Featured

Life Altering Event Insurance

If you have a qualified event and want to make a change to your benefits call Benefits as soon as possible at 617-496-4001 in order to make changes within the 30-day window. Heres a little about each event.

What Is A Qualifying Life Event Nh Health Cost

What Is A Qualifying Life Event Nh Health Cost

Temporary Duty TDY Travel Pay InformationLatest News.

Life altering event insurance. Losing an employer sponsored health insurance plan or becoming ineligible for an employers plan. To do this the employee must submit the Benefits Change Form see below to Human Resources within 31 days of when the childs other coverage begins. These are called qualifying life events.

You also may be able to select a plan up to 60 days in advance of some qualifying life events. Thrift Savings Plan TSP Military Service. Many of lifes big moments may open the door to making changes to your health insurance coverage outside of the regular open enrollment period.

Department of Defense Education Activity DODEA Getting Started. When you click on a question you will see what actions you may need to take for each of the following programs. As an insurance sales agent nothing is more valuable than being able to tie your sales pitch to a big event in your clients life.

There are 4 basic types of qualifying life events. Though individuals may have options to modify their FSA or HSA choices for qualifying events they should continue to thoughtfully choose the best benefits options for them at the time of open enrollmentin anticipation of any major life events that may be on the horizon. Spencer Insurance Agency Inc.

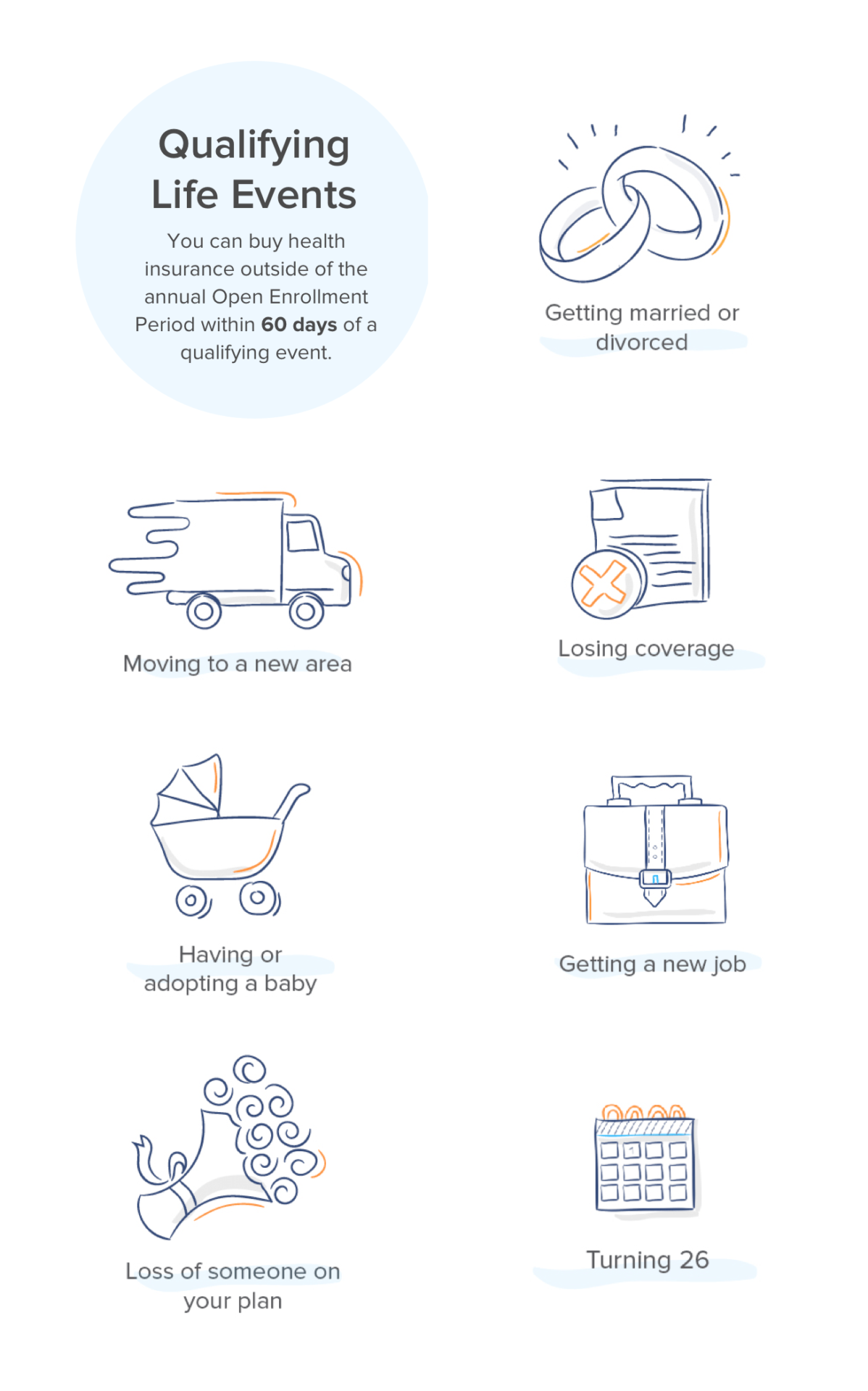

12 Zeilen There are two types of life insurance beneficiaries. Qualifying Life Event QLE A change in your situation like getting married having a baby or losing health coverage that can make you eligible for a Special Enrollment Period allowing you to enroll in health insurance outside the yearly Open Enrollment Period. Everyone can enroll in an individual health insurance plan during open enrollment.

Getting married having or adopting a child or moving to or from another state. 115 West Ave Suite 204 PO. Becoming ineligible for a government subsidized or government sponsored plan.

Life Events Are Life Altering. Clients liveslike everyonesare punctuated with the big things that happen over the course of time. Once you have contacted Benefits information will be mailed to your home with important instructions on how to make your changes online in PeopleSoft and how to submit any required documentation.

And thats the power behind the Life Events feature. For example if a spouse lost their job and their health coverage or became eligible for other coverage through an employer that would be a qualifying event. Moving could be a qualifying event on some coverage if you move outside of the coverage area of your current insurance.

Leave and Earnings Statement. Lets take a quick look. Our goal is to protect families and businesses from a life-altering event by ensuring that you have the right coverage for the right price.

Primary First and Contingent. If an adult child acquires other medical insurance before they turn age 26 it is considered a qualifying event by the IRS and the employee may choose to end their OU plan coverage of the child. Health and Insurance Benefits.

Using Life Events Zeynep can tell what has happened in Rachels life whats currently going on and whats coming up. But sometimes events like a birth or marriage mean youll need to change your coverage at another time of the year. What is a Qualifying Life Event.

The Life Cycle Events is a listing of common events that may occur during or after your Federal career. Understanding Your Civilian Pay. In turn happenings such as marriage divorce having a new child.

Memy family job and retirement. Federal Employees Health Benefits FEHB Program Federal Employees Dental and Vision Insurance Program FEDVIP Federal Flexible Spending Account Program FSAFEDS Federal Long Term Care Insurance. We develop long-term relationships with our customers and spend time discussing what coverage is right for you.

Types of qualifying life events. Changes can most often be made either 30 or 60 days after the qualifying life event happens. Its divided into three sections.

LIFE ALTERING EVENTS Financial advisors are often so focused on doing a great job for their clients they forget that money matters. But that it isnt everything. Losing other affordable minimum Essential Health Benefits.

Life changing events are marriage birth adoption death or change of coverage status for someone eligible for the plan. After a qualifying life event you have a period of 60 days to change your plan or enroll in a new plan. It is best for them to consult their human resources representatives or benefits administrators to ask about the ability to.

But imagine for a. If this 31-day qualifying event window is missed.

4 Life Changing Events That Affect Your Life Insurance

4 Life Changing Events That Affect Your Life Insurance

Benefits A Z Qualifying Life Event Financial Benefit Services Employee Benefit Solutions

Benefits A Z Qualifying Life Event Financial Benefit Services Employee Benefit Solutions

What Is A Special Enrollment Period Thinkhealth

Need To Change Your Health Insurance A Qualifying Life Event Could Help

Need To Change Your Health Insurance A Qualifying Life Event Could Help

Life Changing Events What They Mean For Your Insurance Coverage

Life Changing Events What They Mean For Your Insurance Coverage

Life Events Trigger Re Evaluation Of Life Insurance Smithfin

Qualifying Life Events For Health Insurance Solid Health Insurance

Qualifying Life Events For Health Insurance Solid Health Insurance

What Is A Qualifying Life Event Ramseysolutions Com

What Is A Qualifying Life Event Ramseysolutions Com

Here S What Counts As A Health Insurance Qualifying Life Event

Here S What Counts As A Health Insurance Qualifying Life Event

What Employers Need To Know About A Qualifying Life Event

What Employers Need To Know About A Qualifying Life Event

Qualifying Life Events For Special Enrollment What To Do If You Missed The Deadline For Insurance Youtube

Qualifying Life Events For Special Enrollment What To Do If You Missed The Deadline For Insurance Youtube

Major Life Events Qualify For Special Enrollment Period Healthcare Gov

Major Life Events Qualify For Special Enrollment Period Healthcare Gov

Change Your Benefits Cardinal At Work

Change Your Benefits Cardinal At Work

Qualifying Life Event Special Enrollment Period Under Obamacare

Qualifying Life Event Special Enrollment Period Under Obamacare

Popular Posts

Firstgroup America Benefits Enrollment

- Get link

- X

- Other Apps

Comments

Post a Comment