obligations from a third party seller to the marketplace facilitator. The information shown on Form 1095-A helps you complete your federal individual income tax return. If anyone in your household had a Marketplace plan in 2020 you should get Form 1095-A Health Insurance Marketplace Statement by mail no later than mid-February.

You should receive Form 1095-A from the Marketplace by the end of January of the tax year. If your form is accurate youll use it to reconcile your premium tax credit. It comes from the Marketplace not the IRS.

If youre claiming a net Premium Tax Credit for 2020 including if you got an increase in premium tax credits when you reconciled and filed you still need to include Form 8962. Marketplace Tax Form 1095A Cover Page for Voided Forms January 2019 English Spanish. Store this form with your important tax information.

If you purchased health care insurance through the Marketplace you should receive a Form 1095-A Health Insurance Marketplace Statement at the beginning of the tax filing season. IRS to report certain information about individuals who enroll in a qualified health plan through the Health Insurance Marketplace. It may be available in your HealthCaregov account as soon as mid-January.

If you do not receive your 1095-A by then visit the Marketplaces website healthcaregov for information on how to request a copy of your form online from the Marketplace. Spanish Form 1095-A and Instructions for educational purposes only 2014 Tax Year. Youll use it to fill out Form 8962 Premium Tax Credit and.

Youll need it to complete Form 8962 Premium Tax Credit. If anyone in your household had Marketplace coverage in 2017 you can expect to get a Form 1095-A Health Insurance Marketplace Statement in the mail by mid-February. For county innkeepers or food and beverage taxes the marketplace facilitators report must include the name of each business and the money collected by a marketplace facilitator acting on behalf of each business.

About Form 1095-A Health Insurance Marketplace Statement About Form 1095-A Health Insurance Marketplace Statement Health Insurance Marketplaces furnish Form 1095-A to. Failure to Reconcile Recheck Warning Notices February 2018 English Spanish. See the Instructions for Form 8962 for more information.

The IRS does not issue nor provide you a copy of your 1095-A. This form includes details about the Marketplace insurance you and household members had in 2020. If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement.

As the marketplace facilitator Amazon will now be responsible to calculate collect and remit tax on sales sold by third party sellers for transactions destined to states where Marketplace Facilitator andor Marketplace collection. If you had coverage for the whole year indicate that. If there are errors contact the Call Center.

Dont file your taxes until you have an accurate 1095-A. If Form 1095-A shows coverage for you and everyone in your family for the entire year check the full-year coverage box on your tax return. The purpose of this Certificate is to provide a marketplace seller or remote seller Seller with documentation from a registered marketplace facilitator Facilitator as defined in ARS.

Form 8965 Instructions Information On Irs Form 8965

Form 8965 Instructions Information On Irs Form 8965

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

New Irs Form 1095 A Among Tax Docs That Are On Their Way Don T Mess With Taxes

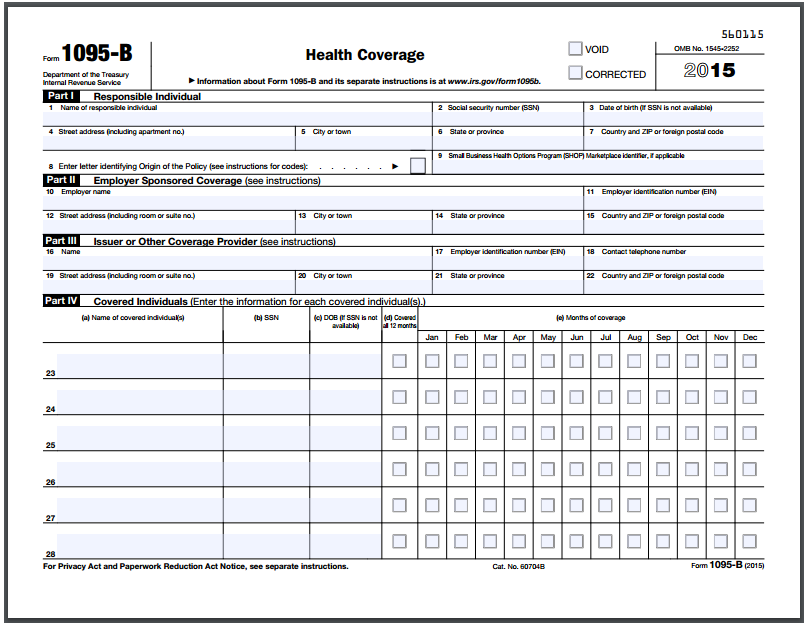

/1095b-741f9631132347ab8f1d83647278c783.jpg) Form 1095 B Health Coverage Definition

Form 1095 B Health Coverage Definition

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Tax Filing With The Affordable Care Act Katz Insurance Group

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment